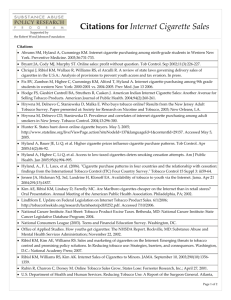

Smuggling and the Global Firm

advertisement

Smuggling and the Global Firm Paper Presented at The Third Annual International Business Forum The Fox School of Business and Management Temple University Kate Gillespie Department of Marketing The University of Texas at Austin Austin Texas 78712-1176 Phone: (512) 471-5438 Fax: (512) 471-1034 kate.gillespie@bus.utexas.edu This is a working draft. Please contact the author before quoting. Smuggling and the Global Firm Twenty years ago, smuggling was prevalent in developing countries such as Mexico where consumers, tired of years of protected national industries, regarded smugglers as Robin Hoods who delivered better and cheaper products to a beleaguered middle class. In a prior article, my co-author and I established that smuggling did not disappear in Mexico as a result of trade liberalization.1 Liberalization was rarely complete, and smugglers could still take advantage of not paying taxes other than tariffs. However as a possible consequence of trade liberalization in the 1980s and 1990s, smuggling in Mexico shifted from project to organized crime and took on a more sinister aspect. Furthermore, by the mid-1990s evidence was surfacing that possible synergies between organized crime involved in the illicit drug trade and organized crime involved in the illegal importation of legal consumer goods were beginning to be exploited. We concluded the article by warning global firms of the negative impact that the new smuggling could have on their operations.2 Since the publication of that article, increasing evidence has unfolded supporting both the evolution of smuggling into organized crime and the use of smuggling as a way to launder money for international drug cartels and possibly terrorist organizations. In retrospect, our 1996 paper was particularly astute in understanding and predicting the recent evolution of smuggling but relatively naïve in its assumption that firms did not willingly involve themselves in smuggling. In this paper, I address the possible 1 We define smuggling here as the illegal importation of otherwise legal goods. For example, this definition encompasses the smuggling of refrigerators as opposed to the trafficking in narcotics. 2 Kate Gillespie and J. Brad McBride, “Smuggling in Emerging Markets: Global Implications,” Columbia Journal of World Business (Winter 1996), pp. 39-54. 1 complicity and culpability of global firms in acts of smuggling. In particular, I will explore the role of firms in the Black Market Peso Exchange, the British American Tobacco smuggling scandal, and litigation brought by foreign governments against U.S. tobacco companies for their alleged cooperation with smugglers. The Black Market Peso Exchange In June 2000, U.S. Customs estimated the global volume of money laundering, much of which was related to the illicit trade in narcotics, to total more than $600 billion a year or between two and five percent of the world’s domestic product. The connection between money laundering and smuggled consumer products has been a major concern of U. S. Customs for several years particularly after the government cracked down on money laundering through U.S. banks. In 1997, undercover agents traced laundered drug money to bank accounts of major U.S. corporations. Colombian drug money in particular had been used to purchase products such as computers and electronics components that were eventually smuggled to Colombia as a way to circumvent Colombian currency controls. Colombian officials estimate that as much as 45 percent of their country’s imported consumer goods are bought with money laundered through the Black Market Peso Exchange. As a result U.S. Customs implemented an industry outreach program to educate U.S. businesses on how the Black Market Peso Exchange (BMPE) works in order that they could spot suspicious buyers.3 A brochure prepared by U.S. Customs explains the how the exchange works: 3 Prepared Statement of John C. Varrone Acting Deputy Assistant Commission Office of Investigations, United States Customs Service in Testimony Before House Committee on Government Reform Subcommittee on Criminal Justice, Drug Policy and Human Resources, Federal News Service, June 23, 2000. 2 The Colombian cartels export narcotics to the United States where they are sold for U.S. dollars In Colombia, the cartels contact a third party—a peso broker—to launder their drug money. The peso broker enters into a “contract” with the Colombian cartel, wherein he agrees to exchange pesos he controls in Colombia for U.S. dollars the cartel controls in the United States. Once this exchange occurs, the cartel has effectively laundered its money and is out of the BMPE process. The peso broker, on the other hand, must now launder the U.S. dollars he has accumulated in the United States. The peso broker uses contacts in the United States to place the drug dollars he purchased from the cartel into the U.S. banking system. The peso broker, still operating in Colombia, now has a pool of narcotics-derived funds in the U.S. to “sell” to legitimate Colombian importers. Colombian importers place orders for items and make payments through the peso broker. Again, the peso broker uses contacts in the U.S. to purchase the requested items from U.S. manufacturers and distributors. The peso broker pays for these goods using a variety of methods, including his U.S. bank account. The purchased goods are shipped to Caribbean or South American destinations, sometimes via Europe or Asia, then smuggled or otherwise fraudulently entered into Colombia. The Colombian importer takes possession of his goods, having avoided paying extensive Colombian import and exchange tariffs, and pays the peso broker for the items with Colombian pesos. The peso broker, who has