Lecture Notes for

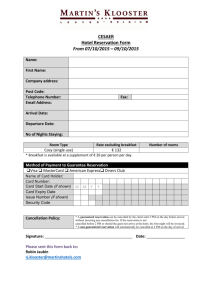

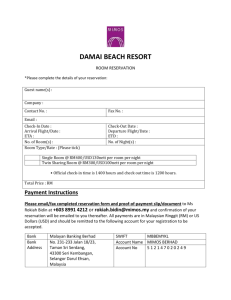

advertisement

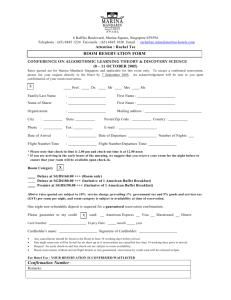

Lecture Notes for Pindyck and Rubinfeld Chapter 11: Pricing with Market Power Example: A Theater’s Profit Based on the Pricing Method Used 1 First Degree Price Discrimination or Perfect Price Discrimination p, $ per unit 6 5 e MC 4 3 Demand, Marginal revenue MR1 = $6 MR2 = $5 MR 3= $4 2 1 0 1 2 3 4 5 6 Q, Units per day With Perfect First Degree Price Discrimination, customers pay their maximum willingness to pay. In this way, the monopolist captures all the consumer surplus (and turns it into profit). The “willingness to pay” is also referred to as the “reservation price.” With first degree price discrimination, the MR curve is no longer relevant to the monopolist’s decision. It’s the demand curve - representing willingness to pay - that is relevant. (In other words, the MR is the demand curve for the first degree price discriminator.) It’s necessary for the firm to be able to identify a customer’s willingness to pay. 2 In practice, perfect first degree price discrimination might not be possible, so a firm may charge a number of different prices representing the approximate reservation prices of consumers – capturing less than all the consumer surplus, but more than a monopolist that charges a single price. P MC P4 P3 P2 P1 D Q 3 Competitive, Single-Price, and Perfect Discrimination Equilibria p, $ per unit p1 A ps B p c =MCc MC es C ec E D MCs Demand,MR d MC1 MR s Qs Qc=Q d Q , Units per day The quantity produced by the first degree price discriminator is the same as the perfect competition quantity, which is larger than the quantity produced by the single price (i.e. non-discriminating) monopolist. Therefore there is no deadweight loss with perfect price discrimination. However, all the CS under competition is captured as PS for the perfect price discriminator. 4 Second Degree Price Discrimination or Quantity Discrimination The willingness to pay for the first few units of a good is high, then the willingness to pay for additional units is less. Second Degree Price Discrimination entails charging different prices for different quantities of the good. Examples: Quantity Discounts (generally) and Block Pricing (for electricity, for example). (a) Second Degree or Quantity Discrimination p1, $ per unit 90 A= $200 70 C= $200 50 B= $1,200 D= $200 30 mc Demand 0 20 40 9 Q , Units per day 0 The first 20 units cost $70 each. The next 20 units cost $50 each. 5 (b) Single-Price Monopoly p , $ per unit 2 90 E = $450 60 F = $900 G = $450 m cmc 30 Demand MR 0 30 90 Q , Units per day This table compares the CS, PS, and deadweight loss between second degree price discrimination (last slide) and single price monopoly (this slide) using the same demand curve and MC. The deadweight loss is less with quantity (or second degree price) discrimination than with the single price (i.e. non-price discriminating monopoly. The second degree price discriminator gets more PS than the single price monopolist. CS is less when there is second degree price discrimination than with the single price monopolist. 6 Third Degree Price Discrimination or Multi-market Pricing Third Degree Price Discrimination entails charging different prices to different groups of consumers – each group of consumers has a different demand curve. Examples: Discounts to students or seniors (because they have lower willingness to pay). Airfares: higher fares charged to business travelers than other travelers (due to Saturday stay-over requirements for discounts). Coupons: Only those persons willing to spend time cutting coupons will use them, so not necessary to give everyone discounted price! Need a way to distinguish groups of customers! Let there be two groups of customers. Then two conditions must hold for profit maximization: 1. MR1(Q1) = MR2(Q2) The MR received from each group of customers must be equal. If MR1 > MR2, then the firm can lower p1 and raise p2 in order to increase Q1 and decrease Q2, thus raising profits. 