Assessing a Technical Business Opportunity

advertisement

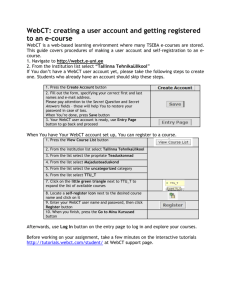

Stevens Institute of Technology Howe School of Technology Management Syllabus EMT 472 – Assessment and Financing of Technical Business Opportunities Spring, 2009 Fridays, 2:30 – 5:00 pm Elliot A. Fishman, PhD Tel: 201-216-8548 Fax: 201-216-5385 efishman@stevens.edu Office Hours: Fridays before class and by appointment Course Web Address: http://webct.stevens.edu Overview This course is geared toward students from the Schools of Engineering and Science who are pursuing a minor in Entrepreneurship. Students from other programs may enroll with the instructor’s permission. This course deals with evaluating and financing technical business opportunities for commercial exploitation. We treat technical business opportunities from two distinct vantage points for commercialization: · Licensing route - Technical business opportunities as IP-protected technology. · Start-up route - Technical business opportunities that are protected by IP and enable stand-alone ventures. Each route to commercialization assumes certain financial risks and benefits, and each strategy requires particular methods for financing and managing IP. The purpose of this course is to give the undergraduate student a grasp of fundamental issues for assessing and financing technical business opportunities that are to be commercialized. The course is organized into three modules: Module 1 - Assessing a Technical Business Opportunity This module will train students to act prudently when confronted with a novel technical idea. Students are expected to understand concepts of uniqueness, market size, barriers to entry, marketability, etc. – and then to evaluate their technical business opportunity against such normative measures. We will have them develop a heuristic framework to choose between licensing, spinning off, or abandoning a new invention. Module 2 - Introduction to Law and Economics of Intellectual Property Students will be introduced to three of the four types of intellectual property (IP) -patents, copyrights and trademarks.* Students are expected to gauge when each type of IP best applies for various technical business opportunities. Students will learn the different types of utility patents (machine, process, composition of matter, business method). We will expose students to issues on patents claims coverage and have them evaluate the strength of patent pools and thickets. Once students appreciate the relative strengths of various forms of IP, we will have them build financial models for licensing scenarios. Finally, students will be introduced to legal procedures by which IP is enforced. While Module 2 is geared toward prospective entrepreneurs, it should also be of interest for those students considering a career in IP law. Module 3 – Financing Technical Ventures This module assumes students will not pursue the licensing option with their technical business opportunity, but instead intend to start a new venture around their idea. Students will be trained to understand and write each element of the entrepreneurial financial plan, including: use of proceeds and cash flow analysis; scenario building and spreadsheet modeling; angel financing and valuation calculations; exit valuations and IRR analysis. Lectures will focus on the merits and drawbacks of particular kinds of financing – angels, venture capitalists and government sources. As the course’s culminating exercise, students are expected to write a complete financial plan on their technical business opportunity. The one-term course will make use of the following texts: Jeffery S. Timmons, New Venture Creation: Entrepreneurship For The 21st Century, 6/e (McGraw-Hill, 2006), ISBN-10: 0071254382, selected chapters. Book chapters will be supplemented by Harvard Business Review articles and cases. Students should log onto WebCT each week to see if new readings or downloads have been added for the next class session. 2 Learning Goals After taking this course, the student will be better able to: Discern between novel ideas that have little chance of commercial success versus commercially promising ideas that should be protected with strong IP. Learn tools and methods for valuing IP in venture, licensing and litigation settings. Specify what kind of patents and claims coverage would provide for monopolist’s market power, for those ideas that are to be protected with strong IP. Construct spreadsheets to financially value technology under various licensing scenarios. Identify when technical business opportunities may merit investment capital for the creation of standalone ventures. Analyze cash flow needs, compute shareholder dilution at various funding levels, and perform return on capital calculations. Understand the principles of intellectual property protection as a strategic asset of the firm. Acquire an operational knowledge of the various forms of intellectual property – patents, trademarks, copyrights, and trade secrets and techniques to exploit a company’s technology for economic gain. Pedagogy Classes will consist of lectures and discussion. This course emphasizes the case method, which requires active student participation and debate. In many cases, the information provided will be sufficiently ambiguous that there is no “right” answer. Just as in the real world, students will be expected to weigh costs and benefits based on uncertain or imperfect information. Problem solving is developed in a collaborative setting, alongside those who may have opposing views. For the case method to be an effective classroom experience, it is imperative that each student read each case ahead of time and come prepared with a critical point of view. On one or two occasions throughout the term, we may invite a guest lecture from industry to lend perspective. On a weekly basis, students are also encouraged to share their own corporate experiences as it relates to the material. 