mary kay worksheet to prepare “schedule c”

advertisement

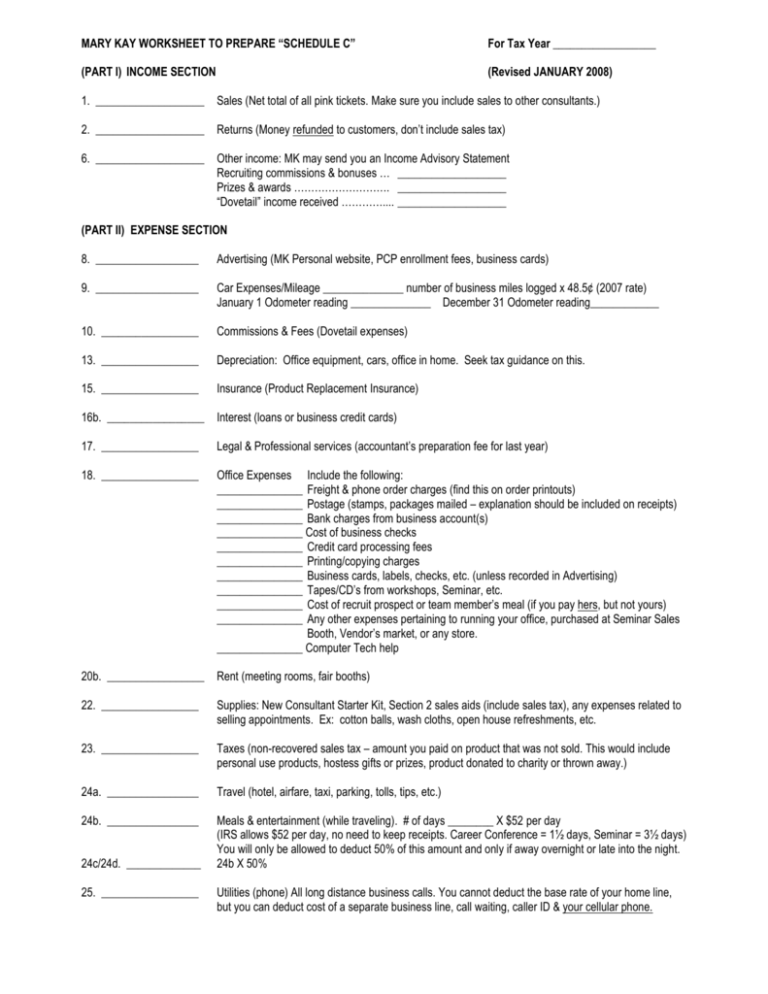

MARY KAY WORKSHEET TO PREPARE “SCHEDULE C” For Tax Year __________________ (PART I) INCOME SECTION (Revised JANUARY 2008) 1. ___________________ Sales (Net total of all pink tickets. Make sure you include sales to other consultants.) 2. ___________________ Returns (Money refunded to customers, don’t include sales tax) 6. ___________________ Other income: MK may send you an Income Advisory Statement Recruiting commissions & bonuses … ___________________ Prizes & awards ………………………. ___________________ “Dovetail” income received ………….... ___________________ (PART II) EXPENSE SECTION 8. __________________ Advertising (MK Personal website, PCP enrollment fees, business cards) 9. __________________ Car Expenses/Mileage ______________ number of business miles logged x 48.5¢ (2007 rate) January 1 Odometer reading ______________ December 31 Odometer reading____________ 10. _________________ Commissions & Fees (Dovetail expenses) 13. _________________ Depreciation: Office equipment, cars, office in home. Seek tax guidance on this. 15. _________________ Insurance (Product Replacement Insurance) 16b. _________________ Interest (loans or business credit cards) 17. _________________ Legal & Professional services (accountant’s preparation fee for last year) 18. _________________ Office Expenses Include the following: _______________ Freight & phone order charges (find this on order printouts) _______________ Postage (stamps, packages mailed – explanation should be included on receipts) _______________ Bank charges from business account(s) _______________ Cost of business checks _______________ Credit card processing fees _______________ Printing/copying charges _______________ Business cards, labels, checks, etc. (unless recorded in Advertising) _______________ Tapes/CD’s from workshops, Seminar, etc. _______________ Cost of recruit prospect or team member’s meal (if you pay hers, but not yours) _______________ Any other expenses pertaining to running your office, purchased at Seminar Sales Booth, Vendor’s market, or any store. _______________ Computer Tech help 20b. _________________ Rent (meeting rooms, fair booths) 22. _________________ Supplies: New Consultant Starter Kit, Section 2 sales aids (include sales tax), any expenses related to selling appointments. Ex: cotton balls, wash cloths, open house refreshments, etc. 23. _________________ Taxes (non-recovered sales tax – amount you paid on product that was not sold. This would include personal use products, hostess gifts or prizes, product donated to charity or thrown away.) 24a. ________________ Travel (hotel, airfare, taxi, parking, tolls, tips, etc.) 24b. ________________ Meals & entertainment (while traveling). # of days ________ X $52 per day (IRS allows $52 per day, no need to keep receipts. Career Conference = 1½ days, Seminar = 3½ days) You will only be allowed to deduct 50% of this amount and only if away overnight or late into the night. 24b X 50% 24c/24d. _____________ 25. _________________ Utilities (phone) All long distance business calls. You cannot deduct the base rate of your home line, but you can deduct cost of a separate business line, call waiting, caller ID & your cellular phone. 