Hampehs! What The Hell Is It?

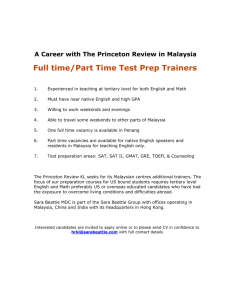

advertisement

Name: CHOONG, MEE FATT Address (Malaysia): 11, Jalan Puteri 10/15, Bandar Puteri, Puchong, 47100. Selangor, Malaysia Telephone (Malaysia): +603-80623674 (Home). Mobile Phone (Malaysia): +6012-2396187 Email ID: meefatt@pc.jaring.my Summary of Experience: Broad experience in implementing banking and financial system applications in an end user environment involving organization change management, data migration and conversion, system integration and core process changes. Strong project planning and project financial management skills. Ability to draft Project Charter which is to set project management disciplines to facilitate the detailed project goal, objective, scope definition, deliverables and resource planning, governance process, timeline and identify potential risks and issues and resolution or workaround. Playing the bridging role among various multitude stakeholders of the project; the end users, vendors, regulators and government bodies and agencies such as Bank Negara Malaysia, and various users group departments such as Business Processes (Organization and Method), Training, Audit, etc, board and shareholders. Good influencing, persuasion and facilitation skills to achieve “win-win-win” situation in all projects ; be it large and complex, compliance, or revenue driven. Conversant with current technology trends, project implementation methodology and full understanding of the SDLC phases, and working knowledge in Information Technology Infrastructure Library (I.T.I.L) concept. Strong believer in system-driven business solution architect to support various Business activities. Ability in preparing and presenting business cases to management and board which consists of project feasible studies, cost benefit analysis, market analysis of the products, risks and the resolution, budget preparation and execution, tasks deliverable constraints and expectations, and benefit definition. (pay-back time frame). Setting quality standard and monitor performance tools so that able to be far-sighted to acknowledge any potential bottle-necks of the projects execution phase in order to ensure project “live” within the prescribed times and cost parameters. Maintain auditable trail of changes in scope, budget and timelines in the Project Steering Committee for audit purpose. In addition, experience in running Help Desk, people management, project management and daily operations of the Credit Card Centre. Kept abreast with the latest Information Technology development, Financial Acts, BAFIA Acts and industrial market needs and advancement, and relate them to the Company’s I.T. Plan and I.T. budget. Demonstrate skills in establishing vendor relationships which include pricing negotiation, contract negotiation, technology integration and business forecast, development issues, service costing and drafting Service Level Agreement and business cases. Experience focus is with project management and implementation with additional related experience in consulting and customer support. Formulated strategic implementation plans. Carried out procurement function by ensuring that the tender process is performed in a transparent manner and that includes placing the Company in an advantageous position. Career aspiration is towards managing Turnkey projects, management role involving resourcing, customer liaison, customer relationship management, as well as contract and revenue management. Work Experience: April 2010 till present. First Vice President & Head of Operations, Global Markets & Investment Management Division (GMIM). UOB Malaysia. Ensure daily smooth operation of Operation Division comprises of; A) Main responsibilities and major tasks; Demand Management-Project Management role for GMIM’s various system implementation, project coordinator for Wall Street system conversion and implementation. This contributes to almost 90% of the KPI. B) Banknotes Operation Unit---daily balancing, AML and Compliance. It has been cease business in March 2011. C) Gold Unit---process of Gold Coins sales and gold bar loan system. D) Business Finance section--- GMIM budget, various reporting and GMIM’s business reports. Split form Operation division since March 2011. E) Treasury Support Function---administration unit and operational for GMIM inclusive supporting dealer’s in daily FX, Gold price and other parameter input. F) Business Assurance, Legal and Documentation-ISDA and Compliance. G) Involve in Standardization projects inclusive attend vendor’s presentation and other system fine tuning. Major Achievement: A) Attend to Banknotes Internal Audit findings. Attend meetings and discussion with Banknote’s dealer, staff and Head of GMIM on replying all audit findings and find tune to improve process and security control in Banknotes. Score a “fair” result. B) Draft and finalize the Operation Capacity Plan to management. C) Draft User Requirement on various system enhancements and mini projects such as Foreign Currency Loan enhancement, MMD in RBS system, SWIFT SCORE, PIDM UR, Interest Rate Swap (IRS) UR, New Business Sector – CTO code UR, Internal Messaging System UR and implementation. Besides, drafting the Business Internet Banking Nostro Management UR, new Corporate Webpage design UR, D) CNY (Chinese Yuen) launching for FCCA and FCTD account. E) Attend all UAT function. Project managers for all system enhancements for GMIM. June 2009 to March 2010: Information Technology Manager. First East Export Bank (PLC). Off-Shore Bank. June 2009 to August 2009. Setup I.T. infrastructure and implement Path Solution iMAL Trade Finance and Treasury system with all vendors. Perform system setup planning with vendors. Familiarize with Off-Shore Banking Act and assist in LOFSA reporting. 