ccril m tierney2 - Law Seminars International

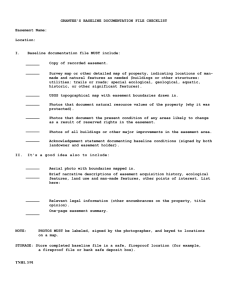

advertisement

Speaker 4: Laura C. Tierney of Fidelity National Financial, Inc. Page 1 Litigation of Disputes Over Easements and Covenants, Codes and Restrictions The biggest problem areas: Where to put our attention; drafting lessons; best approach for resolving issues of intent with poorly drafted documents and using title insurance Easements. An easement may be described as a right to use the land of another. An easement is a non-possessory interest, and is therefore sometimes referred to as an incorporeal hereditament. Easements may be broadly grouped into 2 categories: appurtenant and in gross. In the former case the easement benefits a particular parcel of land (the dominant estate) and burdens another parcel of land (the servient estate). An easement appurtenant runs with the land; i.e., a conveyance of the dominant estate will pass with it the benefit of the easement, while a conveyance of the servient estate will pass with it the burden thereof. This is generally true even where the conveyance fails to make specific reference to the easement. The owner of the servient estate is still the holder of the fee simple title to the land burdened by the easement, and has all the rights and benefits of ownership which are not inconsistent with the use of the easement. If the easement grant or agreement is silent, the duty to repair and maintain will normally fall on the party benefited thereby. In addition, the easement may be non-exclusive; i.e. several parties may have the right to use it in common. An easement in gross does not benefit a particular parcel; i.e., there is no dominant estate, only a servient one. Easements in gross were originally held to be non-transferable, but the modern view is that a commercial easement in gross is transferable by the holder thereof. Restatement of Property, Section 491 (1944). Examples: Easement appurtenant: a right-of way for automobiles which leads from Whiteacre (a landlocked parcel) over Blackacre to a public street. Whiteacre is the dominant estate and Blackacre is the servient estate. Easement in gross: a right-of-way for high-tension power lines which crosses Blackacre. Although Blackacre is the servient estate, there is no particular parcel which is benefited by the easement, so there is no dominant estate. Creation of Easements. Easements are generally created in one of three ways: 1) by grant or reservation; 2) by implication (including necessity); 3) by prescription. Theoretically it is possible to create an easement by estoppel. An easement is subject to the provisions of the Statute of Frauds (i.e., it must be in writing), however easements created by implication, necessity or prescription are exceptions to this rule. Law Seminars International | Easements and CCRs | 4/23/07 in Chicago, IL 1 Speaker 4: Laura C. Tierney of Fidelity National Financial, Inc. Page 2 Termination of Easements. Easements may be terminated or extinguished in several ways. These include: 1) written instrument, 2) merger, 3) overburdening, 4) abandonment, 5) the terms of the instrument creating the easement. Encumbrances, Easements and Restrictions: Title Insurance. Various easements, restrictions and encumbrances all invoke Insuring Provision 2 of the Title Insurance Policy1 unless it is disclosed as an exception from coverage in Schedule B. The definition of “encumbrance” is controlled by each state’s general real estate laws. Generally, recorded easements not shown in Schedule B are protected against. 2 Typically, loss is measured as the difference in value with and without the title defect (diminution in value). The standard exception for easements not of record (exception which states “easements or claims of easements not shown by the public records”) removes coverage for off-record/unrecorded easements. The policy definition of public records is limited to those records which, under state law, impart constructive notice of interests in real estate. 3 The policy also excludes easements agreed to by the insured at time of purchase. More specifically, when an insured agrees in the purchase contract to take the property subject to a certain easement or restriction, the encumbrance is excluded from policy coverage as a matter “agreed to” by the insured.4 To invoke this exclusion, the insurer must show that the insured consciously took title subject to the encumbrance. Insurable Easements. The policy’s definition of “land”5 is phrased so as to exclude easements which, although benefiting the insured realty, are not intended 1 AMERICAN LAND TITLE ASSOCIATION, LOAN POLICY ADOPTED 6/17/06: COVERED RISKS SUBJECT TO THE EXCLUSIONS FROM COVERAGE, THE EXCEPTIONS FROM COVERAGE CONTAINED IN SCHEDULE B, AND THE CONDITIONS, BLANK TITLE INSURANCE COMPANY, a Blank corporation (the “Company”) insures as of Date of Policy and, to the extent stated in Covered Risks 11, 13, and 14, after Date of Policy, against loss or damage, not exceeding the Amount of Insurance, sustained or incurred by the Insured by reason of: 2. Any defect in or lien or encumbrance on the Title. 2 Overholtzer v. Northern Counties Title Ins. Co., 116 Cal. App. 2d 113, 253 P. 2d 116 (1953). 