HOT RETURN PREPARER ISSUES

advertisement

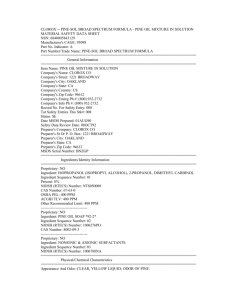

HOT ADVISOR AND RETURN PREPARER ISSUES ALONG WITH RECENT CHANGES TO IRS CIRCULAR 230 By Michael G. Goller1 Michael G. Goller Reinhart Boerner Van Deuren s.c. 1000 N. Water Street Suite 2100 Milwaukee, WI 53202 Telephone: (414) 298-8336 Facsimile: (414) 298-8097 WATS: (800) 553-6215 E-mail: mgoller@reinhartlaw.com ©2008 1 Portions of this outline were prepared by: Harvey Coustan Harvey Coustan LLC 1111 Judson Evanston, Illinois 60202 Telephone: (312) 634-4771 Facsimile: 847 733-1434 E-mail: cpacou@aol.com MW\1490589MGG:LK 01/07/08 HOT ADVISOR AND RETURN PREPARER ISSUES By Michael G. Goller 1. Introduction. On May 25, 2007, the President signed into law H. R. 2206, the Iraq emergency supplemental appropriations bill. The measure carries a minimum wage increase, the Small Business and Work Opportunity Tax Act of 2007 (Title VIII B of the bill), and miscellaneous pension-related technical corrections. It has been assigned a public law number, P.L. 110-28. Key tax provisions in the Small Business Act and Work Opportunity Tax Act of 2007 include: • Tax return preparer penalties are broadened and toughened, effective for returns prepared after May 25, 2007. (Code Sec. 6694 and Code Sec. 7701, as amended by Act § 8246) o Notice 2007-54 makes it clear that the new rules will not apply to “all returns, amended returns, and refund claims due on or before December 31, 2007 (determined with regard to any extension of time for filing); to 2007 estimated tax returns due on or before January 14, 2008; and to 2007 employment and excise tax returns due on or before January 31, 2008. • A new penalty for filing erroneous refund claims applies to any claim filed or submitted after May 25, 2007. (Code Sec. 6676, as added by Act § 8247) o No transitional relief has been provided for this new penalty. • The IRS is given more time (36 months, instead of 18 months) to notify individuals about liability before interest and penalties are suspended, effective for IRS notices provided after Nov. 25, 2007 (the date which is six months after the date of enactment). (Code Sec. 6404(g), as amended by Act § 8242.) • This is a reversal of the 1998 Tax Act. On December 31, 2007, the IRS issued three notices. Notice 2008-13 establishes temporary rules that apply to the Section 6694 preparer penalty provisions, as revised. MW\1490589MGG:LK 01/07/08 1 Notice 2008-11 clarifies Notice 2007-54, which had provided a delay in the application of the new preparer penalty provisions. Notice 2008-12 provides an exception to the requirement under Section 6695 that a preparer "sign" a federal tax return which prior to the new rules did not provide for a preparer signature. 2. Key Provisions of Notice 2008-13. A. What Tax Returns Are Impacted by the New Rules? The notice explains that for purposes of applying the Section 6694(a) penalty, a return means the tax returns which are included in Exhibit 1 to both the notice and this outline. Information returns can also be considered a tax return for purposes of the preparer penalty. Under current regulations, the person who for compensation prepares information returns or other documents that include information that is or may be reported on a taxpayer's tax return is subject to the 6694 penalty if the information reported on the return constitutes a "substantial portion" of the taxpayer's tax return. The notice provides that until further guidance is issued, for purposes of the 6694 penalty, an information return listed in Exhibit 2 to this outline and the notice is a return to which the penalty could be applied if the information reported constitutes a "substantial portion of the taxpayer's return or claim for refund. B. Other Documents Constituting a Substantial Portion of the Taxpayer's Return. (1) Schedules and Studies. The notice explains that until other guidance is issued, for purposes of the 6694 penalty, a document that includes information that is or may be reported on a taxpayer's tax return or claim for refund is treated as a return to which the penalty could apply if the information reported constitutes a substantial portion of the taxpayer's return or claim for refund. For example, a person who for compensation prepares documents, such as depreciation schedules or cost, expense, or other income allocation studies that do not report a tax liability but will affect an entry on a tax return that does report a tax liability, could constitute a substantial portion of such tax return, meaning the individual could be subject to the 6694 penalty. MW\1490589MGG:LK 01/07/08 2 (2) C. Certain Information Returns. Finally, the notice explains that the documents listed in Exhibit 3 to the notice and this outline that includes information that is or may be reported on a taxpayer's tax return or claim for refund and that constitutes a substantial portion of the return or claim for refund will not be subject to a preparer penalty under 6694(a). The individual may be subject to the preparer penalty for willful or reckless conduct under 6694(b) if the information reported on the document constitutes a substantial portion of the taxpayer's tax return or claim for refund and is prepared willfully in any manner to understate the liability on the tax return or claim for refund or in reckless or intentional disregard to the rules and regulations. Definition of the Tax Return Preparer. The notice makes three changes to the definition of a return preparer. First, it eliminates the word "income" as a modifier to tax return preparer, meaning that a tax return preparer constitutes more than just an income tax return preparer. Second, it makes it clear that the taxes in more than subtitle A are included. All taxes in A through E are covered within the definition of a return preparer. Third, the notice explains that a "substantial portion" of a return means a "schedule, entry or other portion of a tax return or claim for refund that, if adjusted or disallowed, could result in a deficiency determination (or disallowance of a refund claim) that the preparer knows or reasonably should know is a significant portion of the tax liability reported on the tax return . . . ." This provision clarifies that a determination as to whether a person prepared a substantial portion of a tax return and thus is considered a preparer will depend on the relative size of the deficiency attributable to the schedule, entry or portion on the return. D. Date Prepared. The notice explains that until further guidance is issued, for purposes of the preparer penalty, a return is deemed prepared on the date reflected by the preparer's signature. If the signing preparer fails to sign, then the date the return is prepared is deemed to be when it is filed. In that case MW\1490589MGG:LK 01/07/08 3 of a nonsigning preparer, the relevant date is the date the person provides advice which will be determined based on all facts and circumstances. E. What Constitutes a Reasonable Belief That the Tax Treatment of the Position Would More Likely Than Not Be Sustained on the Merits? The notice provides that until further new guidance is issued, for purposes of the preparer penalty, a return preparer is considered to reasonably believe that the tax treatment of an item is more likely than not the proper tax treatment if the preparer analyzes the pertinent facts and authorities in the matter described in Section 1.6662-4(d)(3)(ii) and in reliance upon that analysis reasonably concludes in good faith that there is a greater than 50% likelihood that the tax treatment of the item will be upheld if challenged by the IRS. The notice makes it clear that the tax return preparer may rely in good faith and without verification upon information furnished by another advisor, tax return preparer or other third party. The preparer may also rely in good faith without verification upon information furnished by the taxpayer. However, the return preparer may not ignore implications of information furnished to the tax return preparer or actually known to the tax return preparer. The tax return preparer must also make reasonable inquiries if the information furnished by another tax return preparer or third party appears to be incorrect or incomplete. F. Reasonable Cause and Good Faith. The tax return preparer will be found it acted in good faith