doc 367

advertisement

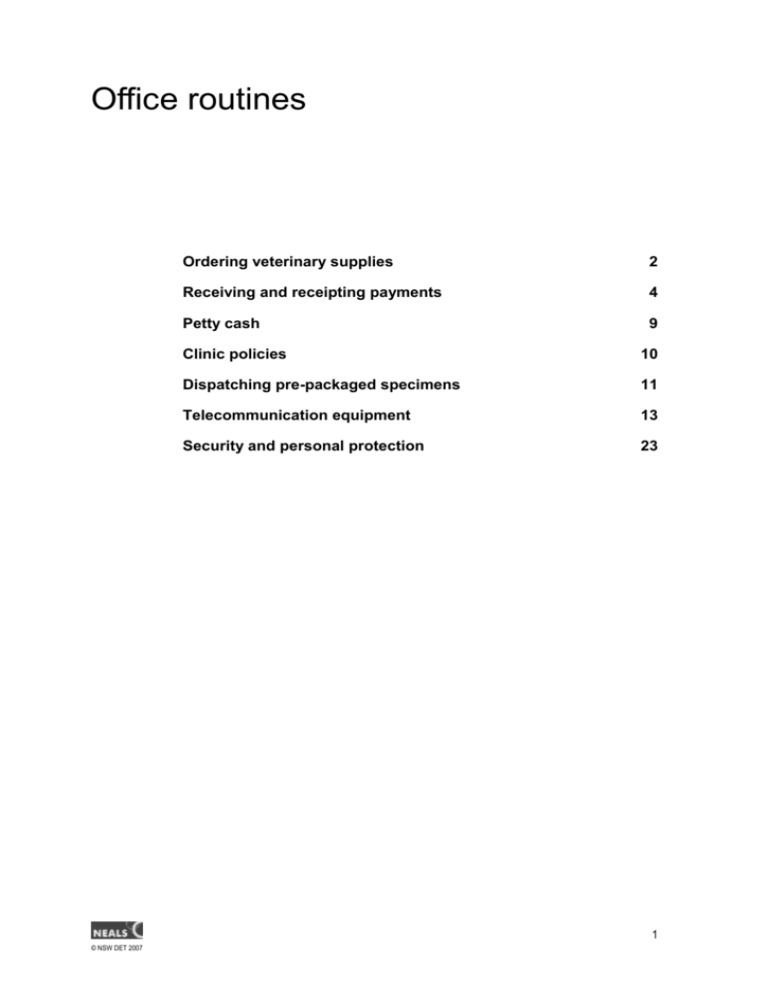

Office routines Ordering veterinary supplies 2 Receiving and receipting payments 4 Petty cash 9 Clinic policies 10 Dispatching pre-packaged specimens 11 Telecommunication equipment 13 Security and personal protection 23 1 © NSW DET 2007 Ordering veterinary supplies Conducting an inventory In a veterinary business you must conduct a regular inventory of veterinary supplies and medicines according to clinic policy and procedure. This will help to ensure that you do not run out of important veterinary medications that will be required for the care of your patients. In addition to conducting a regular inventory of veterinary products you must also conduct a regular inventory of ‘non veterinary’ products such as animal foods or stationary. Ordering Each clinic will have what they regard as adequate supplies of each product. If adequate supplies are not present when you conduct your inventory, you will need to order products from a specialised stockist under the direction of the duty veterinarian or qualified veterinary nurse. Orders may be placed by fax, telephone or the internet Each clinic will have their preferred stockists of items. Check with your clinic. Who are their preferred stockists for products such as veterinary supplies, stationary, office equipment, etc? Once you have placed your order, deliveries will usually occur overnight depending on your clinic location and supplier. Once your order arrives it will need to be unpacked, priced and place away in the appropriate location. This should be done as soon as the products arrive; especially if you have ordered frozen items or items that need to remain under a certain temperature. When you unpack the items you have ordered it is suggested that you mark the item off your invoice and order as you are placing it away. This ensures that you have received the correct item in the correct quantity and that you have been charged correctly for the items. Items that are being placed in the reception area or for sale should be marked with the retail price. It is recommended that these items be priced using a removable price sticker placed on the back of the product. Ensure 2 © NSW DET 2007 that the sticker does not cover any important information on the product regarding use. Alternately, if your clinic has the facility, you can avoid placing price stickers on products by using the pricing bar code on the back of every product. These bar codes are read by a specialised scanner and the price is registered on the clinic computer system. 3 © NSW DET 2007 Receiving and receipting payments At the completion of a sale or service it is necessary to process the payment from the client. Things to remember: If the account is for a procedure or consultation—check with the veterinarian to ensure that it is complete. Payments may be in cash, cheques, EFTPOS or by credit card. Part-payments and deposits This form of payment can only be authorised by the practice manger or the attending veterinarian. The receipt should record the amount tendered and the residual of the outstanding account. Complete and issue receipts Payment for goods or services in a veterinary practice may be by cash, cheque, credit card or EFTPOS. A receipt is a document issued by a seller to acknowledge that an amount of money has been received from a purchaser. A receipt acts as evidence that payment has been received and may be useful for taxation purposes. It should be in duplicate, one copy to the client and one kept by the clinic. It is ideal if all receipts have an individual number, like invoices. Credit notes are similar to receipts, but are issued when items are returned to raise credit against the client’s account. You should add the reason for the return, and the number of the invoice to which it relates. Some clients will be satisfied with the receipts generated by an EFTPOS terminal or with an invoice stamped PAID as a receipt. Others will want a full document. Most computer accounting systems produce receipts automatically when details of payments are entered. An ‘official’ receipt has all the relevant details but also the signature of an authorised person. They should contain: the receipt number the date 4 © NSW DET 2007 the name of the business (seller) the name of the buyer information about the transaction (what it was, type of payment eg cash sale, or account payment) the amount received an authorised signature. Recording payments If kept by computer this generally occurs automatically. Paper-based