made his money charging both the cartels and the importers for his services, uses those new pesos to begin the cycle once again.4 The brochure goes on to note that U.S. exports often purchased with narcotics dollars include household appliances, consumer electronics, liquor, cigarettes, used auto parts, precious metals, and footwear.5 The U.S. firms that sell these products have routinely denied having any idea that they were involved in the BMPE and have been successful in preventing law enforcement agencies from keeping seized monies. Beginning in June 2000, however, a group of corporate executives began a series of meetings at the Justice Department with then Attorney General Janet Reno and other top officials. The companies included Hewlett-Packard, Ford Motor Company, Whirlpool, General Motors, Sony, 4 5 The Black Market Peso Exchange, United States Customs Service, www.customs.gov. Ibid. 3 Westinghouse, and General Electric Company. These talks were not widely publicized, and only General Electric ever agreed to publicly comment on them. While the Justice Department stated that it was only seeking the cooperation of the companies involved in helping to better understand and discourage smuggling and money laundering, the companies appear to have been wary of the proceedings. Rumors arose that sessions were “bogging down in legal murk.”6 With the exception of General Electric, the companies called to participate had products appearing in the Colombian black market. General Electric was invited as the example of a good citizen who was successfully cleaning up the smuggling of its goods into South America. General Electric instituted a strict compliance program in 1995 after reports that its refrigerators were being used in money-laundering operations. Dealers were warned of red flags. These included a customer’s lack of interest in discounts or an unwillingness of a buyer to give company information. Also, unusual forms of payments such as large amounts of cash or checks written on the accounts of third parties were to be considered suspect. Between 1995 and 2000, General Electric estimated that its good citizen policy cost the company about twenty percent of its sales to South America.7 Complicity of Global Firms: The Case of the Cigarette Industry While international firms in a variety of industries were presumably assisting law enforcement in its attempt to stop smuggling and consequently money laundering, the cigarette industry in particular was to come under increased scrutiny and suspicion Lowell Bergman, “U.S. Companies Tangled in Web of Drug Dollars,” New York Times, October 10, 2000, p. 1. 7 Ibid. 6 4 beginning in the late 1990s. Cigarettes were a prime product for smuggling in an era of trade liberalization. In many developing countries, cigarettes remained under government monopoly and imports were subject to substantial tariffs. Even in developed countries heavy excise taxes were leveled on cigarettes. As increasing evidence linked higher prices with lower cigarette consumption, many governments used taxes primarily to discourage smoking rather than as a means to raise revenues. Evidence From the BAT Archives. British American Tobacco (BAT), the world’s second largest cigarette company with sales of 900 billion cigarettes a year, found itself involved in increasing scandals concerning its participation in smuggling. Internal company documents were made public in 1999 after the settlement of litigation by Minnesota against the five largest international tobacco companies.8 Facts about BAT’s contraband trade in cigarettes were found in these documents that included internal memos and faxes some marketed “secret” or “restricted.” The International Consortium of Investigative Journalists within the Center for Public Integrity, a non-profit organization based in Washington, D. C., spent six months analyzing what amounted to 11,000 pages of papers. Subsequently, their findings concerning BAT’s involvement in cigarette smuggling were published on the organization’s website. The documents dated mostly from 1990-1995. While they fell short of implicating BAT employees in the actual transport of smuggled cigarette across borders, they indicated that company officials in Britain and the United States were aware of cigarettes smuggling, supported probable smugglers, and even adjusted their marketing strategies— such as volumes, brands, and price levels—to exploit the situation. A separate office to 8 Kevin Maguire, “Tobacco Chief Dismisses MPs as “Kangaroo Court’,” The Guardian, February 17, 2000. 5 handle contraband trade was established in Hamburg, Germany in 1972 when a BAT study concluded that the company was “years behind the competition” in contraband. 9 A number of euphemism were used when referring to contraband cigarettes such as “duty not paid or DNP and “goods in transit” or GT. Occasionally, BAT officials dropped euphemisms and spoke of smuggling directly as in a June 3, 1993 letter to BAT’s managing director, Don Brown, from the president of Imperial Tobacco Limited in Canada: As you are aware, smuggled cigarettes (due to exorbitant tax level) represent nearly 30% of total sales in Canada, and the level is growing. Although we agreed to support the Federal government’s effort to reduce smuggling by limiting our exports to the U.S.A., our competitors did not. Subsequently, we have decided to remove the limits on our exports to regain our share of Canadian smokers. To do otherwise would place the long-term welfare of our trademarks in the home market at great risk. Until the smuggling issue is resolved, an increasing volume of our domestic sales in Canada will be exported, then smuggled back for sale here.10 Other records dealing with Latin America were especially incriminating to BAT. In Venezuela, where cigarettes had excise taxes of 50 percent, cigarettes produced in Venezuela were exported to free-trade zone in Aruba then re-entered Venezuela as transit. Others were smuggled into Colombia. In a June 25, 1992 note to the director of BAT’s Venezuelan subsidiary, Keith S. Dunt, then BAT’s regional director of Latin America and later its chief finance officer, wrote that he disagreed with plans to limit the number of cigarettes to the company’s distributor in Aruba that were likely headed for the Colombian end market unless there was a “proven strategic necessity.”11 When a president of BAT’s Venezuelan subsidiary complained about the likely smuggling Maud S. Beelman, Duncan Campbell, Maria Teresa Ronderos, and Erik J. Schelzig, “Major Tobacco Multinational Implicated in Cigarette Smuggling, Tax Evasion, Documents Show,” The Public I, www.publici.org, Posted January 31, 2000. 