Seychelles November 2013

advertisement

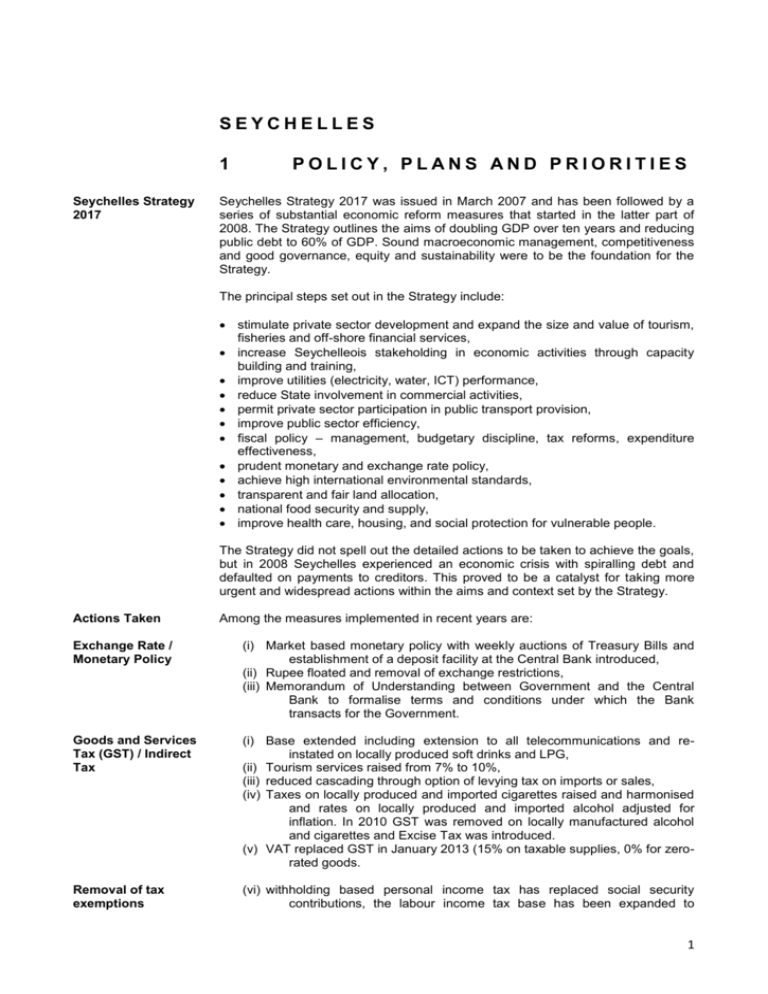

SEYCHELLES 1 Seychelles Strategy 2017 POLICY, PLANS AND PRIORITIES Seychelles Strategy 2017 was issued in March 2007 and has been followed by a series of substantial economic reform measures that started in the latter part of 2008. The Strategy outlines the aims of doubling GDP over ten years and reducing public debt to 60% of GDP. Sound macroeconomic management, competitiveness and good governance, equity and sustainability were to be the foundation for the Strategy. The principal steps set out in the Strategy include: stimulate private sector development and expand the size and value of tourism, fisheries and off-shore financial services, increase Seychelleois stakeholding in economic activities through capacity building and training, improve utilities (electricity, water, ICT) performance, reduce State involvement in commercial activities, permit private sector participation in public transport provision, improve public sector efficiency, fiscal policy – management, budgetary discipline, tax reforms, expenditure effectiveness, prudent monetary and exchange rate policy, achieve high international environmental standards, transparent and fair land allocation, national food security and supply, improve health care, housing, and social protection for vulnerable people. The Strategy did not spell out the detailed actions to be taken to achieve the goals, but in 2008 Seychelles experienced an economic crisis with spiralling debt and defaulted on payments to creditors. This proved to be a catalyst for taking more urgent and widespread actions within the aims and context set by the Strategy. Actions Taken Among the measures implemented in recent years are: Exchange Rate / Monetary Policy (i) Market based monetary policy with weekly auctions of Treasury Bills and establishment of a deposit facility at the Central Bank introduced, (ii) Rupee floated and removal of exchange restrictions, (iii) Memorandum of Understanding between Government and the Central Bank to formalise terms and conditions under which the Bank transacts for the Government. Goods and Services Tax (GST) / Indirect Tax (i) Base extended including extension to all telecommunications and reinstated on locally produced soft drinks and LPG, (ii) Tourism services raised from 7% to 10%, (iii) reduced cascading through option of levying tax on imports or sales, (iv) Taxes on locally produced and imported cigarettes raised and harmonised and rates on locally produced and imported alcohol adjusted for inflation. In 2010 GST was removed on locally manufactured alcohol and cigarettes and Excise Tax was introduced. (v) VAT replaced GST in January 2013 (15% on taxable supplies, 0% for zerorated goods. Removal of tax exemptions (vi) withholding based personal income tax has replaced social security contributions, the labour income tax base has been expanded to 1 include resident expatriates and sector concessions eliminated, a harmonised rate of 15% for all employees is set for Jan 2011, (vii) Introduction of 15% tax on residential rental income, (viii) Removal of exemption on interest income by companies, (ix) Environmental levy raised from SCR 10 to 25 per month, (x) Fees, fines and rents and royalties adjusted for inflation, (xi) All provisions for discretionary exemptions in the Trades Tax and Business Trade Acts repealed, (xii) Revised Business Tax Act to reduce rate and broaden base – as a first step, the maximum rate has been revised downward by 7 percentage points, to 33%. The tax-free threshold was abolished for companies and reduced for sole traders and partnerships. Elimination of Subsidies Household: (i) Universal product subsidies replaced with targeted social safety net, (ii) Seychelles Rupee (SCR) 90 electricity rebate for households eliminated, (iii) Bus fare raised to operating cost recovery levels. Production: (i) Fishermen fuel subsidy coupons abolished, (ii) Subsidies for Agro Industries, Hatcheries, Seychelles Trading Company (STC) and Coevity Prawns abolished, (iii) LPG subsidy by the state oil company, Seychelles Petroleum Corporation (SEPEC) abolished. (iv) Reduced public sector workforce by 17%. Legislation A substantial volume of legislation has been enacted in recent years including enactment of Welfare Act to establish a Social Welfare Agency, Public Debt Management Act, Public Officers Ethics Act, Public Procurement Act, Public Enterprise Monitoring and Control Act, Fair Trading Commission Act, Fair Competition Act, Seychelles Revenue Commission Act, Business Number Act, National Clearance and Settlement Systems Act and amendments to the Central Bank Act. Legislation on customs management, national statistics, public audit, public finance and employment is to be introduced. 2 INVESTMENT PROMOTION 2.1 Institutions SIB Seychelles Investment Board (SIB) is a one-stop shop for all matters relating to business and investment in Seychelles. SIB’s main function is to promote investment and facilitate the investment process in a way which is in line with the administrative, policy and legal framework. The main objective of SIB is to establish the investment framework and promotional capabilities to achieve an optimal sustainable level of business and investment in Seychelles. Legislation to reform the Investment Code and establish SIB as a statutory body was announced in the Budget 2010 Address. SIBA Seychelles International Business Authority (SIBA) is established by the SIBA Act 1994 to promote Seychelles as a location for international business and to monitor, supervise and co-ordinate the conduct of international business activities. SIBA’s Board of Directors has members from public and private sectors. SIBA is a onestop shop that covers licensing and regulation of the primary offshore business 2 activities. It is the authority or Registrar for International Business Companies, International Trusts, Protected Cell Company, Companies Special License, Limited Partnerships. SIBA regulates International (Free) Trade Zone activities. SIBA hosts and disseminates educational information for other offshore entities / services including the Mutual Funds, Offshore Banking, Offshore Insurance, and Ship / Yacht Registrations. SIBA provides name approvals quickly and issue licences with minimum bureaucracy, whilst still maintaining appropriate due diligence processes. SIBA will become the Financial Services Commission and will also oversee all insurance activities. SEnPA The Small Enterprise Promotion Agency (SEnPA) was created in August 2004 to help promote and develop small enterprises, crafts and cottage industries in Seychelles. DBS Development Bank of Seychelles (DBS) has a primary role to provide Seychelles entrepreneurs long term financing. It supports the implementation of sound and viable projects and invests in sectors such as agriculture, fishing, and tourism. Under the Delegation of Functions (DBS Decree) Order 2009 statutory functions, powers and duties that had been vested in the President and Minister for Finance in a number of sections of the DBS Decree are delegated to the Central Bank of Seychelles (CBS). 