Syllabus - of Gerald Pech

advertisement

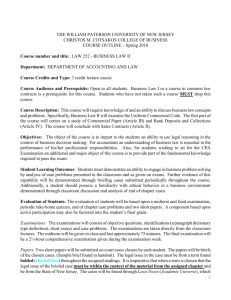

KIMEP University Course outline Fall 2013 Course title: Financial Economics Course Code: ECN 3350 (3 credit hours/5 ECTS credits) Course Meeting Time and Place: Monday 14:30 -15:45 Wednesday 14:30 -15:45 NA Instructor: Dr. Gerald Pech Office: # 220 Valikhanov building Telephone 3040 Email: gpech@kimep.kz Course Pages: L-drive: Gerald Pech/Mathematical Economics Internet: http://www.geraldpech.net/lectures/ECN3350 Office Hours Instructor: Monday, 11-12 pm, Tuesday 11-12 pm, Wednesday 10 am – 12 pm. Course Description: This course provides an introduction to modern financial economics. It applies economic analysis and the theory of finance to the decision making problem of consumers/investors and firms. Topics include portfolio selection, option pricing and market efficiency. Students will learn techniques such as capital budgeting and working capital management and learn how to address decision making problems relating to mergers and acquisitions, bankruptcy and corporate reorganization. Learning Objectives To master the analytical tools for financial decision making To understand the relationship between individual decisions and market outcomes Intended Learning Outcomes At the end of course the students should be able to: Explain the relationship between consumption and investment planning Apply optimality criteria to financial decisions Describe the relationship between theoretical predictions and empirical findings relating to the behavior of actors in financial markets Explain the role of risk in financial decision making Derive the optimal portfolio allocation Explain the role of different financial instruments Relationship between Course and Program Prerequisites: ECN2103 and ECN2083 This course is prerequisite for: no other course Learning Activities Apart from attending class, you should engage in the following activities: Preparing lectures: Read the text book chapters in advance! (1 hour per week) Practicing and reviewing lectures: After finishing each major chapter, I will post problem sets and review questions which will help you practicing and reviewing the material. (2 hours per week) Preparing for exams: Before the midterm and the final, I will post assignments which familiarize you with the style and lay out of the exam. Exams will consist of a short answer section, a problem solving section and a short essay, so you should practice your skills at memorizing, writing and problem solving. (Preparation time for reviewing and doing assignments: 20 hours for midterm, 20-25 hours for the final). Course Outline/Lectures Week Date Subject 1 02.09. 1. Introduction Reading 04.09. 2 3 09.09. 2. Allocating Resources over Time 11.09. “ 16.09. 3. Risk Taking Behavior: Theory 18.09. 4 23.09. BMC, Chpt 4, 5, 6 Pindyck/Rubinfeld Chpt. 5 4. Efficient Markets and Asset Valuation BMC, Chpt 7 25.09. 5 30.09. 5. Behavioral Finance 02.10. 6 7 8 07.10. 10.10. Assignment 1 due 14.10. Review Class 16.10. Midterm Exam 21.10. 6. Risk Management BMC, Chpt 10, 11 7. Portfolio Theory and CAPM BMC, Chpt 12, 13 8. Forward and Future Markets BMC, Chpt 14 9. Options BMC, Chpt 15 10. Principles of Corporate Finance BMC, Chpt 16 11. Real Options BMC, Chpt 17 23.10. 9 28.10. 30.10. 10 04.11. 06.11. 11 11.11 13.11. 12 18.11. 21.11. 13 25.11. 27.11. 14 02.12. 04.12. 15 “, Assignment 2 due 09.12. 11.12. Review Class Assessment Scheme I. Continuous Assessment: Two assignments Quizzes (2 / 3) Midterm Sum continuous assessment: 10 % 10 % 40 % 60 % II. Final Examination: Total 40 % 100% Grading Scale (see course catalogue) A+ 90-100 C+ 67-69 A 85-89 C 63-66 A- 80-84 C- 60-62 B+ 77-79 D+ 57-59 B 73-76 D 53-56 B- 70-72 D- 50-52 F 0-49 Course Policies and Instructor’s Expectations of Students Attendance Attendance is strongly encouraged but ultimately it is in the responsibility of the individual student. Note, however, that there will be at least 3 short, unannounced quizzes during the semester and each student is expected to participate in at least two of them to get full marks. When in the class room, students have to conduct themselves in such a way as to foster an effective learning environment. Honesty Cooperation between students in doing the assignments is encouraged. Do not, however, try to cooperate during exams! Any attempt at cheating will result in zero marks on the exam. Rules and procedures for cheating apply as laid out in the KIMEP catalogue. Instructional Resources The main textbook is: Bodie, Z., Merton, R.C., Cleefton, D.L., Financial Economics, 2nd ed., Pearson 2009, cited as BMC. Supplementary texts Bodie, Z., Kane, A., Marcus, A., Investments, 8th ed., McGraw-Hill 2010. Forbes, W., Behavioural Finance, Wiley 2009. All other course materials can be found in the L-drive folder “Gerald Pech/ Spring 2013/Mathematical Economics”. Excellent instructional resources can also be found on Robert Shiller’s webpage: http://oyc.yale.edu/economics/econ-252-11 For additional readings and links to other interesting websites visit our course page at www.geraldpech.net/lectures/ECN3350. Dates for the topics of the class sessions are tentative. This syllabus is subject to preannounced changes.