when the tax return preparer relied upon the advice of a third party who is not in the same firm as the tax return preparer and that the tax return preparer had reason to believe was competent to render the advice. The advice may be written or oral, but in either case the burden establishing that the advice was rendered is on the tax return preparer. A tax return preparer is not considered it relied in good faith if the following is true: (1) The advice is unreasonable on its face; (2) The tax return preparer knew or should have known that the third party advisor was not aware of all relevant facts; or (3) The tax return preparer knew of should have known at the time the return or claim for refund was prepared that the advice was no longer reliable due to developments in the law since the time the advice was given. MW\1490589MGG:LK 01/07/08 4 G. Interim Penalty Compliance Rules. (1) H. Signing Preparer. A preparer who signs a return shall be deemed to meet the requirements of Section 6694 with respect to a position for which there is a reasonable basis but for which the tax return preparer does not have a reasonable belief that the position would rise to the level of more likely than not being sustained on the merits if the return preparer does the following: (a) The position is disclosed in accordance with 1.6662-4(f) (i.e., properly disclosed on a Form 8275 or 8275-R); (b) The position would not meet the standard for the taxpayer to avoid a penalty under Section 6662(d)(2)(B) (i.e., substantial authority) without disclosure and the preparer provides a taxpayer with the prepared tax return that includes the properly prepared disclosure; (c) If the position would otherwise meet the substantial authority requirements for disclosure under 6662(d)(2)(B)(i), the tax return preparer advises the taxpayer of the difference between the penalty of standards applicable to the taxpayer under Section 6662 and the penalty standards applicable to the tax return preparer under Section 6694 and contemporaneously documents in the return preparer's files that this advice was provided; or (d) If Section 6662(d)(2)(B) does not apply because a position may be described in Section 6662(d)(2)(C) (pertaining to a tax shelter), the tax return preparer advises the taxpayer of the penalty of standards applicable under Section 6662(d)(2)(C) to the taxpayer and the difference if any between these standards and the standards for the preparer penalty under Section 6694 and contemporaneously documents in the tax return preparer's files that the advice was provided to the taxpayer. Nonsigning Preparers. Nonsigning preparers shall be deemed to meet the requirements of Section 6694 with respect to a position for which there is a reasonable basis but for which the nonsigning tax return preparer does not have a reasonable belief that the position would more likely than not be sustained on the merits, if the advice to the taxpayer includes a statement MW\1490589MGG:LK 01/07/08 5 informing the taxpayer of the opportunity to avoid the penalties under Section 6662 that could apply to the position as a result of disclosure, if relevant, and of the requirements for disclosure. I. Nonsigning Preparers Giving Advice to Another Tax Return Preparer. If a nonsigning tax return preparer provides advice to another tax return preparer, the nonsigning tax return preparer shall be deemed to meet the requirements of Section 6694 with respect to a position for which there is a reasonable basis but for which the nonsigning tax return preparer does not have the reasonable belief that the position would more likely than not be sustained on the merits if the advice to the tax return preparer includes a statement that disclosure under Section 6694(a) may be required. If the advice with respect to the position is in writing, the statement must also be writing. If the advice with respect to the position is oral, the statement may be oral. Contemporaneously prepared documentation in the nonsigning tax return preparer's files is sufficient to establish that the statement was given to the taxpayer or other return preparer. 3. The Penalty for Erroneous Refund Claims (New Section 6676). A. If a claim for refund or credit with respect to income tax (other than a claim relating to the earned income credit under § 32) is made for an excessive amount unless it is shown that the claim for such excessive amount has a reasonable basis, the person making such claim shall be liable for a penalty equal to 20% of the excessive amount. B. Excessive Amount. Excessive amount means the amount by which the amount of the claim for refund or credit for any taxable year exceeds the amount of such claim or credit allowed under the Code. C. Coordination with Other Penalties. The new § 6676 penalty shall not apply if the refund or credit is subject to a penalty under § 6662 to 6664 (the accuracy-related penalty and the fraud penalty). 4. The Preparer Penalty. What Is a Return Preparer? A. Prior Law. MW\1490589MGG:LK 01/07/08 6 Definition of a Return Preparer. Section 7701(a)(36) defines an "income tax return preparer." (1) (2) (3) The Code definition includes any person who for compensation prepares an income tax return or claim for refund. (a) It also includes any person who employs another person to prepare income tax returns for compensation. (b) It is not necessary that the preparer have been directly compensated for the return in question if other circumstances indicate that the return was not prepared gratuitously. A person who prepares a substantial portion of a return or claim is considered to be a preparer. (a) The regulations indicate that providing advice on a transaction after the transaction has taken place with respect to an entry on a return or any portion of a return reflecting the tax treatment of that transaction will constitute preparation of the return if the item involved is a substantial portion of the return. (Regs. §301-7701-15)-a non-signing preparer (b) Whether a portion of a return is substantial is determined by comparing that portion with the complete return on the basis of length, complexity, and the tax liability involved. (c) A portion of a return is not considered substantial if it involves gross income or deductions which are either: less than $2,000 or [ii] less than $100,000 and also less than 20% of the gross income (or adjusted gross income if the taxpayer is an individual). Exceptions to the definition of "return preparer." (a) MW\1490589MGG:LK 01/07/08 [i] A person is not an income tax return preparer merely because the person furnishes typing, reproducing, or other mechanical assistance. 7 (b) A corporate employee who prepares a return for his employer (or for an officer or employee of the employer) is not considered an income tax return preparer so long as the corporation is one by whom he is regularly and continuously employed. (c) The definition also excludes a fiduciary of an estate or trust who prepares an income tax return for the estate or trust. (d) Another exception is a person who prepares a claim for refund in response to a deficiency determination. (e) Not more than one person associated with a firm will be treated as a preparer with respect to the same tax return. (4) The Internal Revenue Code and the Regulations issued thereunder contain specific provisions pertaining to the preparer of a tax return. Under section 6701, if a "preparer" knowingly aids or assists in, or advises with respect to, the preparation of any portion of a return and "knows that such portion (if so used) would result in an understatement" of tax, such preparer is subject to a civil penalty. (5) A tax consultant who reviews returns prepared by a taxpayer may be a tax return preparer subject to tax return preparer penalties. Revenue Rule 84-3 discusses four situations where a consultant is deemed to be a preparer. MW\1490589MGG:LK 01/07/08 (a) The taxpayer submits books and records to the consultant who fills out a return and presents it to the taxpayer, after which the return is filed by the taxpayer without making any changes; (b) The taxpayer submits books and records to the consultant who prepares a statement of all necessary information, making it merely a mechanical process for the taxpayer to fill out the return; (c) The consultant is sent a draft of a return to review in its entirety for both substance and accuracy, and the consultant, therefore, recommends substantial changes that the taxpayer incorporates into his return; and 8 (d) B. The taxpayer submits a signed return to the consultant, who thoroughly reviews it in its entirety for substantive correctness and mechanical accuracy. The consultant questions certain entries, but is satisfied that the return is correct and makes no changes. Thereafter, the consultant mails the return to the Service pursuant to the taxpayer's instruction to do so if no changes are recommended. Rev. Rul. 84-3, 1984-1 (C.B. 264). New Law. Under prior law for penalty avoidance purposes, the definition of an income tax return preparer does not include a person preparing nonincome tax returns such as estate and gift tax returns, excise or employment tax returns. The new law broadens the scope of a return preparer to include preparers of estate and gift tax, employment tax, and excise tax returns and returns of exempt organizations. Further, Notice 2008-13 explains in detail what constitutes a return preparer. 