2.2 Investment and Export Incentives Investment agreements made under the 1991 investment law that preceded the Investment Code 2005 continue to distort the market. In tourism and fisheries the previous incentive regime, based on negotiating individual investment agreements with investors, has been replaced through the Tourism (Incentives) Act 2008, and the Agriculture and Fisheries (Incentives) Act 2005. There is now a set package of fiscal incentives subject to an entitlement certificate. Steps are being made to harmonise tax and other incentives and to remove distoring exemptions and concessions so that the following paragraphs are subject to change. The tourism sector benefits from concessions in Trades Tax and GST (Goods and Services Tax), Social Security, Gainful Occupation Permit (GOP), Fuel, Accelerated Depreciation and Market and Promotion. The industrial sector and artisans benefit from the following Trades Tax concessions 5% on raw materials, 10% on Capital Goods, 10% on Packaging materials, 10% on semi-finished items. Artisans are eligible for business tax concession and subsidised rental rate for selling on public and government premises. The Investment Code provides that incentives granted under a written law for a specified activity, during a specified period, shall not be adversely affected during the period. 2.3 ITZ EPZs, Freeports and other Special Economic Zones The International Trade Zone (ITZ) Act 1995 provides for the establishment of international trade zones and regulates operations in the zones. The Minister of Finance can by notice in the Official Gazette declare any area of land within the territory of the country as an ITZ. The notice will also define the boundaries of the 3 area, as well as the entity to manage the area. A number of areas are declared as ITZ. The aim is to combine the benefits of a free port and export processing zone. The distance from major markets hinders the competitiveness of products originating in the Seychelles. The ITZ provide opportunities for lower costs, employment and skills transfer as well as an improvement in the balance of trade. 4 2.4 Tax Reforms Tax Reforms The tax system is undergoing a process of reforms which are eliminating distortions and easing compliance. Changes in Business Tax i) The Business Tax rate has been reduced further for companies, from 33% to 30% except for Telecoms, Insurance companies, Banks and manufacturers of Alcohol and Tobacco. ii) Corporate Social Responsibility Tax (CSR) was introduced in January 2013 and is applicable to all businesses with an annual turnover of above 1 million rupees. The rate is 0.5% of the annual turnover, paid monthly on monthly turnover. In April 2013, this was changed: to 0.25% paid directly to SRC and 0.25% paid to a chosen charity, Non Government Organisations and so on. Otherwise the 0.5% is paid directly to the Seychelles Revenue Commission (SRC) iii) Tourism Marketing Tax (TMT) was Introduced in January 2013 and is applicable to all tourism businesses, banks, insurance companies and telecoms with an annual turnover of 1 million. The rate is 0.5% of the annual turnover, paid monthly on monthly turnover. iv) Change of rate to 15% of taxable income across the board for private medical services and private educational services, regardless of the type of entity. v) Companies listed in the securities exchange will have an applicable rate of 25% of taxable income. f) Residential rent has been transferred from under GST to Business Tax, at the same rate of 15% Income Tax Income tax was introduced in July 2010 to replace social security fund. 18.75% on emoluments and 20% on non-monetary benefits. In October 2010, the rate of 18.75% was reduced to 15%. Presumptive Tax Introduced in 2013 at a rate of 1.5% on Annual turnover for all small businesses with an annual turnover of less than 1 million rupees. Businesses who do not wish to be in this regime can opt out upon request and approval by the Revenue Commissioner Value Added Tax Replaced GST as at January 2013 and is compulsory for businesses with annual re of a threshold of 5 million, this will be changed to 3 million next year. 15% on taxable supplies, 0% for zero-rated goods. Then there’s the exemption list (quite an exhaustive list). 5 Excise Tax was reduced on Alcohol and Tobacco, as VAT is applicable on these goods. Consequently the rate of excise tax on these goods were reduced by 15%. 2.5 Customs and GST International Trade & Export Promotion The Trades Tax Act, 1992 and the Trades Tax Regulations regulates procedures for the application of customs tariff, customs procedures, rules on customs regime and formalities. The tariff structure is based on a system of applied rates. Modifications to applied rates may be made by the Minister of Finance and Trade under the Trades Tax Act. There are no legal restrictions on import payments. Importers require an import licence issued by SLA. Import permit restrictions apply only to restricted goods. All goods are subject to customs duty (Trades Tax Act) and a Goods and Services Tax (GST). GST is not applied to imports of essential food and medicines. Customs duties have been lowered in recent years from an average applied duty of 28.3% (all products) in 2005 to 8.95% in 2007. All permit requirements for the export of goods have been abolished. The list of products requiring an import permit before Customs clearance has been reduced and IT based procedures are modernised. Progress is awaited on enacting a Customs Management Act to be introduced in National Assembly in Q4 2010 and a new Harmonised Systems Code. Average tariff rates are high, while enterprises in certain sectors are granted substantial tariff exemptions or reductions. There are no export credits and export credit guarantees. 2.6 Other Issues The Strategy 2017 emphasises training and capacity building to improve job prospects of Seychellois. 3 ACCESS AND ADMISSION OF FOREIGN INVESTORS 3.1 Foreign Investment & Capital Mobility Foreign investment in Seychelles (portfolio, direct investment, additional investments in existing entities in the form of loans or equity capital) is freely permitted, provided it does not involve alienation of land (See Foreign Ownership of Property). Reserved Activities & Strategic Sectors The Investment Code of Seychelles Act 2005 reserves a number of activities for Seychellois investors and lists strategic sectors in which investment by a foreign or domestic investor may be permitted subject to conditions to protect the public interest. Strategic areas include activities in which state enterprises currently operate. Strategic areas listed in the Code are production and national distribution of electricity and water, storage and distribution of petroleum, airport and seaport infrastructure, and other sectors mining of natural resources, manufacture of arms and ammunition, airspace related activity, genetic centres, broadcasting and telecommunications services (except for internet reseller), animal feed, hatchery, parent stock and abbatoir, and production, distribution and storage of hazardous substances. 