Year 11 accounting handout 2

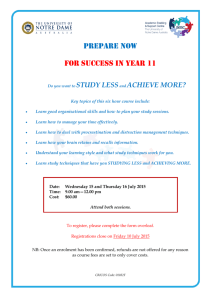

advertisement

ALDRIDGE STATE HIGH SCHOOL 11 ACCOUNTING CORE STUDIES ONE - TRANSACTIONS WITH GST GOODS AND SERVICES TAX Since 1 July 2000, the goods and services tax (GST) has applied to the sale and purchase of most goods and services consumed in Australia. This tax is a consumption tax. It is a tax paid when goods/services are consumed by consumers. Some goods are GST free, however, the majority of goods and services have 10% tax applicable. The goods and services tax (GST) is a broad-based tax of 10% on the supply of most goods and services consumed in Australia. It is designed to be collected by enterprises but eventually paid by consumers. With GST to be included in a transaction, goods with a sales value of $1000 would be invoiced to the purchaser or consumer at a price of $1100, with $100 being the GST collected by the enterprise to pass on to the government. The GST is always calculated as one-tenth of the value, or one-eleventh of the price. Input tax credits are amounts claimed back from the government for the GST paid on acquisitions used by a GST registered business. For a business to claim an input tax credit they must have the tax invoice. Exercise 1 If you are a consumer who purchases goods or services that are GST-taxable, how much tax will you pay on goods or services for which you paid: a) $77 b) $1100 c) $6886 Exercise 2 If you are a supplier who supplies goods or services that are GST-taxable, how much tax will you charge on goods or services with a value of: a) $70 b) $77 c) $1100 d) $6886 The tax invoices and adjustment notes will provide the information necessary to record details of the GST. The two basic GST accounts used are: GST Collected which is a liability for a business. It records the GST that is collected on sales and supplies, and is payable to the ATO. The account is sometimes called a GST Payable account. GST Credits Received which is a negative liability for a business because it reduces the amount owing to the ATO. It records the input tax credits claimed on purchases or acquisitions. This account is sometimes called an Input Tax Credit Receivable account or GST Paid on Inputs account. Let’s look now at some of the possible transactions that you may encounter and how to deal with the GST. 1 OPENING ENTRY The opening entry is not made at the beginning of every accounting period but only to open a set of books, for example, when the owner starts a new business or takes over an existing business. The opening entry is unlikely to include GST elements. Eg. N Jones commenced a business called Jones Industries, with a capital of $18550, which consisted of the following assets and liabilities: Cash at Bank $9000, Accounts Receivable: Baker Enterprises $1100, Garrison and Sons $800; Furniture $1250, Motor Vehicle $7000, Accounts Payable: Brown and Sons $600 This entry would be recorded as follows: DATE Mar 1 General Journal of Jones Industries PARTICULARS F DR Cash at Bank DR 9000 Baker Enterprises DR 1100 Garrison and Sons DR 800 Furniture DR 1250 Motor Vehicle DR 7000 Brown and Sons CR Capital CR (Owner commenced business with assets CR 600 18550 and liabilities) Exercise 3 Prepare an opening general journal for the following: On September 1 V Vincent commenced a new business called Vincent Enterprises, with the following assets and liabilities: Cash at Bank $19000, Accounts Receivable: Baker Pty Ltd $2200, Jackson and Sons $1600, Inventories $4000, Motor Vehicles $27000, Accounts Payable: Brown and Company $6600. ACCOUNTING FOR SERVICE ENTITIES PURCHASING CONSUMABLE SUPPLIES Most businesses that wish to provide a service need some supplies to assist. For eg, an electrician needs a supply of wires and switches, an accountant needs pens and paper. Most of these supplies are written off as expenses as soon as they are purchased. Consider the following: March 2 Purchased consumable supplies for $220 cash, GST-inclusive, cheque 87. This would be recorded as follows: DATE March 