Question Bank – Frank Wood's Introduction to Accounting

advertisement

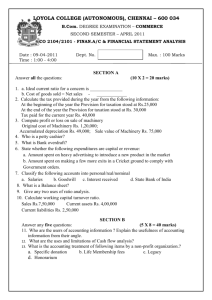

Chapter 4 Books of Original Entry and Ledgers (II) SHORT QUESTIONS B2C04T2Q001eng Write up a two-column cash book to record the following transactions. Then balance it off at the end of the month. 2009 Jul 1 " " " " " " " " " " " " " 3 5 7 11 12 13 19 21 22 23 25 27 30 $ 3,250 6,800 2,500 1,200 3,700 1,880 50 720 300 500 1,250 10,000 350 800 1,000 Cash balance b/d Bank balance b/d Cash sales made. Cash banked. James Chong paid us by cheque. Bought office equipment by cheque. Paid Linda Kee in cash. Received a rates refund by cheque. Withdrew cash from the bank for business use. Paid wages in cash. Paid for motor repairs by cheque. Received a bank loan by cheque. Karen Choi paid us in cash. Paid sundry expenses in cash. Paid insurance by cheque. Answer: Cash $ Cash Book Bank Date $ 2009 1 Balances b/d 3,250 6,800 Jul " 3 Sales 2,500 " " 5 Cash 7 James Chong " 13 Rates – Refund " " 19 Bank 23 Bank loan 300 " 25 Karen Choi 350 Date 2009 Jul Aug Details 1 Balances b/d Details 5 Bank " 11 Office equipment 1,200 3,700 " " 12 Linda Kee 19 Cash 720 " 21 Wages 10,000 " " 22 Motor expenses 27 Sundry expenses " 30 Insurance " 31 Balances c/d 6,400 22,420 3,850 17,990 Cash $ Bank $ 1,200 1,880 50 300 500 1,250 800 1,000 3,850 6,400 17,990 22,420 B2C04T2Q002eng Prepare a petty cash book with analysis columns for stationery, motor expenses, cleaning expenses, sundry expenses and ledger account. The amount spent was reimbursed on 1 May 2009. (14 marks) 2009 Apr 1 " 5 " 6 " 11 " 16 " 20 " 23 " 27 " 29 $ Received $3,000 as the petty cash float. Cleaning expenses Postage stamps Paper clips Paid Brian Tse, a trade creditor. Envelopes Petrol Delivery van repairs Cleaning expenses 400 46 125 350 40 500 1,100 400 Answer: Petty Cash Book Receipt Date $ 2009 3,000 Apr " " " " " " " " " 3,000 39 May 2,961 " Details Total Stationery $ 1 5 6 11 16 20 23 27 29 Cash Cleaning expenses Postage stamps Paper clips Brian Tse Envelopes Petrol Delivery van repairs Cleaning expenses 30 Balance c/d 1 Balance b/d 1 Cash 400 46 125 350 40 500 1,100 400 2,961 39 3,000 $ Motor expenses Cleaning expenses $ Sundry Ledger expenses account $ $ $ 400 46 125 350 40 500 1,100 165 1,600 400 800 46 350 B2C04T2Q003eng Phoebe Shek keeps her petty cash book on the imprest system. The cash float is set at $1,500. On 1 December 2008, the balance of petty cash brought forward was $215. The amount spent in December 2008 was to be reimbursed with cash at the end of the month. The following transactions took place during December 2008: 2008 Dec 1 " 4 " 5 " 9 " 10 " 11 " 15 " 17 " 18 " 20 " 22 " 26 " 28 " 30 $ Cash received to restore the imprest amount. Postage stamps MTR fares Petrol for the motor car Stationery Bus fares Refund to Winnie Poon, a trade debtor, who had overpaid. Donation Cleaning expenses Settlement of Candy Li’s account in the accounts payable ledger. Registered letter postage Refund to Steven Wu, a trade debtor, who had overpaid. Cleaning expenses Envelopes 20 