against

advertisement

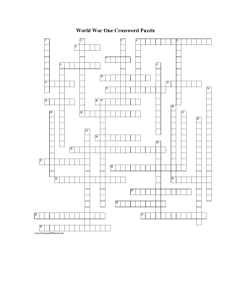

Competitive Supranationalism 1 Competitive Supranationalism: Financial Globalization, EU Institutions and the EU Takeover Directive ABSTRACT : In the debate on the impact of globalization on national political economy, the increasingly central of the European Union remains under explored. This article analyzes the role of the European Union as a mediator of financial globalization by focusing on a crucial case study: the fifteen-year battle over the takeover directive between 1989 and 2003. It presents a novel framework of competitive supranationalism under the forces of globalization. EU policy-making on issues such as the takeover directive exposes a new horizontal cleavage between the Commission and the European Parliament (EP), in addition to the traditional horizontal cleavage between EU institutions and states. The EU Commission sides with increasingly powerful investors, while the EP’s median point is closer to traditional interest groups, such as labor and management. Under the post-1993 co-decision procedure, the EP is acting as a veto point, unraveling classic compromises reached between the Commission and the Council of Ministers. KEY WORDS: Globalization, Corporate Governance, EU integration, European Parliament, Co-decision procedure, Diversity of Capitalisms 1. INTRODUCTION The question of how globalization affects domestic politics has spurred a field of inquiry on systemic convergence (Albert 1991; Berger and Dore 1996; Vogel 1996; Boyer and Hollingsworth 1997; Crouch and Streeck 1997; Kitschelt et al. 1999; Dore 2000; Scharpf and Schmidt 2000; Hall and Soskice 2001; Streeck and Yamamura 2001 and 2003; Schmidt 2002; and Menz 2003). The bulk of this literature on globalization Competitive Supranationalism 2 and domestic institutions continues to focus on individual states. Many studies, for example, continue to treat all OECD countries as independent units, where in fact nineteen out of thirty states (as of May 2004) are EU members that have largely pooled their economic sovereignty. While scholars in the field of international political economy acknowledge the primacy of both globalization and the European Union (EU) in national political economy, they have largely ignored the interactions between globalization and the EU. Despite a nascent literature (Rhodes and Van Apeldoorn 1997; Scharpf 1999; Damro 2001; Weber 2001; and Hay and Rosamond 2002),1 the role of the European Union as a mediator of globalization remains largely unexamined. Meanwhile, the converse role of the European Union as an increasingly key actor in shaping the rules of globalization is also neglected. This article raises three questions that lie at the core of EU interactions with forces of globalization. What is the impact of the EU on the convergence or divergence of various types of capitalism under financial globalization? How does the EU solve its core internal tension between the search for competitiveness and the search for broad-based legitimacy? What is the impact of post-Maastricht institutional changes on the process of EU mediation of globalization? I focus on a single crucial case: the fifteen-year battle over the EU takeover directive from 1989 to 2003. The takeover directive serves as a controlled experiment for the process of EU mediation of financial globalization because of four features. As a key plank in the EU financial strategy and Lisbon strategy to make the EU the most competitive area in the world, it matters enormously. It is also a case of EU-level governance. It involves high stakes for both global investors and traditional domestic actors such as labor and management. Finally, it is a protracted battle over a Competitive Supranationalism 3 long period of fifteen years, during which the impact of EU institutional changes can be tested and the case be broken down in a number of small sub-cases. The rationale behind the takeover directive is simple. By harmonizing fifteen sets of national regulations and facilitating takeovers as a whole, the directive aims at removing obstacles to the free flow of capital. Thus, the takeover directive aims at killing two birds with one stone. On the one hand, it is about advancing the EU’s common (capital) market and leveling the playing field between EU countries. On the other hand, it is about shifting the existing status quo from a restrictive takeover regime (in almost all countries but the UK) to a more market-friendly regime that ‘creates substantial benefits for shareholders’. This in turn ‘could lead to higher firm valuations and lower costs of capital for firms’ (McCahery et al. 2003: ii). It is the quintessential investor-friendly type of reform, a reform that should serve to attract more equity portfolio inflows as well as foreign direct investment (FDI) into the EU. More capital inflows means easier corporate funding and lower cost of capital overall. The Commission precisely calculated that a single financial market would lower the overall cost of capital of EU companies by 0.5 per cent and add 1.1 per cent to overall EU GDP over the next decade.2 A third partly veiled goal was to create a EU-wide financial market that could compete with the US market and thus empower the EU to challenge the US in the game of international rule making. Between 1989 and 2003, the takeover directive went through one of the most amazing institutional roller-coasters ever experienced in the European Union’s history. For years, the Commission tried to introduce a directive that would unify takeover rules across the EU’s internal market. Key states in the Council of Ministers, however, Competitive Supranationalism 4 repeatedly blocked the Commission’s efforts. In particularly, the UK felt that EU regulations would unnecessarily complicate the remarkably efficient voluntary code of the London City. As for Germany, it opposed the introduction of a culture of hostile takeovers into consensual German capitalism. The initial logjam was broken in 1999, when Germany became an active supporter of the takeover directive, partly as a way to mitigate and codify the unavoidable clash of capitalisms. During the ensuing process of the post-Amsterdam co-decision procedure, the EP introduced major amendments and eventually voted down the final compromise draft in a climactic vote on June 4, 2001. After further episodes, the Council reached a new and weakened compromise in November 2003, by making key features of the directive merely optional. The European Parliament passed the watered-down directive on December 16, 2003. The takeover directive is significant, as it challenges existing theoretical paradigms on the European Union to explain the process of EU mediation of globalization. How do we account for the consistent and revived push behind the directive over fifteen years on the one hand and the political and institutional sources of successful opposition to the directive after 1999 on the other? A neo-functionalist theory (Haas 1961 and Lindberg 1963) may shed light on the ‘natural’ spill-over process from the internal market to the euro to the takeover directive. It