10 Ibid. 11 Ibid. 9 6 activities of a company distributor, he was later recommend for replacement. Among other things he was seen as having exceptional ethical norms that could be exploited by BAT’s main competitor Philip Morris. Nonetheless, notes of a meeting in Colombia in February 1992 stated that the “the Bogota office will be clean by Q3/94 in reference to DNP information. Management of DNP will be in Caracas” where another memo noted that “a good quality safe and shredder are required.” 12 Smuggling cigarettes into Venezuela was even suggested as a contingency plan if BAT lost a trademark dispute with rival Philip Morris. A memo dated February 22, 1995 suggested that if BAT lost its claim to the Belmont name in Venezuela, that the firm could launch a new brand in the legitimate market and maintain the Belmont brand in Venezuela via contraband.13 In Africa, BAT officials cooperated even more directly with a known smuggler. Working through a distributor, Sorepex, BAT established a distribution agreement that allowed it to retain significant control over African distribution channels. Correspondence and memos dealing with BAT and its distributor Sorepex includes such references as, “(the distributor) would disguise the cigarette importation by calling the shipment something else, e.g. matches.” No wonder that in 1990 BAT could claim its brands dominated the Cameroon market even though there were no legal imports in the market.14 But smuggling still presented cigarette companies such as BAT with certain challenges. One was how to support smuggled brands with advertising without tipping 12 Ibid. Ibid. 14 “Tobacco Companies Linked to Criminal Organizations in Cigarette Smuggling: Africa,” The Public I, www.publici.org,Posted March 3, 2001. 13 7 their hand to local governments. Where transnational media were available, these could be tapped to reach markets where legal imports of the brands were forbidden. For example, BAT and other cigarette companies used Africa No. 1 Radio broadcast from Gabon to reach their potential market in Cameroon.15 If cigarettes were legal to import, a small amount could be legally imported in order to offer an “umbrella” or excuse for advertising the brand. Another unsettling issue was the possible damage contraband products did to BAT partners. In a note from Dunt to his fellow directors he questions the wisdom of allowing BAT’s wholly owned Brazilian subsidiary to smuggle cigarettes into Argentina where they would cannibalize the sales of BAT’s majority owned Argentine joint venture.16 Increasingly BAT was to face criticism and investigation from national governments and courts concerning their involvement in smuggling. In the late 1990s, BAT found itself involved in a court case in Hong Kong concerning cigarette smuggling into China. China represented a lucrative but relatively closed market to cigarettes. Chinese consumption stands at about one in every three cigarettes manufactured worldwide or about 1.6 trillion cigarettes annually. BAT and other foreign cigarette companies faced steep import taxes as high as 430 percent as well as quotas on cigarettes imports. Nonetheless, BAT quadrupled its exports to China in the early 1990s. An internal 1993 document marked “secret” noted that only 5.4 percent of BAT’s total Chinese sales passed through legal channels, China’s National Tobacco Corporation, the country’s tobacco monopoly.17 15 Ibid. “Major Tobacco Multinational Implicated.” 17 “Tobacco Companies Liked to Criminal Organizations in Cigarette Smuggling: China,” The Public I, www.publici.org, Posted March 3, 2001. 16 8 In the late 1980s, rival smugglers of BAT cigarettes into China had begun to bribe the local BAT director. When one Hong Kong distributor was jilted, he exposed the BAT bribery system to Hong Kong’s anti-corruption commission. A former BAT export director was extradited from the United States. The case foundered when a main witness was discovered murdered and another committed suicide. Nonetheless, the export manager was eventually convicted and sentenced to over three years in jail.18 Although BAT itself was not charged with a crime, company records disclosed during the trial led the judge to conclude that the management of BAT was aware of the smuggling and to some extent such irresponsible behavior amounted to assisting criminals in transnational crime.19 The company claimed at the time the “British American Tobacco does not smuggle. It does not condone smuggling and its business is entirely lawful.”20 Still when officers from the Hong Kong Independent Commission Against Corruption raided the offices of BAT’s largest Hong Kong distributor in 1994 they discovered about 50 billion cigarettes.21 BAT’s alleged involvement with smuggling was not limited to the emerging world. The British government claims that about one in every three cigarettes sold in England are contraband. British customs seized two billion in smuggled cigarettes in 2000 alone. In the mid-1990s, Andorra became the smuggling hub for cigarettes exported from Britain then smuggled back into the market in order to avoid increased cigarette taxes. By 1997, cigarette exports to Andorra were enough to support a 140-a-day habit “Global Reach of Tobacco Company’s Involvement in Cigarette Smuggling Exposed in Company Papers: Part 2,”The Public I, www.publici.org, Posted February 2, 2000. 