6. AmRest Holdings NV: Outlook for 2006

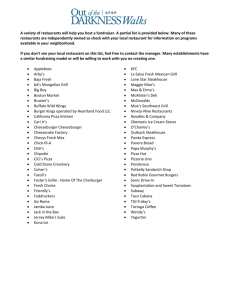

advertisement