Department of Software and Information Systems

advertisement

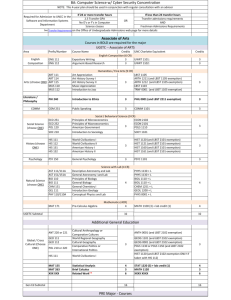

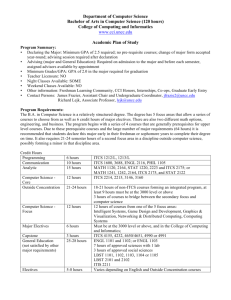

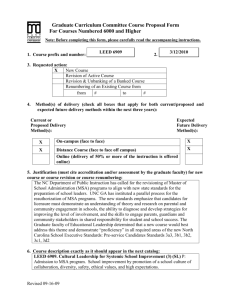

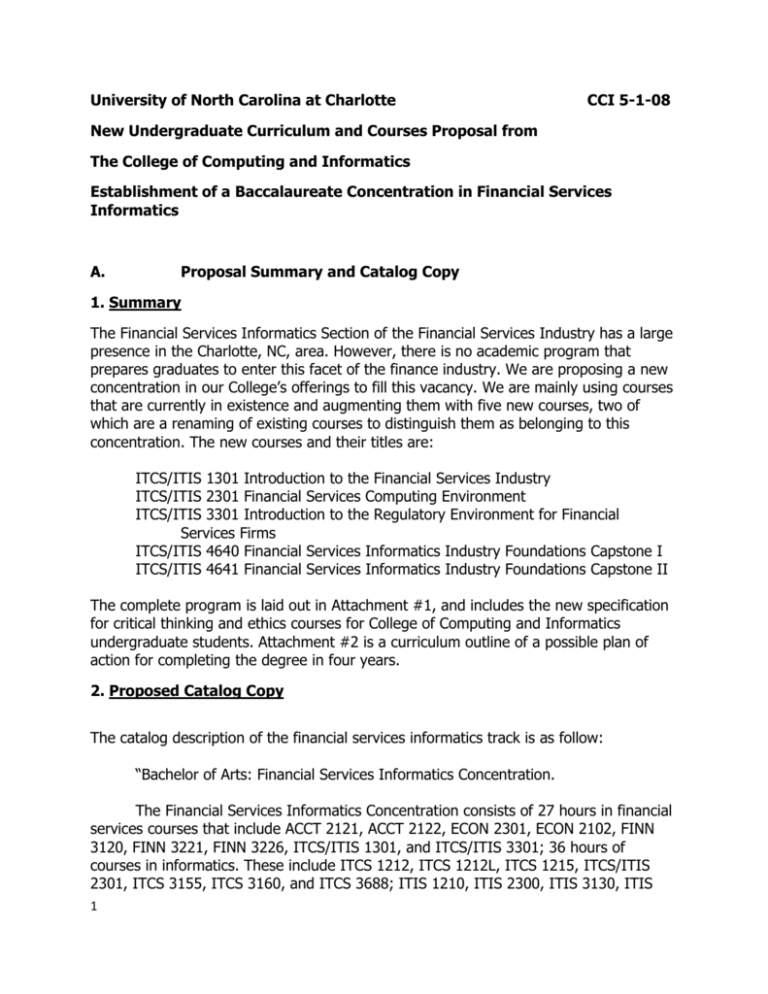

University of North Carolina at Charlotte CCI 5-1-08 New Undergraduate Curriculum and Courses Proposal from The College of Computing and Informatics Establishment of a Baccalaureate Concentration in Financial Services Informatics A. Proposal Summary and Catalog Copy 1. Summary The Financial Services Informatics Section of the Financial Services Industry has a large presence in the Charlotte, NC, area. However, there is no academic program that prepares graduates to enter this facet of the finance industry. We are proposing a new concentration in our College’s offerings to fill this vacancy. We are mainly using courses that are currently in existence and augmenting them with five new courses, two of which are a renaming of existing courses to distinguish them as belonging to this concentration. The new courses and their titles are: ITCS/ITIS 1301 Introduction to the Financial Services Industry ITCS/ITIS 2301 Financial Services Computing Environment ITCS/ITIS 3301 Introduction to the Regulatory Environment for Financial Services Firms ITCS/ITIS 4640 Financial Services Informatics Industry Foundations Capstone I ITCS/ITIS 4641 Financial Services Informatics Industry Foundations Capstone II The complete program is laid out in Attachment #1, and includes the new specification for critical thinking and ethics courses for College of Computing and Informatics undergraduate students. Attachment #2 is a curriculum outline of a possible plan of action for completing the degree in four years. 2. Proposed Catalog Copy The catalog description of the financial services informatics track is as follow: “Bachelor of Arts: Financial Services Informatics Concentration. The Financial Services Informatics Concentration consists of 27 hours in financial services courses that include ACCT 2121, ACCT 2122, ECON 2301, ECON 2102, FINN 3120, FINN 3221, FINN 3226, ITCS/ITIS 1301, and ITCS/ITIS 3301; 36 hours of courses in informatics. These include ITCS 1212, ITCS 1212L, ITCS 1215, ITCS/ITIS 2301, ITCS 3155, ITCS 3160, and ITCS 3688; ITIS 1210, ITIS 2300, ITIS 3130, ITIS 1 3200, ITIS 3300, and ITIS 4220. There is a 6 hour component in Financial Services Informatics Industry Foundations Capstone I and II. There are nine hours of mathematics and statistics courses, including MATH 1120, STAT 1220, and STAT 2223. A 6 hour block is dedicated to PHIL 1105 and LBST 2211 (Ethics designated sections). Finally, there is a requirement for 6 hours of COMM 2105 and ENGL 2116.” New Courses: ITCS 1301. Introduction to the Financial Services Industry. (3) Crosslisted as ITIS 1301. Prerequisites: None. The objective of this course is to provide the student with an overview of the financial services industry, to include such areas as the industry components; regulatory considerations and their impact; and relations with other institutions. Fall, Summer (Evenings) ITIS 1301. Introduction to the Financial Services Industry. (3) Crosslisted as ITCS 1301. Prerequisites: None. The objective of this course is to provide the student with an overview of the financial services industry, to include such areas as the industry components; regulatory considerations and their impact; and relations with other institutions. Fall, Summer (Evenings) ITCS 2301. Financial Services Computing