2 General Journal PARTICULARS F Consumable Supplies Expense GST Credits Received Cash at Bank (Purchased supplies, cheque 87) DR DR CR DR CR 200 20 220 2 SELLING SERVICES A service provider will charge a fee for their service, eg. Mar 3 Charged fees for services provided to J Brown for $550 GST-inclusive, as per tax invoice 1001. DATE March 3 General Journal PARTICULARS J Brown DR GST Collected CR Service fees revenue CR F DR CR 550 50 500 (Charged fee for service, invoice no 1001) PAYING EXPENSES Some expenses will not incur GST eg. Wages, Salaries and Bank Charges. Telephone expense is one that will incur GST. Most expenses incur GST. Eg. Mar 4 DATE March 4 Paid Telephone expenses of $264 as per cheque 8702 General Journal PARTICULARS Telephone Expenses DR GST Credits Received DR Cash at Bank CR F DR CR 240 24 264 (Paid telephone, chq 8702) ACCOUNTING FOR TRADING ENTITIES PURCHASES OF INVENTORIES Purchases of inventories, for most businesses, is one transaction that will include GST. Eg March 4 Jones Industries purchased goods from Cronder Wholesalers for $770 including GST, on tax invoice 901. DATE March 4 General Journal PARTICULARS Inventories DR GST Credits Received DR Cronder Wholesalers CR F DR CR 700 70 770 (Purchased goods, inv 901) If the purchase of inventories had been for cash, the only change to the above entry would have been to credit Cash at Bank account, instead of the accounts payable. 3 PURCHASES RETURNS AND ALLOWANCES Eg. March 5 Returned goods to Cronder Wholesalers, receiving adjustment note 18 for $220, including GST. DATE March 5 General Journal PARTICULARS F Cronder Wholesalers DR GST Credits Received CR Inventories CR DR CR 220 20 200 (Purchases returns, adj note 18) If the purchases had been returned for a cash refund, the only change would have been to debit Cash at Bank to show the cash received. If goods had been exchanged or replaced generally no entry would be made. Exercises: page 82, 3.19 SALES OF INVENTORIES Under the Perpetual inventory system, sales of inventories have two separate elements in the transaction. the revenue or selling price element the expense or cost price element Therefore, two separate entries must be made to record a sale. Eg. March 7 Jones Industries sold goods to K Ryan on tax invoice 101 for $600 with 10% GST to be added. The cost price of these goods was $420. DATE March 7 General Journal PARTICULARS F K Ryan DR GST Collected CR Sales CR DR 660 CR 60 600 (Sold goods, tax inv 101) If the sale of inventories had been made for cash, the only change would have been to debit bank account, not the accounts receivable. To record the cost price element of the transaction, the following entry would be as made: DATE March 7 General Journal PARTICULARS F Cost of Goods Sold DR Inventories CR DR 420 CR 420 (Cost of goods sold, inv 101) 4 SALES RETURNS AND ALLOWANCES Sales returns consist of two parts and involve a GST adjustment. Eg March 8 K Ryan returned goods, recorded on tax adjustment note 11 for a total amount of $110, including GST. The cost price of these goods was $70. DATE March 8 General Journal PARTICULARS F Sales returns DR GST Collected DR M Jones CR DR 100 10 CR 110 (M Jones returned goods, tax adjustment note 11) To record the cost price element of the transaction would be: DATE March 8 General Journal PARTICULARS F Inventories DR Cost of goods sold CR DR CR 70 70 (Cost of goods returned, tax adjustment note 11) Exercises: page 84, 3.20, illustrative example, page 86, 3.22, 3.23 PURCHASE OF ASSETS OTHER THAN INVENTORIES Eg March 9 Jones Industries purchased equipment on credit for $33000 (inclusive of GST) from Equipment Suppliers, as shown on tax invoice 5672. DATE March 9 General Journal PARTICULARS F Equipment GST Credits Received Equipment Suppliers DR DR CR DR 30000 3000 (Purchased equipment on credit, inv 5672) CR 33000 If the equipment had been purchased for cash, the only change to the above entry would be to credit bank account rather than the accounts payable, Equipment Suppliers. HOMEWORK ACTIVITY Record the following entries in the General Journal of Maxwell Smart. Post to the ledger and prepare a trial balance as at 28 February 2013. Feb 3 Purchased goods from Siegfried Ltd for $2 750 including GST, tax inv 103. 