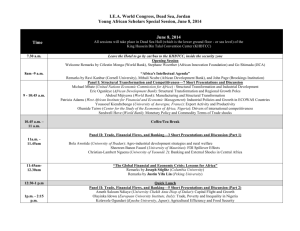

Table of Contents - Lifelong Learning today

advertisement

The Price of Inequality Joseph E. Stiglitz Development is about transforming the lives of people, not just transforming economies Joseph E. Stiglitz, Making Globalization Work “Nothing in the world is more dangerous than sincere ignorance and conscientious stupidity” Martin Luther King, Jr. STIGLITZ, Joseph E., The Price of Inequality: How Today’s Divided Society Endangers Our Future, Reprint with a new Preface, New York-London: Norton, W.W. & Company, 2013, pp. 560. ISBN 13: 978-0-393-34506-3 (paperback). First edition: 2012, pp. XXXII + 414. ISBN 13: 978-0-393-08869-4 (hardcover). Presentation (of the editor) A forceful argument against America’s vicious circle of growing inequality by the Nobel Prize–winning economist. The top 1 percent of Americans control 40 percent of the nation’s wealth. And, as Joseph E. Stiglitz explains, while those at the top enjoy the best health care, education, and benefits of wealth, they fail to realize that “their fate is bound up with how the other 99 percent live.” Stiglitz draws on his deep understanding of economics to show that growing inequality is not inevitable: moneyed interests compound their wealth by stifling true, dynamic capitalism. They have made America the most unequal advanced industrial country while crippling growth, trampling on the rule of law, and undermining democracy. The result: a divided society that cannot tackle its most pressing problems. With characteristic insight, Stiglitz examines our current state, then teases out its implications for democracy, for monetary and budgetary policy, and for globalization. He closes with a plan for a more just and prosperous future. America currently has the most inequality, and the least equality of opportunity, among the advanced countries. While market forces play a role in this stark picture, politics has shaped those market forces. In this best-selling book, Nobel Prize–winning economist Joseph E. Stiglitz exposes the efforts of well-heeled interests to compound their wealth in ways that have stifled true, dynamic capitalism. Along the way he examines the effect of inequality on our economy, our democracy, and our system of justice. Stiglitz explains how inequality affects and is affected by every aspect of national policy, and with characteristic insight he offers a vision for a more just and prosperous future, supported by a concrete program to achieve that vision. The author Joseph Eugene Stiglitz, ForMemRS, FBA, is an American economist and a professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2001) for his analyses of markets with asymmetric information, and the John Bates Clark Medal (1979). He was a lead author of the 1995 Report of the Intergovernmental Panel on Climate Change, which shared the 2007 Nobel Peace Prize. Stiglitz was a member of the Council of Economic Advisers from 1993-95, during the Clinton administration, and its chairman from 1995-97.He is also the former Senior Vice President and Chief Economist of the World Bank (1997-2000). He is known for his critical view of the management of globalization, free-market economists (whom he calls “free market fundamentalists”) and some international institutions like the International Monetary Fund and the World Bank. In 2000, Stiglitz founded the Initiative for Policy Dialogue (IPD), a think tank on international development based at Columbia University. Since 2001, he has been a member of the Columbia faculty, and has held the rank of University Professor since 2003. In 2008, he was appointed by French President Nicolas Sarkozy to chair a Commission on the Measurement of Economic Performance and Economic Progress. Stiglitz helped create a new branch of economics, “The Economics of Information,” exploring the consequences of information asymmetries and pioneering concepts including adverse selection and moral hazard, which have now become standard tools of theorists and policy analysts. His work has helped explain the circumstances in which markets do not work well and how selective government intervention can improve their performance. He also chairs the University of Manchester’s Brooks World Poverty Institute and is a member of the Pontifical Academy of Social Sciences. Professor Stiglitz is also an honorary professor at Tsinghua University School of Public Policy and Management. Stiglitz is one of the most frequently cited economists in the world. Stiglitz has over 40 honorary doctorates and at least eight honorary professorships, as well as an honorary deanship. In 2009 the President of the United Nations General Assembly Miguel d’Escoto Brockmann, appointed Stiglitz as the Chairman of the U.N. Commission on Reforms of the International Monetary and Financial System, where he oversaw suggested proposals, and Commissioned a report on reforming the international monetary and financial system. Since 2012 Stiglitz has been the President of the International Economic Association and is currently presiding over the organization of the IEA triennial world congress that will be held on the Dead Sea Jordan in June 2014. 