6 AfDB Comment on Investment Code Africa Development Bank (2009) Seychelles 2009-2010 Interim Strategy Note Feb 2009 states that “Although the Investment Code of 2005 is a major improvement to the Act of 1991, the Code is still restrictive, unclear in some areas, and bureaucratic. For example, the list of restricted and strategic areas is long and limits competition. Several of the listed activities could attract foreign investors and inject new capital and know-how to the economy.” Budget 2010 and Investment Code The Budget 2010 Address stated that amendment to the Investment Code to streamline the investment approvals procedure, clearly set out decision criteria and specific recourse and appeals mechanisms and a law to establish SIB as an Investme SIB and SIBA Approvals Applications for approval of projects for investment are to be submitted to SIB and approval is required to obtain licenses to implement the project. The Code does not specify the institutional set-up, mandate and functions of SIB, and there is no provision for consultation with the private sector or recognition of the role of the private sector. Applications to invest in an International Trade Zone are made to Seychelles International Business Authority (SIBA) set up under the SIBA Act 1994. Tourism Seychelles Tourism Board (STB) is responsible for all tourism-related activities, which includes policy formulation, marketing and promotional activities, establishment and monitoring of standards of tourism products and services and the management of the Seychelles Tourism Academy. Foreign investment in the tourism is welcomed, especially where major capital investment is required or local expertise is not available. In line with the programme of economic liberalisation and diversification, most State owned tourism enterprises have been privatised mainly to foreign owners. Ownership and investment in small hotels of not more than 15 rooms is reserved for Seychelles nationals and majority ownership of tour operators must be held by Seychelles nationals. 3.2 Foreign Investor: Steps to Set Up Foreign Investment Establishment, Registering and Licensing Processes A foreign investor setting up a business in the Seychelles takes the following steps: Expression of interest from investor/ potential investor to which SIB responds within two working days. Investor submits a business plan / project memorandum to SIB SIB liaises with relevant ministries, departments, authorities and so on who provide views, comments and approvals to SIB SIB communicates the approvals/rejection to the investor who, if succesful, may then apply for a business license with the Seychelles License Authority (SLA) The business should be registered with the appropriate authority – in most instances registration is with the Register of Companies. Once a license had been received, the investor, if a foreigner, proceeds with the application for a Gainful Occupational Permit (GOP) from the Immigration Division, Department of Internal Affairs. However, clearence for any posts must be given by the Employment Division before a GOP can be issued. Approvals are required to lease, rent or buy premises or land from the Government or private sector. The ministry responsible is the Ministry of Land Use and Housing (MLUH). A construction permit is required if the business is involved in construction. Application is made to from the Planning Authority, Ministry of National Development. An Environment Impact Assessment (EIA) from the Department of Environment may be required. 7 If the business is in food or chemical processing, or activities that can put the health or life of the public or employees at risk, an Occupational Safety and Health inspection is required and the Department of Health, Ministry of Health and Social Development should be contacted. Within 7 days of commencing business, registration is required to be made with the Social Security Fund, Ministry of Finance. The investor is also required to register with the Seychelles Revenue Commission for tax payment purposes. Companies Act Companies trading in Seychelles are governed by the Companies Act 1972. Promoters should register the company at the office of Registrar General. The Act stipulates that in order to engage in any business activity a company shall be registered with the Registrar of Companies. A declaration should accompany the Memorandum of Association to be submitted by the company. An overseas company which establishes a place of business or commences to carry on business in Seychelles shall, within fourteen days after the establishment or commencement deliver to the Registrar of Companies for registration: A certified copy of the charter, statutes, memorandums, certificate or articles of association or incorporation of the company or the other instrument which constitutes the overseas company or contains the regulations which govern it, and, if the instrument is not written in the English language, a certified translation thereof. A list of the directors and secretary of the company containing the particulars as mentioned in subsection (3) section 310 of the Companies Act. The name of persons or person who has or have been appointed to be the managing agent or agents of the overseas company in Seychelles, and the particulars in respect of that person or each of those persons mentioned in subsection (3) of section 310 of the Companies Act. The names of two or more persons who have been appointed to accept on behalf of the company service or process and any notices required to be served on the overseas company, and the particulars in respect of those persons mentioned in subsection (3) of the above-name section of the Act. Any of the persons appointed for the purposes mentioned above may be an individual or a firm resident or acquiring on business in Seychelles, or a company formed or incorporated in Seychelles. Budget 2010 and Companies Act Budget 2010 Address stated that amendments to the Companies Act would be introduced. SLA and Licensing The Seychelles Licensing Authority (SLA) was established on 1 September 1984 to deal with all types and aspects of licensing and it also provides interested persons with guidelines on obtaining licenses. It is a regulatory body established under the Licenses Act to grant, renew, refuse, suspend and