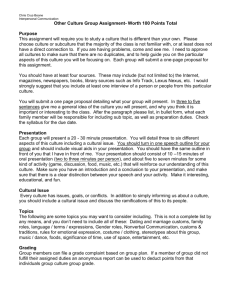

Customs Law

advertisement