2 Stiglitz is the 4th most influential economist in the world today based on academic citations, and in 2011 he was named by Time magazine as one of the 100 most influential people in the world. Stiglitz’s work focuses on income distribution, asset risk management, corporate governance, and international trade, and is the author of ten books, with his The Price of Inequality (2012), hitting The New York Times best seller list. He is the best-selling author of Making Globalization Work (2006); Globalization and Its Discontents (2002, translated into 35 languages); and, with Linda BILMES, The Three Trillion Dollar War (2008). Joseph E. STIGLITZ Curriculum Vitae (pp. 69): Columbia University (last updated: May 10, 2014): https://www0.gsb.columbia.edu/faculty/jstiglitz/download/Stiglitz_CV.pdf Joseph STIGLITZ’s Books Creating a Learning Society: A New Approach to Growth, Development, and Social Progress, with Bruce C. Greenwald, New York: Columbia University Press (2014), The Price of Inequality: How Today’s Divided Society Endangers Our Future (2012), Freefall: America, Free Markets, and the Sinking of the World Economy (2010), Mismeasuring Our Lives: Why GDP Doesn’t Add Up, with J-P. Fitoussi and A. Sen (2010), The Stiglitz Report: Reforming the International Monetary and Financial Systems in the Wake of the Global Crisis (2010), Time for a Visible Hand: Lessons from the 2008 World Financial Crisis (2010), The Three Trillion Dollar War, with L. BILMES (2008), Making Globalization Work (2006), The Roaring Nineties (2003), Globalization and Its Discontents (2002), The Rebel Within: Joseph Stiglitz and the World Bank (2002). “Bibliography of Joseph E. Stiglitz’s Publications”, 1966-2001, The Scandinavian Journal of Economics: Vol. 104, n.º 2, June 2002, pp. 243-259. http://onlinelibrary.wiley.com/doi/10.1111/14679442.00284/abstract?systemMessage=Wiley+Online+Library+will+be+disrupted+9th+Aug+f rom+102+BST+for+essential+maintenance.+Pay+Per+View+will+be+unavailable+from+10-6+BST More about Joseph E. Stiglitz Joseph E. Stiglitz Blog: https://www.goodreads.com/author/show/6426.Joseph_E_Stiglitz/blog Excerpts from Joseph E. Stiglitz’s book The Price of Inequality: There are two visions of America a half century from now. One is of a society more divided between the haves and the have-nots, a country in which the rich live in gated communities, send their children to expensive schools, and have access to firstrate medical care. Meanwhile, the rest live in a world marked by insecurity, at best mediocre education, and in effect rationed health care―they hope and pray they don't get seriously sick. At the bottom are millions of young people alienated and without hope. I have seen that picture in many developing countries; economists have given it a name, a dual economy, two societies living side by side, but hardly knowing each other, hardly imagining what life is like for the other. Whether we will fall to the depths of some countries, where the gates grow higher and the societies split farther and farther apart, I do not know. It is, however, the nightmare towards which we are slowly marching. The protesters have called into question whether there is a real democracy. Real democracy is more than the right to vote once every two or four years. The choices 3 have to be meaningful. But increasingly, and especially in the US, it seems that the political system is more akin to "one dollar one vote" than to "one person one vote". Rather than correcting the market failures, the political system was reinforcing them. The same is true for the market economy: the power of markets is enormous, but they have no inherent moral character. We have to decide how to manage them... For all these reasons, it is plain that markets must be tamed and tempered to make sure they work to the benefit of most citizens. And that has to be done repeatedly, to ensure that they continue to do so. In some circumstances, a focus on extrinsic rewards (money) can actually diminish effort. Most (or at least many) teachers enter their profession not because of the money but because of their love for children and their dedication to teaching. The best teachers could have earned far higher incomes if they had gone to banking. It is almost insulting to assume that they are not doing what they can to help their students learn, and that by paying them an extra $500 or $1,500, they would exert greater effort. Indeed, incentive pay can