Fa13CR Student LN #01A

advertisement

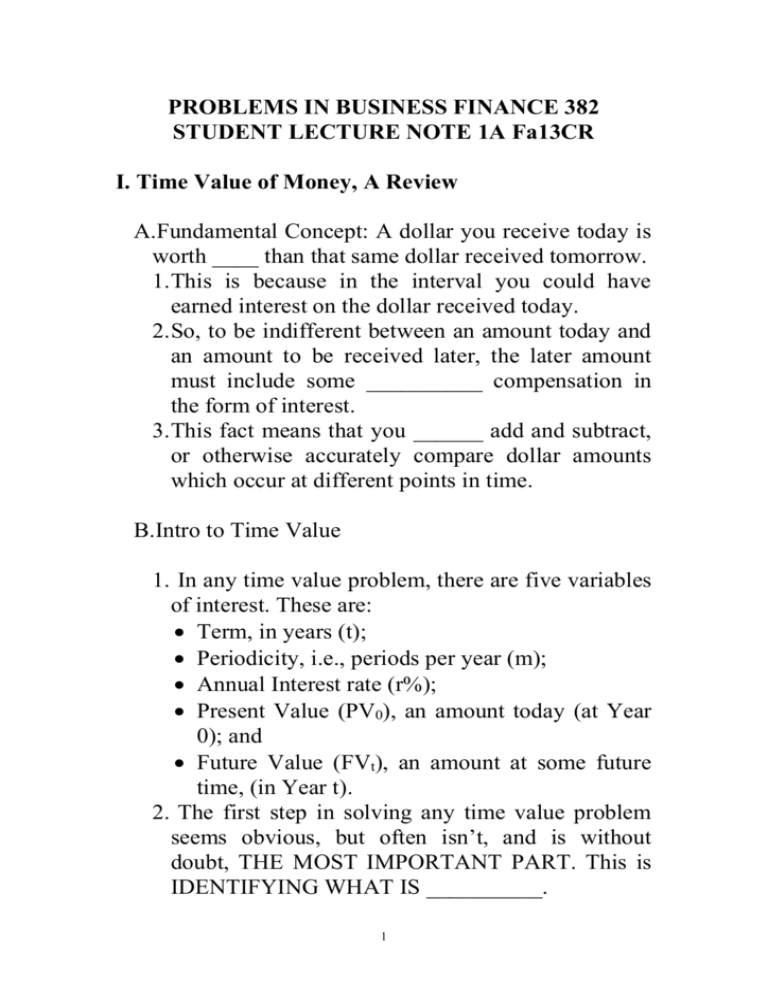

PROBLEMS IN BUSINESS FINANCE 382 STUDENT LECTURE NOTE 1A Fa13CR I. Time Value of Money, A Review A.Fundamental Concept: A dollar you receive today is worth ____ than that same dollar received tomorrow. 1. This is because in the interval you could have earned interest on the dollar received today. 2. So, to be indifferent between an amount today and an amount to be received later, the later amount must include some __________ compensation in the form of interest. 3. This fact means that you ______ add and subtract, or otherwise accurately compare dollar amounts which occur at different points in time. B.Intro to Time Value 1. In any time value problem, there are five variables of interest. These are: Term, in years (t); Periodicity, i.e., periods per year (m); Annual Interest rate (r%); Present Value (PV0), an amount today (at Year 0); and Future Value (FVt), an amount at some future time, (in Year t). 2. The first step in solving any time value problem seems obvious, but often isn’t, and is without doubt, THE MOST IMPORTANT PART. This is IDENTIFYING WHAT IS __________. 1 3. A second step is deciding which approach to use, i.e.,: a. Numerical (using the appropriate formula and a calculator—will work with any calculator), b. Financial Calculator (assumes you have one), or c. Excel Spreadsheet (need to have a computer). C.Future Value of a Single Payment The general formula to determine the FV of a single payment is: r t*m FVt = PV0 1 = PV0 * FVIFr/m,t*m. (1A.1) m Ex. 1A.1 Suppose Ashleigh Smith (F381, Spr’10, F382, Fa’10) deposits $1,521.12 into an account that earns an annual interest rate of 8.5%, which is compounded hourly (Yes!). How much will she be able to withdraw at the end of 14 years? A. 1A.1 FV14 .085 (14*8760 ) = $1,521.12 1 8760 = $1,521.12 * (3.28706209) = $____________ = $_______, where: FVIF 8.5%/8760,14*8760 = (3.28706209). Numerical Approach - Calculator Sequence: 2 0.085 [] 8760 [=] [+] 1 [=] [yx] [(] 8760 [x] 14 [)] [=] [x] 1521.12 [=] Financial Calculator – Calculator Approach: Note, before making any calculations, you need to check whether or not the [P/Y] is set for monthly payments (this is the default for the TI BA II Plus calculator) or not.1 Enter 14*8760 8.58760 -1521.12 0 N I/Y PV PMT Solve for FV 5000.02 Keystrokes (assuming that [P/Y] is set for 1 period per year). 14 [x] 8760 [=] [N] 8.5 [] 8760 [=] [I/Y] 1521.12 [+/-] [PV] 0 [PMT] [CPT] [FV] General Excel Function: =FV(rate,nper,pmt,pv,type). SS Solution: =FV($M9/$K9,$L9*$K9,$O9,-$N9,0) In conclusion: This implies that if somebody offers you $ 1521.12 today or $5,000 at the end of 14 years, and your opportunity cost of funds = 8.5% (compounded 1 With a BAII Plus calculator, this is done using the following steps. To enter compounding periods per year, press [2nd] [P/Y] (m?) [ENTER]. Then press [2nd] [QUIT] to return to standard calculator mode. To check whether the compounding periods are set correctly, press [2nd] [P/Y], it should show whatever you have set. 3 