4 Received adjustment note 45 from Siegfried Ltd for $77, GST inclusive, for goods returned by us. 7 Sold goods on credit for $1 320 including GST, to James Watt, tax inv 67, cost price of $600. 8 Purchased GST free goods for cash $660, cheque 88 12 Sent adjustment note 37 for $44 including GST to James Watt for goods returned with a cost price of $20. These goods were originally sold on Feb 7. 15 Sold goods with a cost price of $250 for $550 GST free, cash register summary. 21 Paid Siegfried Ltd $2 673, cheque 89. 28 Paid electricity account of $132 GST inclusive, using cheque 90. 5 SALE OF ASSETS OTHER THAN INVENTORIES Eg March 10 Jones Industries sold furniture on credit to Furniture Traders Ltd for its book value of $1000. The sale attracted GST, as shown on tax invoice 102 DATE March 10 General Journal PARTICULARS Furniture Traders Ltd GST Collected Furniture (sold furniture on credit, inv 102) F DR 1100 DR CR CR CR 100 1000 If the furniture had been sold for cash, the only change would be to debit bank instead of the accounts receivable. DRAWINGS OF CASH The owner of a business may withdraw cash from the business for personal use. Eg March 11 N Jones, the owner of Jones Industries, withdrew $200 for personal use, using cheque 8703. DATE Mar 11 General Journal PARTICULARS F Drawings DR Cash at Bank CR (Owner took cash for own use, cheque 8703) DR 200 CR 200 DRAWINGS OF INVENTORIES If inventories are withdrawn for personal use, an adjustment to GST is required if the inventories are ones for which an input tax credit has already been received. Eg March 12 The owner of Jones Industries withdrew GST-inclusive inventories worth $132 for personal use. DATE March 12 General Journal PARTICULARS Drawings GST Credits Received Inventories (owner took goods for own use) DR CR CR F DR CR 132 12 120 Exercises: page 90, 3.24 6 CORRECTION OF ERRORS Occasionally errors may be made in the records. It is preferable that these errors be corrected through the general journal. Each error would be treated individually, looking carefully at what accounts need to be increased or decreased. Eg March 10 Jones had erroneously entered the sale of furniture to the sales account for $1000 instead of the furniture account. The error was discovered when the accounts were balanced on 31 March. DATE March 31 General Journal PARTICULARS Sales Furniture DR CR F DR CR 1000 1000 (Correction of error in entry made on March 10) Exercises: page 92, 3.25, page 94, illustrative example, page 98-99, 3.28 – 3.29 REVISION (Page 101-102, exercise 3.33) Journalise the following transactions for M Pale trading as Pale Industries, post to the ledger and take out a trial balance as at 30 April 2013. Apr 1 M Pale commenced business with the following account balances: Cash in Hand $100, Cash at Bank $400, Accounts Receivable: T Blake $50, L Gibson $110, Inventories $900, Vehicle $3 000, Equipment $5 000, Buildings $11 000, Land $11 000, Accounts Payable: B Racey $500, G Wall, $100, Loan from Bank $2 000. 2 Sold goods with a cost price of $150 to T Blake for $220 cash (GST-inclusive), receipt 48. Purchased goods from B Racey $330, (GST-inclusive), tax invoice 101. Paid $500 off the loan from bank, cheque 272. Cash sales $110 (GST-inclusive) of goods with $70 cost price, cash register summary. 3 Owner withdrew goods $44 (GST-inclusive), inter-office memorandum 5. 4 Sold vehicle for $3 300 cash including GST, receipt 49. Purchased goods from G Wall $200 (GST-free), tax invoice 202. Cash sales $150 (GST-free) of goods with $90 cost price, cash register summary. 5 Received $50 cash from T Blake, receipt 50. 6 Paid B Racey $500 in settlement of amount owing on 1 April, cheque 273. Sold goods with a cost price of $60 to L Gibson, tax invoice 59, for $110 (GST-inclusive). 7 Purchased inventories from G Wall $110 (including GST of $8), invoice 707. 