19 “Major Cigarette Multinational Implicated.” 20 “Global Reach of Tobacco Company’s Involvement in Cigarette Smuggling Exposed in Company Papers,” the Public I, www.publici.org, posted February 2, 2000. 21 Ibid. 18 9 for every man, woman and child in the small principality. After a crackdown on tax-free shipments to Andorra, cigarette exports shifted sharply to Cyprus, long thought a hub for contraband to the Middle East. British officials estimated that the majority of British cigarettes shipped to Cyprus were then smuggled back into Britain.22 By June 2000, the British government was considering an in-depth investigation into the alleged smuggling participation of BAT. The House of Commons Select Committee on Health asserted that the allegations based on research by Public Integrity merited careful investigation. Subpoenaed evidence from an advertising agency also showed how another tobacco company had advertised to boost smuggling. The report was unanimously approved by members of parliament from all parties.23 In August 2001, a whistleblower, a former director of BAT’s offshore agents in the Caribbean, alleged that BAT set up a special Swiss subsidiary in 1997 to handle smuggling earnings and that in 1998 alone $200 million in smuggling money from Latin America flowed into the Swiss account. Company files further suggested that the company may have restructured its payments accruing from smuggling in order to protect itself from possible lawsuits, since Swiss bank accounts remained out of the jurisdiction of the UK’s Department of Trade and Industry.24 Nonetheless, by the year-end 2001, BAT had issued a warning that sales could fall by 500 million pound in 2002 due to its need to clamp down on contraband cigarettes.25 “Tobacco Companies Linked to Criminal Organizations in Cigarette Smuggling: Cyprus and the Middle East,” The Public I, www.publici.org., Posted March 3, 2001, 23 Duncan Campbell, “U.K. Considering Formal Investigation Into Cigarette Smuggling,” The Public I, www.publici.org, Posted June 15, 2000. 24 Duncan Campbell, “Clark Company Faces New Smuggling Claims,” The Guardian, August 22, 2001. 25 Kevin Maguire, “Dubai Diplomat Accused of Smuggling BAT Cigarettes,” The Guardian, December 17, 2001. 22 10 Pursuing Culpability Increasing publicity and new revelations from court cases involving cigarette companies spawned more investigations and further suits concerning the tobacco industry’s involvement in smuggling. Public Integrity’s web expose on BAT was extended to include incriminating documents relating to cigarette giants Philip Morris and R.J. Reynolds as well. The consortium’s findings were published in over 40 media outlets in ten countries. Besides promoting the British investigation, it helped fuel three civil lawsuits filed in the United States against the tobacco companies under the Racketeer Influenced and Corrupt Organization (RICO) Act.26 Increasingly, governments looked to establish cigarettes companies’ culpability and demand compensation for the undermining of government tobacco monopolies and national health policies as well as for lost tax revenues. R. J. Reynolds and Iran at the Hague. Before turning to the recent court cases against cigarette companies, it is useful to note that attempted government action against tobacco companies allegedly involved in smuggling goes back nearly twenty years to one of the most controversial cases heard at the international court at the Hague. R. J. Reynolds brought a suit against The Government of Iran and the Iranian Tobacco Company (ITC) at the Iran-United States Claims Tribunal. Under the terms of the Tribunal agreement, the Iranian government could not bring claims against U.S. companies but could present counterclaims if sued by a company.27 “Tobacco Companies Linked to Criminal Organizations in Cigarette Smuggling Trade,” Business Wire, March 5, 2001. 27 Kate Gillespie, “U.S. Corporations and Iran at the Hague,” Middle East Journal, Volume 40, Number 1, (Winter 1990), p. 22. 26 11 R. J. Reynolds sued Iran for over $36 million plus interest for accounts receivable relating to tobacco products sold and delivered to the Iranian Tobacco Company. Iran presented a counterclaim relating to its licensing agreement with Reynolds. Reynolds had licensed ITC to “use its techniques and trademarks and to sell or distribute Winston cigarettes in Iran, and agreed to provide assistance to ITC in connection with manufacturing and advertising of Winston cigarettes.” 28 ITC asserted that Reynolds had shipped large amounts of cigarettes into countries close to Iran thus facilitating the smuggling of illegal Winston cigarettes into Iran. This was in violation of a clause in the license agreements stating that, “Reynolds shall to the extent possible and lawful, exert reasonable effort to prevent illegal entry of all its Brands to License Territory.” ITC sought $10 million in damages for these alleged actions.29 The court eventually decided that the counterclaim concerning the licensing agreement did not fall under the same contract as the demand for payment for the accounts receivable. As such the counterclaim fell outside its jurisdiction and was therefore dismissed. The merit of the case was never decided. When the Tribunal dismissed Iran’s counterclaims, two Iranian judges physically assaulted the neutral nation arbiter assigned to the case. This effectively halted contended awards for the reminder of 1984.30 Outside Iran the Reynolds case appeared the epitome of a straightforward claim.31 The alleged smuggling garnered no interest. The Attorney General of Canada v. R.J. Reynolds Tobacco Company. In hindsight, the $10 million Iran sought from Reynolds for damages due to smuggling 28 R. J. Reynolds Tobacco v. Iran, Case No. 35, Iran-U.S. Claims Tribunal Reports, p.188. Ibid., p. 195. 