emphasizes the crucial role of the European Commission (and Frederik Bolkenstein specifically) as the agent driving the Directive. Yet, it fails to explain the timing of the revival in 1999, when the Directive should have flown naturally from Maastricht. Furthermore, a neo-functionalist framework cannot satisfactorily explain the clash between the EP and the Commission on an issue that would have furthered their common goal of institution building. Competitive Supranationalism 5 Arguably, an inter-governmental lens fares better. Inter-governmentalists such as Moravcsik (1998) emphasize the central role of large governments trying to pursue their national interest in the forum of the council of ministers. The council was indeed the crucial bottleneck for the Directive from 1992 to 2000 and again in 2002-2003. Yet, the flip flop of key countries, such as Germany, Sweden, and the UK, introduces a major problem in an inter-governmental approach: state preferences appear unclear and unsettled, tangled in a complex domestic political battlefield. Furthermore, an intergovernmental approach does not provide leverage over the major clash between the EU Commission and the EP, a clash that proved to be the crucial step in the story. Lastly, an institutional approach, in particular the focus on veto players operating under rules of the game (Tsebelis 2002), goes further in explaining the sequence and outcome of the Takeover Bill. However, Tsebelis and Garret’s (1996) legislative model fails to anticipate the willingness of the EP to turn down a bargain emerging from the conciliation committee in its third reading, despite a significant move toward the EP’s ideal point. The Takeover Bill seems to reveal a situation where the EP increased its power under the new (post-Amsterdam) co-decision rule. More importantly, the Takeover battle underlines the necessity to study legislative politics with at least two dimensions. Views on convergence of capitalist systems under globalization seemed as important as views on furthering EU integration in the EP’s vote. This article presents an alternative theoretical framework of competitive supranationalism under globalization and under codecision procedures. Unlike many other issue-areas, globalization divides the EU’s supranational actors. In particular, as they respond to financial globalization, the Commission and the EP find themselves in Competitive Supranationalism 6 different positions and in competition with each other. The EU Commission tends to give a voice to global investors, due to its own focus on competitiveness and efficiency. On economic issues, the EP tends to reflect the views of large national interest groups, particularly labor and management. The battle over the EU takeover started out as a classic vertical clash of levels, whereby the Commission struggled against the states (in the Council) over sovereignty and regulatory power. After 1999, the thrust of the takeover battle moved to a new-age horizontal clash of visions between the Commission and the EP. In the context of post-Maastricht and Amsterdam co-decision procedures, the EP’s voice greatly increased and shifted the status quo. The June 4, 2001 No-vote in the EP was unprecedented and will probably be seen as a historical turning point in the process of EU mediation of globalization. Through the case of the EU takeover directive, this paper argues that the gradual rise in power of the EP relative to the Commission and to the Council since 1994 has resulted in a complete change of ways in which the EU mediates forces of globalization. While the Commission made the choice in the 1980s to advance EU integration through pro-globalization policies, the EP has since the 1990s pursued higher EU legitimacy through attempts to regulate globalization. Other cases in point include the EP role in the regulation of genetically modified organisms and the EP positions on airline data transfers. In sum, increased pressure for change coming from the international sphere has been recently matched by an institutional increase in policy stability. Section II below presents a theoretical framework of competitive supranationalism under globalization. Section III discusses the analytical narrative of the takeover directive in five rounds, exposing the emerging rift between the European Commission and the European Competitive Supranationalism 7 Parliament. Section IV concludes with the implications of this case study on new ways of understanding the capability of the EU in shaping as well as mediating financial globalization. 2. THEORETICAL FRAMEWORK: COMPETITIVE SUPRANATIONALISM In its heydays, the European Commission had been successful in linking EU integration with pro-globalization reforms such as financial liberalization and deregulation (Sandholz and Zysman 1989; and Jabko 1999). The Commission and the EP mostly supported each other in the common cause of EU integration. However, this traditional model of a pro-globalization EU mediation process has changed since the mid 1990s due to two factors: new cleavages between the EU Commission and the EP in advancing globalization, and a shift of power from the Commission to the EP due to the codecision procedure. The traditional cleavage of EU politics has been a vertical one: the degree of sovereignty transfer to EU institutions. Key EU political debates have centered upon the degree of deepening of EU integration and the selection and sequencing of issue-areas in the movement toward greater EU governance. Both neofunctionalist theorists and intergovernmentalists tend to assume similar preference functions. States tried to minimize the transfer of sovereignty to EU institutions while maximizing the benefits of cooperation. For their part, the EU commission and the EP tried to maximize the process of sovereignty transfer and EU integration. The EP and the Commission are often seen as mutually supportive in their common endeavor. Competitive Supranationalism 8 Following the full liberalization of capital flows in the EU in 1990 and the completion of the EU internal market in 1992, however, the EU became directly enmeshed in the process of global financial integration. The integration of national financial markets into a powerful global market and the explosion in trans-border financial transactions presents a direct challenge to non-liberal capitalist systems. International capital flows soared during the 1990s, pushing world financial markets to an unprecedented level of financial integration. Net cross-border transactions in bonds and equities alone among the G-7 countries (excluding the UK) increased from under 10 per cent of GDP in 1980 to 140 percent in 1995. The volume of daily foreign exchange transactions increased from $590 billion in 1989 to $1.5 trillion in 1998 and is estimated to be above $2 trillion by the early 2000s (Simmons 2001). In particular, equity inflows represent one of the fastest growing components of global capital flows. They also constitute the most potent agent for change within nonliberal economic systems such as France and Germany. Equity flows are primarily driven by US, and, to a second