Mid-term Exam (2013)

Name:

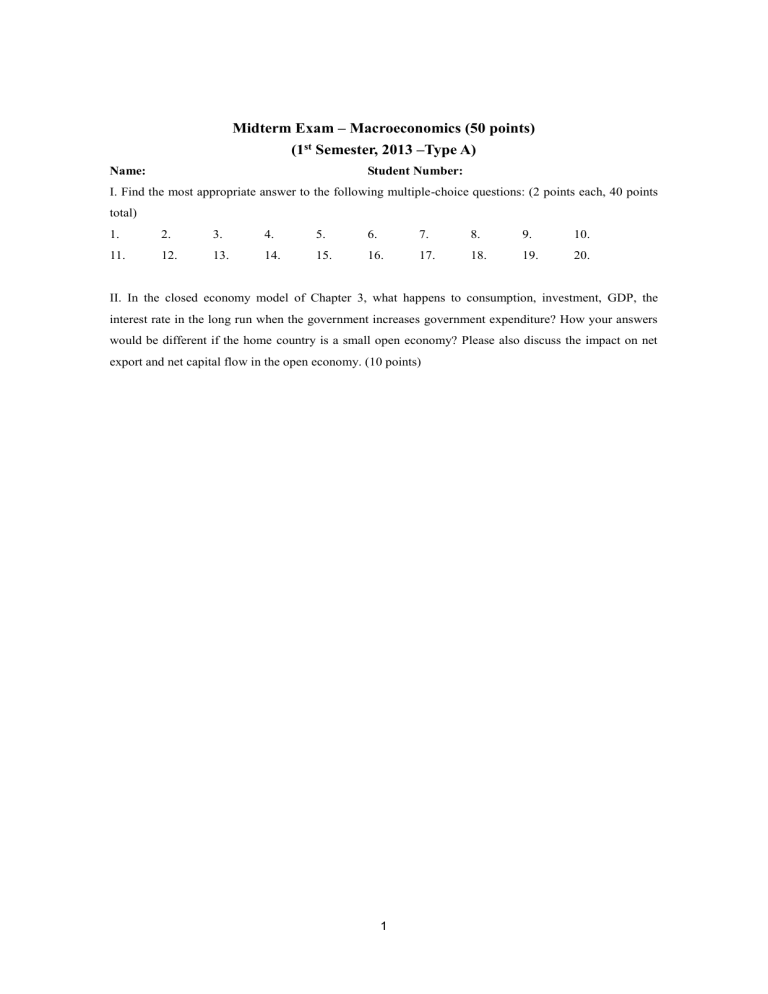

Midterm Exam – Macroeconomics (50 points)

(1

st

Semester, 2013 –Type A)

Student Number:

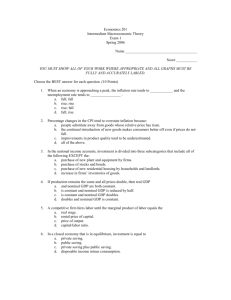

I. Find the most appropriate answer to the following multiple-choice questions: (2 points each, 40 points total)

1. 2.

11. 12.

3.

13.

4.

14.

5.

15.

6.

16.

7.

17.

8.

18.

9.

19.

10.

20.

II. In the closed economy model of Chapter 3, what happens to consumption, investment, GDP, the interest rate in the long run when the government increases government expenditure? How your answers would be different if the home country is a small open economy? Please also discuss the impact on net export and net capital flow in the open economy. (10 points)

1

II. Find the most appropriate answer to the following multiple-choice questions: (2 points each)

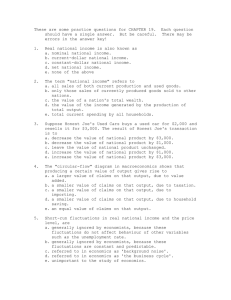

1. Which of the following is NOT a correct statement regarding the long-run model?

(1)

(2)

(3)

(4)

(5)

Market clearing is one of the key assumptions in the long run model.

Prices are flexible.

Demand equals supply in equilibrium.

Technology is fixed.

Supplies of capital and labor are flexible.

2. Which of the following is NOT a correct statement of GDP?

(1)

(2)

(3)

(4)

Market value of all final goods and services produced domestically.

Sum of value added at all stages of production.

Total expenditure on domestically produced final and intermediate goods and services.

Sum of consumption on domestic goods, investment on domestic goods, government spending on domestic goods, and exports.

(5) Sum of consumption expenditure, investment, government spending and net exports.

3. What is the smallest component of GDP in Korea in 2011?

(1) consumption (2) investment (3) government expenditure (4) net exports (5) capital

4. Which of the following is NOT a correct statement of consumption and investment?

(1) Nondurable goods are the goods which cannot be used more than one year.

(2) Consumers’ purchase of services is part of consumption.

(3) Consumers’ purchase of new houses is part of investment.

(4) The change in the value of all firms’ inventories is part of investment.

(5) Spending on plant and equipment is part of investment.

5. Which of the following is NOT a correct statement about inflation or unemployment?

(1) Inflation rate is the percentage increase in the overall level of prices.

(2) GDP deflator can be calculated as 100 times nominal GDP divided by real GDP.

(3) Consumer price index considers price changes of domestically produced products but not imported products.

(4) Labor force is the amount of labor available for producing goods and services.