5. Preparer Penalty for Understatements (Section 6694). Penalties can apply to tax return preparers who prepare inaccurate returns. A. Code section 6694—Prior Law. Section 6694 applied where there was an understatement of a tax liability that was due to a position taken on the tax return for which there was no realistic possibility of being sustained on its merits or where the understatement was due either to a willful attempt to understate the tax liability or to reckless or intentional disregard of rules or regulations. (1) When the understatement resulted from taking an unrealistic position, section 6694(a) imposed a $250 penalty for each return or claim resulting in an understatement. (2) If the understatement was due to a willful attempt to understate, or a reckless or intentional disregard of rules or regulations, the penalty under section 6694(b) was $1,000. (3) Where both penalties under section 6694 applied, the larger penalty under section 6694(b) was reduced by the amount of the MW\1490589MGG:LK 01/07/08 9 lesser penalty paid under section 6694(a). B. New Law. (1) The new law alters the standard of conduct that must be met to avoid the imposition of penalties for preparing a return with respect to which there is an understatement of tax. The provision replaces the realistic possibility standard of § 6694(a) for undisclosed positions with a requirement that there be a reasonable belief that the tax treatment of the position was more likely than not the proper treatment. The provision also replaces the nonfrivolous standard for disclosed positions with a reasonable basis standard. (2) In addition, the penalty is increased from $250 to the greater of $1,000 or 50% of the income made by the return preparer for preparing the return. The penalty for reckless or intentional disregard of rules or regulations of §6694(b) was increased to $5000 or, if greater, 50% of the tax return preparation fees. (3) The tax return preparer can now find herself needing disclosure on the taxpayer’s return to avoid penalty where the taxpayer does not need disclosure to avoid penalty. This is because the taxpayer’s standard for non-disclosed positions remains at “substantial authority” (approximately 40%). Example: Preparer determines that the tax treatment of a transaction reflected on the taxpayer-client’s return has substantial authority, but does not have a more likely than not chance of success. Preparer needs disclosure to avoid penalty, but taxpayer does not. Taxpayer’s options: prepare return inhouse, find a new preparer who will not discover return position in question or will agree to risk penalty. Result: The integrity of the system or the quality of the return is reduced or both. 6. Making the Disclosure. A. What Constitutes "Adequate Disclosure"? (1) MW\1490589MGG:LK 01/07/08 In the case of a “signing preparer”, disclosure is adequate if made in accordance with Regs. §1.6662-4 (f) which permits disclosure on the tax payer’s return on a properly completed Form 8275 or 8275R as appropriate or on the return in accordance with an annual revenue procedure. See Rev. Proc. 2006-48 for an example 10 of the annual revenue procedure. Note that this Rev. Proc. is used to avoid the accuracy-related penalty based upon the substantial understatement (6662(d)) and the preparer penalty under § 6694(a). The Rev. Proc. provides that "the taxpayer must furnish all required information in accordance with the applicable forms and instructions and the money amounts entered on these forms must be verifiable. § 3.05. It also provides that additional disclosure of facts relevant to certain specific enumerated positions must be included. While a detailed summary of all these positions is beyond the scope of this outline, some examples follow: Casualty and Theft Losses Complete Form 4684 Each item or article for which a casualty or theft loss is claimed must be listed on the form. Reasonableness of Officers' Compensation Complete Form 1120, Schedule E when required The time devoted to business must be expressed as percentage as opposed to "part" or "as needed." Section does not apply to "parachute payments" as defined in § 280(g). Further, this section will not apply to the extent the remuneration exceeds $1 million employer remuneration limitation if applicable. Notice 2007-54 indicates that disclosure “under prior and current (new) law…is adequate if made on a Form 8275, Disclosure Statement, or Form 8275R, Regulation Disclosure Statement, attached to the return, amended return, or refund claim, or pursuant to the annual revenue procedure…”The question of adequate disclosure for non-signing preparers under the new law remains unanswered. (2) MW\1490589MGG:LK 01/07/08 Preparer regulations under the old law contain rules for non-signing preparers. (a) Obviously, if the taxpayer needs to disclose, and does disclose, the preparer’s obligation should, as under prior law, be fulfilled. (b) The regulations (§ 1.6694-2(c)(3)(ii)(A and B)) indicate that advisors who qualify as non-signing preparers can meet their own disclosure requirements by including a 11 statement with their advice to their taxpayer clients that disclosure is necessary to avoid the taxpayer penalty. The regulations also provide a method for non-signing preparers who give advice to other preparers to meet their disclosure requirements. If their advice includes a statement that the disclosure under the preparer penalty rules is required, they will meet their own disclosure obligations. This will provide a logical means to meet the requirements under the new law when one preparer gives advice to another. However, a statement in advice to the taxpayer that the taxpayer should disclose a position to avoid a preparer penalty will likely not be too persuasive. B. Disclosure for Estate and Gift Tax Value. Disclosure needed to fix the value for gift tax purposes differs from that listed above. In this situation adequate disclosure is as follows: The Treasury regulations state that a taxpayer makes adequate disclosure if the taxpayer provides certain information. The required information is as follows: (1) A description of the transferred property and any consideration received by the transferor; (2) The identify of the parties involved and their relationship; (3) A detailed description of the method used to determine the fair market value of property transferred, including any relevant financial data and a description of any discounts, such as discounts for blockage, minority or fractional interests, and lack of marketability, claimed in valuing the property; (4) The tax identification number of any trust to which property is transferred; (5) A brief description of the terms of the trust or a copy of the trust instrument; (6) The value of the property transferred and how the property was valued; and (7) A statement describing any position taken that is contrary to any proposed, temporary or final Treasury Regulations or Revenue Rulings published as of the time of the transfer. Treas. Reg. § 301.6501(c)-1(f)(2). MW\1490589MGG:LK 01/07/08 12 It is important to recognize that this disclosure only starts the statutory period on additional assessments, and penalties on other sanctionable positions on gift tax returns will not be avoided with this disclosure. 