revoke licenses where there has been a breach of the licenses regulations and conditions. SLA has power to attach or vary conditions of the licence. SLA took over licensing responsibilities from several Government Ministries and Departments. It is the sole body with the power to issue licenses following approvals from relevant government agencies operating under power given in legislation. For example SLA is responsible for licensing and controlling tourism activity including any class of tourist establishments, tourism guides, travel agents, tour operators etc. The licence is issued by SLA after consultations with the Seychelles Tourism Board, Ministry of Finance and the Town and Country Planning Authority. Licenses are granted for activities in Services – Health Services, Professional and General Services, Trade, Goods, Animals and Vessels, Premises, Fishing activities, Road Transport / Vehicles, Manufacturing, Broadcasting & Telecommunication 8 Licences within a sector of economic development will be granted only when the approvals for related procedures have been given. These may include, but are not restricted to approvals by the SIB with the sector of investment, permission from the Planning Authority, approval for a Gainful Occupation Permit if required. The cost of a licence will vary depending on the type of activity and duration of the licence. There is a processing fee when issuing most of the licences and the processing fee also vary in cost depending on the type of activity and duration of the license. A licence is valid for various terms varying from 1 year to 5 years. Budget 2010 and Licensing The Budget 2010 address stated that legislation will be submitted to the National Assembly during 2010 for a modern Licensing Act to redefine the role of the SLA and introduce modern principles governing the coverage and issue of licences. Banking and Financial Regulation Commercial banks (domestic and non-domestic banking business), are regulated under the Financial Institutions Act 2004. The Insurance Act regulates domestic and non-domestic insurance business. Regulation and supervision of both sectors is carried out by CBS which is responsible for receiving applications and issuing a licence, for domestic or offshore banking, and insurance and related services Apart from the small size of the domestic insurance market there are no restrictions on establishing a foreign insurance or reinsurance company. The Securities and Financial Market Division of CBS regulates the Mutual funds under the Mutual Funds and Hedge Funds Act, 2008 and securities business under the Securities Act, 2007 as well as offshore Insurance. Currently there is no securities market in Seychelles. The Securities Act gives CBS power to grant licenses, permits or authorities with revocation rights upon licence holders failing to comply with laws and conditions with rights of appeal to the Supreme Court. Non-domestic banking is regulated by the CBS under the Financial Institutions Act 2004. The Act makes provision for the licensing of offshore banks which operate with full confidentiality with the exception of criminal investigations. Two banks hold an Offshore Banking License, Barclays Bank (Seychelles) Ltd and BMI Offshore Bank (BMIO). Fisheries The Maritime Zone Act (1999) establishes and defines the Seychelles EEZ, the baselines, continental shelf, territorial waters, and historic waters. Fisheries Act 1942 and Fisheries (Amendment) Act (1987) provides for the regulation of local and foreigners fishing activities. It established the major fisheries management measures, the fishing licensing procedures and fines for breaches of the licence regulations. The Licences (Fisheries) Regulations (1987) sets out various categories of fisheries licence, the conditions of the licence and the fees for both local and foreign licences. SFA The Seychelles Fishing Authority (SFA) (Establishment) Act (1984) sets out the main functions of SFA as: promote, organise and develop fishing industries and fisheries resources in Seychelles. assist in the formulation of policy with respect to fishing development and fisheries resources. conduct negotiations, engage in meetings, seminars or discussions with regard to fishing or fisheries and the establishment or operations of fishing industries, whether at a national or international level, on behalf of the Republic. identify the human resources training requirements of Seychelles with regard to fishing and fishing industries. 9 SFA has a mandate to perform management, planning, development, scientific and training functions, as well regulatory functions including conducting surveillance in collaboration with the Coast Guard in relation to fishing operations in the Seychelles EEZ, monitoring the catch of all fishing vessels, and carrying out scientific and development research. Utilities Public Utilities Corporation (PUC) was created in 1986, with the merger of the Seychelles Water Authority and the Seychelles Electricity Corporation Ltd under the PUC Act 1985. PUC is obliged to provide and ensure the continued supply of electricity, potable water and sewerage services to the population of Seychelles. The principal activities of the Corporation are the generation and distribution of electricity; the storage, treatment and distribution of potable water; and the collection, treatment disposal of sewerage. Land Transport The Land Transport Division of Home Affairs and Transport in collaboration of Seychelles Licensing Authority is responsible for planning, developing, implementing and managing public and private transport in Seychelles. Land Transport is regulated under the Road Act and the Road Transport Act. The Land Transport Division, is in fact responsible for regulating the number of vehicles, their usage, and road worthiness standards to ensure road safety, with the collaboration of the Traffic Section of the Department of Internal Affairs and they also help Ministry of Home Affairs and Transport to control vehicular pollution. Seychelles Public Transport Corporation (SPTC) is the sole company currently providing a public transport service on Mahe. Another company Praslin Transport Corporation (PTC) operates public transport on Praslin. SPTC has 40% shares in PTC, whilst the rest of the shares are owned by the Praslin Development Fund (PDF) a quasi-government agency. The Government is in the process of formulating laws and regulations with a view of liberalising public transport. The process is still in its inception stage. 