Chp 3 Notes

advertisement

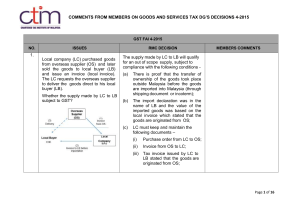

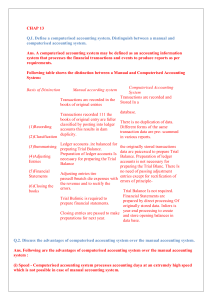

Chapter 3 Year 12 Accounting – Unit 3 Chapter 3 Study/Summary Notes Analysis and Designing Accounting Systems To design an accounting system you need the purpose of the system. GST – introduced in 2000 and is a 10% surcharge tax applied to most products (except fresh food). Due to the introduction of GST a tax invoice is necessary. A tax invoice should contain Name of business providing goods and services ABN (Australian Business Number) Words “tax invoice” Pre-printed document number Date Description of goods and services If more than $1000, purchaser’s name and ABN GST exclusive amount, GST amount, & GST inclusive amount Small businesses may not provide credit, as they may only deal in cash sales therefore a cash receipt will be issued. This must include the GST amount. Business owners must record all receipts and payments of GST. Source Documents Definition: Basic business documents used often in day-to-day transactions. They are the source of the original accounting data. Eg. A cash receipt provides information of cash flow. Cash Transactions It is customary to write the words and numbers on a receipt to make the amount totally clear and to prevent fraud. Eg. It will stop people adding zeros to numbers. It is common business practice to make cash payments by cheque. This automatically provides the firm with a permanent record of all its payments. The business can verify payments with cheque butts. Credit Transaction Most trading firms purchase their stock on credit. One reason for this is that cash purchases drain liquidity and credit purchases provide time for the business to sell some goods before paying back creditors. The source document used is an invoice. An invoice informs a credit customer of the total cost charged for goods provided. (see page 39 of text book for an example) Memorandum for Internal Transactions A memorandum is used for transactions that only affect the business and the owner. External parties are not involved. Eg contributions/withdrawal of assets by the owner Chapter 3 (except cash), such as the withdrawal of stock, donation of stock for advertising, charity. The cost of such donations must be recorded on a memorandum. Why? To satisfy the demands of reliability. Refer to example on pg 40. Statement of Account Statement of Account summarises transactions involving a credit customer over a given period of time and are usually issued monthly. They should include references to source documents. See pg 41 for an example. Other Business Documents The main business documents are invoices, cheques and receipts however other business documents used include order forms and quotations. These are not yet source documents as they are not final and can be changed. See pg 42 for an example. The business should check details of an order form against the invoice to ensure the correct goods have been received. Other business documents include cash register rolls, delivery dockets, employee payslips and bank statements. Information flows As information will be transmitted between entities, it is important that management follows and organised approach which results in a successful accounting system. See pg 43 for a sample. Overview of Accounting System (see page 44 for diagram) Where does double entry occur? In the general ledger as a debit entry and a credit entry. Why do we make balance day adjustments? The accrual method of accounting defines profit as revenue earned less expenses incurred. This is different to revenue received and expenses paid therefore adjustments need to be made. Manual Vs Computerised Accounting The principle of double entry is the same for both. Advantages of Computerised Accounting Process data rapidly Data storage highly efficient Highly reliable and accurate Disadvantages of Computerised Accounting More expensive than manual Requires some knowledge of computers The benefits should be weighed up against the costs of installing and using a manual system. A computerized system may not be a good idea for a small business as the costs may outweigh the advantages. Why has the need for computerised systems increased since 2000? Introduction of GST Do computerised systems mean accountants are out of jobs? No, as there is still a need to analyse and evaluate reports. Chapter 3