27. _________________ Other Expenses: List in Part V _______________ Internet & virus protection _______________ Seminars & workshops (registration for Seminar, Career Conference, Retreat, all workshops, banquets, fashion shows, meeting fees & guest nights. _______________ Uniform (Director Suit & Red jacket only) _______________ Prizes & gifts: to team members, director, customer’s new baby or wedding, etc. _______________ Bad Debts (Any sale included above that payment was never received) (PART III) COST OF GOODS SOLD - 33. Method used to value closing inventory is COST 35. __________________ Beginning inventory at COST (same as last year’s ending inventory.) New consultants who started during this year, yours is ZERO. 36. __________________ Purchases at COST (Section 1 plus any you purchased from other consultants) 36. __________________ COST of product withdrawn for personal use (include gifts to family and friends) 37. __________________ Cost of labor (office help, % of maid service) 41. __________________ Ending inventory at COST (Try to settle everything by the end of the year) Add up all products on your shelf ……………….. _________________ Add in products you need to return to MK ……… _________________ Add in products other consultants owe you ……. _________________ Add in products currently backordered …………. _________________ Subtract products you owe others ………………. _________________ BUSINESS USE OF YOUR HOME (Form 8829) NOTE: If you do not store an inventory, you may not be allowed to take this deduction. _______________ Square footage of your entire home _______________ Square footage of your business use areas: office, inventory storage area (If other rooms are also used, list separately the square footage of each, how used & how often) _______________ Value of home (adjusted basis or fair market value) _______________ Value of land included above _______________ Mortgage Interest (or Rent payments) _______________ Real Estate Taxes _______________ Homeowner’s or Renter’s Insurance _______________ Repairs & Maintenance (also include improvements made to your home this year) _______________ Cost of repairs/improvements to the business area are “Direct Expenses” _______________ Cost of repairs/improvements for general upkeep of the whole house are “Indirect Expenses” _______________ Cost of utilities for the year: gas & electric, water, sewer, trash pickup, etc. OTHER COMMENTS & FAQ’S: ACCOUNTING METHOD (Line F) is CASH. DRY CLEANING EXPENSES for Director suit & Red Jackets are NOT deductible. FOOD costs at or on your way to “business appointments” with other MK people are NOT deductible. CHILD CARE CREDITS are based on net dollars earned. They can only be used as a credit against taxes, not as labor costs. HOSTESS CREDITS are NOT deductible separately because you have already received the deduction by claiming the cost you paid in your inventory. You lose the money you would have received had you sold it at a profit, but you cannot claim a tax loss on what you COULD have earned, only on what expenses you’ve actually paid. RETAIL PRODUCT USED AS DEMOS are NOT deductible separately for the same reason stated above for hostess credits. Even though these are not deductible line items, it is a good idea to keep records of them for the following reasons: (1) It helps to understand where your inventory is going (2) In the case of an audit, these records would prove business activity rather than a predominately personal use of inventory. (3) Non-recovered sales tax on these products