(5) The unemployment rate is the fraction of the labor force that is not employed.

6. Which of the following is NOT a correct statement about a closed economy model in the long run?

2

(1) Consumption is a function of disposable income.

(2) Investment is a function of real interest rate.

(3) The real interest rate adjusts to equate demand and supply.

(4) In the loanable funds model, investment equals consumption in equilibrium.

(5) In the goods and services market model, GDP equals the sum of consumption, investment and government expenditure.

7. Which of the following is NOT a correct statement about money?

(1) Money has three functions: medium of exchange, store of value, and unit of account.

(2) The money supply is the quantity of money available in the economy.

(3) Monetary policy is the central bank’s control over the money supply.

(4) The relative size of various money supply measures in Korea is: currency < monetary base <

M1 < M2.

(5) Because of fractional-reserve banking system, money multiplier is smaller than one.

8. Which of the following is NOT an instrument of monetary policy?

(1) Open market operations.

(2) Discount rate adjustment.

(3) Adjustment of reserve requirements.

(4) Purchase or sale of government bonds by the central bank.

(5) Change in tax revenue.

9. When the government raises revenue by printing money, it imposes an "inflation tax" because the

(1) real interest rate falls.

(2) difference between nominal and real interest rates becomes smaller.

(3) nominal value of money holdings falls.

(4) nominal interest rate falls.

(5) real value of money holdings falls.

10. According to the classical economists, which of the following variables is affected by an increase in money supply?

(1) nominal wage rate (2) nominal interest rate (3) nominal GDP (4) inflation rate (5) all of the above

11. According to the Quantity Theory of Money:

(1) a 10 percent rise in money supply causes a 10 percent rise in the velocity of money.

(2) a 10 percent rise in money supply causes a 10 percent rise in real GDP.

3

(3) a 10 percent rise in the rate of inflation causes a 10 percent rise in money supply.

(4) a 10 percent rise in money supply causes a 10 percent rise in the rate of inflation.

(5) None of above.

12. According to the Fisher equation:

(1) a 10 percent rise in the rate of inflation causes a 10 percent rise in the wage rate.

(2) a 10 percent rise in the rate of inflation causes a 10 percent rise in the real interest rate.

(3) a 10 percent rise in the nominal interest rate causes a 10 percent rise in the rate of inflation.

(4) a 10 percent rise in the real interest rate causes a 10 percent rise in the rate of inflation.

(5) a 10 percent rise in the rate of inflation causes a 10 percent rise in the nominal interest rate.

13. Hyperinflation usually occurs when

(1) people consume too much.

(2) workers demand higher wages.

(3) the government collects too much tax.

(4) the government prints too much money.

(5) the economy grows too fast.

14. If net exports are positive, which of the following is TRUE?

(1) Domestic spending exceeds domestic output.

(2) Domestic saving exceeds domestic investment.

(3) Net capital outflow is negative.

(4) There is a trade deficit.

(5) Private savings exceeds public saving.

15. In the small open economy model with the assumption of perfect capital mobility, if a country begins in a position of balanced trade, what happens in the long run when the foreign country increases its government expenditure?

(1) National savings become smaller than investment.

(2) The interest rate decreases.

(3) The country becomes a net borrower.

(4) Net exports become positive.

(5) The trade balance goes into deficit

16. Which of the following is a correct statement?

(1) The U.S. is the world’s largest debtor nation.

4

(2) The global imbalance is considered as one of the root causes of the global financial crisis of 2008.

(3) Korea has had trade surpluses in recent years.

(4) The U.S. has had trade deficits in recent years.

(5) All of the above.

17. Which of the following is NOT a correct statement?

(1) A policy can reduce the natural rate of unemployment only if it lowers job separation rate or increases job finding rate.

(2) Because the job finding is not instantaneous (i.e. takes time), the natural rate of unemployment is greater than zero.

(3) In our dynamic economy, sectoral shifts occur frequently, contributing to frictional unemployment.

(4) Public job training programs can help reduce frictional unemployment.

(5) Unemployment insurance can help reduce frictional unemployment.

18. Wage is often rigid because of

(1) the minimum wage laws

(2) labor unions.

(3) efficiency wages.

(4) All of the above.

(5) None of the above.

19. 다음 중 한국의 실업률 계산방법과 관련한 설명 중 틀린 것?

(1) 조사대상월 15일 현재 만 15세 이상 인구 중 경제활동인구를 대상으로 고용지표를 조사

(2) 조사대상주간에 수입을 목적으로 매일 평균 1시간 이상 일한 자는 취업자로 분류

(3) 자기가구에서 경영하는 농장이나 사업체의 수입을 위해 주당 18시간이상 일한 무급가족종사자는

취업자로 분류

(4) 직업 또는 사업체를 가지고 있으나 일시적인 병 또는 사고, 연가, 교육, 노사분규 등의 사유로 일

하지 못한 일시 휴직자는 취업자로 분류

(5) 조사대상주간에 수입있는 일을 하지 않았고, 지난 4주간 일자리를 찾아 적극적으로 구직활동을

하였던 사람으로서 일자리가 주어지면 즉시 취업이 가능한 사람은 실업자로 분류

20. 2013년 4월 현재 한국은행의 기준금리는?

(1) 3.0% (2) 3.25% (3) 3.5% (4) 2.75% (5) 2.5%

5