2 Perform all administration, regulatory, human resources, accounting and outsourcing manager role such as souring accounting out-source Company, executive search company, conduct interviews, drafting various job description, and all type of GL tasks. Treasury Operation Manager, September 2009 to March 2010 : Setup Payment system for SWIFT. Manage and processing all placements, borrowings, Nostro, Vostro and Forex position carried out by Treasury. Familiarize with all SWIFT MT 320, 950, 202, 210 and other message. Perform all payment processing January 2006 to June 2009: Vice President, Business Relations (Information Technology). AL Rajhi Bank. Working together with Chief Executive Officer and Chief Information Officer to setup the Information Technology Division and overall entire new Financial Institution Assist in various application systems software evaluation, business case proposal, system and operation requirement and price negotiations, prepare presentation to Bank Negara Malaysia on systems and new bank setup. Assist in setting up the Data Centre together with various vendors and providers inclusive architect consultancy firms. Technical Project Manager for the below systems: A) Corporate and Institutional Banking (Trade Finance, Cash Management and Credit Administration). Handed Over to another PM on May 2007. B) Treasury System. Handed over to another PM on May 2007. C) Bank Negara Malaysia Cheque Truncation and Conversion System. D) SWIFTNet Phase 2. E) Production Support and Enhancement for all BNM And Compliance Systems. Major Achievement: A) Successfully create and apply new Bank Code and branches MICR code for AL Rajhi Bank, Malaysia. B) Project Manager for SWIFT implementation inclusive filing, ordering and purchasing all SWIFT licenses, software, hardware and project implementation together with Decilion. C) Successfully open the Statutory Reserve Account and Current Account with Bank Negara Malaysia. D) Successfully implement all the Bank Negara Malaysia’s Compliance systems such as CCRIS STP, CCRIS LASS, Dcheques, FICPS, FINS (AMLA), PARS, eFIDS, ePintas and ROMS etc. E) Opening major foreign currency Nostro accounts with other foreign financial institutions locally. F) Responsible to setup and interface all Bank Negara Malaysia Compliant Systems such as RENTAS, CCRIS, DCHEQUE, ITEPS-ITIS and EALIS, FISS etc. with Elsag’s Retail Banking System (RBS). G) Responsible to ensure all BNM servers and Payment Gateway servers are in proper functionality in Data Centre and communicate well with Bank Negara Malaysia’s NWI. 3 Effective May 2007, change of portfolio as below : Technical Project Manager for: A) Check Truncation and Conversion System B) Cards (Charge and Pre-Paid Card.) C) Bank Negara Malaysia Compliance System D) Data Warehouse, Business Intelligence and Basel 2 Project. E) Budget, System and Planning Project. Major Achievement: A) Successfully implement Basel 2 Pillar system, Corporate Card, SWIFTNet Phase 2 and CTCS system. B) Implement all BNM system enhancements as and when required. C) Capability to seek exit strategy amicably with Budget, System and Planning project vendor as the vendor fail to present the Budget system. No loss at Al Rajhi bank side. D) Data Warehouse. April 2005 to December 2005: Project Manager. EDS (Malaysia) Application Solution Centre. Cyberjaya. Provide consultancy and Implement projects to client; Bumiputra Commerce Bank Berhad. Provide production support to Core Banking systems application; ALLTEL, OCM24, I-Exchange etc. Major Achievement: Successfully implement the MEPS eDebit and Mobile Money project. Oversee the implementation of Triple DES compliance project, and Rentas STP switch projects. Jan 2003 – Jan 2005: Non-Executive Group Head, (Project Manager) Credit Cards, (Silverlake Integrated Credit Card) Consumer Banking, Bank Mandiri, Jakarta, Indonesia. Contract Expatriate Position. Major Achievement: (January 2003 to September 2003) A) Responsible in developing the Data Migration and Conversion Strategy to migrate 280,000 cards base with account receivable book value of USD 96 million (circa 800 billion rupiah) from GE Capital to Bank Mandiri’s Credit Card System platform. B) Managed data mapping discussion and conversion strategy with GE Capital C) Prepared and chaired the Steering Committee meeting attended by users and