Accounting 10 Module 1 Lesson 3 Lesson Three

advertisement

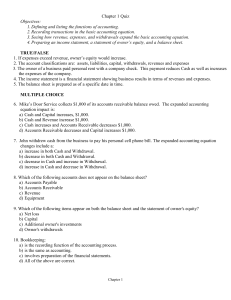

Accounting 10 Module 1 Lesson 3 Accounting 10 1 Lesson 3 Accounting 10 2 Lesson 3 Lesson Three - Analyzing An Expanded Equation Read pages 33 to 53 in the textbook. Topics: • Introduction • Analyzing an Expanded Equation • Analyzing the Income Statement and the Balance Sheet • Remember These Important Points • Do You Understand? • Conclusion • Self Test • Answers for Self Test • Assignment 3 Accounting 10 3 Lesson 3 After studying Lesson 3, the student should be able to • rearrange an accounting equation to show the matching of revenues and expenses for a given accounting period. • analyze and correctly record business transactions on an expanded accounting equation form; rearrange the equation to report the net income or net loss for the accounting period. • prepare an income statement in good form from given information to report revenues and expenses for a specific accounting period. • classify accounting data on an expanded accounting equation form; then prepare an income statement and a balance sheet. • prepare in good form an income statement and related balance sheet from accounting data but without the aid of an expanded accounting equation. • identify how GAAPs affect the preparation of financial statements. Introduction The business transactions you analyzed so far have affected assets, liabilities, and the claim of the owner through her/his investment (capital). While these transactions occur from time to time, they do not show the main reason for operating any business. Simply stated, the main reason for operating a business is to make money. You will also learn the realization of a profit will increase the Owner's Equity for a definite period of time. In the language of accounting, the financial events directly related to the accounting of a business profit (or loss) are known as revenue and expense transactions. These transactions will affect the fundamental elements by expanding the Owner's Equity portion (right side) of the accounting equation. Accounting 10 4 Lesson 3 Analyzing an Expanded Equation Analyzing Revenue Transactions Revenue usually results from the performance of services and/or the sale of goods. For instance, the income for a hairdresser is the fee charged to customers for having their hair done. The commissions earned by a real estate salesperson would be considered as income for the salesperson. You will analyze two transactions that affect Stacom Travel Agency by causing the Owner's Equity section of the accounting equation to expand. In each transaction in this lesson, the balance (B), the transaction (T) and the new balance (N) will be given. Transaction 1 - As of October 31, Stacom Travel has received $2 000 cash from the sale of services during October. Assets Accts. Cash Rec. B $25 800 + 0 + T +2 000 N $27 800 + 0 + $48 800 = Liabilities + Owner's Eq uity Office Bank Loan Accts. R. Ireland, R. Ireland, Equip. Furn. Payable Pay. Capital Drawing Revenue $10 000 + $11 000 = $10 000 + $7 000 + $31 800 - $2 000 + 2 000 $10 000 + $11 000 = $10 000 + $7 000 + $31 800 - $2 000 + 2 000 = $17 000 + $31 800 Analysis: The asset Cash and total assets (left side of the equation) have increased as a result of this transaction. The right side of the equation must also be increased by the same amount. Liabilities refer to the debts of the business so it is not affected by the sales transaction. Therefore, Owner's Equity must be increased by $2 000 as a result of the cash sales of services. Rob Ireland, Capital represents the claim of the owner through his investment. Rob Ireland, Drawing shows a decrease to owner's equity resulting from an owner's withdrawal of assets for personal use. Therefore, neither of these accounts can be used to record this transaction. A special account--Revenue--is added to owner's equity. This account represents such items as commissions or in this case, for sale of services. Accounting 10 5 Lesson 3 Transaction 2 - As of October 31 Stacom Travel sells services on credit to Terry Thomson for $600, to Janet Brown for $1 000, to Black’s Shoe Co. for $2 000 and to J. McCain for $400. All customers were given 30 days in which to make payment to the firm. Assets Accts. Cash Rec. B $27 800 + 0 + T + 4 000 N $27 800 +4 000 + $52 800 = Liabilities + Owner's Equity Office Bank Loan Accts. Equip. Furn. Payable Pay. $10 000 + $11 000 = $10 000 + $7 000 + $10 000 + $11 000 = $10 000 + = R. Ireland, R. Ireland, Capital Drawing Revenue $31 800 - $2 000 + 2 000 + 4 000 $7 000 + $31 800 - $2 000 + 6 000 $17 000 + $35 800 Analysis: The sale of services increase the assets of the business. A new account-Accounts Receivable--is added to the equation. This account is an asset representing amounts due from customers. This asset increases by $4 000 because the business now has claims on the property of four customers until their debts are paid. On the right side of the equation, the increase is shown under Revenue. Revenue for a given period is equal to the inflow of assets (cash and accounts receivable) during that period from the selling of goods or services. When Is Revenue Recognized? The Generally Accepted Accounting Principle (GAAP)--the revenue principle--is stated as follows: Revenue must be recognized at the time of the sale of goods or at the time of the rendering of services. Revenue is always recorded when the sale occurs. Even if the sale is on credit (accounts receivable), the revenue must be recorded when the transaction takes place (even though payment for the sale will not be received until a future date). Analyzing Expense Transactions All businesses have expenses, and for one reason only--to bring revenue into the business. For example, money is spent on employee salaries, advertising, and the use of the telephone to attract customers so that sales of services (or goods) can be made to obtain revenue. Accounting 10 6 Lesson 3 In accounting terms, expenses are the costs of the goods or services used up by a business to earn revenue. • Salaries and wages are dollars used up by the business to pay employees who work in revenue-making activities. • The amount of the rent will be accounted for as an expense because the rented office space will be used to bring customers to the place of business and it will house the employees who are used to earn revenue. • A telephone bill received by a business will be accounted for as an amount used up by the business to support revenue-making activities. Transaction 3: To obtain revenue, Stacom Travel paid cash totalling $3 400 as of October 31 for the following expenses: Rent, $540; Salaries, $2 750 and Utilities, $110. Assets Accts. Cash Rec. B $27 800 + $4 000 + T -3 400 N $24 400 + $4 000 + $49 400 = Liabilities + Owner's Equity Other Bank Loan Accts. R. Ireland, R. Ireland, Assets Payable Pay. Capital Drawing Revenue Expenses $21 000 = $10 000 + $7 000 + $31 800 - $2 000 + $6 000 - 3 400 $21 000 = $10 000 + $7 000 + $31 800 - $2 000 + $6 000 - 3 400 = $17 000 + $32 400 Note: to conserve space, Office Equipment and Furniture were added together under the heading "Other Assets". Analysis: When a business has expenses and pays cash for them, the left side of the equation is decreased because Cash is decreased. The right side of the equation must also be decreased by the same amount. Since Liabilities are not affected by the cash transaction, then Expenses under Owner's Equity causes the third element in the equation to decrease. The minus sign is used opposite Expenses simply to show this item causes a decrease to OE in the accounting equation. Accounting 10 7 Lesson 3 Transaction 4: On October 31, Stacom Travel receives a bill for $600 from the Leader Post, a local newspaper, for running three large advertisements during October. The bill allows StacomTravel a period of 30 days in which to pay for the advertising. Assets Accts. Cash Rec. B $24 400 + $4 000 + T N $24 400 + $4 000 + $49 400 = Liabilities + Owner's Equity Other Bank Loan Accts. R. Ireland, Assets Payable Pay. Capital $21 000 = $10 000 + $7 000 + $31 800 + 600 $21 000 = $10 000 + $7 600 + $31 800 = $17 600 + $31 800 R. Ireland, Drawing Revenue Expenses $2 000 + $6 000 - $3 400 -600 $2 000 + $6 000 - $4 000 Analysis: The left side of the equation is not affected because no asset is involved. Stacom Travel is given 30 days to pay for the advertising and the liability Accounts Payable must be increased to record the new claim of creditors against the total assets of the business. At the same time, the expense incurred must be shown as a second minus sign under OE because Expenses cause a decrease to Owner's Equity in the equation. The analysis of Transaction 4 introduces a second GAAP--the expense principle for recognizing expenses. Just as revenue was recognized as at a point of sale, the expense principle for recognizing expenses is: Expenses must be recognized and recorded when they are incurred while making revenue. Read over and study the section "Matching Revenues and Expenses" on page 40 of the textbook. Remember that the matching principle states that in reporting the net profit or net loss of a business for a financial period, revenues must be matched with those expenses within the same time period. Applying the Matching Principle to the Accounting Equation To apply the matching principle, you must rearrange the expanded section--revenue and expenses--of the accounting equation by: • placing total expenses under total revenue. • calculating the difference between the amounts and listing this as a net income or net loss. Accounting 10 8 Lesson 3 Examine the rearranged equation on page 43 of your text for J. Emery Estate and study the analysis. Remember: revenue is the positive or plus part in calculating net income. Expenses are the negative or minus part in calculating income. The difference between the two will determine whether the owner's equity increases (net income) or decreases (net loss) as a result of the business transactions for a certain period of time. Net Income is the excess of revenue when matched with related expenses of the same time period. Revenue is greater than expenses. Net Loss is the excess of expenses when matched with related revenue for the same time period. Expenses are greater than revenue. Analyzing the Income Statement and the Balance Sheet You just learned how revenue and expense transactions were matched under an expanded accounting equation