hourly), that you would be indifferent between the two alternatives. Instructive Query: Suppose your opportunity cost of funds was 9%, do you prefer the amount today or to receive the amount in the future? D.The Present Value of a Single Payment Suppose we know that a certain amount will be received in the future, and we want to know what it is worth to us in today's dollars given a certain opportunity cost. This is equivalent to asking the question of what amount deposited ______ would grow to this known future amount? The process of finding PVs of future amounts is known as DISCOUNTING. Solve Formula (1A.1) for the PV of a single amount. FV = PV * (1 + (r/m))t*m PV0 = FVt (1 (r/m))t*m Thus, the general formula to determine the PV of a single payment is: 1 PV0 = FVt = FVt * PVIFr/m,t*m. (1A.2) t*m (1 ( r/m)) Ex. 1A.2 Eddie Bertoniere (F382, Fa’05) knows he will need $2,000 at the end of three years. How much will he 4 need to deposit into his bi-monthly compounded, 5% p.a. account today? A. 1A.2 Use Formula (1A.2) to solve for unknown PV. 1 PV = $2,000 * 0.05 1 6 3*6 = $2,000 * (0.861243115) = $_________, where PVIF5%/6,3*6 = 0.861243115. Numerical Approach - Calculator Sequence: 0.05 [] 6 [=] [+] 1[=] [yx] [(] 3 [x] 6 [)] [=] [1/x] [x] 2000 [=] Financial Calculator – Calculator Approach: Enter Solve for 3*6 56 N I/Y PV -1722.4862 0 PMT 2000 FV Keystrokes (assuming that [P/Y] is set for 1 period per year). 3 [x] 6 [=] [N] 5 [] 6 [=] [I/Y] 0 [PMT] 2000 [FV] [CPT] [PV] General Excel Function: =PV(rate,nper,pmt,fv,type) 5 SS Solution: =PV($M13/$K13,$L13*$K13,$O13,$P13,0) E. Annuities 1. An annuity is a ______ of equal payments which are either made or received with a regular frequency. 2. General Rule: FV or PV of a stream of payments is equal to the sum of the individual FVs or PVs in the stream. 3. Important Assumption: Payments are made or received at the ____ of the period. 4. To identify whether an annuity is a future or present value the most important question IS WHEN DOES THE LUMP SUM OCCUR? 5. In the FUTURE VALUE OF AN ANNUITY case deposits are made on a regular basis to ACCUMULATE A FUTURE SUM. F. Future Value of an Annuity The general formula to determine the FV of an ordinary (=end-of-period) annuity is: (1 (r/m)) t*m 1 FVA = A . (r/m) (1A.3) Ex. 1A.3 Boyd “Beau” Mothe III (F382, Sp’12) is 25 years old and expects to retire at age 65, in 40 years. Assume Beau makes weekly deposits of $50.24 into a balanced Vanguard mutual-fund portfolio earning an average, overall return of 6.5% p.a., (compounded weekly) at 6 the end of each week for the next 40 years. How much will his portfolio be worth when Beau retires at 65? A. 1A.3 FVa = $50.24 * (FVIFA6.5%/52,40*52) (1 (.065 / 52)) 40*52 1 = $50.24 (.065/52) = $50.24 (9953.51633) = $__________. Numerical Approach - Calculator Sequence: 0.065 [] 52 [=] [+] 1 [=] [yx] [(] 40 [x] 52 [)] [=] [-] 1 [=] [] [(] .065 [] 52 [)] [=] [x] 50.24 [=] Financial Calculator – Calculator Approach: Enter 40 * 52 6.5 52 N I/Y 0 PV Solve for -50.24 PMT FV 500,064.66 Keystrokes (assuming that [P/Y] is set for 1 period per year). 