be corrosive: it reminds teachers of how bad their pay is, and those who are led thereby to focus on money may be induced to find a better paying job, leaving behind only those for whom teaching is the only alternative. (Of course, if teachers perceive themselves to be badly paid, that will undermine morale, and that will have adverse incentive effects). Americans all benefit from the physical and institutional infrastructure that has developed from the country’s collective efforts over generations. The U.S. incarceration rate is the world’s highest and some nine to ten times that of many European countries. Almost 1 in 100 American adults is behind bars.61 Some U.S. states spend as much on their prisons as they do on their universities. Joseph E. STIGLITZ on YouTube https://www.youtube.com/watch?v=olKOPrRqdH4 Table of Contents Preface Acknowledgments Chapter 1 America’s 1 Percent Problem ix xxvii 1 Chapter 2 Rent Seeking and the Making of an Unequal Society 28 Chapter 3 Markets and Inequality 52 Chapter 4 Why It Matters 83 Chaffer 5 A Democracy in Peril 118 Chapter 6 1984 Is Upon Us 146 Chapter 7 Justice for All? How Inequality is Eroding the Rule of Law 187 Chapter 8 The Battle of the Budget 207 Chapter 9 A Macroeconomic Policy and a Central Bank by And for the 1 Percent 238 Chapter 10 The Way Forward: Another World Is Possible 265 Notes 291 Index 399 4 Editorial Reviews Publishers Weekly In his concise and clearly argued newest, Stiglitz, a Nobel Prize-winning economist, outlines the economic, political, and social obstacles currently facing the U.S. and explores possibilities for how we can overcome them. Beginning with the financial collapse of 2008 and the ensuing Great Recession, Stiglitz (Globalization and Its Discontents) makes the now-ubiquitous point that “the rich were getting richer, while the rest were facing hardships that seem inconsonant with the American dream.” The author opines that from this growing gap stem many other sobering social ills, such as “pollution, unemployment, and […] the degradation of values to the point where everything is acceptable and no one is accountable.” And while he contends that our current modus operandi is “neither stable nor sustainable,” Stiglitz insists that inequality is not inherent in the system. He then goes on to lay out a plan for the long term, recommending practical changes to macroeconomic policies, taxes, labor laws, and how we navigate a globalizing world and dealing with the deficit. His visions of America’s two possible futures reveals the extent of the dishearteningly large socioeconomic rift and its forecasted consequences, but Stiglitz's solutions –upheld by experience, perceptive analysis, and copious research– could very well bridge that divide, and reduce it in the process. (June) New York Times “An important and smart new book [...]. It’s a searing read.” Nicholas Kristof Washington Post “Stiglitz writes clearly and provocatively. He’s the kind of economist who can talk about terms such as ‘rent-seeking’ and the ‘euro crisis’ and bring readers along for the ride [...]. Stiglitz isn’t just writing about people being hurt by inequality, he is also writing about the system itself being in jeopardy and what needs to be done to fix it.” Dante Chinni Kirkus Reviews From one of the world’s leading economists, a political call to action in defense of equality and human rights. Nobel laureate Stiglitz (Economics/Columbia Univ.; Freefall: America, Free Markets and the Sinking of the World Economy, 2010, etc.) insists that increasing inequality in the United States stems from a breakdown of the country’s political and economic systems. The failure to hold any banker accountable for actions that contributed to the recent economic crisis is a prime symptom of the case. The current level of inequality, writes the author, “increases instability, reduces productivity, and undermines democracy.” Stiglitz concedes that there is merit in the arguments of those who point to the effects of technology, greed or the absence of bank regulation as contributing factors, and he agrees that corrective measures are needed. He goes further, arguing that inequality is a by-product of the ability to exploit consumers through monopoly power, and borrowers through shady practices. He shows that the consequences include a monopolistic redistribution powerful enough to have caused massive distortions in the U.S. financial system. 