150 300 12 100 18 300 200 78 23 22 200 26 Required: (a) Record the above transactions in a petty cash book with analysis columns for postage, travelling expenses, cleaning, stationery, miscellaneous expenses and ledger account. (20 marks) (b) Complete all necessary double entries for the month of December 2008 in the ledgers. (5 marks) Answer: (a) Petty Cash Book Receipt Date Details $ 2008 215 Dec 1 1,285 " 1 " 4 " 5 " 9 1,449 " " " " " 10 11 15 17 18 " " 20 22 " " 26 28 " 30 " " $ Balance b/d Cash Postage stamps MTR fares Petrol for the motor car Stationery Bus fares Winnie Poon Donation Cleaning expenses Candy Li Registered letter postage Steven Wu Cleaning expenses Envelopes 31 31 Cash Balance c/d 2009 Jan 1 Balance b/d 2,949 1,500 Total 20 150 300 Postage Travelling expenses $ $ 1,500 2,949 Miscellaneous expenses $ $ Ledger account 1 $ 0.5 0.5 0.5, 0.5 0.5, 0.5 0.5, 0.5 150 300 12 100 18 300 200 0.5, 0.5 0.5, 0.5 22 0.5, 0.5 0.5, 0.5 200 43 250 400 26 38 600 0.5, 0.5 0.5, 0.5 0.5, 0.5 0.5, 0.5 0.5, 0.5 78 23 22 200 26 1,449 $ Stationery 20 12 100 18 300 200 78 23 Cleaning 118 0.5, 0.5 0.5 each 0.5 0.5 0.5 (b) Cash Book Date 2008 Dec " Details 1 31 Petty cash Petty cash Cash $ 1,285 1,449 0.5 0.5 General ledger 2008 Dec 31 Petty cash Postage $ 43 0.5 2008 Dec 31 Petty cash Travelling Expenses $ 250 0.5 2008 Dec 31 Petty cash Cleaning $ 400 0.5 2008 Dec 31 Petty cash Stationery $ 38 0.5 2008 Dec 31 Petty cash Miscellaneous Expenses $ 600 0.5 2008 Dec 15 Petty cash Winnie Poon $ 18 0.5 2008 Dec 26 Petty cash Steven Wu $ 22 0.5 Candy Li $ 78 0.5 Accounts Receivable Ledger Accounts Payable Ledger 2008 Dec 20 Petty cash B2C04T2Q004eng Write up a two-column cash book to record the following transactions. Then balance it off at the end of the month. 2008 Sept 1 " " " " " " " " " Sept " " " $ 3,925 711 1,200 2,700 8,325 4,230 113 1,620 675 1,125 2,813 225 788 1,800 2,250 Cash balance b/d Bank balance b/d (Cr) Bought goods by cheque. Cash banked. Clara Hong, a trade debtor, paid us in cash. Bought furniture and fittings by cheque. Paid Yuki Ma, a trade creditor, in cash. Commission received by cheque. Withdrew cash from the bank for business use. Paid wages by cheque. Paid for repairs by cheque. Cash drawings by the proprietor. Lucas Chan, a trade debtor, paid us in cash. Bought stationery in cash. The proprietor contributed further capital in cash. 3 5 7 11 12 13 19 21 22 23 25 27 30 Answer: Date 2008 Sept " " " " " " " Oct Details 1 5 7 13 19 25 30 30 Balance b/d Cash Clara Hong Commission revenue Bank Lucas Chan Capital Balance c/d 1 Balance b/d 15,963 Cash Book Bank Date $ 2008 Sept 2,700 " " 1,620 " " " " 6,434 " " " " 10,754 11,125 Oct Cash $ 3,925 8,325 675 788 2,250 Details Cash Bank $ 1 3 5 11 12 19 21 22 23 27 30 Balance b/d Purchases Bank Furniture and fittings Yuki Ma Cash Wages Repairs Drawings Stationery Balance c/d 1 Balance b/d $ 711 1,200 2,700 4,230 113 675 1,125 2,813 225 1,800 11,125 15,963 10,754 6,434 B2C04T2Q005eng Jacky Chan is a sole trader who keeps records of cash and bank transactions in a three-column cash