40 [x] 52 [=] [N] 6.5 [] 52 [=] [I/Y] 0 [PV] 50.24 [+/-] [PMT] [CPT] [FV] General Excel Function: =FV(rate,nper,pmt,pv,type) SS Solution: =FV($M17/$K17,$L17*$K17,-$O17,$N17,0) 7 G. Present Value of an Annuity 1. In a PRESENT VALUE OF AN ANNUITY problem the LUMP SUM OCCURS TODAY. Annuity payments are then made in the future. 2. Best example to help the student visualize PV of an Annuity is to think of borrowing money to buy a home (for example). 3. When do you get the loan proceeds? ______! When do the annuity repayments occur? On a regular basis over a future period of time. 4. The general formula to find the Present Value of an Annuity is given below: 1 1 (1 ( r/m)) t*m PVA = R = R (PVIFAr%,t). (1A.4) (r/m) Ex. 1A.4 Joseph Vandigo (F382, Spr’06) is financing a home mortgage from Hancock Bank. Suppose that the biweekly loan payments equal $517.63 and the loan term is 25 years. If the loan’s fixed interest rate is 5.95% how much has Joe borrowed to purchase this home? PVA = $517.63 * PVIFA 5.95%/26,25*26 8 1 1 25* 26 (1 ( 0 . 0595 /26)) = $517.63 (0.0595/26) = $517.63 (338.0781804) = $__________. Numerical Approach - Calculator Sequence: .0595 [÷] 26 [=] [+] 1 [=] [yx] [(] 25 [x] 26 [)] [=] [1/x] [+/-] [+] 1 [=] [÷] [(] .0595 [÷] 26 [)] [=] [x] 517.63 Financial Calculator – Calculator Approach: 25 * 26 5.95 26 N I/Y Enter Solve for PV -174,999.41 517.63 PMT 0 FV Keystrokes (assuming that [P/Y] is set for 1 period per year). 25 [x] 26 [=] [N] 5.95 [÷] 26 [=] [I/Y] 517.63 [PMT] 0 [FV] [CPT] [PV] General Excel Function: PV(rate,nper,pmt,fv,type) SS Solution: =PV($M21/$K21,$L21*$K21,$O21,$P21,0) H. FV and PV of Annuities Due 1. Up to this point we have always calculated the value of annuities based on the assumption that 9 payments are made or received at the ____ of the period. 2. However, in the real world, in many situations, beginning-of-the-period (BOP) payments are more realistic, i.e., lease and mortgage payments. 3. Fortunately, the necessary adjustment to account for BOP payments is quite easy. Think about how a future or present value is affected by making deposits or receiving payments one period sooner. Each deposit made earns interest for an extra period (FV) and each payment received is discounted one less period (PV). Thus, both FV and PV of an annuity due will be ________ than their end-of-period counterpart. The future value of an annuity due is then: r FVAD = A * (FVIFAr%,t) * 1 . m (1A.5) And the present value of an annuity due is: r PVAD = R * (PVIFAr%,t) * 1 . m (1A.6) Ex. 1A.5 Yessica Rizelia (F382, Sp’04, F695, Fa’04) is her firm’s chief financial analyst and she is evaluating leasing a new building. Assume that the purchase price of the building would be $500,000 and the ten-year lease terms will fully amortize this price. What is the 10 estimated monthly, beginning-of-the-period payment Yessica will calculate if the lessor earns a fixed-rate return of 7.5% p.a.? A.1A.5. In this example the lease payments are BOM, so this is a Present Value of an Annuity problem with an Annuity Due chaser. Thus, the PVAD approach given in Formula (1A.6) is the place to start. However, what Yessica is solving for is the lease payment (i.e., R), with the AD twist. r PVAD = R * PVIFA r%/m,t*m * 1 , m PVAD R= . PVIFA * (1 (r/m)) 7.5%/12,10 *12 $500,000 Here: R = = $________. 