systems vary considerably. The basic idea is to ensure that all takings for the days are accounted for—receipts issued plus cash sales (possibly on cash register printouts). Some simple systems just keep a book of all payments, labelled as cash, or as client’s name (cheque or credit) and EFT—which will not appear on daily takings but should appear on the bank statement later. Deductions might be made for payments taken from the takings, such as paying for a groomer’s fees or the gardener. Remember to keep clear records if this happens from the till and not petty cash. Example of a completed receipt 5 © NSW DET 2007 Counting cash and giving change Never put the customer’s money into the till until you have counted it. If you n ed to give change, keep the money (eg $50 note) separate from the till until the change has been counted into the customer’s hand—otherwise it is too easy to get confused if the customer says you have given me the wrong change. Some computer programs allow you to enter the amount of money given by the client to pay the invoice, and then you will be shown the amount of change to give. If you don’t have a cash register or computer program to tell you, the correct procedure is to round down to the nearest five cents if paying cash, or to leave at the exact figure for cheque, credit card or EFT. Then, deduct the amount owing from the total money paid, and if there is any amount left over, this will be the change. If there is a negative number, the client has not paid enough money, and the extra still to be paid is the negative amount. When you have calculated the change to give the client: count it back into their hand starting from the amount they have paid then adding until you reach the exact figure of money they handed you Verify cheque/credit card/EFT payments are correct Cheques are a written order directing the bank to pay the stated amount to either the person named or the bearer. The drawer is the person who owns the bank account; the payee is the person or business who will receive the cheque and the drawee is the bank at which the cheque account is held. It is important to ensure that cheques are completed correctly. Check the list below for details. If the cheque is more than six months old a bank might not honour it. The cheque should be dated and signed. Check the signature with the name/s on the cheque as some may be company cheques. Cheques should not be post-dated without prior arrangement, as they cannot be tendered until the date written on them. Make out the cheque with the same amount in writing as in figures. Write the amounts as close as possible to the pre printed areas to avoid spaces that someone else might add to. Although it is acceptable to fill in a cheque for someone else—eg client who left spectacles at home—or by rubber-stamping some 6 © NSW DET 2007 details, any alterations must be initialled by the cheque drawer— person who signs. You cannot rub out or use liquid paper on a cheque. All corrections are shown and initialled. All cheques should be crossed—two diagonal lines across midcheque—with the words Not Negotiable written through them. This avoids the cheque being stolen and cashed by The Bearer (person holding it). It can only be banked into the account for that name shown if it is crossed and Not Negotiable. It is not advisable to allow people to write cash cheques (the payee is made out as ‘Cash’ and the cheque is not crossed or marked Not Negotiable) for more than the amount owing. Some people do this so they can pay an account and be given cash in change for the overpaid amount and then have that cash to spend. If you do this in a business, you are accepting that this person’s cheque won’t bounce and taking away your cash float (supplies of change in the till). Most practices will not allow it. Example of a correctly completed cheque Credit cards Credit cards such as Bankcard, Visa Card and MasterCard guarantee payment provided that the forms are correctly completed and the card is current. When you are given a credit card, it may either be processed manually through a ‘slider’ and triplicate carbon copy system, or through an online EFTPOS terminal. First, check the expiry date and then any cancelled card list to ensure it is current and legitimate. The ‘slider’ machine imprints the dockets with the card and merchant’s details. The following information needs to be completed: tick the appropriate boxes (type of card), your initials the type of purchase 7 © NSW DET 2007 amounts including total date floor limit, above