Sample BS&A and WIP - Jane Doe

advertisement

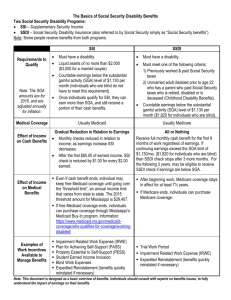

Benefits Summary & Analysis – Employment Stage Note: This is an example of a beneficiary whose earnings goal is above the SGA level and whose Trial Work Period and Extended Period of Eligibility ended several years earlier. Beneficiary Name: Jane Doe Date: 03/5/2015 Summary of your Current Benefits Situation With your signed permission, this is what I have verified about your current benefits with Social Security and other agencies (as needed): Benefit/Income Amount/Type/Month $842/month in SSDI Title II Disability Benefit (SSDI) Your minor child receives a dependent child benefit of $421 Source of information verification Social Security (BPQY), Self Report Parts A, B, and D Medicare Medicare Savings Program - QMB Part D premium paid by 100% Low Income Subsidy BPQY, Self Report, Medicaid agency, Medicare website Medicaid Medicaid with spend-down; BPQY, Self Report, Medicaid agency Food Stamps $16/month Self report, verbal verification with Department of Human 1|Page Services Section 8 Housing, 30% of income towards utilities and rent Housing Assistance Self report, verbal verification with Public Housing Authority What you told me about your current employment situation (including average monthly wages) and/or your future employment plans and earnings goals: You recently started a job at a local supermarket as a bagger/stocker and have been employed in this position for 2 months. You earn $9.00 an hour and are currently working 40 hours a week ($9.00 x 40 x 4.33 = $1,558.80). After a 3-month probationary period, you will be eligible for health insurance benefits. Analysis of How Employment May Affect Your Benefits How your employment situation and/or plans may affect your Social Security cash benefits: Title II Benefits (SSDI): Social Security beneficiaries can access a number of work incentives to help the transition to work. Most of the work incentives have limited time periods. You used some of the incentives during your previous period of work. I will briefly explain those work incentives and the ones that currently apply to you. Trial Work Period (TWP): The Trial Work Period is nine months, not necessarily used consecutively, where earnings of any amount will not impact your benefits. Specific to your situation: You have used all nine of your TWP months. The BPQY from Social Security 2|Page indicates your last Trial Work month was November 2007. Extended Period of Eligibility: This is a consecutive 36-month period that occurs immediately after the TWP during which your eligibility for SSDI cash benefits continues even if you earn too much to receive a payment in a particular month. Specific to your situation: Your Extended Period of Eligibility started in December 2007 and ended in November 2010. During that time, you continued to receive your cash payments because your work activity was not considered to be “substantial”. Substantial Gainful Activity: Because you have completed your Trial Work Period, Social Security will evaluate your current work activity to determine if it is “Substantial Gainful Activity”, or SGA. In most cases, the primary consideration in determining SGA is earnings, however there are a number of other factors. Social Security will also consider productivity, how long you are able to sustain this level of work, whether your employer provides extra assistance or gives you fewer duties because of your disability, and if you have disability-related expenses that are necessary in order for you to work. These factors may reduce the amount of income they count when making a decision of SGA. They compare your “countable income” for the month to the SGA guideline, which is $1,090 in 2015. Specific to your situation: Your monthly earnings goal of $1,558.80 is above the 2015 SGA level; however, some of the factors I outlined above may apply to you. If your work activity is considered to be SGA, Social Security will stop your benefits after a 3-month grace period. At that point, if you continue to work at a level they consider is SGA your eligibility for cash benefits will likely be terminated. You may be able to use the following work incentives to reduce the amount of your earnings that Social Security counts when making a decision of SGA: Impairment Related Work Expenses: 3|Page Social Security may deduct from your gross monthly earnings the cost of certain impairment-related items and services that you need in order to work when they figure your countable earnings. An expense will qualify as an IRWE when: 1. The item(s) or service(s) enables you to work; 2. You need the item(s)or service(s) because of your impairment; 3. You paid the cost and are not reimbursed by another source such as Medicare, Medicaid or a private insurance carrier; 4. The cost is reasonable and represents the standard charge for the item or service in your community; and 5. You paid for the expense in a month you are or were working. Specific to your situation: You have identified the following expenses that may qualify as an IRWE: 1. Medications: Monthly co-pays: $25. 