84 . 24474271 * ( 1 (. 075 / 12 )) Numerical Approach - Calculator Sequence: 1st Step: .075 [÷] 12 [=] [+] 1 [=] [yx] [(] 10 [x] 12 [)] [=] [1/x] [+/-] [+] 1 [=] [÷] [(] .075 [÷] 12 [)] [=] [STO] 1; 2nd Step: .075 [÷] 12 [=] [+] 1 [=] [x] [RCL] 1 [=] [STO] 2; 3rd Step: 500000 [÷] [RCL] 2 Financial Calculator – Calculator Approach: Need to first change the [2nd] [PMT] < = BGN> default from END (end-of-period) to BGN (beginning-of-period). 11 Note: To change the payment period (END/BGN), press [2nd] [BGN], then press [2nd] [SET]. Don’t forget to reset your calculator to [END] after this problem. 10 * 12 7.5 12 N I/Y Enter -500000 PV Solve for PMT 5,898.2246 0 FV Keystrokes (assuming that [P/Y] is set for 1 period per year) and [END/BGN] is set for [BGN]. 10 [x] 12 [=] [N] 7.5 [] 12 [=] [I/Y] 500000 [+/-] [PV] 0 [FV] [CPT] [PMT] General Excel Function: PMT(rate,nper,pv,fv,type) SS Solution: PMT($M25/$K25,$L25*$K25,-$N25,$P25,1) I. The Implicit Interest Rate 1. Finding the interest rate that is “implied” between the present value and future value of a single payment may be done simply by solving equation (1A.1) directly for ‘r”. r FVt = PV0 * 1 m t *m r 1 m FV r 1 = t m PV0 12 1 (t * m) t *m FV = t PV0 1 (t * m) FV r = t 1 * m. PV 0 (1A.7) 2. With annuity problems, finding the implicit interest rate is much easier using the Financial Calculator Function or Excel Function compared to using the Equation Approach. The latter approach requires having the appropriate interest factor table available. 3. If using the Equation Approach you need to look up the relevant FVIFA or PVIFA in the body of the table, in the row which equals t * m. The factor will appear under the column which will be for r m. To convert the “m” period rate into the annual “nominal” (vs. effective) it needs to be multiplied by m as the last step. Ex. 1A.6 Chad Notariano (F382, Sp’11) has found that the price for a 30-second commercial during the (first-three quarters of the) 2006 Super Bowl was $2.5 million. He’s also found that the same 30-seconds cost $550,000 in 1985. What quarterly, compounded growth rate in cost (per second) does this represent assuming that this represents 21 return intervals? A.1A.6. The question asks directly for the cost growth rate between single payments. This is clearly an implicit interest rate question so use (1A.7). 13 1 (21* 4) 1 * 4 = _______%. r = $2.5m $550k Numerical Approach - Calculator Sequence: 21 [x] 4 [=] [1/x] [STO] 1, 2500000 [÷] 550000 [=] [yx] [RCL] 1 [=] [-] 1 [=] [x] 4 [=] Financial Calculator – Calculator Approach: Enter Solve for 21 * 4 N I/Y 1.818877 -550000 PV 0 PMT 2500000 FV Keystrokes (assuming that [P/Y] is set for 1 period per year). 