MBA/ACCT 745 - Office of the Provost

advertisement

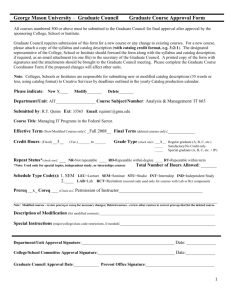

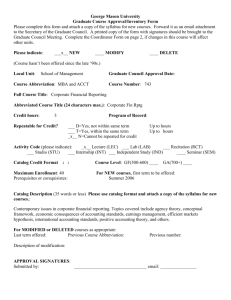

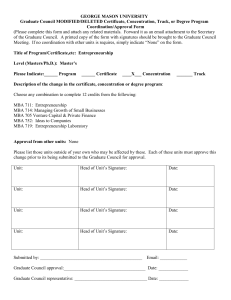

George Mason University – Graduate Council Graduate Course Approval Form All courses numbered 500 or above must be submitted to the Graduate Council for final approval after approval by the sponsoring College, School or Institute. Graduate Council requires submission of this form for a new course or any change to existing courses. For a new course, please attach a copy of the syllabus and catalog description (with catalog credit format, e.g. 3:2:1). The designated representative of the College, School or Institute should forward the form along with the syllabus and catalog description, if required, as an email attachment (in one file) to the secretary of the Graduate Council. A printed copy of the form with signatures and the attachments should be brought to the Graduate Council meeting. Please complete the Graduate Course Coordinator Form if the proposed changes will affect other units. Note: Colleges, Schools or Institutes are responsible for submitting new or modified catalog descriptions (35 words or less, using catalog format) to Creative Services by deadlines outlined in the yearly Catalog production calendar. Please indicate: New__X_____ Modify_______ Department/Unit: School of Management Submitted by: Angel Burgos Delete_______ Course Subject/Number: MBA/ACCT 745 Ext: 8949 Email: aburgos2@gmu.edu Course Title: International Financial Reporting Effective Term (New/Modified Courses only): Spring 09 Final Term (deleted courses only):____________ Credit Hours: (Fixed) __3__ Grade Type (check one): __X___ (Var.) ______ to ______ _____ _____ Regular graduate (A, B, C, etc.) Satisfactory/No Credit only Special graduate (A, B, C, etc. + IP) Repeat Status*(check one): _X__ NR-Not repeatable ____ RD-Repeatable within degree ____ RT-Repeatable within term *Note: Used only for special topics, independent study, or internships courses Total Number of Hours Allowed: _3____ Schedule Type Code(s): 1._LEC LEC=Lecture SEM=Seminar STU=Studio INT=Internship IND=Independent Study 2.____ LAB=Lab RCT=Recitation (second code used only for courses with Lab or Rct component) Prereq _X__ Coreq ___ (Check one):_ Completion of MBA or MSA core requirements, or permission of program director. __________________________________________________________ __________________________________________________________________________________________ Note: Modified courses - review prereq or coreq for necessary changes; Deleted courses - review other courses to correct prereqs that list the deleted course. Description of Modification (for modified courses):____________________________________________________________________ Special Instructions (major/college/class code restrictions, if needed):__________________________________________ Department/Unit Approval Signature:_________________________________________ Date: _____________ College/School Committee Approval Signature:__________________________________ Date:_____________ Graduate Council Approval Date:____________ Provost Office Signature:_________________________________ George Mason University Graduate Course Coordination Form Approval from other units: NONE Please list those units outside of your own who may be affected by this new, modified, or deleted course. Each of these units must approve this change prior to its being submitted to the Graduate Council for approval. Unit: Head of Unit’s Signature: Date: Unit: Head of Unit’s Signature: Date: Unit: Head of Unit’s Signature: Date: Unit: Head of Unit’s Signature: Date: Unit: Head of Units Signature: Date: Graduate Council approval: ______________________________________________ Date: ____________ Graduate Council representative: __________________________________________ Date: ____________ Provost Office representative: ____________________________________________ Date: ____________ Catalog Description: Examines accounting from an international perspective, including the study of various functional areas of accounting across countries and the reporting requirements encountered by companies engaged in international trade and making foreign direct investments. Master Syllabus MBA/ACCT 745: International Financial Reporting Prerequisite: Admission to MBA program and completion of core curriculum Course Description: This 3 credit course examines accounting from an international perspective, including the study of various functional areas of accounting across countries and the reporting requirements encountered by companies engaged in international trade and making foreign direct investments. Learning Objectives: After completing this course, the student will be able to: Understand how generally accepted accounting principles are used by other countries and the United States to report financial information to global users Understand the global variety of accounting regulations and practices Analyze and interpret financial information presented by local, multinational, and transnational corporations for decision making purposes. Understand the issues related to harmonizing worldwide accounting standards Approach to Learning and Student Responsibilities: The course utilizes a mixture of lectures, cases or problem discussions, and illustrations. Students are expected to prepare in advance the assigned readings, homework, and cases and contribute to the discussion of points and analysis of issues during the class meetings. Representative Text(s) and Required Materials: International Accounting. Doupnik, Timothy & Hector Perera, McGraw-Hill Irwin (2007) Course Website: Yes Methods of Student Evaluation: Grades are based on participation in class discussions, cases, writing or problem assignments, one midterm examination (or two midterms), and a final examination. Topics Covered: Introduction to International Financial Reporting Worldwide Accounting Diversity International Harmonization of Financial Reporting International Financial Reporting Standards Comparative Accounting Foreign Currency Transactions and Hedging Foreign Exchange Risk Translation of Foreign Currency Financial Statements Additional Financial Reporting Issues Analysis of Foreign Financial International Taxation International Transfer Pricing Strategic Accounting Issues in Multinational Corporations Comparative International Auditing and Corporate Governance Other topics may be added at the instructor’s discretion Honor Code: The faculty expects students to follow the University’s honor code as presented in the University’s publications. ODS Statement: If you are a student with a disability and you need academic accommodations, please see instructor and contact the Office of Disability Services (ODS) at (703) 993-2474. All academic accommodations must be arranged through the ODS. Note: Please refer to Syllabus Standards School of Management April 2004 document when creating actual course syllabus