management team from Bank Mandiri and GE Capital. D) Played the role as Bank Mandiri’s chief coordinator of personnel to GE Capital. E) Developed the Project Charter and other Conversion sign off documents such as Conversion Strategy, Post Conversion activities, Live Simulation sign off etc. F) Developed the business requirements and user specifications for Credit Card business G) Coordinated the review of requests for product development and service improvements from other departments for the new Silverlake Integrated Card System. H) Implemented and coordinated interface development of Silverlake Integrated Card System with various Core Banking related groups such as Group Accounting, Data warehouse, Group I.T., Branch Network, Marketing, Operations, Card Processing, Consumer Liability, Electronic 4 Banking, Credit and Risk Management Group with Silverlake Integrated Card System. I) Assisted in the Due Diligence exercise by providing statistical reports, information and conversion reports for evaluation and analysis of the portfolio to be purchased. J) There are total of 7 indirect report managers and a pool of Credit Card Centre staff dotted line report to me on the Credit Card setup. On Conversion project, there are 9 members vendor team and 5 I.T. members team report to me. October 2003 to January 2005: A) Set up the merchant acquiring system and business. Established the business platform to support the merchant acquiring business. B) Capitalize on new requirement and improvement on issuing business systems related issues such as launching the Electronic Channel Payment (I.V.R., S.M.S., Standing instruction and Internet Banking) and Automatic Direct Credit System for customers. C) Designed the overall card center organization structure to manage payment products (Credit Card, Debit Card-Visa Electron, Prepaid Card and other types of payment products). D) Developed a business model for card products and coordinated the development of action plans for the implementation of business strategy. E) Evaluated outsourcing to third parties, optimal leveraging of existing Bank processes and other service delivery alternatives to implement the business model and strategy. F) There are 2 managers and a pool of executives indirect to me on this merchant acquiring setup. G) Playing an advisor and consultant role to Group Head of Credit Cards and Executive Vice President, Consumer Banking in applications, systems, and workflow process and operations areas. Aug 2000-Dec 2002: Senior Manager, Systems Support, Operations. American International Assurance Company, Limited from August 2000 to December 2002. Overseeing an Unit-linked implementation project. Designated member of the “People Building Program”. Major achievement: A) Lead and motivated an 8 member team in UL21 till UAT stage. Able to save RM 80,000 by applying prudent management; reject all unnecessary traveling expenses as per budget set. Introduce the usage of Project Charter and GANTT Chart. B) Assisted in drafting the I.T. Division year 2002 budget, planning of the I&W roll-out, drafting business case Mainframe upgrade, involve in setting up Disaster Recovery exercise, and attend to Data Center daily operational activities. C) Drafted and updated the Agency Manual. D) Initiated and implemented a tracking system and mechanism to monitor suspense accounts---Suspense Account Management Tracking System. E) Involved in the Magnum Project (Auto Scoring system). Streamlined and improved input process in eApp System. Recommended the dual control procedure in eApp system. F) Exposed to working knowledge and Information Technology Infrastructure Library (I.T.I.L.) concepts. G) Implemented Inventory Management System (on intranet browser base) which is estimated to save RM 300,000 per year for Printing and Supplies Department. 5 Jun 1997 – Jul 2000: a. Manager, Systems Support Section, Card Services, Standard Chartered Bank Berhad from June 1997 to July 1999. Major achievement; A) Set up the Systems Support Section from scratch. B) Responsible for all systems' security in the Card Services. Ensure no conflict of interest and the objective of dual control is achieved from various functional perspective. C) Monitored and coordinated all I.T. projects in achieving business objectives and ensured Card Center’s system was synchronized with Visa and Mastercard systems (VAP and MIP). D) Playing the coordination role between the Card Services users' needs and the Global Technology Services, Consumer Banking Information System Services, and various vendors such as Sema group as well as Telecommunication companies. E) Establish vendors relationships and acts as main focus contact point with vendors on operational delivery performance matters and ensure services are being delivered within scope. F) Pricing negotiation with vendors on both the software and hardware purchased by the Card Services. It includes service costing, Service Level Agreement (SLA) drafting and service development lifecycle. G) Passed ISO 9000 and ISO for Systems Support. H) Draft and write up on