which authorisation had to be sought. With EFTPOS terminals, the card is passed through the terminal, credit is selected, the amount of money owing is entered and then ‘OKd’ by the client. A PIN is generally not necessary. The bank is contacted and will decline the transaction if there are insufficient resources in the account. If the transaction is approved, a paper receipt is generated and the client must sign it. Check the signature and card, and if the transaction is OK, return the card and print a second copy if the client requires it. Do all this in front of the client and don’t lose/hide/obscure the card. Any carbon copies with signatures should be torn up rather than just thrown away, as they can be used to forge documents. This is a common area for credit card fraud. The client should receive a copy of the receipt and another copy is kept by the business to be recorded and checked against bank deposits later. EFTPOS terminals allow the use of direct debit cards from client’s bank accounts to transfer directly to the business’ account for payments. An online terminal is required. If the line is ‘down’, alternative methods of payment are needed. All on-line processes are recorded and a daily report is generated. All receipts issued from the terminal should be kept and crosschecked against the bank statement later. 8 © NSW DET 2007 Petty cash Petty cash is money that is used for purchase of small tax-deductible items for use within the clinic, eg milk. A petty cash float is created by drawing a business cheque and cashing it. Small purchases are then made from the float and recorded. To obtain petty cash money, a voucher should be filled out and receipts for purchases retained. When the float becomes low again, another cheque is drawn. This is called the IMPREST system of petty cash. The cash on hand in the float, and the balance of vouchers written should always add up to the total imprest float amount. Example of petty cash voucher 9 © NSW DET 2007 Clinic policies Most clinics have a clinic policy document that outlines the rights and responsibilities of the staff members and sets out protocols for performing various tasks. In addition there are usually directions on how to respond in emergency situations. The various policies must also adhere to any relevant government legislation, as you cannot be forced to agree to any workplace policy that will diminish your legal rights or which promotes dishonest behaviour. Some examples of practice policies: customer arrivals: protocol on dealing with new clients, greeting clients, what to do when you are on the phone phone techniques: how to answer the phone correctly payment methods: does the clinic have accounts? routine appointments emergencies house visits and out-calls handling complaints admitting animals into hospital, boarding animals discharging animals infection control: animals with contagious diseases confidentiality. 10 © NSW DET 2007 Dispatching pre-packaged specimens Many veterinary clinics send their samples to a commercial and/or government laboratories for testing. These laboratories produce their own guidelines for the packing, sampling and transportation of samples. These guidelines usually also have instructions on how to fill out the specimen advice sheets and the consignment notes. If not, the courier company that the clinic uses to transport the samples will have its own guidelines. Here are some examples of the types of transportation used for samples in Australia. Make sure you know which laboratories deal with which types of samples and which couriers they use. These tend to use a number of couriers for both air and road transport depending on how far away the clinic is situated. Companies that use air transport have to comply with Civil Aviation, International Air Transport Association (IATA) and International Civil Aviation Organisation (ICAO) regulations. An example of dangerous goods would be a container filled with formalin Blood samples for blood typing racehorses In Australia these are sent to Queensland University. Usually go in a foam esky by Australian Air Express through Australia Post Samples to the local base hospital or commercial laboratory These usually have a courier who picks up from the clinic and transports the specimen by car directly to the laboratory. Due to the freshness of these samples and the rapidity of their arrival at the laboratory they are usually put in a zip lock specimen bag with the specimen advice sheet accompanying in the separate pocket attached to the bag. Commercial or government laboratories situated in another town or city Check with the transport company about the esky, as most will not accept foam eskies unless they are then packaged into a cardboard box. Some require plastic eskies. For unusual samples ring the laboratory first to check requirements and procedures for sampling technique, packaging, preserving and transportation. 