30 Gillespie, “U.S. Corporations and Iran,” pp. 26-27. 31 John R. Crook, “Applicable Law in International Arbitration: The Iran-U.S. Claims Tribunal Experience,” The American Journal of International Law, April 1989. 29 12 would look like chickenfeed compared to actions of other foreign governments brought against this and other cigarette companies in the late 1990s. The first of these was the case of the Attorney General of Canada v. R. J. Reynolds Tobacco Company. On December 22, 1998, Northern Brands International, Inc., an affiliate of Reynolds pled guilty in the United States both to smuggling 26 truckloads of cigarettes into the United States and to money laundering. The company agreed to forfeit $10 million in cash and pay a $5 million fine to the U.S. government. The guilty plea acknowledged that the company knowingly and willfully aided and abetted others who imported cigarettes from Canada into the United States by means of false and fraudulent practices. Northern Brands had sold cigarettes to two import companies that planned to sell in the United States cigarettes that were supposedly re-exported to Russian and Estonia. It represented the first time a major tobacco company had been convicted of a felony crime in the United States.32 One year later nearly to the day on December 21, 1999, the Canadian government filed a civil law suit in U.S. federal court against R.J. Reynolds Holding Inc., claiming that Reynolds and several related companies, including Northern Brands, conspired to smuggle tobacco products into Canada to avoid paying millions in taxes.33 The suit sought $1 billion in damages. Between 1982 and 1991, Canada raised taxes on tobacco products by approximately 550 percent, causing a large discrepancy between tobacco prices in Canada and the United States. Tobacco products manufactured in Canada and exported “in bond” were exempt from most Canadian taxes provided the products were not “Criminal Action: United States v. Northern Brands International, Inc.,” Tobacco Industry Litigation Reporter, Vol. 14, No. 3 (January 15,1999), p.13 33 “Today’s News,” New York Law Journal, December 22, 1999, p.1. 32 13 intended for domestic consumption. By avoiding such taxes, cigarettes exported to the United States and smuggled back into the Canadian black market could be sold for about half the price of cigarettes legally distributed.34 The Canadian government alleged that Reynolds made hundreds of millions of dollars from smuggled cigarettes, while the Canadian government incurred massive expense combating smuggling. 35 The Canadian government claimed that Reynolds sold cigarettes to distributors that they knew were smugglers. Furthermore, when Canada imposed in 1992 an eight-dollar tax on each carton of exported cigarettes, Reynolds sought to avoid this tax as well by manufacturing cigarettes in Puerto Rico to resemble those sold in Canada. These look-alikes were then sold to distributors who smuggled them into Canada.36 The suit asserted five causes for action—four under RICO and one common law fraud—and demanded recovery for lost taxes, restrictions of future smuggling activity, and punitive damages. Damages were sought for lost taxes, law enforcement costs, and health costs resulting from increased consumption of cigarettes. RICO is a broadly worded statute with the purpose to stop the infiltration of organized crime and racketeering into legitimate organizations operating in interstate commerce. To win a suit under RICO, the plaintiff must prove both a violation of the RICO statute such as a pattern of racketeering using the mail or wire services and an injury to business or property as well as establish that the injury was caused by the violation of RICO. 37 “A U.S. Court Dismisses Canada’s RICO Action Due to Revenue Rule,” International Enforcement Law Reporter, Volume 16, No. 9 (September 2000.) 35 “Smuggling: Canada Attorney General v. R. J. Reynolds Tobacco Holding Inc.,” Tobacco Industry Litigation Reporter, Volume 15, No. 2 (December 27, 1999), p. 10. 36 “Taxation: “Revenue Rule’ Blocks Canada From Pursuing Suit That Sought Lost Tax Revenue Damages,” New York Law Journal, October 2001, p. 25. 37 Ibid. 34 14 Reynolds moved to dismiss the suit as the Revenue Rule barred U.S. courts from enforcing the tax judgments of foreign governments. The Revenue Rule is a common law rule with its origin in 18th century English court decisions that sought to protect British trade from oppressive foreign customs. Canada argued that the rule should not apply since it was not attempting to enforce its tax statutes but attempting to recover damages as a result of a violation of the U.S. RICO laws. However, the district court concluded that Canada was seeking to prove injury as a result of lost tax revenues and that this would in turn bar their claims under the Revenue Rule. Furthermore, the court ruled that the alleged injuries relating to law enforcement costs did not constitute a cognizable RICO claim. Injury to Canada from increased tobacco consumption was completely derivative of the harm suffered by individual citizens. Since the harm was indirect, the alleged misconduct did not proximately cause injuries and could not be recovered under RICO. In a final blow to Canada, the court declined to exercise jurisdiction over the common law fraud claims.38 The Latin American Suits. The decision in the case of Attorney General of Canada v. R. J. Reynolds would be disturbing news for plaintiffs in several similar cases brought by foreign governments against tobacco firms. Still Canada was preparing to appeal and the final verdict was far from in. In May 2000 governors from the majority of Columbia’s states filed a civil lawsuit under RICO against Philip Morris for allegedly conspiring to smuggle cigarettes into Colombia and thus defrauding 22 states of billions of dollars in tax revenues. The suit cited court records, industry documents and evidence unearthed by “Case: Foreign government Action: Canada Attorney General v. R. J. Reynolds Tobacco Holding,” Tobacco Litigation Reporter, Volume 15, No. 16 (July 28, 2000), p. 6. 