book. The cash book had the following opening balances as at 1 October 2009: cash $84,000 and bank $44,227. Jacky made the following transactions in the month of October 2009: 2009 Oct 1 " 3 " " " " " " " 10 14 15 18 19 26 30 A cash sum of $30,000 was received from John Lui, a customer, in full settlement of his account of $32,100. Jacky paid $21,850 by cheque to Daisy Chung, a supplier, to settle the account. The cheque amount was after the deduction of a cash discount of 5% received from Daisy. Paid wages of $12,300 by cheque. Paid $3,220 in cash to setttle the account of Mickey Man, a supplier. Made cash sales of $54,830. Deposited $8,000 cash into the business bank. Paid $32,900 by cheque for salaries. Cash sales receipts of $13,300 were banked. Received $40,000 cash from a customer in settlement of his account of $42,000. Jacky banked the remaining sum after withholding $10,000 for private use. Required: (a) Prepare a three-column cash book to record the above transactions. (10 marks) (b) Balance the cash book as at 31 October 2009. (c) Add up the discount columns and post the totals to the correct ledger accounts in the general ledger. (3 marks) marks) Answer: (a) and (b) Cash Book Date 2009 Oct " " " " " " Nov (c) Details Discount Cash $ 1 Balances b/d 1 John Lui 15 Sales 18 Cash 26 Sales 30 Trade debtor 30 Cash 1 Balances b/d 2,100 Bank $ $ 84,000 44,227 30,000 54,830 8,000 13,300 2,000 40,000 30,000 Date 2009 Oct Details 3 Daisy Chung " " " " " 10 14 18 19 30 " " 30 Drawings 31 Balances c/d 4,100 208,830 95,527 157,610 28,477 Discount $ 1,150 Wages Mickey Man Bank Salaries Bank Cash Bank $ $ 21,850 12,300 3,220 8,000 32,900 30,000 10,000 157,610 1,150 208,830 28,477 95,527 1 0.5 each 0.5 each 0.5, 0.5 0.5, 0.5 0.5, 0.5 0.5 each 0.5, 0.5 0.5, 0.5 0.5, 0.5 0.5, 0.5 General Ledger 2009 Oct 31 Total for the month Discounts Allowed $ 4,100 Discounts Received 2009 Oct 31 Total for the month 1 $ 1,150 1 (2 B2C04T2Q006eng Johnson, a sole trader, records all his cash and bank transactions in a three-column cash book. The transactions for the month of December 2009 were as follows: 2009 Dec 1 " 7 " 11 " 13 " " " " 19 23 29 31 Cash in hand $540; bank $6,520 Cr Paid Andrew Au, a supplier, $450 by cheque in full settlement of the amount owing of $500. Received $920 cash from Fanny Lee, a customer, in full settlement of the amount owing of $1,000. Advised by Jim Yim, a customer, that he had paid $460 into Johnson’s bank account in full settlement of the amount due from him of $480. Paid rent of $700 by cheque. Paid Judas Yam, a supplier, $330 in cash to settle an account of $340. Paid salaries of $300 in cash. Withdrew $200 from the bank for business use. Required: (a) Write up a three-column cash book to record the above transactions. (b) Balance the cash book as at 31 December 2009. (c) Add up the discount columns and post the totals to the correct ledger accounts in the general ledger. Answer: (a) and (b) Date 2009 Dec " " " " Details 1 11 13 31 31 Discount $ Balance b/d Fanny Lee Jim Yim Bank Balance c/d 80 20 1 Balance b/d $ 540 920 