3 AMERICAN LAND TITLE ASSOCIATION, LOAN POLICY ADOPTED 6/17/06: DEFINITION OF TERMS (k)"Public Records": Records established under state statutes at Date of Policy for the purpose of imparting constructive notice of matters relating to real property to purchasers for value and without Knowledge. 4 AMERICAN LAND TITLE ASSOCIATION, LOAN POLICY ADOPTED 6/17/06: EXCLUSIONS FROM COVERAGE The following matters are expressly excluded from the coverage of this policy, and the Company will not pay loss or damage, costs, attorneys' fees, or expenses that arise by reason of: 3. Defects, liens, encumbrances, adverse claims, or other matters (a) created, suffered, assumed, or agreed to by the Insured Claimant; 5 AMERICAN LAND TITLE ASSOCIATION, LOAN POLICY ADOPTED 6/17/06: DEFINITION OF TERMS (i) "Land": The land described in Schedule A, and affixed improvements that by law constitute real property. The term "Land” does not include any property beyond the lines of the area described in Schedule A, nor any right, title, interest, estate, or easement in abutting streets, Law Seminars International | Easements and CCRs | 4/23/07 in Chicago, IL 2 Speaker 4: Laura C. Tierney of Fidelity National Financial, Inc. Page 3 to be insured. Thus, if an easement is to be insured, an underwriting determination must be made as to its insurability. Sound underwriting practices require title insurers generally to accept only easements created by express grant or reservation as a basis for insurance. This is because the creation of an easement by implication or prescription will not normally appear in the form of a recorded instrument. However, provided that there is a proper judicial proceeding, a judicial decree which confirms the creation and existence of an easement by implication or prescription is an acceptable basis for insurance. Affirmative Insurance Regarding Easements: Title Insurance. Title insurers are frequently asked to provide certain affirmative insurance in connection with easements burdening the insured land. This is usually done after reviewing a survey which locates the easement(s) in question. Common forms of coverage are: “Policy insures that said easement does not affect the building currently located on the insured premises.” Or “Policy insures that the building currently located on the insured premises does not encroach upon said easement or vice versa.” Another form of coverage frequently requested is “Policy insures that said easement does no affect the beneficial use of the premises (as an office building)” Or “Policy insures that said easement does not materially/substantially/adversely affect the beneficial use of the premises (as an office building).” Restrictive Covenants. Owners of real property frequently impose restrictive covenants affecting the use of the property. Some restrictive covenants are imposed for the purpose of creating a neighborhood scheme; i.e. a set of restrictions uniformly affecting all lot owners in a certain area. The party creating or imposing the restrictive covenants is called the covenantee; the party taking subject to them is referred to as the covenantor. Covenants may also be divided into affirmative and negative. Affirmative covenants (which require the grantee to perform a positive act, i.e. build a sidewalk) are usually held to be personal in nature. Negative covenants (such as the nuisance restrictions; i.e. where land shall not be used for noxious or offensive purpose including, but not limited to stables, tanneries, or for the distillation, sale or consumption of intoxicating liquors) are often held to run with the land, and are sometimes referred to as real covenants. Restrictive Covenants in Chain of Title; Affirmative Insurance. If restrictive covenants are found in the chain of title, the title commitment and policy will normally contain an exception for same; i.e. “Covenants and restrictions found in Deed book ____, page ___” If the restriction contains a reverter provision, the exception may be set up as “Covenants and restrictions containing a right of reversion, found in Deed book ____, page _____.” Title insurers will not roads, avenues, alleys, lanes, ways, or waterways, but this does not modify or limit the extent that a right of access to and from the Land is insured by this policy. Law Seminars International | Easements and CCRs | 4/23/07 in Chicago, IL 3 Speaker 4: Laura C. Tierney of Fidelity National Financial, Inc. Page 4 usually agree to omit this exception simply because the restrictions are ancient, or because they are allegedly personal or because of a change in neighborhood conditions, etc. Where restrictive covenants are found in the chain of title, title insurers are frequently willing to provide affirmative insurance; i.e. “Restrictions have not been violated; a (future) violation will not cause a forfeiture or reversion of title”. The coverage presupposes that the title examiner is reasonably satisfied that this is indeed the case. In some cases a review of a survey is necessary before one can determine whether there has been a violation. Affirmative insurance regarding restrictive covenants is also found in ALTA Endorsements Nos. 9, 9.1, and 9.2. ALTA Endorsements; Affirmative Insurance. Title insurers are often requested to provide ALTA Endorsements Nos. 9, 9.1 or 9.2. These endorsements are similar, but No. 9 is used in connection with loan policies and Nos. 9.1 and 9.2 are issued with owner’s policies. Further, No. 9.1 is