Homework Assignment #3

advertisement

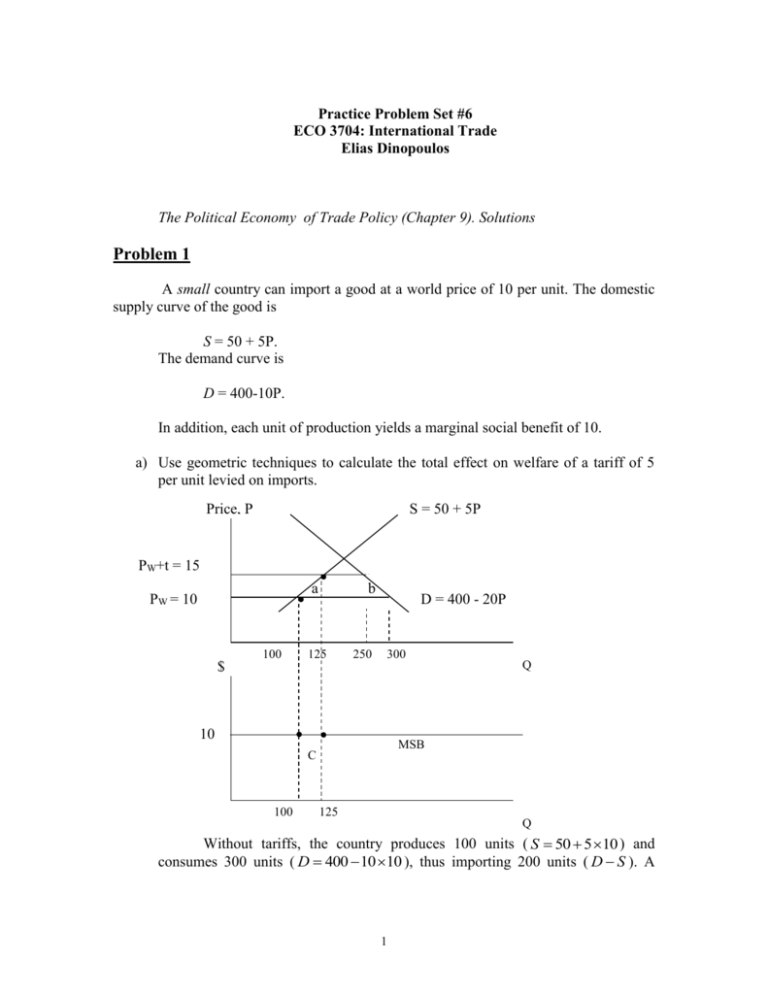

Practice Problem Set #6 ECO 3704: International Trade Elias Dinopoulos The Political Economy of Trade Policy (Chapter 9). Solutions Problem 1 A small country can import a good at a world price of 10 per unit. The domestic supply curve of the good is S = 50 + 5P. The demand curve is D = 400-10P. In addition, each unit of production yields a marginal social benefit of 10. a) Use geometric techniques to calculate the total effect on welfare of a tariff of 5 per unit levied on imports. Price, P S = 50 + 5P PW+t = 15 a PW = 10 100 b 125 250 D = 400 - 20P 300 Q $ 10 MSB C 100 125 Q Without tariffs, the country produces 100 units ( S 50 5 10 ) and consumes 300 units ( D 400 10 10 ), thus importing 200 units ( D S ). A 1 tariff of 5 per unit leads to production of 125 units ( S 50 5 15 ) and consumption of 250 units ( D 400 10 15 ). The increase in welfare is the increase due to higher production of 2510 (measured by area c in the above diagram) minus the losses to consumer and producer surplus of (50 5) 2 and (25 5) / 2 respectively (measured by areas b and a in the above diagram), leading to a net gain of 62.5. b) Use geometric techniques to calculate the total effect of a production subsidy of 5 per unit. S = 50 + 5P Price, P Pwt t= 15 Pwt= 10 a 100 D = 400 - 20P 125 300 Q $ " MSB C 100 125 Q A production subsidy of 5 leads to a new supply curve of S 50 5 ( P 5) . Consumption stays at 300, production rises to 125, and the increase in welfare equals the benefits from greater production ( 2510 ) (measured by area c in the above diagram) minus the production distortion costs [ (25 5) / 2 ] (measured by area a in the above diagram), which is equal to 187.5. c) Why does the production subsidy produce a greater gain in welfare than the tariff? The production subsidy is better targeted policy than the import tariff since it directly affects the decisions which reflect a divergence between social and private costs while leaving other decisions unaffected. The tariff has a doubleedged function as both a production subsidy and a consumption tax. 2 Problem 2 The arguments for free trade in this quote include: a. Free trade allows consumers and producers to make decisions based upon the marginal cost and benefits associated with a good when costs and prices are undistorted by government policy. b. The Philippines is a small country, so it will have little scope for influencing world prices and capturing welfare gains through an improvement in the terms of trade. c. “Escaping the confines of a narrow domestic market” allows possible gains through economies of scale in production. d. Special interest groups may dictate trade policy for their own ends rather than for the general welfare. Free-trade policies are transparent and help eliminate corruption where these groups exert undue or disproportionate influence on public policy. Problem 3 a. This would lead to trade diversion because the lower cost Japanese cars with an import value of 15,000 Euros (but real cost of 10,000 Euros) would be replaced by Polish cars with real cost of production equal to 14,000 Euros. b. This would lead to trade creation because German cars that cost 20,000 Euros to produce would be replaced by Polish cars that cost only 14,000 Euros. c. This would lead to trade diversion because the lower cost Japanese cars with an import value of 16,000 Euros (but real costs of 8,000 Euros) would be replaced by Polish cars with a real cost of production equal to 14,000 Euros. 3