3.3 Gainful Occupation Permit Foreign Employment & Residence An employer is required to notify the Employment Division whenever a vacancy occurs. The employer then advertises the vacancy in a local newspaper to bring the vacancy to the notice of persons seeking employment or seek the services of a private employment agency. All Seychellois being considered for employment by the employer should have a valid job card issued by the ESB. Upon recruitment, the job card must be submitted to the ESB within a period of 15 days. If after the vacant post has been advertised and there is no response from a suitable qualified Seychellois, then the employing organisation may submit a request to the Ministry responsible for employment for the post to be filled by a non-Seychellois. Once approval is granted, the organisation concerned is issued with a certificate to be produced at the Immigration Authorities to obtain a Gainful Occupational Permit (GOP). A person who wishes to be self-employed may register with the ESB. A GOP issued by the Department of Internal Affairs allows the holder to be gainfully occupied in Seychelles. Applications for GOP should be submitted at least ten weeks before the non-citizen employee is due to start work, and the employee must not enter Seychelles for the purpose of taking up employment prior to obtaining the GOP. The application form is to be completed by the person seeking the permit in the case of a self employed or by the prospective employer. Foreigners must meet the following conditions: 10 Employer must have a GOP and or a valid licence to work in Seychelles, have legally entered Seychelles, have a valid passport, pass a medical test as determined by the Ministry of Health. A GOP is valid for one year and may be extended for a period not exceeding two years. Criteria for GOP In considering an application for a GOP, the following are taken into account: (a). character, reputation and health of the prospective employee and where relevant, any member of his / her household to be endorsed on the permit; (b). professional or technical qualification of the person to be employed; (c). availability of the services of persons already exist in Seychelles; (d). protection of local interest; (e). economic and social benefit which the applicant / prospective employee may bring to Seychelles or enhance by his presence. Residence Permit A Residence Permit is issued to a person who (a) is not a prohibited immigrant; (b) has a family or domestic connection with Seychelles; (c) has made or will make special contribution to the economic, social or cultural life of Seychelles. The holder of a Residence permit is not permitted to be gainfully occupied in Seychelles. AfDB Comment on Work Permit African Development Bank (2009) Seychelles 2009-2010 Interim Strategy Note Feb 2009 states that “The work permit policy appears to be based on the potential to earn foreign exchange and not on development goals. Companies with the potential to attract foreign exchange are given a quota. The employer does not have to show whether local employees are available for the position and there are no skill requirements. As a result, cheap labour is often contracted by those industries with quotas such as hotels. Outside the quota it is very difficult and expensive to obtain a work permit for a foreign employee, no matter how skilled or necessary the person is. This makes the employment of foreigners for non-foreign exchange earners and medium sized companies prohibitive (e.g. food processing).” Budget 2010 & Employment Legislation The Budget 2010 Address by the Minister for Finance Danny Faure November 30, 2009 stated that new employment legislation is to be introduced in 2010. 3.4 Foreign Investor Access to Land and Property Rights Land Availability Land is scarce given the topography, environmental constraints and increased developments. The government of Seychelles therefore invested in the reclaimation of artificial islands which have now begaun to open for development. Process for Foreigner to Purchase Land Foreign and domestic investors may own and hold land for their investment projects subject to the provisions of the Immovable Property (Transfer Restriction) Act 1963. Before commencing the purchase of a plot for the development of an economic activity or to lease land from the Government, the foreign investor is required to submit a project proposal to SIB approval. Foreign nationals or companies with foreign participation that wish to acquire property are required to obtain permission from the Ministry of National Development, Department of Land Use. An application fee equivalent to 1.5% of the purchase price of the property is charged for the processing of the application. A notice published in the national daily newspaper The Nation will first make an offer of the property to Seychellois citizens. If no Seychellois is interested, the application goes forward and investors will receive a decision on the request to purchase the immovable property. Following approval, where the Government is selling the land or building, the 11 Lands Division will make arrangements for the transfer with the Attorney General’s Office, which is responsible for transferring all State properties. The cost of the stamp duty and registration is borne by the buyer. When the seller is a private individual or private owned company, the investor will engage a notary or attorney to manage the transfer of ownership which will be registered at the Registration Office. Registration fees and duties are payable. In the case of purchase of shares in a company owning an interest in immovable property, a processing fee is payable. Lease of Land In practice the Government does not sell land for commercial or industrial activities but enters a lease for 60 - 99 years depending on the type and scale of the development. There is usually an initial grace period for payment of rent of 18 – 24 months, depending on the scale of the development. There is an initial premium to be paid upon the signing of the lease, which is usually the equivalent of rent for one year. Once the grace period has elapsed the annual ground rent is payable half yearly in advance to the Ministry of National Development. Typically the rent is reviewed upwards every five years by not more than 25% and not less than 10% of the current rent. Providence Industrial Estate is managed by the Ministry of National Development and plots may be leased for up to 99 years. Construction Approvals All construction projects must be submitted to the Planning Authority for approval under the Town and Country Planning Act. SLA grants licenses to providers of construction services on a project basis. There are market access and National Treatment restrictions in setting up a construction firm. Buildings of class 3 and lower are restricted to Seychellois investors only. Class 1 and 2 licences for general construction do not include electrical and plumbing services. These services are required to be to be subcontracted with 15% preference margin on price for Seychellois providers. 