2. MR1(Q1) = MR2(Q2)= MC(Q1+ Q2) If only a single price is charged to both groups of customers, then we don’t have MR=MC in both markets. If we don’t have MR=MC in both markets, then we’re not profit maximizing! 7 Third Degree Price Discrimination: Example (a) Japan (MARKET ONE) pJ, $ per unit 3,500 CSJ pJ = 2,000 DJ J DWLJ 500 MC MRJ 0 QJ = 3,000 7,000 QJ, Units per year (b) United States (MARKET TWO) p US, $ per unit 4,500 CSUS pUS = 2,500 D US US DWLUS 500 MC MRUS 0 QUS = 2,000 4,500 Q , Units per year US 8 Another way to look at the Third-Degree Price Discrimination Problem: MC MR1 Q1 Q2 MR2 MRT QT Q To find QT = Q1+ Q2, find the intersection of the MC curve with the combined MRT curve. The MRT curve can be found by summing the individual MR curves horizontally. QT is the total amount of output sold, and Q1 and Q2 are the quantities sold to customers is market/group 1 and 2 respectively. 9 Third Degree Price Discrimination (cont’d) Recall from chapter 10 that: MR = P(Q) + P'(Q)Q = P + P(P'(Q)(Q/P)] = P (1 + 1/ed) (where ed = elasticity of demand) We can apply this to the third degree price discrimination model to see the relationship between the prices charged in each market. MR1 = P1(1+1/e1) for market 1 and MR2= P2(1+1/e2) for market 2 Since MR1 = MR2, then P1(1+1/e1) = P2(1+1/e2), or P1/P2 = (1+1/e2)/(1+1/e1). Example: If e1 = -2 and e2 = - 3, then P1/P2 = 4/3 so that the price charged in market 1 is 1.33 times the price charged in market 2. Final note of caution: If MC rising fast (steep upward sloping) and one of the markets is small (low demand), it may not be worth it to sell to the small market. 10 Intertemporal Price Discrimination Intertemporal price discrimination means that customers are separated into different groups by charging different prices at different points in time. This is intended to capture the consumer surplus of those people who want the newest goods right away and are willing to pay high prices for them. Example: newest models of electronic goods, computers, cell phones, etc. are priced much higher than next to last model. New books come out originally as hardbacks and sold at much higher prices than paperback versions that are published a year or so later. Those with demand D1 have a high willingness to pay for new goods as soon as they come out. D2 MR1 D1 MR2 11 Two-part Tariff With a two-part tariff, you first pay an upfront entry fee (T), then you pay a per unit usage fee (P). Example: Club membership + fees for using facilities, razors and blades sold separately, printers that need specialized ink cartridges, phone service (connection fee + per minute charge). Total revenue per customer (i) = T + PQi. ONE CUSTOMER If there’s only one customer (or one type of customer), profit maximizing choice is to charge P = MC and T = entire CS. p, $ per unit 100 D2 T = $4050 10 0 mc 90 100 q2, Units per day 12 Two-Part Tariff (cont’d) Two customers If there are two types of customers, you will charge P>MC and T = remaining CS of the customer with the smaller demand. (a) Consumer 1 p, $ per unit 80 D1 A 1 = $1,800 20 10 C1 = $50 B1 = $600 mc 0 60 70 80 q1, Units per day (b) Consumer 2 p, $ per unit 100 D2 A2 = $3,200 20 10 0 C2 = $50 B2 = $800 mc 80 90 100 q2, Units per day 13 Two-Part Tariff (cont’d) From the previous slide: If you were to charge P = MC and T = 2450 (the whole CS of consumer 1, the one with smaller demand), then Profit = 2(2450) = $4950. If you charge P = 20 > MC and T = 1800, then Profit = 2(1800) + 60(10) + 80(10) = $5000. ****** THEREFORE, if there are two customers (or two types of customer), it is more profitable to charge P>MC and T = remaining CS of the customer with the smaller demand. With many types of customers, one must consider the trade-off. Lower T means more customers will join (because of the more affordable “entry fee”) but lower entry fee revenue per customer. More customers means more per unit sales for usage. Comparing the one-customer to the two-customer case, we can make the following generalizations: a. When customers are similar (have similar demand curves), then charge a high entry fee (T) and a per unit price (P) so that P is close to MC. b. When customers’ demands curve are different, then charge a lower entry fee (T) but a higher per unit price (P) so that P>MC. The two-part tariff works best when customers have similar demand curves. If demand curves are very different, then it might be better to drop the entry fee and set P as a single-price (i.e. non-discriminating) monopolist. 