Environment. (3) Crosslisted as ITIS 2301. Prerequisite: ITCS/ITIS 1301. The objective is for the student to gain insights on several key components in financial computing environments and the enabling technologies. Spring, Summer (Evenings) ITIS 2301. Financial Services Computing Environment. (3) Crosslisted as ITCS 2301. Prerequisite: ITCS/ITIS 1301. The objective is for the student to gain insights on several key components in financial computing environments and the enabling technologies. Spring, Summer (Evenings) ITCS 3301. Introduction to the Regulatory Environment for Financial Services Firms. (3). Crosslisted as ITIS 3301. Prerequisite: ITCS/ITIS 2301. Using case studies, enable the student to understand the compliance and regulatory environment that currently exists for Financial Services firms. Fall, Summer (Evenings) ITIS 3301. Introduction to the Regulatory Environment for Financial Services Firms. (3). Crosslisted as ITCS 3301. Prerequisite: ITCS/ITIS 2301. Using case studies, enable the student to understand the compliance and regulatory environment that currently exists for Financial Services firms. Fall, Summer (Evenings) ITCS 4640. Financial Services Informatics Industry Foundations Capstone I. (3) Crosslisted as ITIS 4640. Prerequisite: Senior standing. An individual or group project in the theory, teaching, or application of Financial Services Informatics under the direction of a faculty member. Projects must be approved before they may be initiated. Fall, Spring, Summer (Evenings) 2 ITIS 4640. Financial Services Informatics Industry Foundations Capstone I. (3) Crosslisted as ITCS 4640. Prerequisite: Senior standing. An individual or group project in the theory, teaching, or application of Financial Services Informatics under the direction of a faculty member. Projects must be approved before they may be initiated. Fall, Spring, Summer (Evenings) ITCS 4641. Financial Services Informatics Industry Foundations Capstone II. (3) Crosslisted as ITIS 4641. Prerequisite: ITCS/ITIS 4640. A continuation of ITCS/ITIS 4640. Fall, Spring, Summer (Evenings) ITIS 4641. Financial Services Informatics Industry Foundations Capstone II. (3) Crosslisted as ITCS 4641. Prerequisite: ITCS/ITIS 4640. A continuation of ITCS/ITIS 4640. Fall, Spring, Summer (Evenings) B. 1. JUSTIFICATION Need Addressed A committee was formed that included representatives from Bank of America, Wachovia, and TIAA-CREF, and the College of Computing and Informatics to address the needs of the Financial Services Informatics Industry. The Financial Services Industry representatives to the committee that drafted this concentration stated clearly the need for such an option. Their needs are a combination of finance and information technology which are currently not being met by any program in the area. This blend of finance, informatics, and the new courses will provide them with a well grounded supply of entry level personnel. 2. Prerequisites Each of the new courses has a clearly stated prerequisite which supports the course in its relationship to others in the program. 3. Course Numbering Each of the five courses is numbered at the proper level. The course numbers reflect the year in which it is anticipated that the courses will be taken by the students enrolled in this concentration. 4. Improvements The courses will provide the foundation for the new concentration. They will be taught by adjunct faculty who are practitioners in the respective areas. 