Form DN-01 Notice for Seeking Clarification on

advertisement

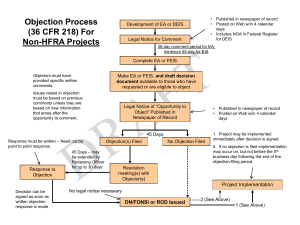

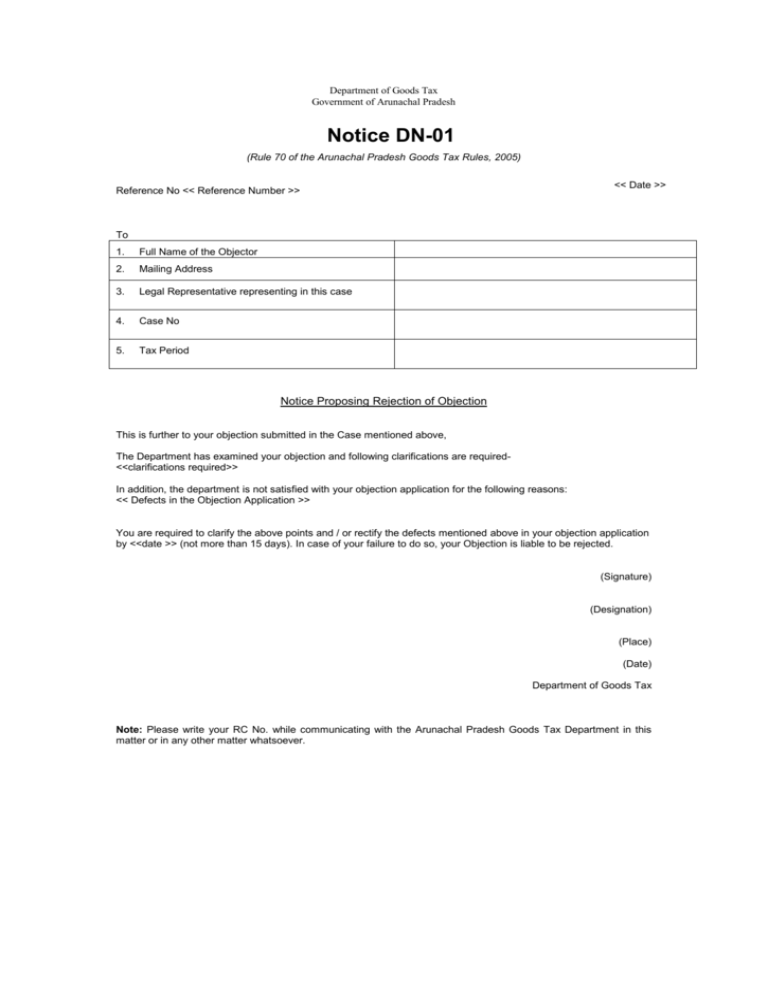

Department of Goods Tax Government of Arunachal Pradesh Notice DN-01 (Rule 70 of the Arunachal Pradesh Goods Tax Rules, 2005) << Date >> Reference No << Reference Number >> To 1. Full Name of the Objector 2. Mailing Address 3. Legal Representative representing in this case 4. Case No 5. Tax Period Notice Proposing Rejection of Objection This is further to your objection submitted in the Case mentioned above, The Department has examined your objection and following clarifications are required<<clarifications required>> In addition, the department is not satisfied with your objection application for the following reasons: << Defects in the Objection Application >> You are required to clarify the above points and / or rectify the defects mentioned above in your objection application by <<date >> (not more than 15 days). In case of your failure to do so, your Objection is liable to be rejected. (Signature) (Designation) (Place) (Date) Department of Goods Tax Note: Please write your RC No. while communicating with the Arunachal Pradesh Goods Tax Department in this matter or in any other matter whatsoever.