degree, British, pension funds and other institutional investors. During the 1990s, as the funds managed by British and American funds grew, these investors sought to diversify their portfolios and increase their overseas investments. Between 1990 and 1998 alone, American investments in foreign shares grew from $197.3 million to $1.4 trillion (Ahmadjian and Robbins 2002). The share of foreign (mostly US and UK) shareholders in France and Germany rose from around 15 per cent to nearly 40 per cent in the 1990s alone. As the presence of foreign investors in domestic non-liberal countries increases, their voice rises and their threat of exit grows more potent. Domestic Competitive Supranationalism 9 political leaders are left to navigate between a potential increase in the cost of capital for domestic industry and the wrath of domestic constituencies. This transformation introduced a new horizontal cleavage within EU politics: the debate between efficiency and participation/equity. This new cleavage splits the EPCommission coalitions, as the two supranational partners have different preferences. With its long-term time frame, the Commission follows the twin goals of integration and economic competitiveness. In a globalized world, it realized that economic competitiveness requires financial competitiveness. The Commission thus embraces reforms that favor the free flow of capital and the attractiveness of the EU to foreign capital. In contrast, the EP’s ideal point (or median preference) is more heavily weighted toward the interests of large national interest groups, such as labor and management. The issue of financial globalization tends to pull together continental labor and management interest groups, thus creating a major counter point to the Commission’s preferences. A second key institutional variable in the clash of titans within EU supranational institutions is the increasing power of the EP through the codecision procedure. The procedure was introduced in the Maastricht treaty of 1992 (implemented in 1993) and expanded and strengthened in the Amsterdam treaty (implemented May 1999). It bestows a veto power to the EP on an increasing percentage of EU legislation, including internal market legislation. Much has recently been written on the significance of the codecision procedure (Tsebelis 1994; Tsebelis and Garrett 1996; Hix 1999; Rittberger 2000; Kreppel 2002; Judge and Earnshaw 2003; Shackleton and Raunio 2003; Burns 2004). The larger debate raises the question whether codecision has radically altered the balance of power in favor of the EP. Based on the case of novel foods regulation, Burns (2004) emphasizes Competitive Supranationalism 10 the Commission’s enduring prerogatives and influence under codecision procedures. Tsebelis (1994) depicts the EP under the pre-Maastricht cooperation rule as a ‘conditional agenda-setter’ and then with Garrett (1996) make a highly controversial argument that the Maastricht co-decision rule has actually weakened the power of the EP to influence the outcome, since the end game allowed the Council to make a constraining take-it or leaveit offer to the EP. In particular, as pointed by Rittberger (2000), the Tsebelis-Garrett model fails to account for cases where the EP chooses to turn down the final legislative compromise. This is precisely the case of the takeover directive. It reveals the true power of the EP through its capacity to unravel compromises reached between the Commission and the Council of Ministers. Competitive supranationalism refers the new cleavage between the EP and the Commission in response to financial globalization (Table 1). The Commission continues to act as first mover and as the initiator of new EU legislation. It continues to face a difficult negotiation with the Council of Ministers over the degree of sovereignty transfer. The coalition of states in the council varies according to the vagaries of domestic politics in major countries. What is new in the decision-making process, however, is the third and last step where the compromise reached between the Commission and the Council can founder in the EP. In turn, whether the EP voice is expressed through an actual negative vote or, ex ante, through the threat of a negative vote, the EP’s divergence in matters related to globalization is forcing the Commission and the Council to include other interest groups. The clash between the EP and the Commission over globalization represents an underlying clash of interests between investors and urban voters on one Competitive Supranationalism 11 hand and labor and management of the other hand (see Appendix 1 for details of coalitions on both sides of the divide). Table 1. Two-dimensional Cleavages in the EU in Responses to Financial Globalization Horizontal Cleavage Vertical Cleavage Sovereignist (states) Federalist (EP, Commission) Efficiency / Output Legitimacy (Commission) Participation/Process Legitimacy (EP) Competitive adaptation; pro-globalization change; EU as catalyst only Cushioning of globalization through national regulations Adaptation/facilitation (Jean Monnet Method) liberalization through EU level Managing globalization through active mediation and selection at EP level 3. ANALYTICAL NARRATIVE: THE TAKEOVER DIRECTIVE BATTLE AND COMPETITIVE SUPRANATIONALISM WITHIN THE EU The takeover directive aims at promoting a ‘common framework for cross-border mergers and acquisitions and facilitating corporate restructuring’ (Beffa, Langenlach, and Touffut 2004: 4). In particular, it was conceived as a way to give equal treatment to all shareholders and protect minority shareholders (including US and UK pension funds) who are often kept in the dark by managers during takeover bids in continental Europe. By 1999, the takeover directive became part of a coherent bundle of 42 reforms, known as Financial Services Action Plan, pushed by the Commission to create a unified EU financial market by 2005. These rules were expected to increase the flow of capital across Competitive Supranationalism 12 EU borders and to make it easier and cheaper to raise money. The plan won the applause of financial investors, both European and American. In March 2000, at the Lisbon EU council, EU leaders put one more lofty goal on top of this multi-level effort, by integrating it in their declared aim of making Europe ‘the world’s most competitive economy by 2010’. They specifically referred to the takeover directive as one of the crucial components in this plan (McCahery et al. 2003). The political battles about the Directive unfolded along four fronts. First, Article 5 enshrines the protection of minority shareholders and requires bidders to make an equal offer to all shareholders. The aim of the article is to prevent speculative attacks and insider deals (Beffa, Langenlach, and Touffut 2004: 8). This article survived in the final bill. Second, a key component of the Directive, a controversial Article 9 requires the board of directors to remain neutral and prohibits defensive measures designed to frustrate bids (thus moving toward a more Anglo-Saxon system). This article led to fierce debates, particularly after December 2000, when