21 [x] 4 [=] [N] 550000 [+/-] [PV] 0 [PMT] 2500000 [FV] [CPT] [I/Y] [x] 4 [=] In the last step, the quarterly rate of 1.818877% is converted to an annual ‘nominal’ rate by multiplying it by ‘m’. General Excel Function: RATE(nper,pmt,pv,fv,type) SS Soln: =RATE($L29*$K29,$O29,-$N29,$P29,0)*$K29 Addendum: How to convert the nominal, annual rate above to the “effective” rate? 14 m r re = 1 1. m (1A.8) 4 Here: 0.0727551 re = 1 1 = ________%. 4 J. Continuous Compounding/Discounting 1. This is the logical extension of what happens when compounding or discounting takes place as frequently as possible, i.e., it is continuous. 2. The most practical application is that continuous compounding is assumed in the pricing of many derivative instruments, most notably in the widelyused Black-Scholes option pricing model (We will be seeing this FIN 384). The future value and present value of a single payment with continuous compounding/discounting are given below. FVCont. = PV0 * ert; (1A.9) PVCont. = FVt * e-rt; (1A.10) where: e = e1 = 2.718281828. BA II+ CS: 1 [2nd] [ex] Additional Practice Problems Ex. 1A.7 Hailee Brasington (F382, Fa’11) has identified a special investment account that guarantees a 9% return p.a. if she makes $200 deposits at the beginning of 15 each month for the next 30 years. What will her account be worth at the end of this period? A.1A.7 r FVa = $200.00 * (FVIFA 9%/12,30*12) * 1 m (1 (.09 / 12))30*12 1 .09 = $200 * 1 (.09/12) 12 = $200 (1830.743483) * (1.0075) = $__________. Numerical Approach - Calculator Sequence: 1st Step: 0.09 [] 12 [=] [+] 1 [=] [yx] [(] 30 [x] 12 [)] [=] [-] 1 [=] [] [(] .09 [] 12 [)] [=] [STO] 1; 2nd Step: 0.09 [÷] 12 [=] [+] 1 [=] [x] [RCL] 1 [=] [STO] 2; 3rd Step: 200 [x] [RCL] 2 Financial Calculator – Calculator Approach: Remember to re-set for BOP payments. [2nd] [BGN] [2nd] [SET] Enter 30 * 12 N 9 12 I/Y 0 PV Solve for -200 PMT FV 368,894.81 Keystrokes (assuming that [P/Y] is set for 1 period per year). 30 [x] 12 [=] [N] 9 [] 12 [=] [I/Y] 0 [PV] 200 [+/-] [PMT] [CPT] [FV] 16 General Excel Function: =FV(rate,nper,pmt,pv,type) SS Solution: =FV($M33/$K33,$L33*$K33,-$O33,$N33,1) Ex. 1A.8 Suppose Brennan Brupbacher (F382, Sp’10) wishes to have accumulated $40,000 to afford a downpayment on a house by the end of 4 years. What weekly deposit will be required to accumulate this future sum if his investment account earns 5.2%? A1A.8. Use formula (1A.3) and solve for the required deposit, A. FV FV = A * (FVIFAr%,t) A = . (FVIFAr%, t) Here: A = $40,000 ÷ (FVIFA 0.1%,208) [(1 (0.052 / 52)) 52*4 ] 1 = $40,000 ÷ (0.052 / 52) = $40,000 ÷ (231.0852153) = $______. Heuristic check: 208 deposits $173.10 = $36,004.8 < $40k. Numerical Approach - Calculator Sequence: .052 [÷] 52 [=] [STO] 1 [+] 1 [=] [yx] [(] 4 [x] 52 [)] [=] [-] 1 [=] [÷] [RCL] 1 [=] [STO] 2 40000 [÷] [RCL] 2 [=] Financial Calculator – Calculator Approach: Enter 4 * 52 5.2 ÷ 52 17 0 40000 N I/Y PV Solve for PMT -173.096318 FV Keystrokes (assuming that [P/Y] is set for 1 period per year). 