4 FOREIGN INVESTMENT OPERATIONS 4.1 Employment Employment Act 1995 and see above Foreign Employment 4.2 Business Taxation Trades Act, Business Tax Act 4.3 SBS Environment, Physical Planning, Health & Safety, Consumer Protection The Seychelles Bureau of Standards (SBS) was established as a government regulatory agency with the enactment of the SBS Act 1987. The core activities of SBS are: Standardisation, Quality Assurance, Metrology and Testing. In Dec 1996, the SBS attained certification status to ISO 9002 quality management system which helped to put the organisation on the forefront of quality in the Seychelles. This certification status was changed to ISO 9001:2000 in October 2002 when the standard was revised. The functions of SBS are laid out in the SBS Act 1987, SBS (Amendment) Act 1995, SBS (Amendment) Act 1997, Weights and Measures Act / Regulations, SBS Standard Mark Regulations and SBS (National Quality System Certification Scheme) Regulations. 12 Environmental Protection Seychelles is regarded as having a strong history of conservation and environment protection activities, which has been heightened over the last 15 years through the development and implementation of environment management plans. The country is party to a number of international conventions. In spite of its small size, Seychelles has been participating in the various negotiations under these conventions such as the Convention on Bio-Diversity (CBD), the United Nations Framework Convention on Climate Change (UNFCCC), the Montreal Protocol and the Stockholm Convention on Persistent Organic Pollutants (POPs) and the Convention on International Trade in Endangered Species (CITES). Local legislation incorporates these conventions. For instance, the Trades Tax Act (1992) Amendment 2005, provides for a Prohibited list which lists the products which are prohibited imports. Majority of the products listed are species listed under CITES. The prohibited list also includes products which are banned under the Montreal Protocol, which prohibits the trade of Chlorofluorocarbon (CFCs) products. The importation of waste and waste products are also controlled because of Seychelles' signature to the Basel Convention on the Control of Trans-boundary Movements of Hazardous Wastes and their Disposal. The Plant Protection Act (1996) provides for legal measures to control the movement of diseases, insects and pests of economic importance, these include plant and plant products, edible fruits and vegetables, growing media and compost. 4.4 Competition Policy & Law Fair Trading Commission (FTC) Act 2009 established FTC to regulate domestic competition and ensure a level playing field for all economic operators. Fair Competition Act 2010 contains provisions on prohibition of abuse of dominant position (section 7) modelled on Article 82 EC Treaty (Art 102 TFEU), prohibition of agreements, trade practices, decisions or concerted practices which have the object or effect of preventing, restricting or distorting competition (section 11) modelled on Article EC Treaty (Art 101 TFEU). The Act prohibits resale price maintenance (section 16), price fixing (section 25), action to restrain competition (section 26), bid-rigging (section 27). As Seychelles needs to build capacity in regulation of competition, the FTC has sought the help of the SADC to boost its effort in order to promote a competitive setting. 4.5 Monetary Policy, Foreign Exchange and Foreign Investors The Central Bank of Seychelles Act 2004 makes the CBS responsible for the formulation and implementation of monetary and exchange rate policies. Major advances in monetary policy have formed part of the overall reforms and the CBS has moved from administrative controls towards the use of indirect or marketbased instruments. All companies operating in Seychelles can raise capital from commercial banks in the country. Foreign and local companies may hold foreign exchange accounts to facilitate business. Transfers and Remitting Funds The Investment Code provides that investors shall have the right to convert payments in Seychelles rupees (SCR), received through an investment, converted to another currency in accordance with Seychelles law and shall have the right to remit funds abroad including capital relating to the investment and various forms of earnings and fees related to the investment. In practice, prior to the reforms of 13 recent years, because of shortages of convertible currency, foreign investors faced difficulties in repatriating accumulated foreign exchange earnings. The foreign exchange market was liberalised in November 2008 with elimination of restrictions on payments and transfers and a floating exchange rate policy. Foreign companies operating in Seychelles, may remit dividends, transfer management fees, royalties and proceeds from the sale of assets. Payments for loan principal and interest can be remitted through banks. Investment outside Seychelles by permanent residents and by companies and other organisations operating in Seychelles is not subject to any limitation. 4.6 Public Procurement Public Procurement Act (2008) establishes clear parameters within which government procurement will take place. The Act regulates and controls practices relating to public procurement in order to promote integrity, fairness and public confidence in the procurement process. The Act incorporates as a statutory body the then existing National Tender Board and specifies its composition. It provides for a Procurement Oversight Unit under the Ministry of Finance primarily to oversee the policy making in this area. Provision has also been made for the setting up of Procurement Committees to deal with procurement for individual Ministries or for a group of Ministries. The rules regulating committees are to be established by Regulation upon the advice of the Procurement Policy Unit. The Act makes provision for a Review Panel to hear complaints by bidders and suppliers who have been aggrieved during the procurement process. 