The Dangers of Illegal Subcontracting

advertisement

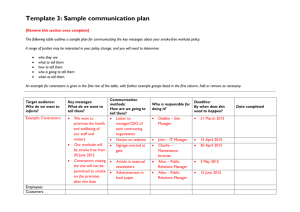

The Dangers of Illegal Subcontracting: What You Don’t Know CAN Hurt You _________________________________________ Hiring a company that skirts the law and subcontracts illegally exposes you to significant criminal and civil penalties. When choosing a building services company, it is increasingly important that you work with companies that reject these practices. What Is Illegal Subcontracting? Subcontractors are used in our industry to reduce the costs of wages, benefits and payroll taxes -- a practice that is not in any way illegal. But some contractors take this practice too far -- cutting corners in their compliance with applicable labor laws, and resulting in significant payroll fraud. There are at least three types of activities that fall into the category of ‘illegal subcontracting’: Misclassifying Employees. Employers are generally required to withhold income taxes and other payroll taxes on wages paid to their employees, but not on payments to independent contractors. Some contractors intentionally classify their employees as independent contractors as a cost-saving measure, even though by law they meet the definition of employees. The Internal Revenue Service (IRS) has developed criteria to determine whether a worker’s employment status, looking at the degree of control and independence exercised by a worker in order to assess his or her employment status. Factors considered include: (i) whether the worker is generally subject to the employer’s instructions about when, where and how to perform work; (ii) whether the worker is generally free to offer his or her services in the marketplace; (iii) how the employer pays the worker; (iv) the specific terms of the contract between the employer and the worker, including the provision of employee-type benefits; and (v) whether the services provided by the worker are a key aspect of the regular business of the employer. • ‘Layering’. ‘Layering’ is using multiple levels of contractors and subcontractors to cover up for the lack of proper documentation and credentials by subcontractors. In this increasingly common scenario, the principal contractor is hired to perform maintenance work after providing all the necessary certifications and insurance forms for its business. The contractor then subcontracts the work to companies lacking the proper documentation and credentials, who perform the work for less than the original contract. • ‘Ghosting’. ‘Ghosting’ refers to the practice by some contractors of hiring an employee who possesses all the proper documentation and credentials, but who sends someone else in their place to do the work -- someone who is not licensed and is not paid correctly under state and federal laws. Who Does It Hurt? Illegal subcontracting harms a great many people and companies, including (i) the honest taxpayers who must foot the bill for lost payroll tax revenues, (ii) ethical building service companies and their employees who are unable to compete effectively against cheating companies, (iii) the customers of cheating companies who could be subjected to embarrassing negative publicity and costly government investigations, and (iv) the workers of the cheating companies who often are denied minimum wage, overtime and other labor law protections. What Are the Consequences? With government enforcement of the tax and labor laws associated with illegal subcontracting becoming more aggressive, the risk of getting caught has intensified. Not only does the illegal subcontractor face criminal and civil fines, but the businesses who hire them are just as likely to face investigation and penalties, including: • Embarrassing adverse publicity and tarnished reputations; • Damaged business relationships; • Costly government investigations and legal defense efforts; and • Large civil and criminal penalties against companies that break the law as well as companies that encourage it. The failure to pay required payroll and withholding taxes can result in civil penalties of up to 100 percent of the unpaid taxes, while criminal penalties of up to five years of imprisonment and/or a $500,000 fine can be assessed if the violation is deemed willful. Beyond the tax penalties, ‘layering,’ ‘ghosting’ and other violations pertaining to inadequate worker documentation are punishable by the U.S. Immigration and Customs Enforcement (ICE) agency with fines of up to $11,000 per affected worker. When companies hire subcontractors based on bids that are too low to possibly maintain compliance with the law, or enforcement authorities can infer that there was knowledge of the illegal practices, the professed ignorance of subcontractor violations is not a strong defense for contractors and their customers. Recent examples of investigations and penalties imposed on companies for illegal subcontracting and other labor law violations that often accompany the practice, include: • An $11 million civil fine against Wal-Mart, combined with a $4 million criminal penalty against 12 janitorial contractors for employing undocumented workers; • A $2 million criminal fine against an Iowa company for employing undocumented workers; • A $22 million payment by several supermarket chains to settle claims of overtime and minimum wage law violations; • A three-year prohibition from government contracts against an Alabama janitorial contractor that violated federal and state overtime wage laws; • Ongoing investigation of janitorial subcontracting violations at Boeing Company; and • ‘Operation Tarmac,’ a nationwide ICE investigation targeting companies that employ undocumented workers at airports. ©2005 Building Service Contractors Association International -- Used With Permission by BSCAI Members