Syllabus

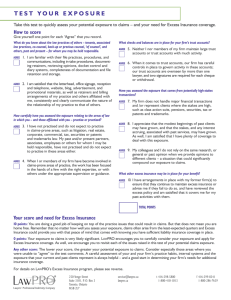

advertisement

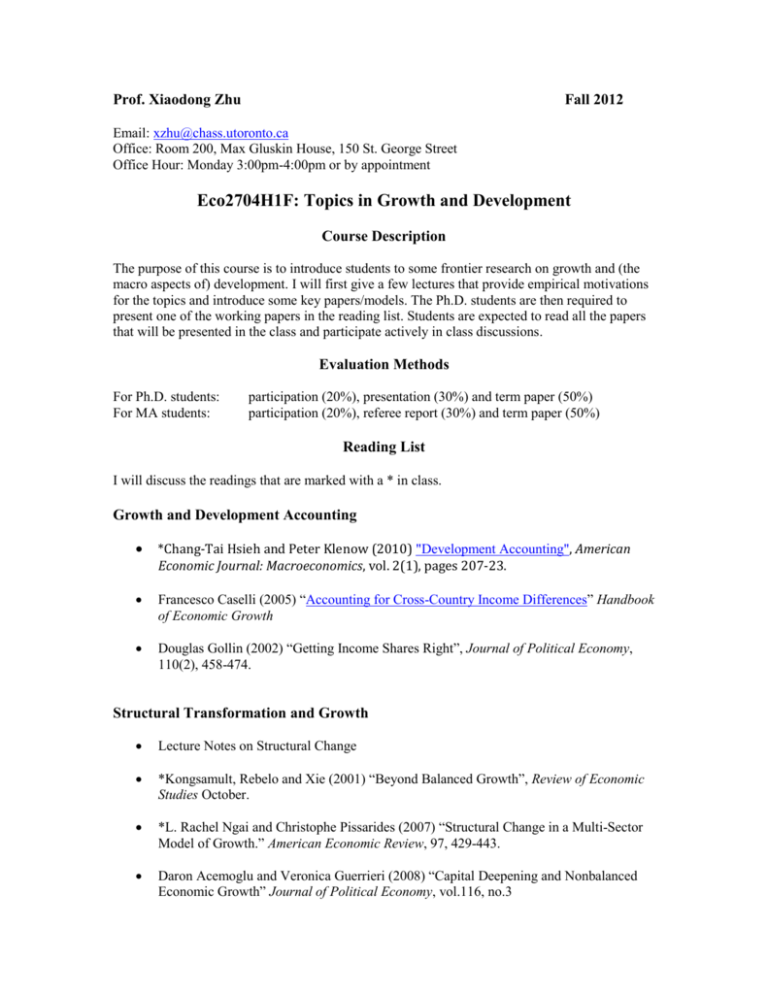

Prof. Xiaodong Zhu Fall 2012 Email: xzhu@chass.utoronto.ca Office: Room 200, Max Gluskin House, 150 St. George Street Office Hour: Monday 3:00pm-4:00pm or by appointment Eco2704H1F: Topics in Growth and Development Course Description The purpose of this course is to introduce students to some frontier research on growth and (the macro aspects of) development. I will first give a few lectures that provide empirical motivations for the topics and introduce some key papers/models. The Ph.D. students are then required to present one of the working papers in the reading list. Students are expected to read all the papers that will be presented in the class and participate actively in class discussions. Evaluation Methods For Ph.D. students: For MA students: participation (20%), presentation (30%) and term paper (50%) participation (20%), referee report (30%) and term paper (50%) Reading List I will discuss the readings that are marked with a * in class. Growth and Development Accounting *Chang-Tai Hsieh and Peter Klenow (2010) "Development Accounting", American Economic Journal: Macroeconomics, vol. 2(1), pages 207-23. Francesco Caselli (2005) “Accounting for Cross-Country Income Differences” Handbook of Economic Growth Douglas Gollin (2002) “Getting Income Shares Right”, Journal of Political Economy, 110(2), 458-474. Structural Transformation and Growth Lecture Notes on Structural Change *Kongsamult, Rebelo and Xie (2001) “Beyond Balanced Growth”, Review of Economic Studies October. *L. Rachel Ngai and Christophe Pissarides (2007) “Structural Change in a Multi-Sector Model of Growth.” American Economic Review, 97, 429-443. Daron Acemoglu and Veronica Guerrieri (2008) “Capital Deepening and Nonbalanced Economic Growth” Journal of Political Economy, vol.116, no.3 Berthold Herrendorf, Richard Rogerson and Akos Valentinyi (2012) “Growth and Structural Transformation” mimeo Francesco Caselli and John Coleman “The U.S. Structural Transformation and Regional Convergence: A Reinterpretation” Journal of Political Economy, June 2001 *Diego Restuccia, Dennis Tao Yang and Xiaodong Zhu (2008) “Agriculture and Aggregate Productivity: A Quantitative Cross-Country Analysis”, Journal of Monetary Economics 55(2), 234-250. Fumio Hayashi and Edward Prescott (2008) “The Depressing Effect of Agricultural Institutions on the Prewar Japanese Economy,” Journal of Political Economy, 2008, vol.116, no.4 Dennis Tao Yang and Xiaodong Zhu (2009) “Modernization of Agriculture and LongTerm Growth.” Margarida Duarte and Diego Restuccia (2010), "The Role of the Structural Transformation in Aggregate Productivity.” Quarterly Journal of Economics 125 (1), 129–173. David Lagakos and Michael Waugh (2012), “ Selection, Agriculture and Aggregate Productivity Differences” forthcoming, American Economic Review.” Trade and Development *Eaton, Jonathan and Kortum, Samuel (2002) “Technology, Geography, and Trade”, Econometrica , 70(5), 1741-1779. *Melitz, M. J. (2003) "The Impact of Trade on Intra-Industry Reallocations and Aggregate Industry Productivity," Econometrica, 71, 1695-1725. *Atkeson, Andrew and Ariel Burstein (2008), “Pricing-to-Market, Trade Costs, and International Relative Prices," American Economic Review, 98 (5), 1998-2031. Dave Donaldson (2009): Railroads of the Raj: Estimating the Impact of Transportation Infrastructure. Michael Waugh (2009): International Trade and Income