38 15 the plaintiffs’ private investigators. The Colombian governors claimed that Philip Morris earned hundreds of million dollars in illegal profits by: Selling cigarettes to smugglers or to distributors known to sell to smugglers; Labeling, mislabeling or failing or label cigarettes in such a way as to facilitate the activities of smugglers; Providing marketing information to distributors and smugglers in order to have high demand cigarettes in the market; Generating false of misleading invoices, bills of lading, shipping documents to expedite smuggling; Shipping cigarettes designated for one port knowing that cigarettes would be diverted to another port and smuggled; Making arrangements for cigarettes to be paid for in a virtually untraceable way, including using Swiss corporations and/or Swiss bank accounts in an attempt to shield smugglers from government investigations.39 In June 2000, Ecuador filed a similar suit against several tobacco companies including R. J. Reynolds, Philip Morris, and BAT.40 In May 2001, Belize and Honduras filed similar suits as well. The Latin American suits also introduced the issue of cigarette companies cooperating with illicit drug dealers. The Colombian suit alleged that, “employees of the Maud S. Beelman, “Philip Morris Accused of Smuggling, Money-Laundering Conspiracy in Racketeering Lawsuit,” The Public I, www.publici.org, posted May 23, 2000. 40 “Case: Foreign Government Action: Ecuador v. Philip Morris Cos.,” Tobacco Industry Litigation Reporter, Volume 15, No. 13 ( June 16, 2000), p.4. 39 16 Philip Morris defendants were personally involved in the laundering of the proceeds of illicit narcotics sales”41 and that “These employees on multiple occasions received large volumes of cash that they took into their personal possession of these employees would be present when large volumes of cash were turned over to the distributors with whom the Philip Morris employees were traveling. These individuals would then smuggle the cash out of Colombia and into Venezuela, with the cash ultimately being deposited in banks and transferred into the coffers of the Philip Morris defendants.”42 The suit went on to contend that the Miami accounts of various Philip Morris cigarette distributors were frozen in the early 1990s by U.S. government because these accounts were being used to launder drug money and that Philip Morris was well aware of the freezing of these accounts.43 The European Union Suit. On July 20, 2000 the European Anti-Fraud Office (OLAF) announced that it would bring a civil action in U.S. court against at least two U.S. cigarette makers in an attempt to recover billion of euros in taxes lost to smuggling.44 In early November 2000, the European Union filed a civil suit in New York under RICO against Philip Morris and R. J. Reynolds Nabisco and Japan Tobacco (to whom RJR sold its international operations in 1999), alleging their involvement in cigarette smuggling. The suit sought compensation for financial losses and an injunction against further smuggling. The EU sought triple damages under RICO for tax losses related to smuggling, losses that were estimated at as much as $1.7 billion annually.45 As such, this suit represented the largest threat to cigarette companies to date. Beelman, “Philip Morris Accused of Smuggling.” Ibid. 43 Ibid. 44 “EU Announces Intention to Sue Cigarette Companies in the U.S.,” International Enforcement Law Reporter, Volume 16, No. 9 (September 2000.) 45 Bruce Zagaris, “EU Brings RICO and Tax Fraud Actions Against Tobacco in the US,” International Enforcement Law Reporter, Volume 16, No. 12 (December 2000.) 41 42 17 Similar to the case brought by the Colombian governors, The EU suit alleged that the defendants were involved with organized crime and drug dealers as a result of their willful participation in cigarette smuggling. According to the suit, Reynolds had dealings with individuals in Spain who they knew or should have know were identified by Spanish authorities as being involved in narcotics trafficking.46 On July 17, 2001, a U.S. judge dismissed the EU suit, ruling that the European Union, the plaintiff in the suit, had not been injured because under European Commission law the ability of the EU member states to collect taxes had no corresponding effect on the ability of the European Commission’s to fund its budgetary requirements. The court went on to state that its ruling did not mean that the individual member states would not have been harmed by smuggling. In response to this ruling, the EU re-filed its suit in U.S. District Court in New York along with ten EU member states for loss of tax revenue.47 September 11 and the Patriot Act As Canada prepared to argue its case at a U.S. Court of Appeals and the EU refiled their case, the U.S. tobacco industry faced a new challenge to their position. To date the industry had defended itself by means of the Revenue Act. However, a new act of Congress or a new foreign treaty could leave the industry vulnerable. In the wake of September 11, such action appeared possible. Erik Schelzig and Mary Beth Warner, “Tobacco Firms Used Suspected Drug Trafickers, EU Lawsuit Claims,” The Public I, www.publici.org, posted November 7, 2000. 