mgt_Lia Jen.JR - GLOBALBUSINESSSJUTEAMAVON

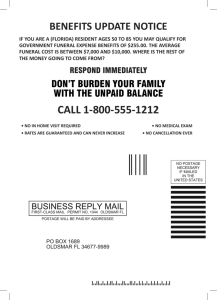

advertisement