3 C. IMPACT 1. Students served This proposal will chiefly serve students in the College of Computing and Informatics who have chosen to take the financial services informatics concentration. These new courses will be available to any other students who might show an interest in the field and who have the proper prerequisites. 2. Effect on Existing Courses and Curricula a. Offering The courses will be offered as shown in their respective catalog copies. The three lecture courses will be offered once each year and the capstone project courses will be offered each semester. b. Other Courses The three lecture courses will not have any impact on other courses as they will be taught by adjunct faculty. The capstone courses will compete with other similar capstone courses for all undergraduate student s in the College. c. Anticipated Enrollment We expect the enrollment to begin slowly as the concentration begins to pick up adherents. Initially, we anticipate small class sizes or ten or so, and building eventually to a regular sized undergraduate course of thirty to thirty-five. d. Enrollment Impact These courses will not have any impact on additional courses as the students will need to take these five as part of their concentration. They will enroll in other courses which are taken by undergraduates in the College, and will be seen as part of the growth of the College’s undergraduate program. e. Topics Courses None of the courses have been offered as topics courses and none are anticipated to be presented as such. f. Other Catalog Copy No other area of catalog copy is impacted. 4 D. 1. RESOURCES REQUIRED TO SUPPORT PROPOSAL Personnel a. We anticipate hiring fully qualified, according to SACS criteria, adjunct faculty from the financial services informatics industry to teach the courses. Funds will be made available initially for the hires from the College’s lapse salary account. Additional funds will be requested to upgrade one of the College’s core positions allocated for part-time faculty as part of the normal budgeting process. b. The following adjunct faculty meet SAC accreditation and may teach the following courses: ITCS/ITIS ITCS/ITIS ITCS/ITIS ITCS/ITIS ITCS/ITIS 2. 1301: 2301: 3301: 4640: 4641: Benjamin Teal, Bank of America Ken Russell, Kinetic Strategy Partners; Allan Shub, Wachovia Ken Russell, Kinetic Strategy Partners; Allan Shub, Wachovia Any CCI tenure-track faculty member Any CCI tenure-track faculty member Physical Facility No new physical facility will be required to teach the lecture courses. Lab space is available for the capstone courses. 3. Equipment and Supplies No new equipment or supplies are required to deliver the new courses. 4. Computer No new computing equipment will be required to support the new courses. 5. Audio-Visual No new audio-visual equipment will be needed as all classrooms are equipped with smart podiums. 6. Other Resources No other resources will be needed to support this proposal. 5 7. Funding Sources Funds to hire the adjunct faculty will be made initially through use of lapse salary. A request will be made during the normal budget cycle to increase the allocation for the core positions that fund part-time instructors. E. CONSULTATION WITH THE LIBRARY AND OTHER DEPARTMENTS OR UNITS 1. Library Consultation Consultation with the Library was initiated on 17 April 2008. Their reply letter is at Attachment #3. 