Differences Kei-Mu Yi and Jing Zhang (2010): Structural Change in an Open Economies Trevor Tombe (2011): “The Missing Food Problem” *Chris Edmond, Virgiliu Midrigan and Daniel Y. Xu (2012) “Competition, Markups, and the Gains from International Trade, Appendix” Misallocation and Aggregate Productivity *Diego Restuccia and Richard Rogerson (2008) “Policy Distortions and Aggregate Productivity with Heterogeneous Plants” Review of Economic Dynamics, vol. 11(4), pages 707-720, October *Chang-Tai Hsieh and Peter J. Klenow (2009) “Misallocation and Manufacturing TFP in China and India” Quarterly Journal of Economics 124, November 1403-1448. Hugo Hopenhayn (2012) “On the Measure of Distortions” Loren Brandt, Trevor Tombe and Xiaodong Zhu (2012) "Factor Market Distortions Across Time, Space and Sectors in China" Eric Bartelsman, John Haltiwanger and Stefano Scarpetta (2009) "Cross-Country Differences in Productivity: The Role of Allocation and Selection," NBER Working Paper 15490 *Chang-Tai Hseh and Peter J. Klenow (2012) "The Life Cycle of Plants in India and Mexico" Roberto N. Fattal Jaef (2012) “Entry, Exit and Mis-allocation Frictions” Chang-Tai Hsieh, Erik Hurst, Chad Jones and Peter J. Klenow (2012) “The Allocation of Talent and U.S Economic Growth” Michael Peters (2011) "Heterogeneous Mark-Ups and Endogenous Misallocation" Collard-Wexler, A., J. Asker, and J. De Loecker (2011): “Productivity Volatility and the Misallocation of Resources in Developing Economies,” NBER Working Paper 17175. Finance and Development Robert Townsend (1979) “Optimal Contract and Competitive Markets with Costly State Verification,” Journal of Economic Theory 21, 265-293 Williamson, Stephen D (1986). “Costly Monitoring, Financial Intermediation, and Equilibrium Credit Rationing,” Journal of Monetary Economics, 18(2): 159-79. *Douglas Diamond (1984) “Financial Intermediation and Delegated Monitoring” Review of Economic Studies 51(3) 393-414. *Jeremy Greenwood & Juan M. Sanchez & Cheng Wang, 2010. "Financing Development: The Role of Information Costs,”American Economic Review, 100(4), pages 1875-91, September. Jeremy Greenwood and Boyan Jovanovich (1990) “Financial Development, Growth and the Distribution of Income,” Journal of Political Economy, 98(5), 1076-1107. Castro, Rui, Gian Luca Clementi, and Glenn M. MacDonald (2009) “Legal Institutions, Sectoral Heterogeneity, and Economic Development,” Review of Economics Studies, 76(2): 529-561. Chakraborty, Shankha and Amartya Lahiri (2007). “Costly Intermediation and the Poverty of Nations,” International Economic Review, 48(1): 155-183. Clementi, Gian Luca and Hugo A. Hopenhayn (2006). “A Theory of Financing Constraints and Firm Dynamics,” Quarterly Journal of Economics, 121(1): 229-265. Francisco J. Buera & Joseph Kaboski & Yongseok Shin (2011) "Finance and Development: A Tale of Two Sectors," American Economic Review, 101(5): 1964–2002. *Benjamin Moll “Productivity Loss from Financial Frictions: Can Self-Financing Undo Capital Misallocation?” Virgiliu Midrigan and Daniel Y. Xu (2011) “Finance and Misallocation: Evidence from Plant-level Data,” NBER Working Paper 15647 Simon Gilchrist and Egon Zakrajsek (2012) "Misallocation Losses Owing to Financial Distortions: Direct Evidence From Dispersion in Borrowing Costs" Jeremy Greenwood & Juan M. Sanchez & Cheng Wang (2011) “Quantifying the Impact of Financial Development on Economic Development” Stelios Michalopoulos, Luc Laeven, and Ross Levine (2009) “Financial Innovation and Endogenous Growth”