the EP, under the leadership of its rapporteur, Klaus Lehne (of CDU, Germany) introduced amendments on the topic. Debates ensued over the possibility of ‘poison pills’. Lehne pushed for the right of defenders to issue shares to special ‘white knights’ and highlighted two key concerns. First, German companies would be defenseless against US companies (where Delaware rules give a degree of defensive rights to managers). Second, the EU would still be a level playing field, given the endurance of ‘golden shares’, shares that allow governments to prevent the sale of companies they consider strategically important. Lehne likewise emphasized the case of EDF (Electricité de France), a state-owned French utility company that is able to take over utilities in Spain and Italy, while being protected from Competitive Supranationalism 13 takeovers itself. The final takeover outcome makes the entire Article 9 optional, thereby allowing directors to frustrate hostile bids through poison bills or multiple voting shares defenses without shareholder approval. Third, Article 11 aims at banning multiple voting rights and imposing other restrictions on voting rights, although a decision was made early on not to ban the double share system used in France, where shares held for over two years carry double voting rights. There were intense debates about this article and, as for Article 9, the final outcome made it optional. Finally, a major bone of contention related to workers’ rights. In December 2000, the EP added provisions requiring consultations with a company’s workers before a takeover offer is made,. This did not fly. The 2001 compromise draft would have required bidding company to detail in its prospectus the impact of its offer on employment working conditions and the location of operation. Employees’ views would then have been attached to the recommendation presented by the board to shareholders.3 This proved insufficient for most national labor unions and for the EU-wide labor federation (ETUC). They argued for full worker consultation in the process. The final 2003 outcome includes significant right of information for workers. The issue, however, ended up splitting the grand EP coalition between PSE and EPP in December 2003. The Socialists argued that information rights were not sufficient and voted against the final bill.4 Debates over these four issues revealed an increasing rift between the Commission and the EP between 1989 and 2003, a period which can be divided into five rounds for analytical purpose. In round one, the battle started out as a classic vertical contest between EU institutions and states that are unwilling to transfer sovereignty. In Competitive Supranationalism 14 round two, the growing presence of foreign investors in the EU scene had shifted the balance toward the Commission’s preferences by the mid 1990s. Then, in round three, the Commission solved the vertical dilemma and found a compromise with states, only to discover a novel front: a horizontal split with the EP. The directive nearly fell victim to this supranational battle of titans. In Round four, the Commission revived the directive while addressing some of the EP’s concerns, only to full victim to the opposition of the Council. In the last round, the Council took the initiative and found a new compromise with the EP, albeit a much weaker one than initially foreseen and one that was fiercely opposed by the Commission. The Commission appeared as the key coordinator throughout the five rounds, but the EP became the ultimate veto point. 3.1 Round 1: Initial Commission Blueprint and Defeat in the Council of Ministers, 1989-1994 Building on the great EU regulatory move of the Single European Act (1986) in the late 1980s, the European Commission first drafted a takeover directive in 1989 (OJC 64, 14/3/1989). The initial directive was a detailed document specifying all required terms of a takeover bid. Interestingly, this first and crucial draft originated from the Commission and preceded the Maastricht Treaty and the euro. It came on the heels of the package on the removal of capital controls in all EC countries (achieved in 1990) and other financial deregulatory moves. The rough battle around De Benedetti’s hostile bid on Société Generale de Belgique provided an incentive for the Commission to act. It seemed clear to the Commission that the Europe needed some kind of ‘Geneva Competitive Supranationalism 15 convention’ to avoid real warfare among European companies (interview with senior Commission official, 02/12/2003). Most member states opposed this draft directive as too detailed and an unwarranted intrusion into their domestic policy (McCahery et al. 2003). At the Edinburgh EU Council meeting of December 1992, the Commission announced that it would revise the proposed directive. It received overall albeit tepid approval to move in this direction. This position was only reconfirmed at the Essen Council meeting of December 1994, without further progress. Throughout these five years, the British opposition was particularly strong. Britain feared the expansion of EU power into an area of British strength and suggested that the EU simply adopt the UK Takeover Code.5 Germany and the Netherlands were strongly opposed to a fundamental shift in their capitalist systems. Thus, the EU’s elite bureaucracy, the Commission, out of a normative conversion to global standards on the one hand and calculations that it would both serve EU competitiveness and EU integration on the other, pushed the initial draft of the Directive. Most states, however, did not feel the incentives to shift the status quo. The level of foreign ownership in stock markets such as Germany, France, Spain, or Italy, remained relatively low until 1995 (10-15 per cent) and the pressures of equity investors was not yet keenly felt. 3.2 Round 2: From the Revised Commission Blueprint to Agreement in the Council, 1996-2000 In February 1996, the Commission brought the takeover directive back on top of the EU legislative agenda when it proposed a new and simplified version that was based Competitive Supranationalism 16 on the British City Code on Takeovers and Mergers.6 The proposal was less detailed so as to obtain British support. British support was slow to come, partly because of enduring suspicions about the Commission, and partly because of conflicts with its own regulatory system. The UK expressed concerns that the Directive might increase the legal rights of those involved in takeover bids. The UK Takeover Panel, in a fight for its own survival, argued that takeovers might end up ‘snarled in legal wrangling’ and that the speed and efficiency of the code would be eroded.7 Around 1998, however, the lineup of states was shifting. The UK could count on Ireland, Netherlands, and Sweden as clear allies opposing the Directive, but that would be insufficient to defeat a qualified majority vote. In mid-1998, Austria (as the EU presidency) gave priority to the Directive with tepid support from Germany. On their part, Belgium, France, Spain, and Italy formed a coalition pushing for changes in the takeover directive, particularly pushing