Sample Property Taxation By-law

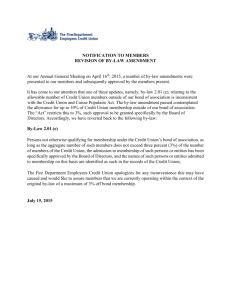

advertisement