11 © NSW DET 2007 There are two items of paperwork that must accompany most samples: 1. Specimen advice sheet (SAS) or request form 2. Consignment notes What are the local couriers that your workplace deals with and what are their deadlines for collection? 12 © NSW DET 2007 Telecommunication equipment Developments in the field of telecommunications are so rapid any description of equipment rapidly becomes out-of-date. It includes a wide range of telephone, facsimile (fax), telex systems, intercom, paging, public address systems and computer systems. The following table briefly describes some of the telecommunications equipment that veterinary nurses might be required to use. Hand held battery operated—can be used anywhere (within limits) Transportable battery operated can be used in or out of a car Permanently fitted in cars. Some allow ‘hands free’ speech and will accept voice activated dialling cordless phone intercom Enables telephone to be used within 100 metres from the base unit, thus enabling communication between two or more locations, (often within the same building), without interfacing with the main telephone system public address system Useful if not overused when it can become irritating, distracting and subsequently ignored paging system Used to attract attention of an individual and direct them to a particular location to collect a message or receive further instructions bleeper system Pocket sized personal radio receiver, battery operated, giving out a high pitched signal when activated (usually from switchboard)—holder of the ‘bleeper’ then telephones the switchboard to collect message Care must be taken to ensure bleeper is within range of central control point Similar to the ‘bleeper’ but operates over a wider area mobile phone radio paging telephone answering machine commander Includes those that: answer call and play recorded message answer recorded message left by caller can be used for dual purpose answering calls or recording messages have a bleeper or voice-activated remote control facility enabling off-site user to contact own machine and listen to messages Phone set-up with multiple lines and multiple phones to allow 13 © NSW DET 2007 phone system answering of phone in various parts of the clinic and transferring of calls from one phone to another Has a ‘hold’ facility to allow nurse to discuss the case with the veterinarian and then return to the call two- way radio Base set at clinic and another in car to enable vet nurse to call when vet is away from clinic facsimile (fax) Transmits exact copies of documents (including graphics) over phone lines to another fax terminal quickly and accurately Charges based on time to transmit message at same rate as telephone calls All faxes are compatible and they are grouped by speed of transmission. groups 1 and 2 are the slowest group 3 transmits a document in approximately 20 seconds group 4 (used with digital telephone networks) is capable of transmitting a message in approximately 3 seconds fax machines can be fitted into cars Specific telecommunication systems Telephone system A handset of multi-station telephone/intercom system can be used for: communication, messages incoming and outgoing set message systems: seamless diversion systems which save clients having to make another phone call if calling after hours. The types of telephone systems are fixed stations, multi handset, mobile, cordless, portable. To use: Remember to answer with correct greeting, identify your business and yourself. Get the caller’s details, including name and phone number, any message and time of call, take written notes in phone message book, ensure action is followed up. Use standard form or a message pad. Outgoing calls—be clear with your introduction, (name etc) and purpose/message. Speak clearly, use expression, use names—make calls personal. Allow caller to hang up first. Always thank caller for their call. Answer promptly (by 3rd ring). Use hold sparingly after asking permission first and then continue to recontact every 60 seconds and re-ask if they wish to continue holding or if you should take a message. 