4.7 Intellectual Property Seychelles is a member of the World Intellectual Property Organisation since 2000. Seychelles is a contracting party to the Paris Convention for the Protection of Industrial Property and the Patent Cooperation Treaty (PCT) and a member of the African Regional Intellectual Property Organisation (ARIPO). In 2013, an Intellectual Property Office was established to enable the registration of patents, trademarks and copyrights IP Legislation Intellectual property legislation includes the Copyrights Act 1984, the Trade Marks Decree 1977 and the Patents Act 1901. The Government acknowledges that there are weaknesses in the IP regime in Seychelles. The principal weakness is lack of human resource capacity. Seychelles is aware that it will become party to the WTO TRIPS Agreement without any transition period accorded upon accession. WIPO is reviewing IP legislation in Seychelles. As Seychelles is in the WTO accession process, the Government has requested that it is placed in the fast track mode within WIPO's Intellectual Property Development Plan (IPDP) that it provides to member states. Ministry of Finance and Trade in conjunction with the Office of the Registrar General is responsible for formulating and implementing policy in relation to trade marks in goods and services, and patents. The Ministry of Community Development, Youth, Sports and Culture is responsible for registering copyrights associated with literary works, musical works, artistic works, performances of literary or musical works, films, sound recordings and broadcasts. A joint task force is expected to be formed between the Police, Customs and the IP Office to provide for more effective enforcement. However, current IP assets need to be audited and human resources development is required. In IP protection, foreign nationals are treated no less favourably than nationals. Any advantage, favour, privilege or immunity granted by Seychelles to the nationals of one country is accorded unconditionally to the nationals of other 14 countries. Legislation that will be enacted will not discriminate between nationals and foreigners in keeping with WTO principles of MFN and National Treatment. 4.8 Investment Protection and Dispute Settlement Constitution Article 26 Right to property (1) Every person has a right to property and for the purpose of this article this right includes the right to acquire, own, peacefully enjoy and dispose of property either individually or in association with others. (2) The exercise of the right under clause (1) may be subject to such limitations as may be prescribed by law and necessary in a democratic society (a). in the public interest; (b). for the enforcement of an order or judgment of a court in civil or criminal proceedings; (c). in satisfaction of any penalty, tax, rate, duty or due; (d). in the case of property reasonably suspected of being acquired by the proceeds of drug trafficking or serious crime; (e). in respect of animals found trespassing or straying; (f). in consequence of a law with respect to limitation of actions or acquisitive prescription; (g). with respect to property of citizens of a country at war with Seychelles; (h). with regard to the administration of the property of persons adjudged bankrupt or of persons who have died or of persons under legal incapacity; or (i). for vesting in the Republic of the ownership of underground water or unextracted oil or minerals of any kind or description. (3) A law shall not provide for the compulsory acquisition or taking of possession of any property by the state unless (a). reasonable notice of the intention to compulsorily acquire or take possession of the property and of the purpose of the intended acquisition or taking of possession are given to persons having an interest or right over the property; (b). the compulsory acquisition or taking of possession is necessary in the public interest for the development or utilisation of the property to promote public welfare or benefit or for public defence, safety, order, morality or health or for town and country planning; (c). there is reasonable justification for causing any hardship that may result to any person who has an interest in or over the property; (d). the state pays prompt and full compensation for the property; (e). any person who has an interest or right over the property has a right of access to the Supreme Court whether direct or on appeal from any other authority for the determination of the interest or right, the legality of the acquisition or taking of possession of the property, the amount of compensation payable to the person and for the purpose of obtaining prompt payment of compensation. (4) Where the property acquired by the state under this article is not used, within a reasonable time, for the purpose for which it was acquired, the state shall give, to the person who owned it immediately before the acquisition of the property, an option to buy the property. (5) A law imposing any restriction on the acquisition or disposal of property by a person who is not a citizen of Seychelles shall not be held to be inconsistent with clause (1). National Treatment The Investment Code provides that foreign investors shall enjoy the same rights and shall be subject to the same duties and obligations as domestic investors. Subject to the Constitution, the Code and international obligations, the Government shall not discriminate between investors or against foreign investors on any ground 15 including, but not limited to, citizenship, residence, religion or the State of origin of the investment. Investor Protection The Code provides that investors are guaranteed protection against any measure of nationalisation or expropriation of their property except for reasons of public interest, in accordance with a law, on a non-discriminatory basis and subject to the grant of prompt and full compensation. An investor aggrieved by any nationalisation or expropriation may seek constitutional remedies, or other remedies under the written law or resort to other methods of resolution of disputes provided for in any agreement between the investor and the Republic. (See Article 26 of Constitution above). In 2012, the Investment Appeal Panel was set up under the Seychelles Investment Act, 2010. The Act allows an aggrieved investor to apply to the panel for (i) a review of a decision taken by a public sector agency with regard to that investor’s investment or proposed investment where the investor is not satisified with the decision of the public sector agency, or (ii) for an order where the public sector agency does not issue a decision within the required time limit. The panel may then recommend the annulement of an unauthorised act or decision or remedy an omission of the public sector agency or may even recommend the re-evaluation of an application. A commercial court was also established to deal with commercial disputes. 