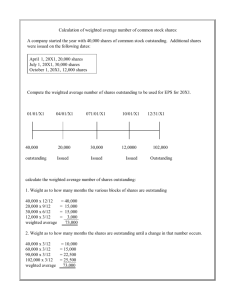

15–20

advertisement