5 This is still not the deeper problem, however. More fundamentally, people underestimate the problem of inequality; as a result, they fail to perceive the changes that are already underway. Stiglitz presents the situation as “the bigger battle over perceptions and over big ideas,” a battle being fought through persuasion, framing, misrepresentation and obfuscation. Changing course requires winning this battle for truth. In this way, he argues, equality, the rule of law and accountability can be reestablished. An impassioned argument backed by rigorous economic analysis. https://www.kirkusreviews.com/book-reviews/joseph-e-stiglitz/price-inequality/ The New York Times Book Review The single most comprehensive counterargument to both Democratic neoliberalism and Republican laissez-faire theories. While credible economists running the gamut from center right to center left describe our bleak present as the result of seemingly unstoppable developments –globalization and automation, a self-replicating establishment built on “meritocratic” competition, the debt-driven collapse of 2008– Stiglitz stands apart in his defiant rejection of such notions of inevitability. He seeks to shift the terms of the debate. It is not uncontrollable technological and social change that has produced a two-tier society, Stiglitz argues, but the exercise of political power by moneyed interests over legislative and regulatory processes. “While there may be underlying economic forces at play,” he writes, “politics have shaped the market, and shaped it in ways that advantage the top at the expense of the rest.” But politics, he insists, is subject to change. […]. Circumstances in the summer of 2012 justify Stiglitz’s more apprehensive conclusion. Prospects for programs boosting public investment are virtually nil. Republicans stand a good chance of taking control of both branches of Congress after the next election. Their presumptive presidential nominee, Mitt Romney, may capture the White House. If so, his tax and regulatory proposals will most likely embody all that Stiglitz finds repugnant. Even if Romney loses, the American political system does not appear ready to respond to Stiglitz’s call to arms. Stiglitz may prove most prescient when he warns of a society governed by “rules of the game that weaken the bargaining strength of workers vis-à-vis capital.” At present, he says, “the dearth of jobs and the asymmetries in globalization have created competition for jobs in which workers have lost and the owners of capital have won.” We are becoming a country “in which the rich live in gated communities, send their children to expensive schools and have access to first-rate medical care. Meanwhile, the rest live in a world marked by insecurity, at best mediocre education and in effect rationed health care.” Except for a brief period in 2008-9, when the stock market decline hit the wealthy the hardest, the trends would seem to be moving toward Stiglitz’s pessimistic vision of the future, with little prospect of change no matter who wins office on Nov. 6. Thomas B. Edsall Thomas B. Edsall, the Joseph Pulitzer II and Edith Pulitzer Moore professor at the Columbia School of Journalism, writes a weekly online column for The Times. Cf.: http://www.nytimes.com/2012/08/05/books/review/the-price-of-inequality-by-josephe-stiglitz.html?pagewanted=all&module=Search&mabReward=relbias%3Ar&_r=0 “Everyone should read this!!! It’s time for American’s to educate themselves about what’s going on in our country”. Anonymous, posted July 7, 2012 6 “This is a very realistic and thought provoking book on what is happening in the US Economy. It is clear the inequality gap has been widening for 30 years or so and there has been one band aid after another put on it. The “Great Recession” ripped that off and now we all can see what has happened and what is continuing to happen. In this book Joseph Stiglitz not only describes what has happened with clear evidence but he also proposes solutions to the problem. This is what I like most about this book is he gives clear and concise recommendations. Whether you agree or not you should take them seriously as Stiglitz is a serious economist and has no political stake in his conclusions. We know how it ends up if we allow this inequality to continue: Just go to any country where the inequality is high –the rich build bigger and bigger gates and walls to wall themselves off from the community, they become self-contained and the poor scramble for what remains. Then, in a blink of an eye, things like the Arab Spring occur. So, we know this ends badly and Stiglitz describes this in detail”. Anonymous, posted September 9, 2012 http://www.barnesandnoble.com/w/the-price-of-inequality-joseph-estiglitz/1110779544?ean=9780393088694 Stiglitz has a lot to say in this very important book. The basic thesis of this book is that income inequality in the United States is higher than it has ever been in history. The standard of living of the top 1% continuously rises, while that of the lower 99% continues to fall. The opportunities for upward mobility are fewer in the United States than in many other countries. The reason is that the upper 