2. Transportation: para-transit bus to accommodate your wheelchair: $120 monthly You must have receipts to show Social Security when you submit your request for IRWE approval. Let me know if you have any other expenses that you think may qualify as IRWE. Subsidy and Special Conditions: Social Security understands that you may require extra support from your employer or an employment agency in order to perform the essential functions of the job. This support may qualify as a special deduction called Subsidy and/or Special Condition. If you report the possibility of subsidy and/or special condition, Social Security will ask your employer to identify the cost of the extra support you receive. In addition, if you get support on the job from an employment agency, Social Security will use a special formula to determine the value as a special condition. The total amount is deducted from your gross earnings when they determine your countable earnings. 4|Page Specific to your situation: You currently have a job coach with you on the job 10 hours a week. The plan is to reduce the job coach assistance to 2 hours a week over the next 3 months. Social Security may consider this a special condition. You also mentioned that you are not able to lift items over 10 pounds, and other employees in the same position are required to lift up to 50 pounds. Eliminating this requirement from your job description may be considered an employer subsidy. Your employer informed the Supported Employment provider that the value of this subsidy is approximately $140 each month. Based on the above information, I estimate that you may have combined IRWE and Subsidy/Special Conditions totaling more than $630 a month. If Social Security approves these deductions, your countable income will not be greater than the SGA guideline and your benefits will likely continue for now. Even with the decrease in job coach hours, the amount of deductions will reduce your countable income below the SGA limit. We will continue to monitor this over the coming months. I can help you gather the necessary documentation for Social Security so that they can consider the value of these subsidies/special conditions and IRWE when they evaluate your work activity. How your earnings may impact your dependent child’s benefits: Your eight-year old child is eligible for benefits because you are receiving SSDI. If your cash payment is terminated due to SGA level work, your child’s payment will also be terminated. However, if Social Security approves deductions for IRWE and Subsidy/Special Conditions as outlined above, your SSDI benefits should continue, at least for now. Expedited Reinstatement (EXR): EXR is an important safety net for you. If your benefits stop because of your work activity and you subsequently are unable to sustain SGA level earnings, you can request reinstatement of your benefits. This is a 5-year period that would start the month your benefits are terminated. You can get up to six months of provisional benefits while you wait for Social Security to review your medical records to determine if you continue to meet their definition of disability. We can talk more about EXR if your IRWE and Subsidy/Special Condition deductions are not enough to reduce your countable income below the SGA level. 5|Page How your employment situation and/or plans may affect your health insurance (Medicare and/or Medicaid): Note: you will be eligible for health insurance benefits from your employer after your probationary period. It is fine for you to have health insurance through your employer and have Medicare and Medicaid coverage as well. I will follow up with you in the next month; when you are eligible to enroll in the employer plan we can discuss your options. Extended Period of Medicare Coverage (EPMC): Many people think that if they lose their cash benefits due to work, they will also lose their Medicare coverage. In fact, even if your SSDI benefits were stopped due to work, you would continue to have Medicare for an extended period of time due to a work incentive called Extended Period of Medicare Coverage. Specific to your situation: Your Medicare coverage will continue as long as you are getting an SSDI payment. Medicaid: Your Medicaid spend-down is income-based and will likely be impacted by employment. I will help you contact the Medicaid agency to discuss your options. You may want to consider another category of Medicaid called Medicaid buy-in. This is a type of Medicaid specifically for individuals with disabilities who are working and need Medicaid in order to work. You may pay a small premium, which is based on your income. You are eligible for the buy-in as long as your adjusted/countable income does not exceed $XXXX a month. The program allows for a deduction of the same disability-related expenses (IRWE) discussed above, in addition to counting less than half of your gross earnings. They do not count your SSDI benefit when determining eligibility. You are allowed to stay in the program for 12 months if your job ends, as long as you are actively seeking other employment. Note [Note to CWICs: Not every state has a Medicaid buy-in, and the rules vary widely from state to state. For example, not every state excludes the Social Security benefit when determining eligibility for the Medicaid buy-in. Contact your state Medicaid agency to determine 1) if a buy-in exists, and 2) how income is treated for eligibility and premium (if applicable) purposes.] 