200 100 2010 Jan Cash 1,660 1,030 Cash Book Bank Date $ 2009 Dec " 460 " " 7,410 " " " 7,870 2010 Jan Details 1 7 19 23 29 31 31 Discount $ Balance b/d Andrew Au Rent Judas Yam Salaries Cash Balance c/d $ 10 $ 6,520 450 700 50 330 300 200 60 1 Balance b/d Bank Cash 1,030 1,660 7,870 7,410 (c) General Ledger 2009 Dec 31 Total for the month Discounts Allowed $ 100 Discounts Received 2009 Dec 31 Total for the month $ 60 B2C04T2Q007eng Transactions involving the petty cash book of Minnie Nam's business for the month of May 2008 are as follows: 2008 May " " " " " " " " " " " 1 2 3 5 9 10 18 21 28 29 30 31 Petty cash in hand $1,000. Bought coffee and snacks totalling $334 for the office. Paid wages of $340. Paid $130 for postage. Paid $158 for stationery. Restored the imprest amount and increased the amount to $1,300. Bought envelopes and writing paper for $50. Paid $250 for office carpet cleaning. Paid $300 for courier charge. Paid $450 for newspapers and magazines. Refunded $168 to Kim Chan, a trade debtor, for an overpayment on his account. Restored the imprest amount to $1,300. Required: (a) Prepare the petty cash book for the month of May 2008 with analysis columns for wages, sundry expenses, postage, stationery and ledger account and balance the petty cash book as at 31 May 2008. (b) Complete all necessary double entries for the month in the ledgers. Answer: (a) and (b) Petty Cash Book Receipt Date $ 2008 1,000 May " " " " 1,262 " " " " " " 1,218 3,480 1,300 Details 1 2 3 5 9 10 18 21 28 29 30 Balance b/d Coffee and snacks Wages Postage Stationery Cash Envelopes and writing paper Carpet cleaning Courier charge Newspapers and magazines Kim Chan " " 31 Cash 31 Balance c/d Jun 1 Balance b/d Sundry Ledger Total Wages expenses Postage Stationery account $ $ $ $ $ $ 334 340 130 158 50 250 300 450 168 2,180 1,300 3,480 334 340 130 158 50 250 300 450 340 1,034 430 208 168 168 (c) Date Details 2008 Cash Book Bank Date Cash $ $ Details 2008 May May 10 Petty cash 1,262 " 31 Petty cash 1,218 Wages $ 31 Petty cash May 31 Petty cash 31 Petty cash 430 Stationery $ 2008 May 1,034 Postage $ 2008 May 340 Sundry Expenses $ 2008 31 Petty cash 208 Accounts Receivable Ledger Kim Chan $ 2008 May 30 Petty cash 168 Bank $ General Ledger 2008 Cash $ B2C04T2Q008eng Lucy Ip keeps her petty cash book on the imprest system. The imprest amount is $3,000. On 1 October 2009, petty cash in hand was $2,344. The following transactions took place during the month: 2009 $ Oct 1 Petty cash restored to the imprest amount " 5 Postage stamps 50 " 6 Taxi fares 90 " 8 Petrol for the motor van 300 " 10 Ballpoint pens and paper 200 " 11 Bus fares 15 " 15 Refund to Jimmy Wong for an overpayment on his 87 account in the accounts receivable ledger " 16 Stamps 100 " 18 Magazines 16 " 21 Motor van repairs 600 " 23 Envelopes 40 " 24 Petrol for the motor van 310 " 28 Courier charge 120 " 31 Cinema tickets for staff 280 Required: (a) Record the above transactions in a petty cash book with analysis columns for postage, travelling, motor expenses, stationery, sundry expenses and ledger