4 [x] 52 [=] [N] 5.2 [÷] 52 [=] [I/Y] 0 [PV] 40000 [FV] [CPT] [PMT] General Excel Function: = PMT(rate,nper,pv,fv,type) SS Solution: =PMT($M37/$K37,$L37*$K37,$N37,$P37,0) Ex. 1A.9 Assume that on Dennis Haydell’s (F382, Fa’09) 7th birthday his grandparents gave him a special investment certificate that was worth $10,000 on the day he turned 23 (16 years later) as long as he earned an “A” grade in his Finance 382 class (which he clearly did). Assuming their investment was to earn an annual return of 6.75%, compounded daily, what did his grandparents originally pay for this certificate? A.1A.9. This is a present value of a single payment question, so use formula (1A.2). PV = $10,000 * (PVIF 0.0675/365,365*16) 1 = $10,000 * 16 *365 . 0675 1 365 18 = $10k * (0.3396295) = $________. Numerical Approach - Calculator Sequence: .0675 [÷] 365 [=] [+] 1 [=] [yx] [(] 16 [x] 365 [)] [=] [1/x] [x] 10000 [=] Financial Calculator – Calculator Approach: Enter 16 * 365 6.75 ÷ 365 N I/Y Solve for PV -3396.29 0 10000 PMT FV Keystrokes (assuming that [P/Y] is set for 1 period per year). 365 [x] 16 [=] [N] 6.75 [÷] 365 [=] [I/Y] 0 [PMT] 10000 [FV] [CPT] [PV] General Excel Function: PV(rate,nper,pmt,fv,type) SS Solution: =PV($M41/$K41,$L41*$K41,$O41,$P41,0) Ex. 1A.10 Congratulations, Jessica Poret (F382, Sp’09) you have matched four numbers in the Louisiana State Lottery. Jessica has two choices as to how she may receive her prize, described below. What is the implied rate of return between the two alternatives assuming the annual return is compounded bi-monthly? 19 Alternative 1: Jessica will receive an after-tax prize of $65,000, today. Alternative 2: Jessica would receive an after-tax prize of $2,518.63 at the end of every other month for the next five years. A.1A.10. In this problem both the present value (of Alternative 1) compared to the annuity stream (of Alternative 2), as well as the term (and m) are known. What is unknown is r, the relevant interest rate. As described above in reference to Ex. 1A.6, when the implicit interest rate problem involves annuities, there is no direct Equation Approach, and the relevant PVIFA table must be used. PVA = R * PVIFA X%/6,5*6 $65,000.00 PVIFA = = 25.80768116. $2,518.63 To find the answer using the equation approach, you need to be able to look up the PVIFA factor (calculated above) in the appropriate table in the row where t*m = 30. It occurs under the 1% column, this is the bi-monthly rate, so the annual (nominal) rate equals 1% * 6 = 6%. Financial Calculator – Calculator Approach: Enter Solve for 5*6 N I/Y 1.00001 -65000 PV 20 2518.63 PMT 0 FV Keystrokes (assuming that [P/Y] is set for 1 period per year). 5 [x] 6 [=] [N] 65000 [+/-] [PV] 2518.63 [PMT] 0 [FV] [CPT] [I/Y] [x] 6 [=] Ans. = ___________%. In the last step, the bi-monthly, nominal rate of 1.00001% is converted to an annual basis by multiplying it by “m”. General Excel Function: RATE(nper,pmt,pv,fv,type) SS Soln: =RATE($L45*$K45,$O45,-$N45,$P45,0)*$K45 Ex. 1A.11 Jonathan Miller (F382, Fa’08) and his spouse have managed to save up $50,000 that they are going to use to purchase a home at 39725 River Oaks Drive, Ponchatoula. Assume the purchase price equals $235,000. If the mortgage terms are for a 15-year, 