3 Required Text(s) Books: You may purchase these or use a copy on reserve at SC Williams Library Jeffery S. Timmons, New Venture Creation: Entrepreneurship For The 21st Century, 6/e (McGraw-Hill, 2006), ISBN-10: 0071254382, selected chapters. Required Readings (Harvard Business School Cases and Notes) All Articles will be posted on WebCT several weeks prior to the assigned class date, except for the HBS cases, which students are to purchase and download themselves from www.hbsp.com Harvard Business Review Cases and Articles – You must purchase copies of these and download these directly from HBS Publishing www.hbsp.com 1. 2. 3. 4. 5. 6. 7. Discovering New Value in Intellectual Property (HBR R00109); The Protection of Intellectual Property in the United States (HBS 9-897046); Intellectual Property and Strategy (HBS 9-704-493); Case: Palm Computing (A) (HBS9-396-245) Case: X-IT and Kiddie (9-803-041) Intellectual Asset Valuation (9-801-192) Case: Priceline vs. Microsoft (9-802-074) Articles from Miscellaneous Sources These will be posted to WebCT 8. Fishman, Securitization of IP Royalty Streams: Assessing the Landscape, Technology Access Report 9. USC Title 35 – Patents 10. USC Title 17 - Copyrights 11. USC Title 15 – Unfair competition 12. Article on Business Method Patents from BusinessWeek 13. Sample License Agreement A 14. Sample License Agreement B 15. Sample License Agreement C Assignments 1. Reading and Class Participation. Students are expected to attend each class and read all assigned materials ahead of time. Active class participation is required of each student, each week, and class participation will weigh heavily in the final grade. 4 2. Cases and Write ups. Students are expected to prepare to discuss each of the assigned cases; cases are due at the start of class, before group discussion takes place. 3. There will be a mid-term quiz. All written work is to be submitted by the dates stipulated. Late work will be automatically graded down by 10%. Midterm Quiz Class participation Case write-ups (4) 25% 15% 60% (15 pts. each) Total 100% Ethical Conduct The following statement is printed in the Stevens Graduate Catalog and applies to all students taking Stevens courses, on and off campus. “Cheating during in-class tests or take-home examinations or homework is, of course, illegal and immoral. A Graduate Academic Evaluation Board exists to investigate academic improprieties, conduct hearings, and determine any necessary actions. The term ‘academic impropriety’ is meant to include, but is not limited to, cheating on homework, during in-class or take home examinations and plagiarism.“ Consequences of academic impropriety are severe, ranging from receiving an “F” in a course, to a warning from the Dean of the Graduate School, which becomes a part of the permanent student record, to expulsion. Reference: The Graduate Student Handbook, Academic Year 2003-2004 Stevens Institute of Technology, page 10. Consistent with the above statements, all homework exercises, tests and exams that are designated as individual assignments MUST contain the following signed statement before they can be accepted for grading. ____________________________________________________________________ I pledge on my honor that I have not given or received any unauthorized assistance on this assignment/examination. I further pledge that I have not copied any material from a book, article, the Internet or any other source except where I have expressly cited the source. Signature ________________ Date: _____________ Please note that assignments in this class may be submitted to www.turnitin.com, a webbased anti-plagiarism system, for an evaluation of their originality. 5 Course Schedule Syllabus: EMT 472 Fall 2008 - Technology Asessment & Financing Session # Date Lecture Topic Reading Beforehand 1 4-Sep Field Trip to Whitney Museum - Buckminster Fuller Exhibit n/a 2 11-Sep Technology Assessment Segway Scooter questions on Fuller exhibit 3 18-Sep Guest Lecture: Heath Leadership Lecture Series: Greg Gianforte ********* Babbio 122 5 PM ************ 4 25-Sep Intro to Intellectual Property Patents 5 2-Oct Guest Lecture: Keith Lobo, MS 78 Venture Capital ********Babbio 319 3:30 PM ************* 6 9 0ct Copyrights * Trade Secrets Trademarks 7 16 0ct IP Valuation 1: DCF 8 23-Oct IP Valuation 2: Comps and other ways to value IP Razgaitis Chapter 7 slides download from WebCT Discovering New Value in IP The Protection of IP in the US (HBS 9-897-046) IP and Strategy (HBS 9-704-493) USC Title 35, Title 17 Homework Due Analayze claims language of a patent (in class) Trade secret exercise (in class) DCF Analysis of a patent portfolio (in class) patent portfolio valuation exercise (in clas) 9 30-Oct open book quiz open book quiz - use all readings to date Hand in take-home quiz 10 6-Nov Licensing Agreements downloads from WebCT 13-Nov 12 20-Nov Non-compete agreements Confidentiality Agreements Non-disclosure Agreements Appropriation & Leakage downloads from WebCT 11 downloads from WebCT Mark up licensing agreements (in class) Mark up agreements exercise (in class) Pixar Case 13 4-Dec Start-ups downloads from WebCT Kiddie Fire Ladder case 6