account. Show the balance carried down to 1 November 2009 (b) and the restoration of the cash float. (20 marks) Complete all necessary double entries for the month of October 2009 in the ledgers. (4 marks) Answer: (a) Petty Cash Book Receipt Date Details $ 2009 2,344 Oct 1 Balance b/d 656 " 1 Cash " 5 Postage stamps " 6 Taxi fares " 8 Petrol for the motor van " 10 Ballpoint pens and paper " 11 Bus fares " 15 Jimmy Wong " 16 Stamps " 18 Magazines " 21 Motor van repairs " 23 Envelopes " 24 Petrol for the motor van " 28 Courier charge " 31 Cinema tickets for staff Oct 31 Balance c/d 3,000 792 Nov 2,208 " 1 Balance b/d 1 Cash Total $ 50 90 300 200 15 87 100 16 600 40 310 120 280 2,208 792 3,000 Postage $ Travelling expenses Motor expenses $ $ Sundry Stationery expenses $ $ Ledger account 1 $ 50 90 300 200 15 87 100 16 600 40 310 120 270 105 1,210 240 280 296 87 0.5 0.5 0.5, 0.5 0.5, 0.5 0.5, 0.5 0.5, 0.5 0.5, 0.5 0.5, 0.5 0.5, 0.5 0.5, 0.5 0.5, 0.5 0.5, 0.5 0.5, 0.5 0.5, 0.5 0.5, 0.5 0.5 each 0.5 0.5 0.5 (b) Cash Book Date 2009 Oct Nov Details 1 Petty cash 1 Petty cash Cash $ 656 2,208 0.5 0.5 General Ledger 2009 Oct 31 Petty cash Postage $ 270 0.5 2009 Oct 31 Petty cash Travelling Expenses $ 105 0.5 2009 Oct 31 Petty cash Motor Expenses $ 1,210 0.5 2009 Oct 31 Petty cash Stationery $ 240 0.5 2009 Oct 31 Petty cash Sundry Expenses $ 296 0.5 Jimmy Wong $ 87 0.5 Accounts Receivable Ledger 2009 Oct 15 Petty cash B2C04T2Q009eng Josephine Tam is a sole trader, selling office furniture on a credit basis. On 1 April 2009, she had $360,000 in the bank. During the month of April 2009, Josephine Tam: (i) Deposited the following sales proceeds into the bank account: 2009 $ Apr 6 Albert Co 33,000 (after deducting a 4% cash discount) " 15 Billy Ltd 38,950 (after deducting a 5% cash discount) " 22 Connie Store 36,660 (after deducting a 6% cash discount) " 28 Dinnie Ltd 35,775 (ii) Issued the following cheques: 2009 Apr 1 Cash for business use " 2 Baron Ltd " 10 Drawings " 18 Duke Lee 19 Office equipment 20 Earl Co 22 Marquess Ltd 25 Rent and rates 29 Viscount Co $ 50,000 3,700 50,000 8,160 (after deducting a 4% cash discount) 30,000 65,900 54,520 (after deducting a 6% cash discount) 25,400 58,880 (after deducting a 8% cash discount) (iii) Made the following payments in cash: 2009 Apr 3 Salaries " 7 Purchases " 8 Electricity " 15 Telephone expenses " 21 Drawings $ 15,500 10,000 3,000 540 10,000 Required: (a) Prepare the three-column cash book for Josephine Tam’s business for the month of April 2009. Then balance off the cash book at the end of the month. (b) (17 marks) Show the discount accounts in the general ledger. (2 marks) Note: Transactions must be recorded in date order. Answer: (a) Cash Book Date 2009 Apr 1 " 1 " 6 " 15 " 22 " 28 Details Discount Cash Bank $ $ $ Balance b/d 360,000 Bank 50,000 Albert Co 1,375 33,000 Billy Ltd 2,050 38,950 Connie 2,340 36,660 Store Dinnie Ltd 35,775 Date 2009 Apr " " " " " " " " " " " " " " May 1 Balances b/d 5,765 50,000 504,385 10,960 157,825 Details Discount $ 1 2 3 7 8 Cash Baron Ltd Salaries Purchases