6|Page Note How your employment situation and/or plans may affect other benefits you receive (SNAP, HUD rental subsidies, etc.): You told me that you receive a Supplemental Nutrition Assistance Program (food stamp) benefit in the amount of $16.00 each month and that you have not yet reported your earnings to the Division of Family Services. Food stamp eligibility and amounts are figured according to income; typically, 80% of your income is counted. Additionally, they allow other income exclusions, such as medical costs in excess of $35.00 a month. Once you report your earnings, it is likely that you will no longer be eligible for this benefit. However, you will still be better off financially, due to the increase in your income. You are receiving housing assistance through the Section 8 Housing Choice Voucher Program. You reported your earnings to the housing representative and your monthly rent went up significantly. As your income goes up, the amount you pay in rent normally increases as well. However, due to a work incentive called the Earned Income Disregard (EID), 100% of your increased income for the first 12 months of employment should be disregarded when your rent is calculated. During the second 12 months only 50% of your increased income should be counted. We will need to verify with the housing authority that you have not yet used any of the EID and ask that they apply the exclusion. Employment Services and Supports You Might Need Ticket to Work: The Ticket is a voluntary program that allows you to access services from either the state Vocational Rehabilitation agency or an Employment Network (EN) to help you reach your employment goal. When you work with VR or assign your Ticket to an EN, develop a plan, and continue to make timely progress towards employment, Social Security will not conduct a continuing medical review. 7|Page Specific to your situation: You have an open case with the State VR agency, so your Ticket is considered “in use”. When VR closes your case, you can assign your Ticket to an EN for follow-up services. Let me know if you would like to explore potential ENs that serve your area. Benefits Issues Your rent was increased when you reported your earnings to the housing authority. Since this is the first employment you’ve done since getting your Section 8 voucher, it is likely that the housing authority made an error by not applying the Earned Income Disregard. A meeting will have to be scheduled to discuss the disregard and determine your eligibility for it. Earned Income Tax Credit (EITC) You are likely to qualify for the Earned Income Tax Credit, so you will probably keep most of your earnings. EITC is a tax credit for certain people who work and have low wages. The EITC may put more money in your pocket and make you eligible for a tax refund. If you would like to find out more information about this, you can go online to www.irs.gov or ask a VITA volunteer to help you. VITA stands for Volunteer Income Tax Assistance (VITA). They provide assistance with tax calculations and preparation free of charge. Local volunteer tax preparation site information is available by calling the IRS toll-free number 1-800-906-9887 or online at www.irs.gov Other Important Items Issues Requiring Immediate Action: Since you have used your TWP and EPE, it is important to report your earnings to Social Security immediately, as well as the use of any work incentives, so that they have the information they need to determine your countable earnings for the SGA decision. Social Security will likely send you a Work Activity Report when you report your 8|Page earnings. If you need help filling out the form, please contact me. It’s important that you answer the questions accurately so that Social Security is aware of the potential use of work incentives. You must report your income to the Medicaid agency immediately. You will ask them about the impact on your spend-down or tell them you want to apply for the Medicaid buy-in. You must also report your income to the Food Stamp agency as well as the Housing Authority. Be sure to ask the Housing Authority to apply the Earned Income Exclusion. Important Dates or Deadlines: o Report to Social Security that you