47 “EU Files New Lawsuit Against Tobacco Firms for Smuggling to Evade Taxes,” International Enforcement Law Reporter, Volume 17, No. 10 (October 2001.) The countries joining in the suit were Belgium, Finland, France, Germany, Greece, Italy, Luxembourg, the Netherlands, Portugal, and Spain. The British government said it was not actively involved in the lawsuit because its preoccupation was not with the smuggling of American but rather British brands. 46 18 As the Bush Administration rushed anti-terrorism legislation through Congress, issues of money laundering were key. Since money laundering had become a part of suits against tobacco companies, these companies were keen to avoid any wording that could be interpreted as making them vulnerable to foreign countries out to collect taxes lost to cigarette smuggling. R. Bruce Josten, the executive vice-president of the U.S. Chamber of Commerce, presumably acting on their behalf of the American companies, wrote to Treasury Secretary Paul O’Neill on October 10 and 15, 2001, offering suggestions for wording in the Financial Anti-Terrorism Act of 2001 in front of the House of Representatives. Nearly identical wording to that in the October 15 letter was attached to the bill and came to be known as the “Rule of Construction”: None of the changes or amendments made by the Financial Anti-Terrorism Act of 2001 shall expand the jurisdiction of any Federal or State court over any civil action or claim for monetary damages for the nonpayment of taxes or duties under the revenue laws of a foreign state, or any political subdivision thereof, except as such actions or claims are authorized by United States treaty that provides the United States and its political subdivisions with reciprocal rights to pursue such actions or claims in the courts of the foreign state and its political subdivisions.48 Also dropped from the House bill was original wording that expanded unlawful activity for money laundering to include, “Fraud and any scheme to defraud against a foreign government or foreign government entity, if such conduct would constitute a violation of this title if it were committed in interstate commerce in the Unites States.” Sources reporting to Public Integrity said that passage was dropped under pressure from Maud S. Beelman, “White House Sought to Soften Anit-Terrorism Legislation in Support of Tobacco Companies,” The Public I, www.publici.org, posted Novemeber 19, 2001. 48 19 the President and tobacco lobbyists concerned about its affect on Canada’s lawsuit against R. J. Reynolds.49 Although the cigarette companies had won a brief victory, the House wording ran into strong opposition in the Senate and was eventually deleted from the USA Patriot Act that President Bush signed into law on October 26, 2001. One lawyer involved in the RICO lawsuits was quoted as saying that had the measure passed as proposed the rule of construction would have killed the cases. New treaties would have been required to pursue the claims against U.S. cigarette companies, by which time the statute of limitations would have expired.50 Still the victory soon proved to be hollow. Canada had pursued their case to a U.S. Court of Appeals that eventually agreed with the decision of the district court. One dissenting judge opined that the Revenue Rule had nothing to do with the case “despite the considerable confusion created by the defendant’s able arguments.”51 However, even as the Patriot Act was being debated, a petition to rehear the Canadian appeal was denied on October 19, 2001.52 On February 19, 2002, the new EU lawsuit was dismissed as well. Judge Nicholas G. Garaufis stated that Congress did not intend to abrogate the Revenue Rule when it added money laundering to the federal racketeering statute with the passage of the USA Patriot Act. The plaintiffs argued that the legislative history of the Patriot Act, particularly the refusal to add the Rule of Contention, showed a clear intention on the part 49 Ibid. Ibid. 51 “Case: Foreign Government (Taxes: Attorney General of Canada v. R. J. Reynolds Tobacco Holding),” Tobacco Industry Litigation Reporter, Volume 16, No, 24 (October 19, 2001), p. 3. 52 “Case: Foreign Government: Attorney General of Canada v. R. J. Reynolds Tobacco Company,” Tobacco Industry Reporter, Volume 17, No. 6 (December 28, 2001), p. 4. 50 20 of Congress to abrogate the Revenue Rule and to allow federal courts to enforce, through the new money-laundering provision in the racketeering statute, the tax collection efforts of foreign governments. The judge concluded that the burden was on the plaintiffs to show that Congress “affirmatively acted to abrogate the Revenue Rule with RICO” either at the time of passing RICO in 1970 or at the time of the passage of the Patriot Act, and this they had not done.53 Corporate Responses to the Smuggling Threat As long as they were not held culpable, cigarette companies could take advantage of smuggling in order to both create larger primary markets and to garner higher market shares for their brands. The lawsuits, and the concomitant scrutiny by host governments, posed some of the greatest threats these companies had ever encountered. The corporate responses were both haphazard and organized. Most actions appeared to be designed to protect the companies rather than stop the smuggling. Companies alternately denied their involvement in smuggling and defended it. Twice in so many years, Philip Morris defeated shareholder resolutions that suggested corporate complicity in smuggling and called for an internal review.54 Company assertions that they were cooperating with governments were veritably scorned by governments who filed lawsuits against the companies. When the BAT scandal broke on the pages of The Guardian and the website of Public Integrity, the deputy director of BAT, Kenneth Clarke, responded in a letter to The Mark Hamblett, “Tobacco Companies Win Dismissal of Foreign Tax Suits,” The Legal Intelligencer, Volume 226, No. 35 (February 21, 2002), p. 4. 