Petty Cash Info - Carleton College

advertisement

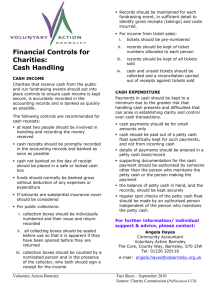

Carleton College Departmental Petty Cash Policy (last revised June 26, 2012) Policy Statement Carleton College permits departments to maintain a limited petty cash fund. All departments maintaining petty cash funds are required to exercise specific controls over its use and safeguard the fund at all times. Purpose and Use The purpose of the petty cash fund is to provide departments with ready cash for the payment of various small expenditures, such as cab fare, postage, and other reimbursements less than $25. The petty cash fund can also be used as a "change fund" in the department for handling ticket sales at events. Guidelines 1. Petty cash funds are established with the Business Office. The total fund balance is established collaboratively by the Comptroller and the Department Chair in consultation with the Department Petty Cash Custodian. The total fund balance is usually between $50-$250, based on the needs of the department. Individual circumstance or events may dictate a need for a higher limit or a temporary increase in the limit. As a guideline use $25 for the individual transaction limit. You should collect receipts for all petty cash transactions. 2. Accountability for the petty cash fund should be assigned to one employee in the department, designated as the Department Petty Cash Custodian. The Departmental Petty Cash Custodian is appointed by the Department Chair. The Department Chair cannot appoint himself/herself as Petty Cash Custodian. Notify the Business Office if there is a change in the Petty Cash Custodian. In order to ensure accountability for the new custodian, the fund should be reconciled with the Business Office at the time of the change. 3. It is the responsibility of the Petty Cash Custodian to safeguard the fund by limiting access to the fund, securing the fund, distributing cash to others upon request, obtaining supporting documentation for disbursements from the fund, maintaining receipts, balancing and reconciling the fund. Petty Cash Custodians are prohibited from cashing personal checks from petty cash funds, for themselves or others. D:\533577378.doc 1/3 4. The petty cash fund should be kept in a locked drawer or cabinet with the key in the custodian’s possession. Any losses of petty cash are the responsibility of the department. 5. The Petty Cash Reconciliation should indicate the amount disbursed, the purposes of the disbursement, and the signature of the person receiving the cash. The receipts, plus cash on hand, should equal the total amount of the fund at all times. Petty cash funds should be reconciled with the Business Office on at least a monthly basis. 6. Petty cash funds not in use during the summer should be deposited with the Business Office on or before June 30. New funds will be issued September 1. Reconciliation and Reimbursement of the Fund The Petty Cash Custodian should properly document transactions in the following manner: Document each transaction on the Petty Cash Reconciliation, identifying all pertinent information (who, purpose, transaction detail and date of expense). Identify the department and expense code to be charged. For reimbursement of business meals the names of the individuals in attendance, the business purpose, date, and place of meeting must be clearly stated on either the Petty Cash Reconciliation or the supporting documentation. The individual receiving the payment must sign the Petty Cash Reconciliation to acknowledge the receipt of cash. Attach all original receipts to the Petty Cash Reconciliation. Reference each receipt to the corresponding transaction on the reconciliation. Detail receipts for all transactions should be obtained. The Petty Cash Custodian will be reimbursed by the Cashier in the Business Office for amounts paid out of the petty cash fund upon presentation of Petty Cash Reconciliation. Restrictions on Use Petty cash should not be used for the following: 1. Travel expense reimbursements. Continue to use the payment request form. 2. Payments to vendors for invoices submitted directly to the department where a purchase order was issued. Continue to send these invoices to the Business Office for processing and payment in order to appropriately clear the purchase order from the system. D:\533577378.doc 2/3 3. Payments to independent contractors, consultants, awards, etc., to non-Carleton employees. These should be processed with a check request through Accounts Payable in the Business Office in order to ensure appropriate IRS reporting. 4. Payments to employees for services, awards, prizes, bonuses, etc. These should be processed through the Payroll process. 5. Personal borrowing (IOUs) or salary advances. 6. Never cash personal checks. Reporting Stolen or Lost Petty Cash In the event that petty cash is stolen, the following procedures should be followed: 1. Inform Security of the theft at ext. 4444. 2. Obtain a copy of the incident report and attach to the Petty Cash Reconciliation. Submit the reconciliation and report to the Business Office. Closing a Petty Cash Account The petty cash fund should be closed with the Business Office when the purpose for which the fund was established has been completed, as determined by either the Department Head or the Business Office. In addition, The Business Office reserves the right to conduct periodic usage reviews and, based on the results, can request closure or reduction of the fund. Audit Each reimbursement request will be subject to audit by the Business Office Cashier. In addition, the Business Office may perform periodic unannounced audits of the fund to ensure proper controls are maintained. Contact Any questions concerning the petty cash fund or this policy can be directed to Linda Thornton, Comptroller, via e-mail at lthornto@acs.carleton.edu, or by phone at x4171. D:\533577378.doc 3/3