7. Interplay with IRS Circular 230. A. Standards for Advising With Respect to Tax Return Positions and for Preparing or Signing Returns, § 10.34. (1) (2) Realistic Possibility Standard - Return Preparation. Practitioner may not sign a tax return if the practitioner determines that the return contains a position that does not have a realistic possibility of being sustained on its merits. The practitioner can sign a return if the realistic possibility standard is not met if: (a) The position is not frivolous; and (b) It is adequately disclosed to the Internal Revenue Service. Proposed regulations bring the Circular 230 rules of Section 10.34 up to the revised §6694 standard. (a) In order to sign a tax return, a preparer would need reasonable belief that “…the tax treatment of each position on the return would more likely than not be sustained on its merits (the more likely than not standard)…” (emphasis supplied), or there was a reasonable basis for each position and each position was adequately disclosed to IRS. (b) A practitioner could not advise a client to take a position on a tax return, or prepare the portion of tax return on which a position is taken, unless a. “The practitioner has a reasonable belief that the position satisfies the more likely than not standard, or b. the position has a reasonable basis and is adequately disclosed to Internal Revenue Service.” (emphasis supplied)—for nonsigning preparers. (c) MW\1490589MGG:LK 01/07/08 Under the proposed regulations, 13 a. “A practitioner is considered to have a reasonable belief that the tax treatment …is more likely than not the proper tax treatment if the practitioner analyzes the pertinent facts and authorities, and based on that analysis reasonably concludes, in good faith, that there is a greater than fifty-percent likelihood that the tax treatment will be upheld if the IRS challenges it.” b. Acceptable authorities for this analysis are found in Treasury regulations §1.6662-4(d)(3)(iii). Generally: i. Internal Revenue Code and other statutory provisions ii. Proposed, temporary, and final regulations iii. Revenue rulings and revenue procedures iv. Tax treaties and regulations thereunder v. Treasury Department and other official explanations of such treaties vi. Court cases vii. Congressional intent as reflected in committee reports, joint explanatory statements of managers included in conference committee reports and floor statements made prior to enactment by one of a bill’s managers viii. Joint Committee “Blue Book” (General Explanations of tax legislation ix. Private letter rulings x. Technical advice memoranda issued after 10/31/1976 xi. Actions on Decisions and general counsel memoranda (GCM)issued after 3/12/1981 or GCMs published in pre-1955 Cunuklative Bulletins xii. Internal Revenue Service information or press releases xiii. Notices, announcements, other administrative announcements published by IRS in Internal Revenue Bulletins. xiv. Not articles, treatises , legal opinions rendered by tax professionals (d) MW\1490589MGG:LK 01/07/08 A position is considered to have a reasonable basis if it is reasonably based on one or more of the §1.66624(d)(3)(iii) authorities. It is a significantly higher standard than “not frivolous” or “not patently improper” according 14 to the proposal. It is not satisfied if the position is merely arguable or a “colorable” claim. B. Covered Opinion Rules.-Covered opinion rules will continue to apply, but the “reliance opinion” category may take on more significance where a preparer seeks assurance from another that a return position has a more-likely-than-not chance of success. Will IRS look for opinions that meet the requirements of Circular 230 §10.35 to support preparer nondisclosed positions? MW\1490589MGG:LK 01/07/08 15 Monetary Penalties on Practitioners and Firms Under Circular 230 9. IRS Notice 2007-39 (the Notice)provides guidance on how IRS will apply the Circular 230 monetary penalties authorized by the American Jobs Creation Act of 2004 (JOBS Act). A. Amended Title 31, section 330 requires that in order for an employer or firm to be penalized, 3 conditions must be present: (1) The representative must be acting “on behalf of” an employer or firm or other entity, An agency relationship existed, the purpose of the agency relationship was to provide services in connection with practice before the IRS, and the penalized conduct arose in connection with the agency relationship. (2) The action must be “in connection with the conduct giving rise to the penalty,” and (3) such employer or firm or other entity must have known or reasonably should have known of the prohibited conduct: Members of principal management knows or has information from which a person with similar experience and background would reasonably know of the prohibited conduct, or The employer, etc. did not take reasonable steps to ensure compliance with Circular 230 and one or more individuals associated with the employer, etc. in connection with their agency relationship engages in conduct prohibited under Circular 230, §10.52 that harms a client, the public or tax administration. §10.52 provides that prohibited conduct is willful violation of the Circular 230 rules or reckless or through gross incompetence, violating the rules on tax return preparation and written opinions. B. The law further provides that the penalty cannot exceed the gross income derived (or to be derived) from conduct giving rise to the penalty. MW\1490589MGG:LK 01/07/08 16 (1) (2) (3) Separate monetary penalties imposed on the practitioner and the employer, firm, or other entity may not exceed the gross income derived by the practitioner and employer, firm, or other entity, respectively. The penalty can be less than such amount Determination of the amount of the penalty will involve consideration of: (a) “the level of culpability of the practitioner, firm, or other entity; (b) whether the practitioner, firm, or other entity violated a duty owed to a client or prospective client; (c) the actual or potential injury caused by the prohibited conduct; and (d) the existence of aggravating or mitigating factors.” The Notice indicates that the IRS will generally not impose a penalty in the case of a minor technical violation(whatever that means) where there is little or no injury to a client, the public, or tax administration, and there is little likelihood of similar misconduct—foot faults will get a pass! MW\1490589MGG:LK 01/07/08 17 RECENT REVISIONS TO IRS CIRCULAR 230 On September 26, 2007, the Treasury issued final regulations and one proposed regulation included in Circular 230.1 The regulations issued in final form were originally proposed on February 8, 2006. 1. Practice Before the Internal Revenue Service (Section 10.2). 2 (a) Section 10.2(a)(4) explains that practice before the IRS "comprehends all matters connected with the presentation to the Internal Revenue Service or any of its officers or employees relating to a taxpayer's rights, privileges or liabilities under laws or regulations administered by the IRS." (b) The new revisions clarify that such practice includes "rendering written tax advice with respect to any entity, transaction, plan or arrangement or other plan or arrangement having the potential for tax avoidance or tax evasion . . . ." Id. Comment: What if the advice is verbal? Presumably, this alone is not practice before the IRS. Comment: Most written advice will qualify, because tax advice is usually given to assist in tax avoidance. 2. Power of Attorney (Section 10.3). Sections 10.3(a) and (b) clarify that a practitioner is not required to file a Form 2848, Power of Attorney with the IRS before rendering written tax advice. Comment: This rule is needed because giving written tax advice is now clearly practice before the IRS. 1 All section citations are to IRS Circular 230 unless otherwise noted. 