14 Two-Part Tariff (cont’d) Let N be the number of customers who are willing to pay the entry fee, then: Profit = N(T)T + (P-MC)Q(N(T)) 1. N(T)T is the revenue from the entry fee. The number of customers willing to pay the entry fee falls as T rises. As T rises, N(T)T initially rises (because the fee per customer rises), but then falls (as T becomes high, fewer and fewer customers are willing to pay). Think about this as similar to what happens to MR in the regular monopoly case when we lower P. d(N(T)T)/dT = N’(T)T + N(T) (-) (+) As T rises, the first term of the derivative is negative (because N’(T) negative since raising T drives away customers). The second term is positive. Initially, revenue rises as T rises because the second term (+) overpowers the first term (-). Then after a certain T, revenue falls as T increases further, because the first term of the derivative (-) overpowers the second term (+). This gives rises to an inverse U curve for the entry fee revenue. 2. (P-MC)Q(N(T)) is the revenue from per unit sales. Holding P and MC constant, the revenue from per unit sales falls as T rises. This is because higher T means fewer customers (N) paying the entry fee. Fewer customers means lower per unit sales (Q). 15 Two-Part Tariff (cont’d) Reminder: In the graph below, P and MC are held constant. Total Profit= entry fee + unit sales Entry fee revenue Unit sales profit T 16 Bundling Bundling means that two or more different goods are sold as a package. Bundling is used when customers have heterogeneous demands. See the two numerical examples below: Example 1: Reservation Prices: Person A Person B DVD1: “There’s Something About Mary” $10 $8 DVD2: “Meet the Parents” $5 $6 Reading the Table: According to the table above, person A has a maximum willingness to pay of $10 for the DVD “There’s Something About Mary.” Note: Person A has a higher willingness to pay than Person B for DVD1. But the reverse is the case for DVD2. Let MC = 0 Two Pricing Strategies: 1. Sell DVD1 and DVD2 individually: Set p1 = $8 and p2=$5. These are the maximum prices that can be charged while selling to both customers. Given that MC=0, you want to sell to both customers. Profit = 2($8) + 2($5) = $26 2. Sell DVD1 and DVD2 as a bundle – the “Ben Stiller Special”: Set the price of the bundle pb = $14. That’s the maximum that can be charged if you want to sell to both customers. Profit = 2($14) = $28 *** In Example 1, profit is higher when selling as a bundle. 17 Bundling (cont’d) Example 2: Reservation Prices: Person A Person B DVD1: “There’s Something About Mary” $10 $8 DVD2: “Meet the Parents” $6 $5 In example 2, we’ve switched the willingness to pay for DVD2, but the numbers in the table are otherwise the same. Two Pricing Strategies: 1. Sell DVD1 and DVD2 individually: Set p1 = $8 and p2=$5. These are the maximum prices that can be charged while selling to both customers. Given that MC=0, you want to sell to both customers. Profit = 2($8) + 2($5) = $26 2. Sell DVD1 and DVD2 as a bundle – the “Ben Stiller Special”: Set the price of the bundle pb = $13. That’s the maximum that can be charged if you want to sell to both customers. Profit = 2($13) = $26 In Example 2, profit is the same whether selling as a bundle or individually. WHY? 18 Bundling (cont’d) Why does bundling create higher profits in Example 1 but not in Example 2? Answer: Because in Example 1 demands were negatively correlated, but in example 2 demands were positively correlated. To see this, look at the two graphs of the reservation prices. In the graph below, if you draw a line through points