54 Beelman et.al.,“Multinational Organized Cigarette Smuggling, Evaded Taxes.” 53 21 Guardian that both disclaimed responsibility and chided governments for causing the problem: Too many governments follow a policy of raising tobacco taxes to excessive levels and ignore dramatic tax differentials between neighbouring countries…It is not in our wider commercial interests to encourage or condone smuggling and it is certainly contrary to our standards as a responsible company…However, where governments are not prepared to address the underlying causes of the problem, businesses such as ours who are engaged in international trade are faced with a dilemma. If the demand for our brands is not met, consumers with either switch to our competitors’ brands or there will be the kind of dramatic growth in counterfeit products that we have recently seen in our Asian markets. Where any government is unwilling to act or their efforts are unsuccessful, we act, completely within the law, on the basis that our brand will be available alongside those of our competitors in the smuggled as well as the legitimate market.55 Many interpreted this response as being especially arrogant and likely helped to fuel the BAT scandal in Britain. Early on, companies also sought to shift the blame on to distributors. In the wake of the Northern Brands case, Philip Morris and R. J Reynolds filed trademark infringement claims against distributors claiming that cigarettes designated for export were later re-imported into the United States. Philip Morris contended that the defendants undermined their Marlboro brand in the United States because their cigarettes for export were materially different from those intended for sale in the United States, citing different formulations, packaging, quality control, health warnings, and promotional campaigns for different markets.56 Still the attempt to shift blame to distributors appeared feeble in light of the plethora of evidence arising from court cases, and often posted on the web, that indicated the cooperation of cigarette companies with their smuggling distributors. Kenneth Clark, “Dilemma of a Cigarette Exporter,” The Guardian, February 3, 2000. “Case: Trademark Infringement: Philip Morris Inc. v. Allen Distributors, Inc.,” Tobacco Industry Litigation Reporter, Volume 14, No. 8 (March 26, 1999), p. 16. 55 56 22 Lobbying, such as that directed at the USA Patriot Act, was also practiced on an international scale. Alongside the lawsuits being filed in the United States, the World Health Organization (WHO) began negotiations in Geneva in late 2000 in hopes of crafting a treaty that would place tight restrictions on both cigarette advertising and smuggling. With tobacco companies largely excluded from the talks, major cigarette companies have already begun lobbying the individual countries that will eventually have to ratify any treaty forwarded by WHO.57 Inevitably, cigarette companies, as well as other firms caught in smuggling, will have to take greater responsibility for stopping smuggling. The cigarette scandals and lawsuits have yet to make the firms pay for past actions. But they created a new attitude among many governments that is less amenable to corporate arguments that the firm knew nothing about the smuggling. The smuggling lawsuits brought under RICO threatened tobacco companies with losses far beyond any lawsuit in the industry to date. The companies cannot afford to lose cases like these in the future pending a change in the U.S. law or the passing of an international treaty relating to cigarette smuggling. Though beneficial to many companies in the past, smuggling will be a problem for companies to solve in the immediate future. Conclusions Since the mid-1990s, predictions based on the Mexican Paradigm have largely come true. While trade liberalization may have decreased the total level of smuggling, what is left is still significant and increasingly in the hands of organized crime. The smuggling of consumer products has become ever more intertwined with narcotics traffic 57 “Tobacco Industry Lights Into WHO,” Legal Times, September 11, 2000, p.1. 23 and possibly terrorist activities. Corporate officers who became involved in smuggling have even been murdered. The immediate implications for corporations of the cigarette saga are ambiguous. The tobacco industry still wields a powerful lobby, and their successful attempts to protect themselves from accountability have in turn offered protection to firms in other industries. The United States may not wish to be responsible for collecting the taxes of other states, especially as such payments to foreign governments from U.S. companies can only mean less taxes paid the U.S. government. However, the United States foreign policy is currently seeking cooperation between countries to fight terrorism, and money laundering and smuggling are increasingly involved in this debate. In any case, the publicity of smuggling in the tobacco industry provides us the realization that firms are far less the victims of smuggling as the participants in it. Although the U. S. government has been relatively lenient thus far towards U.S. firms caught in the Black Market Peso Exchange, the exposes concerning tobacco companies and the successful anti-smuggling actions taken by companies such as General Electric may make authorities less gullible in the immediate future. Governments, both host and home, are unlikely to be as sympathetic to corporations as they have been in the past. 24 25