for vacant land and No. 9.2 is for improved land. ALTA Endorsements: Form 9. It has become common for institutional lenders to require certain additional title insurance coverage(s) for loans secured by first mortgages on improved real property. This endorsement is designed to provide those coverages in a single, inclusive form. It affords the lender various protections with respect to private property restrictions, building setback lines, encroachments and excepted minerals; it is not suitable for use with policies insuring owners or unimproved land. If a modification of an endorsement is requested, the title insurer must consider the state regulatory requirements for filing and approval of forms. (See attached Exhibit A) Form 9.1. This endorsement is designed to provide certain frequently requested protections for an owner of unimproved property concerning private property restrictions, encroachments and excepted minerals. (See attached Exhibit B) Form 9.2. This endorsement is designed to provide certain frequently requested protections for an owner of improved property concerning private property restrictions, encroachments and excepted minerals. (See attached Exhibit C) These endorsements are designed as an explicit extension of coverage otherwise provided to insured lenders by the ALTA Loan Policy. ALTA Form 9, 9.1 and .2 were developed to meet "off-record" occurrences. The Endorsement extends the lender's and/or owner’s coverage in three general areas: (a) covenants, conditions and restrictions, (b) encroachments, and (c) rights of others to use the surface of the land for mineral development. ALTA Endorsements: Form 4 Condominium: This endorsement provides the insured lender with coverage against loss or damage by reason of: 1) the failure of the unit described in Schedule A to be part of the condominium regime in accordance with the state statute; 2) the failure of title to the unit along with the common elements due to the failure Law Seminars International | Easements and CCRs | 4/23/07 in Chicago, IL 4 Speaker 4: Laura C. Tierney of Fidelity National Financial, Inc. Page 5 of the condominium documents to comply with the appropriate state condominium statutes; 3) present violations of CCRs and/or the reversion or forfeiture of title resulting therefrom; 4) the priority of lien for assessments over the insured mortgage lien; 5) the failure of the insured unit to be assessed for real property taxes as a separate parcel 6) any obligation to remove improvements due to present or future encroachments; and 7) the failure of title by reason of a right of first refusal. Discussion: United States of America v. Austin Two Tracts, L.P. a Texas limited partnership; 239 F. Supp. 640; 2002 U.S. Dist. LEXIS 26014 Carstensen v. Chrisland Corp. (1994) 247 Va433, 442 SE2d 660 Hamouda v. Harris, 845 N.E. 2d 374 (Mass. App. Ct. 2006) Case Studies: Landlocked: During 2005 an insured purchases a 30 acre parcel for $8M and obtains title insurance. Insured purchases with the intent to subdivide and develop the real property into 8 to 10 large single family homes. The property is landlocked with access to a public road over a private road via right-of-way (created via a 1950 deed). The private road is located on land owned by an adjoining landowner. Insured at time of purchased obtained a special endorsement insuring against loss sustained by reason of a final judgment enforcing covenants, conditions and restrictions from the 1950 deed (which deed also conveyed interests in the 1950 right of way). The 1950 right-of-way provides the sole available access to the otherwise landlocked property. Adjoining neighbor objects to the insureds subdivision of the insured property. Litigation ensues. Restrictions: Insured purchases 2 beachfront lots for $10M with the intent to build condominiums. Insured purchased title insurance. Insured proceeds with the development when insured is advised by the neighbors of the following CCR which is not listed as an exception, “only one one-family or single unit dwelling shall be erected or allowed to remain on any one of the lots”. The restriction only affected one of the two lots. Insured owner purchases golf course. Insured intends to discontinue the use of the property as a golf course and develop it into residential homes. A remote deed in chain from common granter (the golf course developer) contained restrictions reciting that the property “shall be used only as a golf course”. Common grantor objects to the requested change in use. The restrictions in the remote deed were not listed as exceptions on title policy. Comment: The buyer/lender (you or your potential client) of commercial property is different than a buyer/lender of residential property. Therefore, as an attorney Law Seminars International | Easements and CCRs | 4/23/07 in Chicago, IL 5 Speaker 4: Laura C. Tierney of Fidelity National Financial, Inc. Page 6 representing a client, or a lender, real estate developer, etc., make sure utilize a title insurer/underwriter that offers the broadest type of coverage in order to protect a variety of contingencies such as being able to use the land for the purpose the insured intends. Laura C. Tierney, Esq. Fidelity National Financial, Inc. 601 Riverside Avenue Jacksonville, Florida Law Seminars International | Easements and CCRs | 4/23/07 in Chicago, IL 6