A and B, it is negatively sloped. Example 1: Graphing Reservation Prices Reservation price for good 2 (r2) B 6 5 A 1 Reservation price for good 1 (r1) 1 2 3 4 5 6 7 8 9 10 In the graph below, if you draw a line through points A and B, it is positively sloped. Example 2: Graphing Reservation Prices Reservation price for good 2 (r2) 6 5 A B 1 1 2 3 4 5 6 7 8 9 10 Reservation price for good 1 (r1) 19 Bundling (cont’d) If you only offer goods as a bundle, it’s called “pure bundling.” If you offer goods individually or as a bundle, it’s called “mixed bundling.” Mixed Bundling Mixed bundling may lead to higher profits than pure bundling when either: 1. MC >0 2. Demands not perfectly negatively correlated. Example 3: MC>0 Reservation Prices: Person A Person B Person C Person D DVD1: “There’s Something About Mary” $10 $50 $60 $90 DVD2: “Meet the Parents” $90 $50 $40 $10 MC1 = 20, MC2 = 30. If you graph the reservation prices of Persons A, B, C, and D, you will see that they are perfectly negatively correlated because they’re all on the line r1 + r2 = 100 Reservation price for good 2 (r2) Reservation price for good 1 (r1) 20 Mixed Bundling (cont’d) Example 3 Pricing Strategies: 1. Sell DVDs individually: Set p1 = 50 and p2 = 90. Then Persons B, C, and D buy DVD1 and Person A buys DVD2. Profit = 3(50-20) + (90-30) = $150. (To see why p1 = 50 and p2 = 90 is the best individual prices, try p1 = 90 or 60 and p2 = 50 or 40 and calculate the profit.) 2. Pure Bundling: Set pb = $100 Then all 4 customers buy the bundle. Profit = 4(100) – 4(20) – 4(30) = $200. 3. Mixed Bundling: p1 = p2 = $89.99 pb = $100 Person A buys DVD2 only (because they get Consumer Surplus = $0.01 from buying DVD2 but CS = 0 from the bundle). Person D buys DVD1 only (similar reasoning as Person A). Persons B and C buy bundle (CS = 0, so they’re indifferent between buying and not buying the bundle – we assume they buy). Profit = 200 + 2(89.99) – 3(20) – 3(30) = $229.98 *** Why mixed bundling is better here: Recall MC1 = 20, MC2 = 30. Person A had a very high reservation price for DVD2 but a very low reservation price for DVD1, and with person D it was the opposite case. (Note that MC1 < reservation price of A for DVD1 and MC2 < reservation price of D for DVD2.) Therefore it’s better to give these two customers the incentive to buy one DVD only – the one for which they have a very high reservation price – and save on the manufacturing costs for the DVD that is not valued very highly. 21 Mixed Bundling (cont’d) Example 4: Demands not perfectly negatively correlated Reservation Prices: Person A Person B Person C Person D DVD1: “There’s Something About Mary” $10 $40 $80 $90 DVD2: “Meet the Parents” $90 $80 $40 $10 MC1 = MC2 = 0. If you graph the reservation prices of Persons A, B, C, and D, you will see that they NOT are perfectly negatively correlated because they’re not all on a straight line. Reservation price for good 2 (r2) Reservation price for good 1 (r1) 22 Example 4 Pricing Strategies: 1. Sell DVDs individually: Set p1 = 80 and p2 = 80. Then Persons C and D buy DVD1 and Persons A and B buy DVD2. Profit = 4(80) = $320. (To see why p1 = 80 and p2 = 80 is the best individual prices, try p1 = 90, 40, or 10 and p2 = 90, 40, or 10 and calculate the profit.) 2. Pure Bundling: Set pb = $100 Then all 4 customers buy the bundle. Profit = 4(100) = $400. 3. Mixed Bundling: p1 = p2 = $90 pb = $120 Person A buys DVD2 only and Person D buys DVD1 only, because the bundle is too expensive. Persons B and C buy the bundle. Profit = 2(120) + 2(90) = $420 *** Why mixed bundling is better here: Person A had a very high reservation price for DVD2 but a very low reservation price for DVD1, and with person D it was the opposite case. Persons B and C have a higher joint valuation for the bundle ($120) than Persons A and D ($100). Therefore it’s better to give A and B the incentive to buy one DVD only – the one for which they have a very high reservation price – while charging a higher bundle price to Persons B and C. 23 Example: Bundling of Tickets to Football Games 24