for priority regulation of takeovers in the country of listing.8 In April 1999, Germany (hosting the presidency of the EU) worked on building a compromise with the UK, in an attempt to avoid marginalizing the country where over half of EU takeovers were taking place.9 In June 1999, the UK indicated that it was ready to accept the compromise. The German leadership, under Third Way leader Schroeder had borne fruits. However, on June 21, 1999, the takeover directive hit an unexpected rock: Gibraltar. Instead of approving the directive, the council of ministers had to shelve the proposal. Indeed, Spain became worried that Gibraltar might open its own backdoor takeover regulatory authority. This peculiar and puny obstacle ended up blocking the progress of the takeover directive for a full year. Competitive Supranationalism 17 Meanwhile, Germany suddenly moved from being a mild supporter of the Directive to become a strong supporter. The move was caused by the shock of the largest ever foreign hostile takeover involving Vodafone AirTouch’s attempt to take over Mannesmann. Germany expressed worry about this unmitigated clash of capitalisms and hoped that the takeover directive could remedy this. 10 Mario Monti, the EU Commission for Competition also waded in, promising that the EU authorities would fully review and scrutinize the Vodafone deal. He also added support for an urgent takeover directive. By 1999, foreign investors held 40 per cent of the French stock market and nearly 20 per cent of the German stock market. Flows of capital (except for the Vodafone deal) seemed to favor France over Germany. France had shifted to become a defender of proinvestor regulations and Germany was beginning to shift as well. The Commission saw added urgency for its project. On June 19, the EU takeover directive was finally passed unanimously by the council of ministers on agriculture (an oddity due to the absence of necessary discussions and to the concern for speed). At this point, there seemed to be a convergence between the Commission and all state leaders on the urgent need for a regulation that would both mitigate the British-German clash of capitalisms and encourage the flow of capital into the EU. By 2000, this clearly appeared to be related to EU competitiveness and long-term growth. 3.3 Round 3: EP Counter-Voice and Defeat of the Directive, 2001 The Directive entered the next step in the co-decision procedure, the review by the EP. The EP relies heavily on the institution of a rapporteur in its proceedings. Rapporteurs guide the legislation through and suggest amendments as part of a final Competitive Supranationalism 18 report that serves as the key template for the final vote in the plenary.11 In this case, the rapporteur was Klaus-Einer Lehne, a German Christian democrat (CDU). Under his leadership, a long list of concerns emerged from committee discussions in the EP. As noted above, the concerns related to the lack of defensive measures allowed to managers, to workers’ rights, and to the jurisdictional powers over takeovers. On December 12, 2000, the EP confirmed most of these amendments in a general vote. This vote triggered the last step of the co-decision procedure: conciliation. A conciliation committee was created with 15 MEPs and 15 state ministers with the aim of reaching a compromise or Joint Text. The ideal point of the state council and the Commission proved far from the ideal point of the EP. Indeed, the EP was far more receptive to the positions of key interest groups such as labor and management than the Commission and the state council. Thanks to its increased powers since Maastricht, the EP could force the text back to the drawing board by passing amendments. The EP move drew angry critiques from the Commission (Mario Monti and Fritz Bolkenstein) as well as from Baron Lamfalussy who argued that quicker legislative mechanisms had to be designed in the ‘instantaneous internet age’.12 An irony in the process was the fact that the German CDU (pro-business) led the opposition against a draft spearheaded by German Social Democrat leader Schroeder. In early April 2001, the formal process of conciliation was launched after difficult meetings between the Commission and Klaus-Einer Lehne. The process gave a deadline of six weeks for the state council and the EP to reach a compromise. Four weeks into the process, Germany announced that it was backing out of the agreement on the takeover directive.13 It was revealed that the German government faced strong lobbying pressures Competitive Supranationalism 19 from both large corporations and labor unions. It probably also felt politically vulnerable in a battle where it had let the opposition occupy its usual political ground. The German move put Sweden, the holder of the EU presidency, in a bind. While trying to broker a compromise with the EP, Sweden had to worry for a potential crippling back-door agreement between Germany and the UK. Spain began to express concerns that the Directive would leave its companies undefended in the face of US threats.14 German counter-voices also arose, led by young defenders of the new equity culture and by Jurgen Schrempp, the (former) paradigm of German shareholder value.15 Meanwhile, the Commission forged ahead, unveiling new components of its plan for a single European financial markets and declaring that the Takeover Bill and others would soon be approved.16 The Commission also promised to push its fights against golden shares and to investigate Volkswagen and seven other German companies that have discriminatory statutes against investors. A compromise deal was reached at the last hour. It involved EU states, the EP representatives, and the Commission despite its lack of involvement in this round in the process. The key component of the compromise was to introduce a five-year transition period before removing managerial defenses against investors. The text itself was closer to the ideal point of the Commission and the state council. Other minor changes related to employee rights. On the EP side, the key leader and signatory of the deal with Klaus Lehne, the same MEP who ended up voting no on this deal in the EP vote of June 4, 2001. Lehne did say that he was dissatisfied with the resulting compromise.17 On the council’s side, the vote was 14-1, with Germany dissenting from the deal. Fresh from this vote, Germany started lobbying all its MEPs to vote against the draft. Competitive Supranationalism 20 The battle reached its climax on July 4, 2001, when the EP took its final vote on the joint text approved by the conciliation committee. This vote became one of the most peculiar votes in the EP’s history. All EP party groups (except the ELDR Liberal Democrats and the Non-attached group) broke down within their middle. On the yes side, the coalition included Benelux liberal democrats, conservatives from the UK, France, Spain, and Italy; ‘modern’ socialists from France, Italy, and the UK; sovereignists, and even one Italian communist MEP. On the no side, all German MEPs (except one CDU member) were joined by most Austrian delegates, as well as key groups of Spanish socialists and