8 Returned goods to the value of $55 (GST-inclusive) to G Wall, adjustment note 51. 10 Cash sales $1 100 (GST-inclusive) of goods with $700 cost price, cash register summary. Paid $50 interest on loan, cheque 274. 17 Received adjustment note 52 for GST-free goods returned to G Wall, $5. 19 L Gibson returned inventories to the value of $11 (GST-inclusive) with a cost price of $6, adjustment note 97. 20 Cash sales $80 (GST-free) of goods with $40 cost price, cash register summary. Received $100 from L Gibson, receipt 51. 23 Bought land for $3 000 (plus GST) from ABC Finance Co, paying, $1 000 deposit as per receipt and tax invoice 606. 25 Sold inventories with a cost price of $40 to T Blake for $66 (GST-inclusive), tax invoice 60. 27 Purchased GST-free inventories for cash $100, cheque 275. Paid stationery $110 (GST-inclusive), cheque 276. 30 Inter-office memo 6 issued to change stationery recorded on 27th to correct account of travel expenses. 7 Page 98, Exercise 3.28 From the following information for the business of A Storey, retailer, prepare General Journal entries, post these to the ledger and prepare a trial balance as at 30 September. Sept 1 A Storey commenced business with assets of furniture $5 000 and cash at bank of $30 000. 4 Paid rent $2 090, cheque 001. 10 Purchased GST-free inventories for $1 200 from Wholesale Food Ltd, tax invoice 247. 13 Cash sales of GST-free goods with a cost price of $500 for $850, cash register summary. Sold furniture for $5 500 (GST inclusive) to Furniture Seconds Ltd, tax invoice 301. 15 Purchased inventories for $5 280 (GST-inclusive) from Wholesale Food Ltd, tax invoice 255. 17 Returned inventories valued at $550 (GST-inclusive) to Wholesale Food Ltd, adjustment note 75. 18 Paid wages $1 330, cheque 002. 19 Cash sales of goods with cost price of $2 000 for $3 300 GST-free, cash register summary. 21 Sold GST-inclusive inventories with cost price of $500 for $880 to N Nash, tax invoice 302. 26 Received $880 from N Nash, receipt 801. 27 Purchased advertising from Mail Newspapers $418, tax invoice 993. 28 Sold inventories with cost price of $300 for $594 (GST-inclusive) to P Peters, tax invoice 303. 29 Sent adjustment note 501 for $176 to P Peters, who returned taxable goods with a cost price of $100. 30 Owner withdrew $500 cash for personal use, cheque 003. 8 Page 99, Exercise 3.29 From the following information for the business of B Garronne, prepare General Journal entries, post these to the ledger and prepare a trial balance as at 31 May. May 1 B Garronne commenced business with a deposit to the business’s bank account of $25 000, receipt 801. 8 Paid rent $550, cheque 401. Purchased GST-free inventories for $1 210, cheque 402. 14 Performed services for $880 cash (GST-inclusive), receipt 802. 16 Purchased furniture for $1 452 (GST-inclusive) from Harvey Jones Ltd, tax invoice 388. 17 Purchased inventories for $528 (GST-inclusive) from T Terry, tax invoice 556. 20 Returned inventories valued at $55 (GST-inclusive) to T Terry, adjustment note 775. 21 Paid advertising $330, cheque 403. 22 Cash sales of goods with cost price of $200 for $330 GST-free, cash register summary. Sold GST-inclusive inventories with cost price of $300 for $440 to N Brown, tax invoice 763. 24 Received $440 from N Brown, receipt 803. 29 Paid wages $1 209, cheque 404. 30 Sold inventories with cost price of $100 for $198 (GST-inclusive) to P Donald, tax invoice 764. Sent adjustment note 111 for $88 to P Donald, who returned taxable goods with a cost price of $60. 31 Owner withdrew GST-inclusive inventories for personal use, $440, inter-office memo 05. Paid bank charges $20, as per bank statement. COMPUTERISED ACCOUNTING TIPS Ensure you use the business name, not the owner’s name to name your journal, ledger and trial balance. Ensure each page of your ledger has column headings included: In Excel, go through File, Page Set Up, Sheet, Rows to repeat at the top. Ruling and presentation is to be consistent throughout each exercise. 9