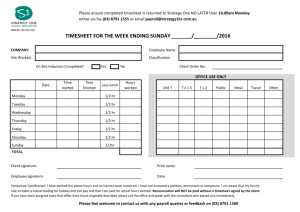

SECTION 1 - USING THE MOOREPAY SYSTEM

advertisement