5.75%, fixed-rate loan calculate their monthly loan payments. A.1A.11. When does the lump sum occur? Clearly, if you borrow money you receive the proceeds of the loan now. Therefore, this is a PV of an annuity question so use formula (1A.4) and solve for R. First, need to solve (1A.4) for R. PVA PVA = R * (PVIFAr%,t) R = . PVIFA r%, t 21 Second, what amount of the home purchase needs to be financed? Amt Borrowed = Purchase Price – Downpayment. Here: $235,000 - $50,000 = $_________. The monthly loan payment is then: R = $185k ÷ (PVIFA 5.75%/12, 15*12) 1 1 15*12 (1 (.0575 / 12)) = $185k ÷ .0575 12 = $185k ÷ (120.4224293) = $________. Heuristic Check: $1,536.26 * 180 = ___________ > $185,000. Note: Why “A” in (1A.3) is not the same as “R” in (1A.4). If you had chosen to solve this (incorrectly) as an FVIFA problem the answer you would have gotten is: $649.80 (student to verify). CLEARLY, not the same as the correct answer above. Numerical Approach - Calculator Sequence: .0575 [÷] 12 [=] [STO] 1 [+] 1 [=] [yx] [(] 15 [x] 12 [)] [=] [1/x] [+/-] 1 [=] [÷] [RCL] 1 [=] [STO] 2 185000 [÷] [RCL] 2 [=] Financial Calculator – Calculator Approach: 22 Enter 15 * 12 N 5.75 ÷ 12 I/Y -185000 PV Solve for PMT 1536.25866 0 FV Keystrokes (assuming that [P/Y] is set for 1 period per year). 15 [x] 12 [=] [N] 5.75 [÷ ] 12 [=] [I/Y] 185000 [+/-] [PV] 0 [FV] [CPT] [PMT] General Excel Function: = PMT(rate,nper,pv,fv,type) SS Solution: =PMT($M49/$K49,$L49*$K49,-$N49,$P49,0) Ex. 1A.12 According to an ABC news source the price for a 30second commercial during (the first-three quarters of) Super Bowl XLV (2011) was $3.0 million. Assuming that the cost has grown at an annual rate of (exactly) 6.52480495% (continuously compounded) and that the number of intervals equals (t =) 26 what would the cost of a comparable 30-second commercial have been in 1985? A.1A.12. The question provides known FV and the interest rate between single payments. This is then a question where you need to find present value. However there is continuous discounting so use equation (1A.10). PVCont. = FV26 * e -(r*t) = $3.0m * e -(.0652480495 * 26) = $3.0m * 0.18333333 = $________. 23 Numerical Approach – Calculator Sequence: .0652480495 [x] 22 [=] [+/-] [2nd] [ex] [x] 3000000 [=] Financial Calculator – Calculator Approach: n/a General Excel Function (to find “e”): EXP(number) SS Soln: =F52*(EXP(-B52*C52)) RULES FOR POSITIVE AND NEGATIVE SIGNS IN EXCEL FUNCTIONS Note: These rules apply generally to annuity problems because in single payment problems FV (PV) is always positive (negative) whether in the argument or answer. The Jessica Poret and Kelly Rollins (F382, Sp’09) Rule: In every TVM equation there is one negative property. PV is Always negative, unless it is equal to zero, in this case PMT has to be negative. FV is Always positive! The Dr. Meyer Rules (inspired by Jessica Poret and Kelly Rollins, (above)): If the Lump Sum is FV and known (unknown) then PMT is negative in the answer (argument). If the Lump Sum is PV and known (unknown) then PMT is positive in the argument (answer). 24