Electricity 10 Drawings 15 Telephone expenses 18 Duke Lee 19 Office equipment 20 Earl Co 21 Drawings 22 Marquess Ltd 25 Rent and rates 29 Viscount Co 30 Balances c/d Cash $ Bank 1 $ 50,000 3,700 0.5, 0.5 0.5, 0.5 0.5 each 0.5 each 0.5 each 50,000 0.5, 0.5 0.5 8,160 30,000 0.5, 0.5 0.5 65,900 0.5 0.5 0.5, 0.5 0.5 0.5, 0.5 0.5, 0.5 0.5, 0.5 0.5, 0.5 15,500 10,000 3,000 540 340 10,000 3,480 5,120 10,960 8,940 50,000 54,520 25,400 58,880 157,825 504,385 (b) General Ledger 2009 Apr 30 Total for the month Discounts Allowed $ 5,765 Discounts Received 2009 Apr 30 Total for the month 1 $ 8,940 1 B2C04T2Q010eng Thomas Lo maintains a three-column cash book. In addition, a petty cash float of $1,000 is also kept for small cash payments. The following transactions occurred in July 2009: 2009 Jul 1 " 1 " " 3 5 " " " 7 11 12 " 13 " " " " " " " " " 19 21 22 22 23 25 27 27 30 " 30 Cash balance Bank balance Accounts receivable ledger: Besa Cheung Kitty Cho Accounts payable ledger: Lucia Koo Diana Sit Petty cash in hand was $234. A cheque was issued to restore the petty cash float. A cheque received from a trade debtor. Bought office fixtures costing $40,000. A deposit of 30% was paid by cheque, with the balance paid on delivery one month later. Cash sales receipts Cash banked. Besa Cheung settled her account with us by cheque, after deducting a 3% cash discount. Kitty Cho settled her account with us in cash, after deducting a 5% cash discount. Paid insurance by cheque. Settled our account with Lucia Koo in cash, less a discount of $90. Paid for electricity in cash. Cash drawings by Thomas Lo. Withdrew cash from the bank for business use. Government rent refund by cheque. Paid wages by cheque. Paid rates in cash. Settled our account with Diana Sit by cheque, less a 4% cash discount. All the cash was banked with the exception of $40 that was kept in the cash box. $ 9,850 12,240 9,000 1,500 800 2,000 1,800 2,160 4,500 1,800 2,250 300 1,440 1,300 1,296 5,400 Required: (a) Prepare the three-column cash book for the month of July 2009. Then balance off the cash book at the end of the month. (b) Show the discount accounts in the general ledger. (17 marks) (2 marks) Answer: (a) Cash Book Date 2009 Jul " 1 3 " " " " " " 7 11 12 13 23 25 " 30 Aug (b) Details 1 Balances b/d Accounts receivable Sales Cash Besa Cheung Kitty Cho Bank Government rent — Refund Cash Balances b/d Discount Cash Bank $ $ $ 9,850 12,240 1,800 2,160 270 75 4,500 8,730 1,425 1,440 1,300 909 Date 2009 Jul " Details Discount Cash Bank $ $ $ 1 Petty cash 766 5 Office fixtures 12,000 " " " " " " 11 19 21 22 22 23 Bank Insurance Lucia Koo Electricity Drawings Cash " " " " " 27 27 30 30 31 Wages Rates Diana Sit Bank Balances c/d 345 14,875 29,479 40 11,023 4,500 1,800 90 710 2,250 300 1,440 1,296 5,400 80 1,920 909 40 11,023 170 14,875 29,479 1 0.5 each 0.5, 0.5 0.5, 0.5 0.5, 0.5 0.5 each 0.5 each 0.5, 0.5 0.5, 0.5 0.5, 0.5 0.5 0.5, 0.5 0.5 0.5, 0.5 0.5, 0.5 0.5, 0.5 General Ledger 2009 Jul 31 Total for the month Discounts Allowed $ 345 Discounts Received 2009 Jul 31 Total for the month 1 $ 170 1