ACCT 5327 - Robert Ricketts

advertisement

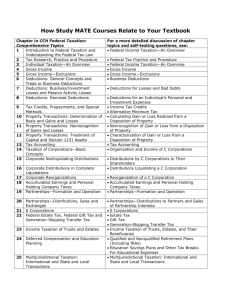

ACCT 5327 Advanced Taxation Fall, 2013 Instructor: Robert Ricketts Frank M. Burke Chair in Taxation Director, School of Accounting, Rawls College of Business Office: BA E368 Phone/email: 834-3180 rricketts@ba.ttu.edu Web Address: http://rricketts.ba.ttu.edu Required Text: CCH Federal Taxation Comprehensive Topics. Smith Harmelink, Hasselback, 2014 edition. Course Objectives: The objectives of this course are to conduct an in-depth analysis of the taxation of corporations, partnerships and S corporations. We will begin the semester with an overview of the income tax framework applicable to corporations, focusing on the analysis and determination of the total tax paid on corporate income, and how tax professionals structure transactions in order to minimize this total tax burden. We will study special rules applicable to compensation of officers and employees and how those rules affect corporate operations. We will also compare how corporate income is reported to shareholders and to the IRS, reconciling the two sets of results and analyzing the economic and political ramifications of the corporate income tax. We will then move to an analysis of the tax costs associated with alternative business structures. The two primary alternatives are partnerships and S corporations, each of which is subject to only a single layer of income tax, paid at the investor level. By the end of the semester, students will be able to recognize how different forms of organization are useful in different economic circumstances, and how professionals plan transactions to minimize taxes and maximize after-tax economic consequences to the business and its owners. Learning Outcomes: Upon successfully completing this course, students will be able to: Measure the tax consequences of formation of different types of business entities; Understand the differences in the tax costs associated with conducting a business through a corporation, a partnership, or an S corporation; Recognize the differences in accounting for taxes for GAAP and tax reporting purposes; Calculate the tax consequences of distributions from a business entity to its owners; Analyze the differences between alternative approaches to the acquisition, merger, disposition, etc. of a business unit in a consolidated business activity; and Understand the life cycle of a business organization and explain how taxes affect the structure of transactions at different stages of that life cycle. Grading (Assessment): Grades will be based on three examinations, a comprehensive income tax project, and a series of group cases. Course activities will carry the following weights: Regular Exams (2) Final Exam – Comprehensive Comprehensive Income Tax Project Group Assignments Total 200 points 100 points 75 points 75 points 450 points To receive an A, you must accumulate 405 points; for a B, you must accumulate 360 points, 315 for a C and 270 for a D. Please note that the grading process is a mathematical calculation of the components listed above. Extra credit is not available. All students will be graded equally and fairly. Academic Honesty: Integrity is the cornerstone of the practice of accounting, and accounting students in the Rawls College of Business do not cheat, nor do they tolerate cheating by their classmates. Any student found cheating on any assignment in this class will receive an F for the course. In egregious circumstances, I will pursue more substantial sanctions, up to and including expulsion from the Honors College, the Rawls College of Business, and/or the University. Do not test this policy. If you are unsure whether a particular behavior may be construed as inappropriate, contact me before engaging in it. Integrity is a minimum requirement for all students participating in accounting courses in the College of Business. Those who lack it should not plan to enroll in subsequent accounting courses. Disabling Conditions: Any student who, because of a disabling condition, may require special arrangements in order to meet course requirements should contact the instructor the first week of classes to make necessary accommodations. Civility in the classroom The Texas Tech University Provost has asked that the following statement be included in this syllabus: “Students are expected to assist in maintaining a classroom environment which is conducive to learning. In order to assure that all students have an opportunity to gain from time spent in class, unless otherwise approved by the instructor, students are prohibited from using electronic devices, challenging instructor’s authority, eating or drinking in class, coming in late or leaving early, making offensive remarks, reading newspapers, sleeping or engaging in any other form of distraction. Inappropriate behavior in the classroom shall result in, minimally, a request to leave class.” Religious Holidays A student who is absent due to a religious holy day will be allowed to take an exam or complete an assignment missed on that day. Changes I reserve the right to make changes in the syllabus, including changes in the number or dates of assignments and exams. In particular, I reserve the right not to count scores on assignments or exams in the event that the integrity of the assignment or exam is, or may have been, compromised. Any changes in assignments or due dates will be announced in class. It is the responsibility of each student to attend class and become aware of such changes. Revised Schedule PART I: The Corporate Income Tax Week Date Topic 08/27 Overview – The Double Taxation of Corporate Income Calculating the Corporate Income Tax Regulatory uses of the corporate tax--§199 Stock Options—consequences for employees and employers Accounting for Book-Tax Differences Reporting Book-Tax Differences to Investors – 1 2 3 4 5 6 08/29 09/03 09/05 09/10 09/12 09/17 09/19 09/24 09/26 10/01 10/03 Tax Consequences of Corporate Formation Distributions to Shareholders—Dividends and Constructive Dividends Case 1 EXAM I Assignment Ch. 14, pp. 24-62 Regs. §1.199 Code & Regs., §§83, 421 ASC 743 ASC 718 Ch. 14, pp. 1-26 Ch. 15, pp. 1-21 PART II: Redemptions, Liquidations & Acquisitions 7 8 9 10 11 10/08 10/10 10/15 10/17 10/22 10/24 10/29 10/31 11/05 11/07 Stock Redemptions Liquidating Distributions, generally Liquidation of Subsidiaries Corporate Reorganizations Reorganizations Continued Consolidated Returns Consolidated Returns (cont.) Book-tax Reconciliation in consolidated setting EXAM II Ch. 15, pp. 21-42 Ch. 16, pp. 1-21 Ch. 17, pp. 1-28 Ch. 17, pp. 28-38 PART III: Partnerships and S Corporations as Alternatives to Corporations 12 13 14 15 11/12 11/14 11/19 11/21 11/26 11/28 12/03 Partnerships—Taxation of Operations Tax Consequences of Partnership Formation Partnerships—Distributions of Cash & Property Distributions—Special Rules S Corporations—Overview Thanksgiving Holiday S Corporations—Distributions to Shareholders FINAL EXAM Ch 19, pp. 34-58 Ch 19, pp. 1-28 Ch 20, pp. 1-15 Ch 20, pp. 16-27 Ch 21, pp. 1-20 Ch 21, pp. 21-29