14 © NSW DET 2007 To maintain the system: Cleaning, disinfecting and deodorising may sound extreme but could be needed. Know your phone’s tricks, eg last number redial, messaging, how to use hold and transfer calls. Call supplier for faults. Intercom system A handset of multi-station telephone/intercom system can be used to communicate within different parts of a business premises—eg reception to surgery or outside Vet nurse using an intercom phone Facsimile machine A facsimile (fax) machine can be used to send and receive written communication instantly along phone lines. It can be used for pictures, drawings and text. These machines are generally left ‘On’ all the time to receive messages from, for instance, pathology. 15 © NSW DET 2007 When you send a fax, use a cover sheet identifying you and your business, and to whom the fax is sent and how many pages. To maintain fax machines: Avoid excessive heating (and lesser, cooling) and direct sunlight. Keep machine on flat surface, and with plenty of ventilation (20 cm front and back, 10 cm sides). Avoid food and water. Pager Pagers are used for direct-access paging: callers end either tone-alerts or numeric and alphanumeric messages from a visual display unit via a modem. Computer Computers are playing an increasingly important role in the day to day running of veterinary practices in a number of areas, including: client records cash flow analysis sales and purchase control word processing stock control desktop publishing costing and budgetary control email communication electronic faxes personnel records wages/salary systems market research 16 © NSW DET 2007 A computer system in a veterinary practice might have the following common components: A system unit or main console/file server which has: Monitor (screen)—the bigger the better and preferably with flat screen Keyboard—important to consider ergonomics—eg wrist rests Hard drive (with RAM—rapid access memory)—the larger the RAM the faster the handling of complex programs CD-ROM or CD-Rewritable facility External hard drive systems or other storage devices such as tape drives, ZIP disk drives, SuperDisk etc—designed to copy large amounts of data rapidly as an external backup to the hard drive or to transfer data elsewhere Operating system—the underlying code which provides commands the computer follows to make sense of the programming instructions in the various software applications which can be added to its repertoire System components such as processor chip—the bigger Hz; the faster the chip; the graphics package—converts data into seamless motion images especially in games—can be a very heavy demand; speakers and sound processing card. In addition there may also be peripheral devices such as: 17 © NSW DET 2007 terminals or workstations (other simple monitors or intelligent computers which can be used as remote access to the main console by network linkage systems) printers/scanners/image productions units (eg intelligent copiers), devices used to produce hard copies of information onto paper. Very old printers use ‘dot matrix’ technology; more recently, inkjet and laser printing are used. Scanners can collect and digitalise data from an image or book and load onto the computer for memory or modification. modems—communications devices linked by telephone to a network server which enables contact between other computers externally electronic or intelligent cash tills or drawers—where the till is linked to the computer, so registering a cash payment on receipts generates a response in the cash collection zone and opens the till for change or to receive payments. They may be able to use bar-code scanners too to read items for pricing and checking stock and re-order needs. some have dedicated buttons for particular prices or services. software—anything to do with the computer and which isn’t hardware enough to be kicked eg word processing packages such as word or wordperfect, fax software, anti virus programs—always turn off before introducing a new program; data handling; internet browsing etc. Computer maintenance: Computers combine electronic with electromechanical parts. Motherboards, video and networking cards carry only an electrical current, whereas hard and floppy disk drives use moving parts, which can wear out. You can improve your computer’s life span by a few maintenance procedures. Apart from updating assorted processor chips (the brain) and memory board components, you can’t prevent it from becoming outdated! Power surges: caused by too much power, electrical storms etc, and brownouts, caused by too little power (electrical overload, storms etc) can damage a computer. A power-surge protector and backup system can be installed for a relatively low cost (several hundred dollars) and allows time to properly save and shutdown. Static electricity: from synthetic carpets can be discharged through the first metal touched eg a computer, so a rubber mat under the computer will prevent this problem. Ventilation: 18 © NSW DET 2007 around a computer is vital—20-30 cm of clear airspace at various points. Although most computers have inbuilt fan ventilation systems, these may overload (and make lots more noise) if not considered. A computer should not be paced in an excessively hot/sunny area. In a poorly ventilated room, computers generate noticeable amounts of heat. Moisture: is a common threat—most notably from drinks! High humidity and condensation also cause problems, which damage machines and keyboards. Dust: is the other major bugbear and all computers in dusty or dirty environments should have dust covers. Dust can lead to shorting out and electrical fires, also to damage to various CD and floppy disk drives. Soft brush and cloth or air pressure sprays are useful to clean areas such as the keyboard. Proper start up and shutdown procedures: will save a lot of damage and loss of data/corruption of disks/hard drives. Follow the steps properly and allow time for the steps. Avoid excessive turning on and off. If you are working with remote workstations, these should be shutdown first before doing the main console. Viruses: from Internet, or (more commonly) contaminated e-mail attachments or floppy disks can cause major disruption of hard drive and data, and can replicate and send themselves on to others from your computer. There are many virus protection software packages available free on the Internet or for purchase—but they only work if you apply them and regularly update their information. Backup: often and always at the end of each day prior to shutdown. Keep a separate backup copy of data away from the business premises. Complete a new backup for every day of the week and then rotate, the disks or CDs etc. Regular clean out: of the recycling bin, tidying of the connections and a manual service of the computer are helpful. CD-ROMs: Do not expose to liquids, pressure, excessive heat, moisture, sunlight or magnetic field (eg cart, computer, refrigerator). 19 © NSW DET 2007 Use the special adhesive labels and a felt pen, or write on before affixing to the disks. Regularly use a good virus-checker program to check on safety. Keep confidential data locked away in safe boxes. Printers Stationery (paper), thermal (heat sensitive) rolls for ECG and poss. Anaesthesia prac. Toner (black powder) may need replacing or topping up. Inkjet heads also need to be replaced regularly. Computer software There are a number of commercial packages available designed specifically for veterinary practices. You should be able to create a new client and patient, retrieve and update a record and save it, and create a receipt for a payment. The three basic types of software most commonly used in veterinary practices are: word processing: for written text such as letters, path reports, histories data bases: for information such as names, addresses, phone numbers, patient signalment, wages, personnel records, drugs and price lists—this can be sorted, re-arranged, searched and analysed using key words or fields, eg doing a patient search for a dog named ‘Misty’ spreadsheets: for dealing with figures such as income and expenditure, invoices and receipts—these are used to generate financial reports and analysed for business planning. Cash register Cash registers can be used to: collect and store financial payments issue paper receipts for sales link to inventory to manage ‘just in time’ ordering. In the main cash registers are basic key opened. Intelligent till linked to computer. Also multi-function key-operated—eg provides list of daily transactions etc. Cash registers can be maintained by: cleaning and drying as for computers leaving drawer ajar with small amount of money overnight to avoid breakage if thief enters premises. 