2 Unless otherwise noted, the effective date of any provision is September 26, 2007. MW\1490589MGG:LK 01/07/08 18 3. A new class of practitioners is created-Enrolled Retirement Plan Agents (ERPA) who have a limited scope of practice before the IRS. (Section 10.3(e)) Can represent only in: (a) Employee Plans Determination Letter program (b) Employees Plans Resolution System (c) Employee Plans Master and Prototype and Volunteer Submitter Program (d) Forms 5300 and 5500 examinations ERPA qualification will require competency examinations, renewal process (every three years), and CPE requirements (72 hours in 3 years) and 16 hours required in enrollment year. 4. Contrary to proposed regulations, non-practitioner return preparers will continue to qualify to represent taxpayers in audits of returns prepared by them (Section 10.7 (c)(viii)) 5. Practice By Former Government Employee, Their Partners and Associates (Section 10.25). (a) If a former government employee had personally and substantially participated in a matter involving specific parties, he or she may not, subsequent to government employment, represent or knowingly assist in that particular matter any person who was a specific party as to that matter. Comment: Firm can represent in matter only if the former government employee is “isolated” so that he or she cannot assist in the representation. (b) Further, a government employee who, within one year of termination of government employment, had official responsibility for a particular matter involving specific parties, may not, within two years after government employment ended, represent in that particular matter any person who is or was a specific party to that particular matter. (c) Finally, no former government employee may, within one year after government employment has ended, communicate with or appear before, with the intent to influence, any employee of the Treasury in connection with the publication, withdrawal, amendment, modification, or MW\1490589MGG:LK 01/07/08 19 interpretation of a rule, the development of which, the government employee participated in or within one year prior to termination, had official responsibility. 6. Contingent Fees (Section 10.27). (a) The final regulations make a number of modifications to the proposed changes to Circular 230 on the issue of contingent fees. A number of commentators opposed further limitations on contingent fees under section 10.27. (b) Generally, a practitioner may not charge a contingent fee for services rendered in connection with any matter before the IRS. A number of exceptions exist however. (i) A practitioner may charge a contingent fee for services rendered in connection with the Service's examination or challenge to (a) an original tax return or (b) an amended return or claim for refund or credit where the amended return, claim for refund or credit was filed within 120 days after the taxpayer received written notice of the examination or written challenge to the original return. (ii) Further, a practitioner may charge a contingent fee for services in connection with a claim for credit or refund filed solely in connection with the determination of statutory interest or penalties assessed by the IRS. (iii) Finally, a practitioner may charge a contingent fee for services rendered in connection with any judicial proceeding arising under the code. (c) The new rule applies to fee arrangements entered into after March 26, 2008. (d) Definition under Circular 230 is “any fee that is based, in whole or in part, on whether a position taken on a tax return or other filing avoids challenge by the IRS or is sustained by the IRS or in litigation. A contingent fee includes a fee that is based on a percentage of the refund reported on a return, that is based on a percentage of the taxes saved, or that otherwise depends on the specific result attained. A contingent fee also includes any fee arrangement in which the practitioner will reimburse the client for all or a portion of the client’s fee in the event MW\1490589MGG:LK 01/07/08 20 that a position taken on a tax return or other filing is challenged by the IRS or is not sustained, whether pursuant to an indemnity agreement, a guarantee, rescission rights, or any other arrangement with a “similar effect.” Section 10.35, Covered Opinions, relating to written advice that requires substantial due diligence and disclosures, includes a category of “contractual protection” that includes opinions where the fees charged are contractually protected including contingent fee arrangements. Comment: AICPA Rule 302 defines a contingent fee as “a fee established for the performance of any service pursuant to an arrangement in which no fee will be charged unless a specified finding or result is attained, or in which the amount of the fee is otherwise dependent upon the finding or result of such service.” However, fees are not considered “contingent” in tax matters if determined based on results of judicial proceedings or the findings of governmental agencies. AICPA interpretation 302-1 says no contingent fee in tax matters if there is “…reasonable expectation of substantive review by (IRS)…” except original returns. SEC rule is same as AICPA rule 302, but rejects the AICPA interpretation and requires that for an auditor of an SEC registrant to charge a contingent fee for tax services , the fee must be determined by courts or government agencies “ acting in the public interest.” 7. Conflicts of Interest (Section 10.29). (a) The rule clarifies that when there is a conflict of interest, a practitioner can still represent a client if the practitioner reasonably believes that the practitioner will be able to provide competent and diligent representation of each affected client and the representation is not prohibited by law. (b) Each affected client must waive the conflict of interest and give informed consent, confirmed in writing by each affected client, at the time the existence of the conflict of interest is known by the practitioner. Confirmation may be made within a reasonable period after informed consent, but in no event later than 30 days. (c) Copies of the written consents must be retained by the practitioner for at least 36 months from the date of the conclusion of the representation of each affected client and must be provided to the IRS upon request. Comment: New IRC Section 6694 can bring this rule into play. MW\1490589MGG:LK 01/07/08 21 8. Standards With Respect to Tax Returns and Documents, Affidavits and Other Papers (Proposed Section 10.34). (a) Tax returns. A practitioner may not sign a tax return as a preparer unless the practitioner has a reasonable belief that the tax treatment of each position on the return would more likely than not be sustained on its merits (the more likely than not standard), or there is a reasonable basis for each position and each position is adequately disclosed to the Internal Revenue Service. A practitioner may not advise a client to take a position on a tax return, or prepare the portion of a tax return on which a position is taken, unless— (1) the practitioner has a reasonable belief that the position satisfies the more likely than not standard; or (2) the position has a reasonable basis and is adequately disclosed to the Internal revenue Service. Comment: compare with new IRC Section 6694 that requires that a preparer cannot sign a tax return if he knows or should have known of a position that had a more likely than not chance of success. Current Section 10.34 is at “realistic possibility of success” level similar to former IRC Section 6694. 9. Sanctions (Section 10.50). (a) Authority to Censure, Suspend or Disbar (Section 10.50(a)). The Secretary of the Treasury or a delegate, after notice of an opportunity for proceeding, may censure, suspend or disbar any practitioner from practice before the IRS if the practitioner is shown to be incompetent or disreputable, fails to comply with any regulation in this part (under the prohibited conduct standards of Section 10.52), or with intent to defraud willfully and knowingly misleads or threatens a client or prospective client. A censure is a public reprimand. (b) Authority to Disqualify an Appraiser (Section 10.50(b)). The Secretary of the Treasury or a delegate, after due notice and opportunity for hearing, may disqualify any appraiser for violation of these rules applicable to appraisers. Comment: This penalty can be imposed even though the appraiser was not penalized for aiding and abetting under IRC Section 6701. MW\1490589MGG:LK 01/07/08 22 (c) Authority to Impose Monetary Penalty (Section 10.50(c)). (i) In general, the Secretary of the Treasury or a delegate, after notice and an opportunity for a proceeding, may impose a monetary penalty on any practitioner who engages in conduct subject to sanction. (ii) Further, if the practitioner was acting on behalf of an employer