Business Continuity Plan, Fall Back Plan on Y2K project (host systems and PC based systems) and co operate with Global Technology Services and Sema group in carrying out Disaster Recovery Plan. I) Able to practice prudent management to minimize all I.T. costs in the Card Center. (Involved in price negotiation and establishing good vendor management including other service provider relationship). b. Operations Manager, Card Services, Standard Chartered Bank Berhad (S.C.B.M.) from July 1999 to July 2000. Overseeing the daily operation of the Card Services Division ; A) Card Production Section B) Customer Service Management --- Merchant Services Unit and Merchant Payment Unit. C) Item Processing and Replacement Unit D) Customer Dispute and Chargeback unit. Improved and fine tuned on all operational processes. Major achievement in S.C.B.M.: Ensure Card Center passed both the Y2K internal and Bank Negara audit. Lead Card Center to the new millennium by ensuring all systems was Y2K compliant. 6 Nov 1992-Jun 1997: Senior Computer Support Officer, Information Technology Department, Public Finance Bhd, from November 1992 to June 1997. Major achievement: A) Successfully computerized the L.A.N. Informix system (Fixed Deposits, Hire Purchase, Loans, General Ledger) in 138 branches within the prescribed times and cost parameters. B) Involved in Public Bank's RM 300million Re-Engineering project. Successfully implement Genesis’s Branch Delivery Saving System for all 150 branches for Public Finance Berhad. (WAN based project) C) Project Leader for 3 projects simultaneously; drafted and planned the WAN based Fixed Deposits and Hire Purchase implementation methodology for Public Finance Berhad and was the Committee Member for Fixed Deposits Universal Banking. Aug 1989-Jun 1992 (Washington State University): a. Tutor (Economics, Computer Science and Statistics), Student Academic Learning Center (S.A.L.C.) Washington State University. Spring 1991 to Summer 1992. Major achievement: Recognized by the S.A.L.C’s Coordinator and management as the outstanding tutor. Testimonial can be provided on request. b. Computer Lab Consultant, English Department, Faculty of Literature and Arts, Washington State University. Fall 1991. c. Clerical Assistant 1, Holland Library Circulation Department, Washington State University, Fall 1989 to Fall 1990. Education: Washington State University, Pullman WA. U.S.A. Graduated in June 1992. Major in Finance and Management Information System (M.I.S.), minor in Mathematics and Economics. GPA = 3.24/4.00 Major subjects : Finance : Investment Analysis, Financial Future Market, Financial Management, Managing Financial Institutions, Money and Banking, Micro and Macro Economics, Econometrics, Marketing, Strategic Management, Cost Accounting, Management and Organization, Public and Tax Accounting. M.I.S. : System Analysis and Design, Database Management, Applied Program Development, Multiple Regression Analysis, Quality Control Management, Principal Optimization and Information System, Applied Probability, Applied Statistical Methods, Probability and Statistics and Decision Analysis. 7 I.T. Environments and Computer Skills: Software SQL*Net, Dbase111, SQL, Paradox, HTML, Java, Cobol, Pascal, Informix, MS Project, Word, Excel, Minitab, SQS and Mathlab. Systems and Network WindowsNT Core Technologies, OS2, DOS, PC, TCP/IP, data communications, IBM MQ Series (a middleware application systems) LAN, WAN. Databases and Applications Customer Information Systems (Banking ), Financial applications (Fixed Deposits, Saving, General Ledger, Loans, Hire Purchase, LFCM (Insurance), Financial Reporting), Monarch, Brioquery, Banking/Customer Profitability. ) Knowledgeable in CardPac Credit Card Management System (CCMS), Credit Assisted Collection System (CACS) and CCMS sub systems; APPS (Application system) Theoretical knowledge of Call Centre technologies and her network infrastructures. Management Skills: Exposed to effective management skills, good interpersonal communication skills, personal tact, patient and integrity. Trained to be a self-motivated, success-driven, analysis-minded, team-centered and resultoriented. Possess strong dynamic supervisory skill along with strong business acumen. Built an intense work ethic. Relishes being a strategic decision maker, a change or reengineering leader and believer. Honours and Activities: a. Council Member, American Universities Alumni Malaysia. (1996 –2000) b. Assistant Treasurer, American Universities Alumni Malaysia. (2001 – present) c. Founder and Committee Member, Malaysian Youth United States Graduate Association. (1997 – 2000) d. Dean's List (Fall 1989 and Spring 1992), Washington State University. e. Golden Key National Honour Society. f. Member of American Society for Quality Control. g. Member of Business Information System Club, Washington State University. h. Treasurer, The Malaysian Student Association in Washington State Univ. j. Malaysia Red Crescent Society member since 1980. k. Represented school in football and volleyball. References : Available Upon Request. 8