20 © NSW DET 2007 Photocopier Photocopiers can be used to: reproduce text, print, diagrams, pictures, photos mass copies. The most common type of copier is the lightweight one-off through to ream at a time with paper sorters, stackers, staplers and built in features such as double siding and reduction/enlargement. To use a photocopier, simply: Turn on, allow to warm-up and ensure adequate paper supplies in place. Paper sizes may be varied, as can thickness. Use control panel or follow manual to create copies. Alter controls to adjust light/dark, numbers and other features. To maintain a photocopier: Add paper: check feed tray. Use paper by opening package at seam and adding upper side first and gently fanning pages to ‘unstick’ it. Always keep unused paper wrapped, as humidity will affect paper and make it much more prone to paper jams. Use the bypass feed tray for overhead transparency films or thick papers. Avoid paper jams, but if they occur, follow manufacturer’s instructions and remember to check all possible places and remove all fragments. As machine have some very hot parts, best to cool down, or turn off machine. The platen (glass cover) and sliding cover may not be clean. A damp cloth and some Mr Sheen prevent sticking together and remove dirt (and bugbear of photocopiers—liquid paper corrections). Replacing toner cartridges: toner is the fine black powder, which forms the images on photocopies. As it runs out, the cartridge may need to be agitated or have its contents replaced. Follow instructions for machine and dispose of toner carefully OR return to supplies for swap over so correct part is sent. Regular maintenance should be performed according to number of copies completed—call service centre after every so many copies. See Test Sheet to check on performance of copies. Ventilation is very important. Photocopiers can overheat and malfunction. In a small room, they can also generate unpleasant smells and ozone gas. OHS issues. Always take care with electricity if opening parts of copier. Avoid food and drinks around machines; do not watch copying process with bright light. Avoid metal clips, which scratch platen. 21 © NSW DET 2007 Be aware of copyright laws: For example, you many be able to copy up to 1/10 or one chapter of a work without permission. You are not allowed to copy banknotes, stamps, passports and ID cards or cheques. 22 © NSW DET 2007 Security and personal protection Practice security involves safe guarding: money medicines personnel property personnel well being loss of and/or injury to animals client confidentiality. Theft and armed hold-up If thieves really want to get in, they will get in, causing lots of damage in a short period of time. The majority of offenders are those who commit a crime because there was an opportunity, such easy access to the till, leaving the back doors open, carrying large amounts of money to and from the bank or not leaving personal belongings visible—in the office or staff cars. Strategies to prevent or minimise theft: good lighting within the building and the car park alarm systems positioning merchandise away from doors and open windows positioning merchandise where there can be adequate surveillance by staff secure lockable till with limited staff access maintain a small float in the till lockable safe out of public view secure storage of S8 medicines and anabolic steroids lock up protocol. 23 © NSW DET 2007 Clinic lock-up protocol 1. Reconcile till. 2. Put money in safe. 3. Leave $50 float in the till—if someone breaks in it is better to have a small amount of money available. Most petty theft is usually drug-related and after ready cash. 4. Check that cages are secure. 5. Check that all animals are fed and watered. 6. Check that all oxygen cylinders are turned off. 7. Turn off automatic processor. 8. Turn off lights except light in reception area. 9. Turn on security light. 10. Check that doors and windows are locked. 11. Set the alarm by putting in your personal code. Personnel protection This covers protection from: aggressive clients threats to personal safety for staff working late in the clinic injury from animals workplace hazards. Some workplaces have ‘panic buttons’ installed which can be activated in response to serious personal threat such as an armed hold-up. Activation should lead to immediate response by the police. Are there any situations in your workplace that could raise concerns for the personal safety of the staff? If so, what mechanisms are in place to deal with them? Patient security This includes: Adequate restraint of animals to prevent injury to handlers and animals Prevention of escape Isolation of animals with infectious diseases Ask clients to always have dogs on leads and cats in baskets to prevent fighting and having frightened animals leaping out of owners’ arms. Ensure hospitalised dogs are securely restrained when on leads and that cage doors are properly closed. 24 © NSW DET 2007