Italian, Greek, and Dutch Christian Democrats. The most pro-EU French party (the UDF) ended up voting with its pro-EU German friends against the Directive, while anti-EU sovereignists like Charles Pasqua joined socialist EU-proponents like Michel Rocard. Adding to the drama of the moment, the final vote was an unprecedented tie (273-273), and the EP President (who did not vote) declared that the Directive had passed, only to discover an EP rule that a tie meant a failure to pass. The result hung in the balance as one voting MEP could not be identified. In the end, the Directive failed on that fourth of July. Tables 2 analyzes the big voting blocs on each side of the divide. Competitive Supranationalism 21 Table 2. Votes for and against the EU takeover directive FOR Votes 1 2 Party Name Country 34 Conservative and Unionist Party UK 26 Labor Party UK 3 20 Partido Popular Spain 4 16 French Traditional Right (RPR, DL, UDF) France 5 16 Parti Socialiste + MRG/PRG France 6 14 Liberal Democrats BENELUX Belgium, Netherlands, Lux 7 13 Italian Nationalists and Independents Italy 8 12 Democratici di Sinistra (PSE) Italy 9 10 Liberal Democrats UK 10 8 Partido Socialista Portugal 11 7 French Sovereignists (RPF-Pasqua,MPF) France 12 6 Chasse-Peche France 13 Total Explained 4 Venstre (Liberal-Democratic) Denmark 186 (68%) AGAINST Votes 1 66 2 46 Continental Christian Democrats: CDU-CSU + OVP + CDA Germany, Austria, Netherlands Continental Social Democrats: SPD + SPO + Arbeid Germany, Austria, Netherlands 3 29 Forza Italia + PPE Allies Italy 4 20 Spain 5 Total Explained 18 Partido Socialista Obrero Español French Unreformed Left (PCF, Greens, dissidents) France 179(66%) Source: European Parliament, Minutes of the Proceedings : Results of roll-call votes. Author’s identification of parties and countries and calculations. The yes votes represented a collection of small and diverse components: various liberal democrats, conservatives from the UK, France, and Spain, and social democrats from France, Italy, and the UK, together with odd nationalists. The no votes were from a few large coherent blocks, an alliance between Christian Democrats from Germany, Austria, the Netherlands, and Italy, and Social Democrats from Germany, Austria, the Netherlands, and Spain (see Appendix 1 for details of coalitions). The ideal point of the Competitive Supranationalism 22 EP remained different from that of the state council and Commission. The EP proved to be a full veto player and full agenda-setter under the revamped post-Amsterdam rules. 3.4 Round 4: Revival and Defeat in the Council, 2002-2003 The Commission absorbed the defeat. Yet, convinced that the takeover directive was badly needed for EU’s competitiveness and concerned that it was a key plank of its overall master plan for an effective EU financial market, the Commission revived it right away in July 2001. The Commission appointed a nine-member High Level Group of Company Experts, led by an academic, Jaap Winter, to review all issues raised during negotiations with the EP and in the EU council. The Group of Experts produced a report in February 2002 that actually strengthened the takeover directive and maintained the controversial Article 9. In particular, the new draft banned multiple voting rights—a practice common in Sweden18—and introduced the notion of breakthrough, that is, the possibility to override all oppositions once a bidder controlled 70 per cent of the shares.19 Investors applauded the new proposals. But neither the Council nor the EP were amused. Fresh opposition appeared from the leading business family in Sweden, the Wallenberg family. This major lobbying move forced the Swedish government to shift its stance to opposition. As for Germany, it introduced in January 2002, its own takeover code that had the merit to clarify unclear elements but also enshrined managerial defense tools. In February 2003, the Directive seemed to gain a boost, when the UK, Germany, and France produced an agreement that they should push overall EU reforms and support Commission’s efforts to improve European competitiveness. But there was no specific mention of the takeover directive. In the end, in May 2003, the Council decided to shelve Competitive Supranationalism 23 the directive, when a backroom deal between Germany and the UK sealed UK opposition on the directive in exchange for German opposition for the directive on temporary workers’ rights. Another deal involving France with an exchange on Agriculture policy seemed to provide more back up for Germany, in addition to potential support from Austria and Sweden. At this stage, the takeover directive died again in the hands of oldstyle EU council log-rolling, although the looming threat of another EP vote may have decreased the value of a positive move for countries like the UK and France. The process further proved how difficult EU mediation of global finance had become under current institutional rules. Meanwhile, reports indicated that capital inflows (both equity and FDI) stagnated in the EU since 2000 and that the overall EU competitiveness was suffering. 3.5 Round 5: Council-EP Weak Final Compromise and Commission Wrath In the last round, the three supranational protagonists, the Commission, the Council, and the EP reached the only possible compromise that could save the takeover directive. The final outcome is much closer to the EP’s ideal point than to the Commission’s, leading the Commission to consider a complete withdrawal of the proposal before the final vote. In the end, concern about its lack of democratic legitimacy and the strength of the Council-EP coalition led the Commission to accept the outcome. In the words of a senior Commission official, ‘if the Council and the EP have a strong majority in favor, it is very hard for the Commission to go against it. Is it democratic for the Commission to go against the people?’20 Competitive Supranationalism 24 In June 2003, the Greek presidency proposed to pass a symbolic takeover directive by entirely removing the key articles, articles 9 and 11. Commissioner Bolkenstein vetoed this proposal, saying ‘article 9 was non-negotiable’.21 By November 2003, under Italian leadership, the Council prepared a compromise that was acceptable to the EP: making articles 9 and 11 simply optional. Despite strong Commission opposition, US concerns about protectionism, and lobbying by foreign investors, EU states in the Council voted 14-0 (with Spain abstaining) in favor of the watered-down compromise on November 27. The potential veto of the EP and the looming EP elections of June 2004 proved decisive in shaping the final outcome. In the end, the EP approved the bill 321219 on December 16, 2003. Unlike the July 2001 vote, the EP vote was mostly among party lines. Liberals (NDLR), Conservatives (EPP), and some nationalists (UEN) backed the deal, while Socialists (PSE), Greens, and Unified Left (GUE) members voted against the deal. Indeed, the emerging grand EP coalition of 2001 that had brought together continental conservatives and socialists were divided over the issue of employee rights. 