or any firm or other entity in connection with the conduct giving rise to the penalty, the Secretary or delegate may impose a monetary penalty on the employer, firm, or entity if it knew, or reasonable should have known, of such conduct. Comment: Notice 2007-39 provides guidance on monetary penalties imposed on firms. (iii) 10. The amount of the penalty shall not exceed the gross income derived or to be derived from the conduct giving rise to the penalty. The sanction provisions apply to conduct occurring on or after September 26, 2007 except for the monetary penalty provisions which apply to conduct that occurs after October 22, 2004. Incompetent and Disreputable Conduct (Section 10.51). (a) Definitions. Incompetence and disreputable conduct for which a practitioner may be sanction under Section 10.50 above includes, but is not limited to, (i) Criminal conviction of any federal tax offense. (ii) Conviction of any criminal offense involving dishonesty or breach of trust. (iii) Conviction of any felony under federal or state law for which the conduct involved renders a practitioner unfit to practice before the IRS. (iv) Giving false or misleading information or participating in any way in giving false or misleading information to the IRS or any tribunal authorized to participate in federal tax matters in MW\1490589MGG:LK 01/07/08 23 connection with any matter pending or likely to be pending before them, knowing the information to be false or misleading. Comment: The facts or other matters contained in testimony, federal tax returns, financial statements, applications for enrollment, affidavits, declarations or other documents or statements, whether written or oral, are included in the term "information." (v) Solicitation of employment as defined in Section 10.30 (pertaining to advertising). The use of false or misleading representations with intent to deceive a client or prospective client in order to procure employment or intimating that the practitioner is able to properly obtain special consideration from the IRS. (vi) Willful failing to make a federal tax return or willfully evading or attempting to evade or participating in any way in evading or attempting to evade any assessment or payment of federal tax. (vii) Willfully assisting, counseling, encouraging a client or a prospective client in violating or suggesting to a client or prospective client to violate any federal tax law or knowingly counseling or suggesting to a client or prospective client an illegal plan to evade federal taxes or payment thereof. (viii) Misappropriation of or failure to promptly or properly remit funds received from a client for the purpose of payment of taxes or other obligations to the United States. (ix) Directly or indirectly attempting to influence the official action of an officer or employee of the IRS by using threats, false accusations, duress or coercion or by the offer of any special inducement or promise of advantage or by bestowing any gift, favor or thing of value. (x) Disbarment or suspension from practice as an attorney, CPA, public accountant or actuary by any duly constituted authority of any state, territory or possession of the United States or any Federal court or Federal agency, body or board. (xi) Knowingly aiding and abetting another person to practice before the IRS during a period of suspension, disbarment or ineligibility of such other person. MW\1490589MGG:LK 01/07/08 24 (xii) Contemptuous conduct in connection with practice before the IRS including the use of abusive language, making false accusations or statements knowing them to be false or circulating or publishing malicious or libelous matter. (xiii) Giving a false opinion, knowingly, recklessly or through gross incompetence, including an opinion which is intentionally or recklessly misleading, or engaging in a pattern of providing incompetent opinions on questions arising under the Federal tax laws. A false opinion includes those which reflect or result from a knowing misstatement of fact or law, from an assertion of a position known to be unwarranted under existing law, from counseling or assisting in conduct known to be illegal or fraudulent, from concealing matters required by law to be revealed, or from consciously disregarding information indicating that material facts expressed in the opinion or offering material are false and misleading. Comment: Reckless Conduct is defined as a highly unreasonable omission or misrepresentation involving an extreme departure from the standards of ordinary care that a practitioner should observe under the circumstances. A pattern of conduct is a factor that will be taken into account in determining whether practitioner acted knowingly, recklessly, or through gross incompetence. Gross incompetence includes conduct that reflects indifference, preparation which is grossly inadequate under the circumstances, and a constant failure to perform obligations for a client. (xiv) Willfully failing to sign a tax return prepared by the practitioner when a practitioner's signature is required by the federal tax laws unless the failure is due to reasonable cause and not due to willful neglect (italicized language added in final regulations to provide for situations where competing obligations such as Section 10.34 or IRC Section 6694 might lead to not signing a return which should not be subject to discipline). Comment: Notice “when…required.” IRC Section 6694 may very well apply to returns that do not require signature. (xv) MW\1490589MGG:LK 01/07/08 Willfully disclosing or otherwise using a tax return or tax return information in a matter not authorized by the Internal Revenue Code, contrary to the order of a court of competent jurisdiction, or 25 contrary to the order of an administrative law judge in a proceeding under Section 10.60 (pertaining to disciplinary proceedings before the Office of Professional Responsibility). 11. Violations Subject to Sanction (Section 10.52). A practitioner may be sanctioned under Section 10.50 above if the practitioner willfully violates any regulations (other than Section 10.33 pertaining to Best Practice Rules) contained in Circular 230 or recklessly or through gross incompetence violates the standards with respect to tax returns and other documents (Section 10.34), the covered opinion rules (Section 10.35), procedures to insure compliance (Section 10.36) or the rules governing written advice that is not a covered opinion (Section 10.37). 12. 13. Receipt of Information Concerning a Practitioner (Section 10.53). (a) An officer or employee of the IRS that has reason to believe that a practitioner has violated any provision of Circular 230 will make a written report to the Director of Professional Responsibility of the suspected violation. Section 10.53(a). (b) Further, if a person other than an officer or employee of the IRS having information of a violation of any provision of Circular 230 may make a report of the alleged violation to the Director of the Office of Professional Responsibility or an employee of the IRS. If such a report is made, the IRS employee will make a written report of this suspected violation to the Director of the Office of Professional Responsibility. Section 10.53(b). Instituting a Proceeding (Section 10.60(a)). (a) 14. Whenever the Director of Professional Responsibility determines that a practitioner (or employer, firm or other entity, if applicable) violates any provisions of the laws or regulations governing practice before the IRS, the Director may reprimand the practitioner in accordance with Section 10.62 (below) or institute a proceeding for sanction. A proceeding is instituted by filing a complaint as discussed in Section 10.62 below. Preliminary Proceedings (Section 10.61). (a) Section 10.61(a) relates to the ability of the Office of Professional Responsibility to meet with a practitioner, employer, firm or other entity MW\1490589MGG:LK 01/07/08 26 or appraiser concerning allegations of misconduct, regardless of whether a disciplinary proceeding has been initiated. The rule does not create a right to a conference; however, it is the Office of Professional Responsibility’s policy not to deny a request for a first conference. (b) 15. The Director of the Office of Professional Responsibility may confer with the practitioner, employer, or other firm or entity or an appraiser