1% have designed the economic, political, tax, and education systems to benefit themselves, to the detriment of everyone else. They do not realize that in the long term, their well-being is inextricably coupled to the well-being of society as a whole. Stiglitz quotes Paul Ryan, who said that "a central difference between the parties is whether we are a nation that still believes in equality of opportunity, or whether we are moving away from that, and towards an insistence on equality of outcome." Stiglitz goes to great length (including over 100 pages of footnotes) to show how Ryan does not allow the facts to "... get in the way of a pleasant fantasy." Stiglitz shows how "the 1 percent, in attempting to claim for themselves an unjust proportion of the benefits of this system, may be willing to destroy the system itself to hold on to what they have.” Stiglitz shows how the high pay of corporate CEO’s in the financial sector is total sham. They used to call it incentive pay, but when CEO’s perform poorly, they changed its name to retention pay. Stiglitz writes about the policies that the IMF imposed in developing countries. He shows that the policies have been proven wrong and often fail. Rather than being designed to aid the developing countries, IMF policies were in fact designed to enrich the international financial sector and corporate interests. The book shows how inequality has eroded the rule of law in the United States. Illegal activities during the great recession of 2008 escape without prosecution. Banks that commit huge foreclosure frauds can escape with minimal penalties, often just a slap on the wrist. Crime pays. Stiglitz cogently argues that recessions are not caused by lack of austerity--they are caused by lack of demand. Cutting back on government spending causes unemployment to increase, thereby worsening recessions. The Fed over-emphasizes its role in curtailing inflation, while minimizing the importance of lowering unemployment. They just don't get the fact that if you don't have a job, inflation doesn’t matter much. 7 This book is a no-holds-barred slam at the government’s policies. But it is not simply a condemnation. The last chapter is a well thought-out description of how economic policies could be reformed, for the betterment of all citizens. This book is extremely important. I wish that all politicians, economists and executives would read this book. David December 23, 2013 Cf.: https://www.goodreads.com/book/show/16685439-the-price-ofinequality?from_search=true The Observer Friday 13 July 2012 The Price of Inequality by Joseph Stiglitz (review) The Nobel economist savages the neoliberal ideology that has made society intolerably unfair ROBERTS, Ivonne Yvonne Roberts / The Observer An Occupy London protester outside the Bank of England. Photograph: Andy Rain/EPA The ancient Greeks had a word for it –pleonexia– which means an overreaching desire for more than one's share. As Melissa Lane explained in last year’s Eco-Republic: Ancient Thinking for a Green Age, this vice was often paired with hubris, a form of arrogance directed especially against the gods and therefore doomed to fail. The Greeks saw tyrants as fundamentally pleonetic in their motivation. As Lane writes: “Power served greed and so to tame power, one must tame greed.” In The Price of Inequality, Joseph E. Stiglitz passionately describes how unrestrained power and rampant greed are writing an epitaph for the American dream. The promise of the US as the land of opportunity has been shattered by the modern pleonetic tyrants, who make up the 1%, while sections of the 99% across the globe are beginning to vent their rage. That often inchoate anger, seen in Occupy Wall Street and Spain’s los indignados, is given shape, fluency, substance and authority by Stiglitz. He does so not in the name of revolution – 8 although he tells the 1% that their bloody time may yet come– but in order that capitalism be snatched back from free market fundamentalism and put to the service of the many, not the few. In the 1970s and 80s, “the Chicago boys”, from the Chicago school of economics, led by Milton Friedman, developed their anti-regulation, small state, pro-privatisation thesis – and were handed whole countries, aided by the International Monetary Fund (IMF), on which to experiment, among them Thatcher’s Britain, Reagan’s America, Mexico and Chile. David Harvey’s A Brief History of Neoliberalism describes how the democratically elected Salvador Allende was overthrown in Chile and the Chicago boys brought in. Under their influence, nationalisation was reversed, public assets privatised, natural resources opened up to unregulated exploitation (anyone like to buy one of our forests?), the unions and social organisations were torn apart and foreign direct investment and “freer” trade were facilitated. Rather than wealth trickling down, it rapidly found its way to the pinnacle of the pyramid. As Stiglitz explains, these policies were –and are– protected by myths, not least that the highest paid “deserve” their excess of riches. In 2001, Stiglitz, a former chief economist at the World Bank, and arch critic of the IMF, won the Nobel prize for economics for his theory of “asymmetric information”. When some individuals have access to privileged knowledge that others don’t, free markets yield bad outcomes for wider society. Stiglitz conducted his work in the 1970s and 80s but asymmetric information perfectly describes the Libor scandal, rigging the interest rate at a cost to the ordinary man and woman in the street. Stiglitz details the profound consequences not just of the current financial meltdown but of the previous decades of neoliberal interventions on the incomes, health and prospects of the 99% and the damage done to the values of fairness, trust and civic responsibility. In the process, Stiglitz methodically and lyrically (almost joyously) exposes the myths that provide justification for “deficit fetishism” and the rule of austerity. If George Osborne is depressed at the ineffectiveness of Plan A, he should turn to Stiglitz’s succinct explanation on page 230 to feel truly miserable. Cutting spending, reducing taxes, shrinking government and increasing deregulation destroys both demand and jobs –and doesn’t even benefit the 1%. For roughly 30 years after the second world war, the 1% had a steady share of the US cake. In the five years to 2007, however, the top 1% seized more than 65% of the gain in US national income. In 2010, their share was 93%. This did not create greater prosperity for all (myth number one). On the contrary, much of this gain was “rent seeking”, not creating new wealth but taking it from others; a modern wild west. In the last three decades, the bottom 90% in the US (figures that resonate in the UK) have seen their wages grow by 15%. The 1% have seen their wages increase by 150%. Another myth is that bloated salaries are necessary to retain high achievers. Except, as Stiglitz points out, the rewards are more often for failure. The inequality gap is becoming a chasm. Stiglitz demonstrates how, in the US, those born poor will stay poor yet nearly seven in 10 Americans still believe the ladder of opportunity exists. Stiglitz is one of a growing band of academics and economists, among them Paul Krugman, Michael J Sandel and Raghuram Rajan, who are trying to inject morality back into capitalism. He argues that we are reaching a level of inequality that is “intolerable”. Rentseekers include top-flight lawyers, monopolists (Stiglitz refers to the illusion of competition: the US has hundreds of banks but the big four share half of the whole sector), financiers and many of those supposed to be regulating the system, but who have been seduced and neutered by lobbyists and their own avarice. In the “battlefield of ideas”, while governments turn citizen against citizen by demonising, for instance, benefit scroungers, what Stiglitz calls corporate welfare goes unchecked. In 2008, insurance company AIG was given $150bn by US taxpayers –more, says Stiglitz, than the total spent on welfare to the poor in the 16 years to 2006. Stiglitz is a 9 powerful advocate for a strong public sector. He argues for full employment, greater investment in roads, technology, education; far more stringent regulation and clear accountability. Culpable bankers, he says, should go straight to jail. Gross domestic product is an unsatisfactory measure of progress, he believes. Stiglitz wants to see metrics that include the cost of inappropriate use of resources. He illustrates the price of immiseration and unfairness. Management of Firestone tyres demanded much longer hours and a 30% wage cut. The demand created conditions that led to the production of many defective tyres. Defective tyres were related to more than 1,000 deaths and injuries and the recall of Firestone tyres in 2000. Unfairness affects lives, productivity and, ultimately, Stiglitz warns, the security of the 1%. The Price of Inequality is a powerful plea for the implementation of what Alexis de Tocqueville termed “self-interest properly understood”. Stiglitz writes: “Paying attention to everyone else’s self-interest –in other words to the common welfare– is in fact a precondition for one’s own ultimate wellbeing […] it isn’t just good for the soul; it’s good for business.” Unfortunately, that’s what those with hubris and pleonexia have never understood –and we are all paying the price. Yvonne Roberts is an Observer leader writer and a fellow of the Young Foundation Cf.: http://www.theguardian.com/books/2012/jul/13/price-inequality-joseph-stiglitz-review 10