4.9 Seychelles & COMESA International Agreements and Obligations – Trade and other Agreements, BITs, DTTs Seychelles is a member of the COMESA FTA. In signing the FTA the Government anticipates that the country would benefit from a wider, harmonised and more competitive market, greater market access and food security and a greater investment in infrastructure. Government of Seychelles Letter of Intent to IMF June 2010 states “We remain on track for the implementation of the COMESA common external tariff by 2013. As a preliminary step, we have introduced in the 2010 budget a common excise tax on petroleum, motor vehicles, alcohol and cigarettes that applies equally to imports and locally-produced items. A roadmap has been established and a chief negotiator has been appointed to prepare for the negotiations to accede to the World Trade Organisation.” WTO, Seychelles and COMESA WTO Accession of Seychelles Memorandum on the Foreign Trade Regime: Updated Version 2009 states “Seychelles' trade policy is orientating towards regional integration with the Common Market for Eastern and Southern Africa (COMESA). The Government of Seychelles firmly believes that regional integration will provide the economic sectors of the country with more scope for development in terms of acquiring an increased market for the exports of goods and services”. IOC Seychelles is a member of IOC along with Union of Comoros, Madagascar, Mauritius, and Reunion (France). IOC is a sub-regional grouping which promotes intra-regional cooperation amongst its member states taking into account their insular nature, small and vulnerable economies, and the protection of their fragile natural environment. EPA Seychelles is currently negotiating the EPA with the EU in the Eastern and Southern Africa (ESA) configuration. Other International Bodies Seychelles is a member of the International Monetary Fund (IMF), the Work Bank, the International Finance Corporation (IFC), the International Centre for the 16 Settlement of Investment Disputes (ICSID) and the Multilateral Investment Guarantee Agency (MIGA). Status of Forces Agreements During the last half of 2009, Seychelles signed Status of Forces Agreements (SOFAs) with the US, France and the EU’s Atalanta naval mission, legalising their presence in the country. This arose out of the need to counter increased piracy activity in the Indian Ocean, including within Seychelles 320-km exclusive economic zone (EEZ), which has a negative impact on fishing activity. 17 5 SADC RELATED ISSUES Seychelles joined SADC in September 1997. Due to human and financial constraints, the Government decided to withdraw its membership from the organisation and ceased to be a member in 2004. In 2006, the Government felt that that the time was right to re-join SADC and it initiated the process in that same year. Seychelles was re-admitted to SADC in August 2008. AfDB on Seychelles and Regional Integration African Development Bank (2009) states “The prospects for enhancing regional integration are, however, constrained by the prohibitive ICT costs in Seychelles emanating from the lack of availability of international telecommunications bandwidth capacity. Lack of foreign exchange has been a major constraint for local operators’ investment into submarine cable initiatives. Seychelles is currently looking seriously at various submarine cable options such as the East African Submarine System (EASSy), South East Africa Communication Project (SEACOM), and the East African Marine System (TEAMS) is timely. Fast and higher-capacity ICT broadband capability would greatly facilitate the development of offshore financial and business services, as well as the movement towards higher-value business tourism.” WTO, Seychelles and Regional Integration WTO (2009) “Being geographically isolated, it is essential for Seychelles to strive towards economic integration with its neighbours and regional partners. The government also considers that there are many gains from regional integration, which include trade gains, increased returns and competition and investment. Although there are also challenges that the country faces when joining the regional groupings. They mostly include overlapping membership issues, institutional issues and policy design issues as well as increased competition to the domestic industries.” Budget 2010, Seychelles and Regional Integration Budget 2010 Address by the Minister for Finance Danny Faure Nov 30th 2009 states “Regional Integration: Seychelles is taking great strides in terms of aligning itself with international best practice. We are working intensively with our regional partners so as to strengthen regional integration. In 2009, Seychelles became a member of the COMESA FTA and 2010 will see us become a party to the SADC Trade Protocol. As part of our efforts to widen our trading avenues in both our imports and exports, we are exploring a number of Free Trade Agreements. Only this month, Seychelles had a first round of negotiations towards a bilateral FTA with Turkey, which is a world leader in manufacturing. It is hoped that this FTA will lead to cheaper imports such as intermediate goods and finished products.” Bilateral Investment Treaties Bilateral Investment Treaties with Seychelles as at 1 June 2010 Seychelles Partner Country Date of Date of Entry into Signature force 1. China 10 Feb 2007 2. Cyprus 28 May 1998 19 March 1999 3. Egypt 22 Jan 2002 18 Double Taxation Agreements Double Taxation Agreements concluded with Seychelles as at 1 June 2010 Partner Type of Agreement Date of Signing 1. Belgium 27 April 2006 2. Botswana Income & Capital 26 August 2004 20 June 2005 Gains 3. China Income and Capital 26 Aug 1999 17 Jan 2000 4. Cyprus Income and Capital 28 June 2006 2 Nov 2006 5. Indonesia Income and Capital 27 Sept 1999 16 May 2000 6. Japan Income and Capital 25 Sept 1970 7. Malaysia Not Specified 2 Dec 2003 10 July 2006 8. Mauritius Not Specified 11 Mar 2005 22 June 2005 9. Norway Income and Capital 18 May 1955 10. Oman Not Specified 13 Sept 2003 20 Jan 2004 11. South Africa Income and Capital 26 Aug 1998 3 July 2002 12. Switzerland Income and Capital 26 Aug 1963 13. Thailand Not Specified 26 April 2001 14 April 2006 14. UAE Income and Capital 19 Sept 2006 23 April 2007 15. Vietnam Not Specified 4 Oct 2005 7 July 2006 16. Zimbabwe 6 Aug 2002 Sources included African Development Bank (2009) Seychelles 2009-2010 Interim Strategy Note Feb 2009 http://www.afdb.org/fileadmin/uploads/afdb/Documents/PolicyDocuments/SEYCHELLES_INTERIM%20STRATEGY%20NOTE%2020092010.pdf Government of Seychelles (2009) Debt Management Strategy for 2010 –2012 http://www.finance.gov.sc/Downloads/DebtManagement/Debt%20Management%2 0Strategy.pdf IMF (2010) Seychelles: First Review under the Extended Arrangement, Request for Modification of Performance Criteria, and Financing Assurances Review—Staff Report; Staff Supplement; and Press Release http://www.imf.org/external/pubs/cat/longres.cfm?sk=24029.0 Seychelles (2007) Seychelles http://www.egov.sc/documents/strategy2017.pdf Strategy 2017 Seychelles (2009) Budget 2010 Address by the Minister for Finance Danny Faure Nov 30th 2009 http://www.sib.gov.sc/Resources/Others/Budget%202010%20English.pdf Seychelles Investment Bureau (2007) Tourism http://www.sib.gov.sc/Resources/Tourism_Strategy_2017.pdf Seychelles Investment Bureau (2010) Double http://www.sib.gov.sc/pages/general/Download.aspx Strategy Tax 2017 Agreements UNCTAD (2010) Bilateral Investment Treaties and Double Tax Agreements http://www.unctad.org/Templates/Page.asp?intItemID=2339&lang=1 WTO (2009) Accession of Seychelles Memorandum on the Foreign Trade Regime: Updated Version WT/ACC/SYC/9 26 May 2009 http://www.finance.gov.sc/images/DivisionsUnits/Trade/PoliciesLegislation/SYC9.p df 19