concerning allegations of misconduct. If a conference results in a stipulation in connection with the ongoing proceeding which the practitioner, employer, firm or other entity or appraiser is the respondent, the stipulation may be entered in the record by either party in the proceeding. Procedural Changes in Disciplinary Proceedings (§ 10.62-10.65). (a) Contents of a Complaint (Section 10.62). A complaint must name the respondent, provide a clear and concise description of the facts and law that constitute the basis for the proceeding, and be signed by the Director of the Office of Professional Responsibility or person representing the Director. It is sufficient if it fairly informs the respondent of the charges brought so that the respondent is able to prepare a defense. Section 10.62(a). The complaint must also specify the sanctions sought by the Director of the Office of Professional Responsibility. If the sanction sought is suspension, the duration of the suspension sought must be specified. Section 10.62(b). (b) Service of the Complaint (Section 10.63). Under Section 10.63(d), within ten days of serving a complaint, copies of the evidence and support of the complaint must be served on the respondent. Comment: The rule does not obligate the Director of Practice to provide more evidence than what supports the complaint. However, the current policy of the Office of Professional Responsibility is to provide to respondent upon request a copy of what is understood to be the "OPR administrative file" prior to filing of the complaint under Section 10.60. In general, this file contains materials that the Office of Professional Responsibility considered in the course of determining whether to issue a final complaint. Communications from the Office of Chief Counsel presumably will not be made available because they are generally subject to an attorney/client privilege. MW\1490589MGG:LK 01/07/08 27 Comment: The Director's policy should make it possible for practitioners to obtain exculpatory evidence that may be necessary to defend a misconduct allegation. Comment: The IRS expects to issue Internal Revenue Manual provisions pertaining to the Office of Professional Responsibility's procedures for investigations. It is expected that those procedures will formalize the definition of the OPR administrative file and the current practice of providing it to the respondent upon request. (c) Supplemental Charges (Section 10.65). The new rules containing clarification in Section 10.65 making it clear that the Office of Professional Responsibility may file supplemental charges against a practitioner by amending the complaint to reflect additional charges so long as the practitioner is given notice and an opportunity to prepare a defense to the supplemental charges. 16. Discovery, Hearings and Publicity. (a) Motions and Requests (Section 10.68). At any time after filing the complaint, any party may file a motion with the Administrative Law Judge. Unless otherwise noted by the Administrative Law Judge, a motion must be in writing and must be served on the opposing party. It must precisely specify its grounds and the relief sought and, if appropriate, must contain a Memorandum of Facts and Law in support thereof. Section 10.68(a)(1). Either party may move for summary adjudication upon all or any part of the legal issues in the controversy. A response is due within 30 days. Section 10.68(a)(2). (b) Discovery (Section 10.71). Discovery may be permitted at the discretion of the Administrative Law Judge, only upon written motion demonstrating the relevance, materiality, and reasonableness of the requested discovery. Within ten days of the receipt of the answer the Administrative Law Judge will notify parties of the right to request discovery and the time frame for filing a request. MW\1490589MGG:LK 01/07/08 28 (c) Hearings (Section 10.72). (i) Time and Procedural Requirements (Section 10.72(a). The Administrative Law Judge will preside over a hearing on the complaint for sanction. Absent determination by the Administrative Law Judge that in the interest of justice a hearing must be held at a later time, the Administrative Law Judge should, upon notice sufficient to allow proper preparation, schedule a hearing to occur no later than 180 days after the time for filing the answer. (ii) Cross-examination (Section 10.72(b)). The party is entitled to present his or her case or defense by documents or evidence, to submit rebuttal evidence and to conduct cross-examination in the presence of the Administrative Law Judge. (iii) Prehearing Memorandum (Section 10.72(c)). Unless ordered by the Administrative Law Judge, each party shall file and serve on the opposing party a prehearing memorandum consisting a list of exhibits, a list of witnesses, identification of prospective expert witnesses with a copy of their reports, if any, and a list of undisputed facts. (iv) MW\1490589MGG:LK 01/07/08 Publicity (Section 10.72(d)). [a] All reports and decisions of the Secretary of the Treasury or delegate, including any reports and decisions of the Administrative Law Judge, are subject to the protective measures discussed below, are public and open for inspection within 30 days after the Agency's decision becomes final. [b] If a redaction of names, addresses and other identifying information of third-parties, the Administrative Law Judge will issue a protective order to ensure that the identifying information is available to the parties and the Administrative Law Judge for purposes of the proceeding but is not disclosed or open to inspection by the public. Section 10.72(d)(4). 29 [c] Further, upon a motion by a party or other affected person, and for good cause shown, the Administrative Law Judge may make an order which Justice requires to protect any person in the event disclosure of information is prohibited by law, privilege, confidential or insensitive in some way. The original proposal was adopted without modifications except the 30 days after final decision provision. Comment: Many commentators find this transparency very troubling in that the final regulations provide that, notwithstanding the need for the 30 day period, reports and decisions of an Administrative Law Judge and appellate authority will be available for public inspection. The IRS countered this argument by noting that the Office of Professional Responsibility will review every allegation received by that office. If an allegation warrants investigation, the practitioner is provided with an opportunity to confer with the office regarding the allegation against the practitioner. After that conference, the Office of Professional Responsibility may close the investigation without action or, if it believes a violation of Circular 230 has occurred, attempt to reach an agreement with the practitioner on the appropriate sanction. If an agreement is not reached, the OPR then sends the case to the Office of Associate Chief Counsel (general legal services) for further action. An attorney from that office will review the case file and if a violation of Circular 230 has occurred, the practitioner is offered one more opportunity to discuss the merits and settlement of the case before a formal complaint is filed. 