introduccion - Nafta Office

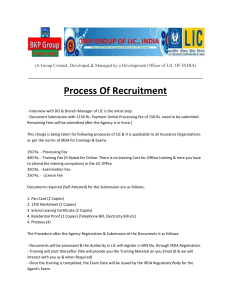

advertisement