2. Consultation with Other Departments or Units Consultation with the Department of Finance. The reply letter is at Attachment #4. F. 1. INITIATION AND CONSIDERATION OF THE PROPOSAL Originating Unit The proposal was approved by the Faculty of the College of Computing and Informatics on _________________________________. 2. Other Considering Units No other units were requested to consider this proposal. G. 1. 2. 3. 4. 5. 6. 7. 8. 6 ATTACHMENTS Financial Services Informatics Degree Requirements Curriculum Outline Library Consultation Department of Finance Consultation Course Outline: ITCS/ITIS 1301 Course Outline: ITCS/ITIS 2301 Course Outline: ITCS/ITIS 3301 Course Outlines: ITCS/ITIS 4640 and 4641 Attachment #1 FINANCIAL SERVICES INFORMATICS DEGREE REQUIREMENTS CORE—FINANCIAL SERVICES 27 hours ACCT 2121, 2122, ECON 2301, 2102, Introduction to the Financial Services Industry ITCS/ITIS 1301, Introduction to the Regulatory Environment for Financial Services Firms ITCS/ITIS 3301, FINN 3120, 3221, 3226 CORE—INFORMATICS 36 hours ITCS 1214, 1215, 3155, 3160, and 3688 ITIS 1210, 2300, 3130, 3200, 3300, and 4220 Financial Services Computing Environment ITCS/ITIS 2301 FINANCIAL SERVICES INFORMATICS 6 hours MATHEMATICS/STATISTICS 9 hours Financial Services Informatics Industry Foundations Capstone I & II—ITCS/ITIS 4640 and 4641 MATH 1120, STAT 1220, and STAT 2223 CRITICAL THINKING AND ETHICS 6 hours ELECTIVES—FREE 5 hours PHIL 1105 and LBST 2211 GENERAL EDUCATION REQUIREMENTS GENERAL EDUCATION I Skills of Inquiry 3-6 hours 6 hours ENGL 1101 and 1102, or 3 hours ENGL 1103 GENERAL EDUCATION II Science 10 hour 7 hours of approved Sciences with 1 lab, and 3 hours of approved Social Sciences GENERAL EDUCATION III Liberal Education 9 hours 3 hours LBST 1101, 1102, 1103, 1104, or 1105 6 hours LBST 2301 and 2102 (3 hours LBST 2211 included above) GENERAL EDUCATION IV Communication Skills 6 Hours COMM 2105 and ENGL 2116 TOTAL 120 hours 7 Attachment #2 Bachelor of Arts with a Concentration in Financial Services Informatics Curriculum Outline Freshman Year Fall ITCS 1212 & L ITCS/ITIS 1301 ENGL 1101 MATH1120 LBST 110X 3 3 3 3 3 -----15 Spring ITCS 1215 ITIS 1210 ENGL 1102 STAT 1220 PHIL 1105 3 3 3 3 3 -----15 Sophomore Year Fall ITIS 2300 ACCT 2121 ECON 2301 STAT 2223 COMM 2105 Spring 3 3 3 3 3 -----15 ITCS/ITIS 2301 ACCT 2122 ECON 2102 LBST 2211 ENGL 2116 3 3 3 3 3 -----15 Junior Year Fall ITIS 3200 ITCS/ITIS 3301 FINN 3120 SOC SCIENCE LBST 2102 Spring 3 3 3 3 3 -----15 ITIS 3300 ITCS 3155 FINN 3221 ITCS/ITIS 4640 ELECTIVES 3 3 3 3 3 -----15 Senior Year Fall ITCS 3160 ITIS 3130 FINN 3326 ITCS/ITIS 4641 LAB SCIENCE 8 Spring 3 3 3 3 4 -----16 ITCS 3688 ITIS 4220 LBST 2301 LAB SCIENCE ELECTIVES 3 3 3 3 2 -----14 Attachment #3 J. Murrey Atkins Library Consultation on Library Holdings To: Prof. Lejk From: Kelly Evans, Business Librarian Reese Manceaux, Research Data Services Date: May 5, 2008 Subject: Financial Services Informatics Summary of Librarian’s Evaluation of Holdings: Evaluator: Kelly J. Evans and Reese Manceaux Date: May 5, 2008 Please Check One: Holdings are superior Holdings are adequate 9 _____ (see attachment) __X__ Holdings are adequate only if Dept. purchases additional items. _____ Holdings are inadequate _____ Comments: Please see the attachment Course Proposal Kelly J. Evans Reese Manceaux ______________________________ Evaluator’s Signature 5/9/08 ______________________________ 10 Library Resources: Databases Business1. Business Source Premier-article database in various areas of business and information technology. (Example searches, asset management, private banking, and custody services.) 