4. CONCLUSION This paper has argued that the EU takeover directive provided a unique prism to analyze the clash of capitalisms under globalized finance and the role of the EU as a mediator of globalization. A Commission concerned about the long-term competitiveness of the EU spearheaded the EU’s role as a mediator of financial globalization. By 1999, the coalition of foreign investors, liberal capitalists (UK and Nordic countries) and Commission had led the revival of the directive. This coalition was opposed by a continental labor-management coalition that heavily dominated the ideal point of the EP. Competitive Supranationalism 25 The clash of capitalisms under globalization became a clash between Commission and EP, an unusual conflict between two pro-integration actors known for back-scratching deals. I call this emerging horizontal split between supranational actors within the EU on issues related to globalization competitive supranationalism. The expanding codecision procedure has given the EP and the large interest groups that it represents the power to oppose pro-globalization compromises reached between the Commission and the Council of Ministers. The resulting clash of titans has changed the trajectory of the EU’s response to globalization. On the takeover directive, the role of the rapporteur in the EP (Klaus Lehne) gained a prominence equal to that of the Commissioner in charge of the file. In addition to the case of the takeover directive, the EP has also expressed its divergent interests and power on issues such as the regulation of genetically-modified organisms (GMOs, 1996-2003), the liberalization of harbor services (November 2003), and the transfer of air passenger data (April 2004). Since the late 1990s, the Commission has thus proved less able to move forward on its vast plan for a unified EU financial market and its pro-globalization competitiveness agenda. In the short-term, the EU has proved more democratic but unable to deal with the build-up of external financial pressures. The incentives for change coming from global finance are offset by a rise in the number of veto players in the EU legislative process, particularly by the rise of the EP as a fullfledged veto player and agenda-setter. Competitive Supranationalism 26 Appendix 1. Underlying Coalition Lineup in the Battle over the takeover directive EU level Groups (and global level) Net National Preferences (based on 2001 EP vote) Sub-State Level PRO • EU Commission (Bolkenstein) • ECJ (ruling on ‘Golden Shares’)** • Baron Lamfalussy • Investor Groups: - EUROFI: Paris-based pressure group for single financial market - Federation of European Securities Exchanges - US Pension Funds (CalPERS) • Think Tanks: - CEPS (Center for European Policy Studies) Denmark, Finland, Sweden22 France (divided) Luxembourg Portugal UK, Ireland (including Pat Cox) • Investor Groups: - UK: FT, Association of British Insurers (Montagnon) - Germany: young equity activists, Jurgen Schrempp (Daimler Chrysler) + Deutsche Bank Research (Schroder) • Management: - UK - FR: AFEP (Association Francaise des Entreprises Privees) (divided position) - Ger: Siemens (Baumann) • Government Bodies: - UK Takeover Panel (hesitations) CON • European Parliament • Labor: European Trade Union Confederation (ETUC) Belgium, Netherlands Germany, Austria23 Greece Spain (divided) Italy (divided) • Management: - Volkswagen, BASF - Wallerstein (Sweden) - French leaders (Beffa, Peyrelevade, mixed position) • Labor: - Mining, Chemical, and Energy Workers Union (Germany) • Sub-state governments: - Lower Saxony (VW) Competitive Supranationalism 27 REFERENCES: Adolff, Johannes (2002) ‘Turn of the Tide? The Golden Share Judgements of the European Court of Justice and the Liberalization of European Capital Markets’, German Law Journal, 3(8) 1. Ahmadjian, Christina and Gregory Robbins (2002) ‘A Clash of Capitalisms: Foreign Shareholders and Corporate Restructuring in 1990s Japan’, Working Paper 203, New York: Columbia Business School. Albert, Michel (1991) Capitalisme Contre Capitalisme, Paris: Editions du Seuil. Beffa, Jean-Louis, Langenlach, Leah and Touffut, Jean-Philippe (2003) Comment Interpréter (le projet de) la Directive O.P.A.?, Prisme, (November), Paris: Centre Saint-Gorbain. Betts, Paul and Hargreaves, Deborah (2001) ‘No way in: Germany’s rejection of a key provision of an EU takeover code throws another obstacle in the way of dynamic cross-border capitalism in Europe’, Financial Times, 3 May. Boyer, Robert and Rogers Hollingsworth (eds) (1997) Contemporary Capitalism, Cambridge: Cambridge University Press. Centre Saint-Gobain Pour la Recherche en Economie (2003) Comment Comprendre la Directive Européenne sur les OPA?: Compte-Rendu du Débat (March 27), unpublished document. Competitive Supranationalism 28 Cioffi, John W. (2002) ‘Restructuring ‘Germany Inc.’: The Politics of Company and Takeover Law Reform in Germany and the European Union’, Law & Policy 24(4): 355-402. Crouch, Colin and Wolfgang Streeck (1997) Political Economy of Modern Capitalism: Mapping Convergence and Diversity, London: Sage. Dombey, Daniel and Williamson, Hugh (2001) ‘Berlin glee greets demise of EU takeover directive’, Financial Times, 6 July. Dombey, Daniel and Mann, Michael. (2002) ‘The European parliament is often distracted by world affairs but has a critical legislative role’, Financial Times, 10 April. Dore, Ronald and Suzanne Berger (eds) (1996) National Diversity and Global Capitalism, Ithaca: Cornell University Press. Dore, Ronald (2000) Stock Market Capitalism: Welfare Capitalism, Oxford: Oxford University Press. Europarl Newsreport (2003) ‘MEPS back compromise on takeovers’, 27 Nov. European Parliament (2003) Minutes: Result of Roll-Call Votes – Annex 2, 16 Dec 2003. European Parliament (2001) Minutes of proceedings: Result of Roll-Call Votes, 7 April 2001. Financial Times (1998a) ‘Move to dilute EU takeover rules: Brussels directive UK seeks to continue with non-statutory system’, Financial Times, 28 Sept. Financial Times (1998b) ‘Discord over Brussels’ takeover directive’, Financial Times, 4 Oct. Competitive Supranationalism 29 Financial Times (1999a) ‘EU aims to push through takeover harmony rules: German compromise may appease UK and end 10-year deadlock’, Financial Times, 12 April. Financial Times (1999b) ‘Germans Seek New Bid Rules’, Financial Times, 23 November. Garrett, Geoffrey (1998a) ‘Global Markets and National Politics: Collision Course or Virtuous Cycle?’, International Organization 52(4): 787-824. Hargreaves, Deborah (2000) ‘European parliament backs measures that may end hostile takeovers in EU’, Financial Times, 14 December. Hargreaves, Deborah (2001a) ‘Germany backs out of takeover accord: Change of heart could endanger Europe’s industrial integration’, Financial Times, 2 May. Hargreaves, Deborah (2001b) ‘Compromise found on takeover rules’, Financial Times, 7 June. Hargreaves, Deborah (2001c) ‘Germans seek to kill off EU takeover directive’, Financial Times, 3 July. Hargreaves, Deborah (2001d) ‘Europe’s liberalisers hurt by legal backing for ‘golden shares’, Financial Times, July 4. Hall, Peter and David Soskice (eds) (2001) Varieties of Capitalism: The Institutional Foundations of