so the net income or net loss may be calculated for a certain period of time. The details of this expanded equation may now be reported into two accounting statements: • the income statement, which summarizes the revenue and related expenses to report the net income or net loss for the accounting period; and • a balance sheet to report the position of assets, liabilities, and the total owner's equity as at the end of the accounting period. Analyzing an Income Statement The basic form of an income statement is based upon the expanded part of the accounting equation. Study carefully pages 47, 48, 49 and 50 in the textbook. Pay careful attention to how an income statement is completed from the equation. Accounting 10 9 Lesson 3 Assets = Liabilities + Owner's Equity Accts. Office Bank Loan Accts. Cash Rec. Equip. Furn. Payable Pay. B $24 400 + $4 000 + $10 000 + $11 000 = $10 000 + $7 600 + $49 400 = $17 600 + R. Ireland, + 6 000 Revenue Capital - 4 000 Expenses $29 800 + 2 000 Net Income $31 800 On accounting paper, the completed Income Statement would look like this: Stacom Travel Income Statement For the Month Ended October 31, 20__ Revenue: Sales $6 000.00 Expenses: Rent Expense Salaries Expense Utilities Expense Telephone Expense Advertising Expense $ 500.00 2 750.00 110.00 40.00 600.00 Total Expenses 4 000.00 Net Income Accounting 10 $2 000.00 10 Lesson 3 Preparing a Balance Sheet Net income is the amount remaining after revenues and expenses have been matched for an accounting period. Certain balance sheet items must be changed during the accounting period. Either or both assets and liabilities can change as a result of revenue and expense transactions. A new point must be learned in preparing the owner's equity section of the balance sheet. The net income under Owner's Equity must be added to the owner's capital. The Owner's Equity section now shows two items of claims: the Capital (investment) and Net Income (the difference between the revenue and expenses). Study carefully pages 50, 51, 52 and 53 in the textbook concerning the balance sheet. To show you another example of how the balance sheet is completed, here is the expanded accounting equation for Stacom Travel. Assets = Liabilities + Owner's Equity Accts. Office Bank Loan Accts. R. Ireland, + 6 000 Revenue Cash Rec. Equip. Furn. Payable Pay. Capital - 4 000 Expenses B $24 400 + $4 000 + $10 000 + $11 000 = $10 000 + $17 600 + $29 800 + 2 000 Net Income $49 400 = $17 600 + $31 800 Accounting 10 11 Lesson 3 On accounting paper, the completed balance sheet would look like this: (We will again categorize Office Equipment and Furniture separately instead of using "Other Assets".) Stacom Travel Balance Sheet as at October 31, 20__ Cash Accounts Receivable: Terry Thompson Janet Brown Black’s Shoe Co. J. McCain Office Equipment Furniture $24 400.00 $ 600.00 1 000.00 2 000.00 400.00 4 000.00 10 000.00 11 000.00 Bank Loan Payable Account Payable: A&B Furniture Co. The City Record Nelson Equipment Co. $49 400.00 $6 000.00 600.00 1 000.00 Total Liabilities Owner’s Equity Rob Ireland, Capital Add Net Income Less Drawing Total Owner’s Equity Total Assets $10 000.00 7 600.00 $17 600.00 $31 800.00 2 000.00 2 000.00 Total Liabilities and Owner’s Equity 31 800.00 $49 400.00 Remember These Important Points Sources of increases in capital result from • the generation of revenue by the business. • additional investments by the owner of the business. Sources of decreases in capital result from • expense transactions. • withdrawals made by the owner. • All revenue transactions will cause Assets and the Owner's Equity in the accounting equation to increase by the amount of the sale of services. Accounting 10 12 Lesson 3 • All expense transactions will cause OE in the accounting equation to decrease. To balance the accounting equation, either Assets will decrease by the amount of the expense, or Liabilities will increase by the amount of the expense. • When revenues are greater than related expenses for the same time period, a net income results. • When expenses are greater than related revenues for the same time period, a net loss results. • Net income always increases Owner's Equity. Net loss always decreases Owner's Equity. • The net income or net loss for a specific accounting period is reported in a financial statement called the income statement. • The body of the income statement reports the details of matching revenues and related expenses to the net income or net loss for the accounting period. • The income statement is always prepared before the related balance sheet because the net income (or net loss) reported by the income statement must be reported in the balance sheet at the end of the accounting period. • A new balance sheet is prepared at the end of the accounting period because assets, liabilities, and the owner's equity have changed. • The net income for the accounting period is added to the owner's Capital less Drawings under the Owner's Equity section of the related balance sheet, to report the total claim of the owner against total assets as at the end of the accounting period. • A net loss would be deducted from Capital less Drawings in the Owner's Equity section of the balance sheet. • The total Owner's