17. Appeal of Decision of Administrative Law Judge (Sections 10.77 and 10.78). (a) Any party to the proceeding may file an appeal of the decision of the Administrative Law Judge to the Secretary of the Treasury or a delegate. The appeal and brief must be filed in duplicate with the Director of the Office of Professional Responsibility within 30 days within the date of the decision of the Administrative Law Judge. Section 10.77(a) and (b). (b) The decision of the Administrative Law Judge will not be reversed unless it is established that it is clearly erroneous. The issues that are exclusively a matter of law are reviewed de novo. Section 10.78. MW\1490589MGG:LK 01/07/08 30 EXHIBIT 1 - Tax Returns Reporting Tax Liability Income Tax Returns - Subtitle A Form 926, Return by a U.S. Transferor of Property to a Foreign Corporation; Form 990T, Exempt Organization Business Income Tax Return; Form 1040, U.S. Individual Income Tax Return; Form 1040A, U.S. Individual Income Tax Return; Form 1040-EZ, Income Tax Return for Single Filers and Joint Filers With No Dependents; Form 1040-EZT, Claim for Refund of Federal Telephone Excise Tax; Form 1040X, Amended U.S. Individual Income Tax Return; Form 1040-PR (Anexo H-PR), Contribuciones sobre el Empleo de Empleados Domesticos; Form 1041, U.S. Income Tax Return for Estates and Trusts; Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons; Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return; Form 1120, U.S. Corporation Income Tax Return; Form 1120-C, U.S. Income Tax Return for Cooperative Associations; MW\1489971MGG:LK 01/03/08 Form 1120-IC DISC, Interest Charge Domestic International Sales Corporation Return; Form 1120-F, U.S. Income Tax Return of a Foreign Corporation; Form 1120S, U.S. Income Tax Return for an S Corporation; Form 1120X, Amended U.S. Corporation Income Tax Return; Form 8831, Excise Taxes on Excess Inclusions of REMIC Residual Interests (I.R.C. §860E); and Form 8924, Excise Tax on Certain Transfers of Qualifying Geothermal or Mineral Interests (New Form, Exclusion from Capital Gains). Estate and Gift Tax Returns - Subtitle B Form 706, U.S. Estate Tax Return; Form 706-A, United States Additional Estate Tax Return; Form 706-D, United States Additional Estate Tax Return Under Code Section 2057; Form 706-GS(D) Generation-Skipping Transfer Tax Return for Distributions; Form 706-GS(T) Generation-Skipping Transfer Tax Return for Terminations; Form 706-NA, United States Estate (and Generation-Skipping Transfer) Tax Return - Estate of nonresident not a citizen of the United States ; Form 706-QDT, United States Estate Tax Return for Qualified Domestic Trusts; MW\1489971MGG:LK 01/03/08 Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return; and Form 843, Claim For Refund and Request for Abatement (also used to claim refunds for employment and certain excise tax returns). Employment Tax Returns - Subtitle C Form CT-1, Employer's Annual Railroad Retirement Tax Return; Form CT-2, Employee Representative's Quarterly Railroad Tax Return; Form 940, Employer's Annual Federal Unemployment Tax Return; Form 940-PR, Planilla para la Declaración Federal ANUAL del Patrono de la Contribución Federal para el Desempleo (FUTA); Form 941, Employer's QUARTERLY Federal Tax Return; Form 941-PR, Planilla para la Declaración Federal TRIMESTRAL del Patrono; Form 941-SS, Employer's QUARTERLY Federal Tax Return; Form 941-M, Employer's MONTHLY Federal Tax Return; Form 943, Employer's Annual Federal Tax Return for Agricultural Employees; Form 943-PR, Planilla Para la Declaración ANUAL de la Contribución Federal del Patrono De Empleados Agrícolas; Form 944, Employer's ANNUAL Federal Tax Return; MW\1489971MGG:LK 01/03/08 Form 944-PR, Planilla para la Declaración ANUAL de la Contribución Federal del Patrono; Form 944(SP), Declaración Federal ANUAL de Impuestos del Patrono o Empleador; Form 944-SS, Employer's ANNUAL Federal Tax Return; Form 945, Annual Return of Withheld Federal Income Tax; Form 1040-SS, U.S. Self-Employment Tax Return. Miscellaneous Excise Tax Returns - Subtitle D Form 11-C, Occupational Tax and Registration Return for Wagering; Form 720, Quarterly Federal Excise Tax Return; Form 720X, Amended Quarterly Federal Excise Tax Return; Form 730, Monthly Tax Return for Wagers; Form 990-PF, Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation (with respect to the excise tax based on investment income); Form 2290, Heavy Highway Vehicle Use Tax Return; Form 2290(FR), Declaration d'Impot sur L'utilisation des Vehicules Lourds sur les Routes; Form 2290(SP), Declaración del Impuesto sobre el Uso de Vehículos Pesados en las Carreteras; MW\1489971MGG:LK 01/03/08 Form 4720, Return of Certain Excise Taxes on Charities and Other Persons Under Chapters 41 and 42 of the Internal Revenue Code; Form 5330, Return of Excise Taxes Related to Employee Benefit Plans; Form 8612, Return of Excise Tax on Undistributed Income of Real Estate Investment Trusts; Form 8613, Return of Excise Tax on Undistributed Income of Regulated Investment Companies; and Form 8849, Claim for Refund of Excise Taxes. Alcohol, Tobacco, and Certain Other Excise Taxes - Subtitle E Form 8725, Excise Tax on Greenmail; and Form 8876, Excise Tax on Structured Settlement Factoring Transactions. MW\1489971MGG:LK 01/03/08 Exhibit 2 - Information Returns That Report Information That is or May be Reported on Another Tax Return That May Subject a Tax Return Preparer to the Section 6694(a) Penalty if the Information Reported Constitutes a Substantial Portion of the Other Tax Return Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding; Form 1065, U.S. Return of Partnership Income (including Schedules K-1); Form 1120S, U.S. Income Tax Return for an S Corporation (including Schedules K-1); Form 5500, Annual Return/Report of Employee Benefit Plan; Form 8038, Information Return for Tax-Exempt Private Activity Bond Issues; Form 8038-G, Information Return for Government Purpose Tax-Exempt Bond Issues; and Form 8038-GC, Consolidated Information Return for Small Tax-Exempt Government Bond Issues. MW\1489971MGG:LK 01/03/08 Exhibit 3 - Forms That Would Not Subject a Tax Return Preparer to the Section 6694(a) Penalty Unless Prepared Willfully in any Manner to Understate the Liability of Tax on a Return or Claim for Refund or in Reckless or Intentional Disregard of Rules or Regulations Form 1099 series of returns; Form W-2 series of returns; Form W-8BEN, Beneficial Owner's Certificate of Foreign Status for U.S. Tax Withholding; Form SS-8, Determination of Worker Status; Form 990, Return of Organization Exempt from Income Tax; Form 990-EZ, Short Form Return of Organization Exempt From Income Tax; Form 990-N, Electronic Notice (e-Postcard) for Tax-Exempt Organizations not Required To File Form 990 or 990-EZ; Form 1040-ES, Estimated Tax for Individuals; Form 1120-W, Estimated Tax for Corporations; Form 2350, Application for Extension of Time to File U.S. Income Tax Return; Form 2350 (SP), Application for Extension of Time to File U.S. Income tax Return (Spanish Version); Form 4137, Social Security and Medicare Tax on Unreported Tip Income; Form 4768, Application for Extension of Time to File a Return and/or Pay U.S. Estate (and Generation-Skipping Transfer) Taxes; MW\1489971MGG:LK 01/03/08 Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return; Form 4868 (SP), Application for Automatic Extension of Time to File U.S. Individual Income Tax Return (Spanish Version); Form 5558, Application for Extension of Time to File Certain Employee Plan Returns; Form 7004, Application for Automatic 6-Month Extension of Time To File Certain Business Income Tax, Information, and Other Returns; Form 8109, Federal Tax Deposit Coupon; Form 8027, Employer's Annual Information Return of Tip Income and Allocated Tips; Form 8809, Application for Extension of Time to File Information Returns; Form 8868, Application for Extension of Time To File an Exempt Organization Return; Form 8892, Application for Automatic Extension of Time to File Form 709 and/or Payment of Gift/Generation-Skipping Transfer Tax; and Form 8919, Uncollected Social Security and Medicare Tax on Wages. MW\1489971MGG:LK 01/03/08 EXHIBIT 4 Penalties—Prior (§ 6694(a)) Penalties—New (§ 6694(a)) Frivolous Return3 Cannot sign Cannot sign Reasonable Basis for Tax Treatment4 Can sign with disclosure5 Can sign with disclosure Realistic Possibility Standard (33%)6 Not disclose if standard met Can sign with disclosure Reasonably Believe That More Likely Than Not Correct (51%) Not disclose if standard met Not disclose if standard met Note: If there is a reasonable basis for a position, a taxpayer can avoid a negligence penalty under § 6662. Yet the preparer cannot avoid the § 6694(a) penalty unless there is also disclosure on the return. Note: If the CPA concludes that the realistic possibility standard is met but does not disclose, the CPA is subject to the § 6694(a) penalty. Yet arguably this also meets (indeed, goes beyond) the reasonable basis test, meaning no accuracy-related penalty. 3 The percentage of comfort is perhaps 9% or less. 4 Reasonable basis is defined in § 1.6662-3(b)(3). The percentage of comfort is perhaps 20%. 5 Use Form 8275 or 8275R or pursuant to annual revenue procedure 6 The position is considered to have a realistic possibility if a person knowledgeable in the tax law would be lead to conclude that the position has approximately a one-in-three, or greater, likelihood of being sustained on its merits. § 1.6694-2(b). MW\1489971MGG:LK 01/03/08