have returned to work by 3/15/15. o Contact the state Medicaid agency by 3/15/15 to report income. o Contact the housing authority by 4/1/15 to schedule an appointment to discuss eligibility for the Earned Income Disregard. o Contact the state Supplemental Nutrition Assistance Agency by 4/15/15 to report earnings. Recordkeeping reminders: Please keep this Benefits Summary & Analysis in your records. Remember to keep letters you get about your benefits. Keep notes and receipts whenever you report changes and be sure to keep everything together in one place so you can find it. The notes should include things like: The agency where you made the report, the date, who you talked to, what you told them, and What papers you submitted. Remember that it is your responsibility to promptly report all relevant changes to the Social Security Administration and any other federal, state, or local entity administering benefits you receive! 9|Page Using this Report You should keep this report and refer back to it when you have questions about how your employment plans may affect your Social Security benefits, associated health insurance, and any other federal, state or local benefits. It is also important for you to share this report with other people who are helping you achieve your employment goals. The information contained in this report is intended to help you make informed choices about important life issues that may affect your Social Security and/or other public assistance benefits. The accuracy of information and advice contained in this report is dependent upon: 1. The accuracy and completeness of the information you provided about your current and past benefits status; 2. The accuracy and completeness of information you provided about relevant factors such as current and past earnings, unearned income, resources, disability status/medical condition, marital status, and living arrangements; 3. Current laws and regulations governing the effect of employment and other factors on Social Security disability benefits and other federal benefits; and 4. Current Social Security Administration policies and procedures regarding the use of applicable work incentives. Changes in the factors described above may seriously affect the accuracy of the information provided in this correspondence. Please contact your CWIC immediately to discuss any changes in your benefits situation or employment plans or to answer any additional questions you have about how employment may affect your benefits! CWIC Signature: Date: NOTE: By signing this Benefits Summary & Analysis report, staff is verifying that a copy of this report has been provided to and reviewed with the beneficiary. 10 | P a g e Work Incentives Plan Customer Name: Jane Doe Date: 1/05/2015 Employment Goal: Continue job as bagger/stocker, working 40 hrs per week, earning $9.00/hr ACCESSING EMPLOYMENT SERVICES AND SUPPORTS Action Step Meet with CWIC to explore Employment Networks for Ticket assignment Person Responsible Target Date Completed Date When VR case is closed Jane RESOLVING EXISTING BENEFIT ISSUES Action Step Meet with housing representative to discuss increase in rent and application of Earned Income Disregard Person Responsible Jane/CWIC Target Date Completed Date 3/30/2015 MANAGING SOCIAL SECURITY BENEFITS AND WORK INCENTIVES Action Step Person Responsible Create benefits binder to keep receipts for work-related expenses, letters from Social Security Jane/CWIC Complete SSA-821 form Jane/CWIC Target Date Completed Date 3/30/2 2/1/2015 When sent by Date required by Social 11 | P a g e Social Security Collect receipts for monthly medication co-pays and transportation Jane Complete IRWE request form Jane/CWIC Security Mon Monthly starting with 1/2015 3/15/2015 Submit request for IRWE to Social Security; include receipts Jane 3/30/2015 Explore employer subsidy & Complete Subsidy/Special Conditions request form Jane/CWIC/job coach 3/15/2015 MANAGING FEDERAL, STATE OR LOCAL BENEFIT PROGRAMS Action Step Report earnings to Division of Family Services Person Responsible Jane Target Date Completed Date Immediately PLANNING FOR FUTURE HEALTHCARE NEEDS Action Step Person Responsible Target Date Contact Medicaid agency to report earnings Jane Immediately Meet with Medicaid eligibility worker to discuss Medicaid buy-in option and continuation of Part B premium help Jane/CWIC As soon as possible Completed Date FOLLOW-UP CONTACT PLAN 12 | P a g e Action Step Person Responsible Target Date Contact CWIC when earnings have been reported to the Division of Family Services and the Medicaid agency - Jane 3/30/15 Update the BSA to reflect the new MSP and status of Food Stamp allocation CWIC 4/1/2015 Contact CWIC if employer offers an increase in hourly wage Jane When offer is being considered Contact CWIC if there are changes in IRWE amount & job coach time Jane Ongoing Beneficiary Signature: Date: CWIC Signature: Date: Completed Date 13 | P a g e