Equity in the balance sheet at the end of the accounting period will be made up of three parts: the owner's Capital (investment), the owner's Drawing, and the net income or net loss as reported by the income statement. Accounting 10 13 Lesson 3 Do You Understand? Revenue and expense transactions - financial events that determine the profit (or loss) of a business. Commissions - the fees a business charges for buying or selling goods; i.e. - real estate for clients. Accounts receivable - an asset representing amounts due from customers. Revenue - an inflow of assets resulting from the sale of goods or services. Revenue principle - revenue must be recognized at the time of the sale of goods or at the time of the rendering of services. Expenses - costs incurred by a business in earning revenue. Expense principle - expenses must be recognized and recorded when they are incurred. Matching principle - revenues and expenses must be correlated to report the net income (or net loss) for an accounting period. Net income - the excess of revenue over expenses. Net loss - the excess of expenses over revenue. Sales - the main source of revenue for firms that sell goods. Fees earned - the main source of revenue for professionals such as doctors or lawyers. Income statement - a financial report of the results of matching revenues with related expenses for a definite accounting period. Conclusion You have seen how business transactions can be recorded by increasing and decreasing the items in the Accounting Equation. This equation has been expanded to record revenue and expense items under Owner's Equity. You have also seen how a balance sheet is expanded in the Owner's Equity section. Accounting 10 14 Lesson 3 Self Test 4. 1. Problem 2-4, page 43 of the text 2. Problem 2-5, page 44 of the text 3. MC 2-4, page 46 of the text Problem 2-7, page 54 of the text P 2-4 a, b Cash + $__________ Accts. + Rec. $__________ Equip= Accts. + H. Chan ment Pay. Capital $___________ $__________ $__________ $_________Revenue $_________Expenses $__________ $__________ Did the matching of revenue against related expenses produce a net income or a net loss for the period? Explain your answer. ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ Accounting 10 15 Lesson 3 P 2-5a Assets Cash + $__________ Accts. + Rec. $__________ = Liabilities + Owner's Equity Equip= Accts. + D. Bojkovsky, ment Pay. Capital $___________ $__________ $__________ $_________Revenue $_________Expenses $_________ $__________ Did the matching of revenue against related expenses produce a net income or a net loss for the period? Explain your answer. ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ Key Figure to Check: Final Cash Balance is $1 650. Accounting 10 16 Lesson 3 P 2-5b (ix) Accounting 10 17 Lesson 3 P 2-7 Accounting 10 18 Lesson 3 Answers for Self Test Assets Cash $2 510 + + $10 000 Accts. Rec. $1 090 = + + Equip = ment $6 400 = Liabilities + Accts. Pay. $1 000 $1 000 Owner's Equity + + H Chan, Capital $5 000 $9 000 $+8 000 Revenue $-4 000 Expenses +4 000 (Net Income) P 2-4b The matching of revenue and expenses produced a net income because there was excess revenues over expenses by $4 000. P 2-5a Cash + $1 650 Accts. Rec. $2 650 + Equip = ment $3 800 = Accts. + D. Bojkovsky, $4 900 Revenue Pay. Capital $-3 850 Expenses $850 $6 200 $1 050 The revenue matched against the expenses for June for Bojkovsky Tree Service produced a net income. A net income results because the total revenues exceed the total expenses for the same time period. Accounting 10 19 Lesson 3 Accounting 10 20 Lesson 3 MC 2-4a Revenue recognition MC 2-4b Service was performed on April 3. Revenue is recognized when the service is performed, not when the cash is received. MC 2-4c The elements are assets and owner's equity. Both elements increase. Assets increase because there is an increase in the amount of receivables the business expects to collect. Owner's equity increases because service revenue causes the increase when the service has been performed. The accounts affected are Accounts Receivable and Fees Earned. P 2-7a Diamond Theatre Income Statement For the Year Ended December 31, 20__ Revenues: Admissions Revenue ........................................ $202 000 Parking Fees Earned ....................................... 23 570 Concessions Revenue ....................................... 37 500 Total Revenues............................................... Expenses: Salaries Expense .............................................. Telephone Expense .......................................... Advertising Expense ........................................ Insurance Expense ........................................... Miscellaneous Expense .................................... Building Rental Expense ................................. Utilities Expense.............................................. Film Rental Expense ....................................... Projection Rental Expense .............................. Total Expenses ................................................. Net Income (Loss)....................................................... Accounting 10 21 $96 300 112 6 000 1 500 56 18 000 3 000 52 175 4 800 $263 070 181 943 $ 81 127 Lesson 3