Comparative Advantage, Oxford: Oxford University Press. Hay, Colin and Rosamond, Ben (2002) ‘Globalization, European Integration and the Discursive Construction of Economic Imperatives’, Journal of European Public Policy 9(2): 147-67. Competitive Supranationalism 30 Hix, Simon (1999) The Political System of the European Union, Houdmills: Palgrave Hooghe, Liesbet (2001) The European Commission and the Integration of Europe. Cambridge: Cambridge University Press. Jabko, Nicolas (1999) ‘In the Name of the Market: How the European Commission Paved the Way for Monetary Union’ Journal of European Public Policy 6(3): 475-95. Judge, David and Earnshaw, David (2003) The European Parliament, European Union Series, New York: Palgrave Macmillan. Katzenstein, Peter (1985) Small States in World Markets, Ithaca: Cornell University Press. Keohane, Robert and Milner, Helen (eds) (1996) Internationalization and Domestic Politics, Cambridge: Cambridge University Press. Kitschelt, Herbert, Lange, Peter, Marks, Gary and Stephens, John D. (eds) (1999) Continuity and Change in Contemporary Capitalism. Oxford: Oxford University Press. Krasner, Stephen (1999) Sovereignty: Organized Hypocrisy, Princeton: Princeton University Press. Kreppel, A. (2002) the European Parliament and the Supranational Party System: A Study of Institutional Development, Cambridge: Cambridge University Press. McCahery, Joseph A, Renneboog, Luc, Ritter, Peer and Haller, Sascha (2003) The Economics of the Proposed European takeover directive, Centre for European Polcy Studies (CEPS), Research Report in Finance and Banking No. 32. Competitive Supranationalism 31 Marks, Gary and Hooghe, Liesbet (2001) Multi-level Governance and European Integration, Governance in Europe Series, Oxford: Rowman & Littlefield Publishers Inc. Menz, Georg (2003) ‘Re-regulating the Single Market: national varieties of capitalism and their responses to Europeanization’, Journal of European Public Policy 10(4): 532-55. Moravcsik, Andrew (1991) ‘Negotiating the Single European Act: National Interests and Conventional Statecraft in the European Community’ International Organization 45(1): 651-88. Moravcsik, Andrew (1998) The Choice for Europe: Social Purpose and State Power from Messina to Maastricht, Ithaca: Cornell University Press. Norman, Peter (2001) ‘MEPs to be sidelined over market reform’, Financial Times, 4 May. Rhodes, Martin, Heywood, Paul and Wright, Vincent (1997) Developments in West European Politics, New York: St. Martin’s Press. Rittberger, Berthold (2000) ‘Impatient Legislators and New Issue Dimensions: a Critique of the Garrett-Tsebelis standard version of Legislative Politics’ Journal of European Public Policy 7(4): 554-75. Sandholz, Wayne and Zysman, John (1989) ‘1992: Recasting the European Bargain’ World Politics 42(I): 95-128. Scharpf, Fritz (1999) Governing in Europe: Effective and Democratic?, Oxford: Oxford University Press. Competitive Supranationalism 32 Schmidt, Vivien (1996) From State to Market?: the Transformation of French Business and Government, Cambridge: Cambridge University Press. Schmidt, Vivien A. (2002) The Futures of European Capitalism, Oxford: Oxford University Press. Simmons, Beth (2001) ‘International Politics of Harmonization’ International Organization 55(3): 589-620. Streeck, Wolfgang, and Yamamura, Kozo (2001) The Origins of Nonliberal Capitalism, Ithaca: Cornell University Press. Tsebelis, George (1994) ‘The Power of the European Parliament as a Conditional Agenda Setter’, American Political Science Review 88(1): 128-42. Tsebelis, George (2002) Veto Players: How Political Institutions Work, Princeton: Princeton University Press. Weber, Steven (ed) (2001) Globalization and the European Political Economy, New York: Columbia University Press. Yamamura, Kozo and Streeck, Wolfgang (eds) (2003) The End of Diversity? Prospects for German and Japanese Capitalism, Ithaca: Cornell University Press. Zysman, John (1983) Governments, Markets, and Growth Ithaca: Cornell University Press. Competitive Supranationalism 1 33 Multi-level governance theorists Hooghe and Marks (2000), for example, demonstrate that all economic spheres have undergone a massive transfer of sovereignty from the national to the EU level between 1968 and 2000. 2 Financial Times, December 4, 2002, p.11. This figure relates to the overall impact of creating a unified financial market. The takeover directive is a key component of this program, but not the only one. See next paragraph. 3 Argument presented by the Swedish Trade Minister and the Swedish main union leader. Dombey, Daniel and Williamson, Hugh (2001) ‘Berlin glee greets demise of EU takeover directive’, Financial Times, 6 July. 4 Europarl Newsreport (2003) ‘MEPS back compromise on takeovers’, 27 Nov. 5 Interview with a senior Commission official on December 2, 2003. 6 Europarl Newsreport (2003) ‘MEPS back compromise on takeovers’, 27 Nov. 7 Financial Times (1998) ‘Move to dilute EU takeover rules: Brussels directive UK seeks to continue with non-statutory system’, Financial Times, 28 Sept. 8 Financial Times (1998) ‘Discord over Brussels’ takeover directive’, Financial Times, 4 Oct. 9 Financial Times (1999) ‘EU aims to push through takeover harmony rules: German compromise may appease UK and end 10-year deadlock’, Financial Times, 12 April. 10 Financial Times, November 23, 1999 11 Dombey, Daniel and Mann, Michael. (2002) ‘The European parliament is often distracted by world affairs but has a critical legislative role’, Financial Times, 10 April. 12 Hargreaves, Deborah (2000) ‘European parliament backs measures that may end hostile takeovers in EU’, Financial Times, 14 Dec. 13 Hargreaves, Deborah (2001) ‘Germany backs out of takeover accord: Change of heart could endanger Europe’s industrial integration’, Financial Times, 2 May. 14 Betts, Paul and Hargreaves, Deborah (2001) ‘No way in: Germany’s rejection of a key provision of an EU takeover code throws another obstacle in the way of dynamic crossborder capitalism in Europe’, Financial Times, 3 May. 15 ibid 16 Norman, Peter (2001) ‘MEPs to be sidelined over market reform’, Financial Times, 4 May. 17 Hargreaves, Deborah (2001) ‘Compromise found on takeover rules’, Financial Times, 7 June. 18 Ironically, the Commission introduced this feature to win the approval of the EP Rapporteur, Klaus Lehne. Lehne had spoken in favor of a level playing field and in favor of the removal of all obstacles used by countries other than Germany. Interview with two Commission officials, December 2, 2003. 19 Interview with a senior Commission official, December 2, 2003. 20 Interview with two senior Commission officials, December 2, 2003. 21 Interview with a senior Commission official, December 2, 2003. 22 A particular factor in the case of Sweden seems to have been the role of the Swedish presidency of the EU in January-June 2001. Competitive Supranationalism 23 34 This clear rejection by Austrian MEPs took place in spite of the crucial role of Austria as a champion of the Directive during its Presidency of the EU in July-December 1998. TOTAL: 8457 WORDS (including notes, references, and appendix) (not counting abstract) DATE: June 14, 2004