KEY Macro Questions Lesson 12

advertisement

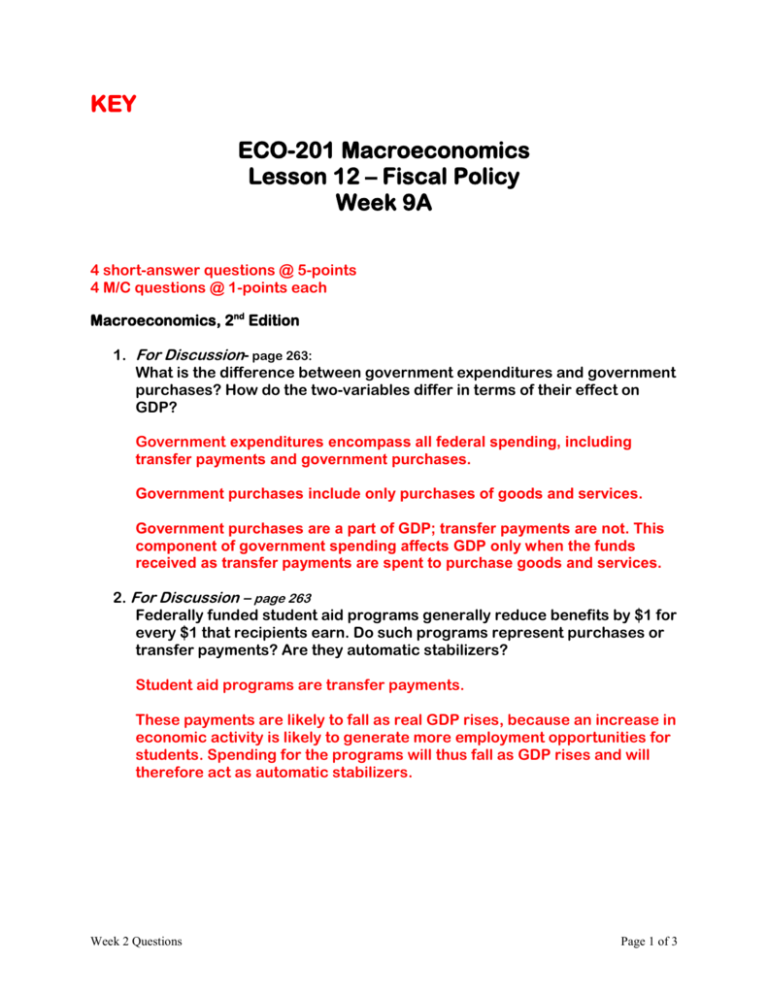

KEY ECO-201 Macroeconomics Lesson 12 – Fiscal Policy Week 9A 4 short-answer questions @ 5-points 4 M/C questions @ 1-points each Macroeconomics, 2nd Edition 1. For Discussion- page 263: What is the difference between government expenditures and government purchases? How do the two-variables differ in terms of their effect on GDP? Government expenditures encompass all federal spending, including transfer payments and government purchases. Government purchases include only purchases of goods and services. Government purchases are a part of GDP; transfer payments are not. This component of government spending affects GDP only when the funds received as transfer payments are spent to purchase goods and services. 2. For Discussion – page 263 Federally funded student aid programs generally reduce benefits by $1 for every $1 that recipients earn. Do such programs represent purchases or transfer payments? Are they automatic stabilizers? Student aid programs are transfer payments. These payments are likely to fall as real GDP rises, because an increase in economic activity is likely to generate more employment opportunities for students. Spending for the programs will thus fall as GDP rises and will therefore act as automatic stabilizers. Week 2 Questions Page 1 of 3 3. For Discussion - page 263 Crowding out reduces the degree to which a change in government purchases influences the level of economic activity. Is it a form of automatic stabilizer? NO. First, it isn’t a government program. Second, it acts to REDUCE the impact of changes in fiscal policy; it doesn’t insulate the economy from other shocks. 10. For Discussion - page 264: Give and justify your view on whether government borrowing can shift the cost of providing public sector goods and services from one generation to the next. The argument that the burden can’t be shifted rests on the assumption that taxing one group to make interest payments to another is a redistribution of income. The argument that the burden can be shifted holds that such a transaction is not a redistribution but a payment for postponing consumption. In this view, it is no more a redistribution than is the payment of government employees for services rendered. Page 2 of 3 Video Questions for Lesson 12 Select the ONE best answer 1. In the video "Fiscal Policy," an economist states that the value of the national debt in 1800 would be approximately _______ dollars in the year 2000. a. b. c. d. 83 million 830 million 1 billion 83 billion 2. In the video "Fiscal Policy," President Reagan's tax cuts were based on the work of a. Milton Freidman b. John Maynard Keynes c. Arthur Laffler d. Adam Smith 3. The economists in the video "Fiscal Policy" all agree that it is very important to pay off the national debt. A. B. True False 4. In the video "Fiscal Policy," the Laffler curve illustrates that if taxes are cut, tax revenues increase. a. b. True False Page 3 of 3