2. EconLit-article database in the area of economics research. 3. Industry Market Research-database featuring the latest in various industry trends, finances, and outlook. 4. Lexis-Nexis Academic- database that includes federal, state and international laws and regulatory information regarding corporate business practices. 5. Westlaw-legal research database that includes case laws. 6. Investext Plus-full-text reports about investment research on companies and industries. 7. Globus-International database of global trade and investment research. 8. SAGE Journals Online-include more than 246 journals including areas of business and technology. 9. CCH Tax Research Network-database involving U.S. taxation information provided by the CCH tax services. 10. Checkpoint-primary and secondary sources regarding U.S. local, state and federal taxation. Information Technology1. Compendex- bibliographic database of technology and engineering research literature—excels at computer security articles (also 11,000+ articles with banking or financial in the title). 2. IEEE Xplore-publications of the IEEE in the areas of electrical engineering and computing.— contains a few articles on financial systems such as E-commerce technology conference papers. 3. Springer-Link-(full text) combines journals with subjects of business and economics, and computer science (Journal of Financial Services Research/Financial Cryptography and Data Security for examples.) 4. Academic Search & MasterFile – mostly interdisciplinary databases but they do contain some scholarly journals such as: Bank Systems & Technology, Computer Security Update. 11 Books published in last five years SubjectsHedge Funds- 15 books. Corporate Governance- 41 books and e-books. Monetary Policy- 13 books and e-books. Banks and Banking- 113 books and e-books. 2 are published in last five years. 34 related subject headings. Consumer Protection- 7 books and e-books. Identity Theft United States Prevention-42 books and e-books. Computer Security- 90 books Electronic Commerce – 54 books and e-books / Electronic Funds Transfers – 15 books Computer Networks-Security – 34 books and e-books Database Management – 29 books and e-books 12 Attachment #4 Department of Finance The Belk College of Business 9201 University City Blvd. Charlotte, NC 28223-0001 Telephone 704-687-7623 Fax 704-687-6987 MEMORANDUM To: Dr. Rick Lejk, Associate Dean, College of Computing and Informatics From: C.W. Sealey, Chair, Department of Finance Date: 25 April 2008 Subject: New Undergraduate Curriculum and Course Proposal As Chair of the Department of Finance, I support your proposed undergraduate program in Financial Services Informatics. If I can be of further assistance, please let me know 13 Attachment #5 Course outline for ITCS/ITIS 1301 Introduction to the Financial Services Industry 1. The Nature of Financial Services a. History of financial services National Banking Act – 1863 Federal Reserve Act – 1913 Banking Act – 1933 Depository Institutions Deregulation and Monetary Control Act – 1980 Riegel-Neal Act – 1994 Gramm-Leach-Bliley Act - 1999 b. Banking services Consumer/Commercial Banking Private Banking Investment Banking Credit Cards Virtual Banking c. Investment services Asset Management Hedge Funds Custody Services d. Insurance Services Brokerage Underwriting Reinsurance 2. The Role of Financial Services and Financial Markets in a Modern Economy a. Economic stability and growth b. Trading c. Supply/Demand 3. Financial Instruments a. Dimensions and concepts b. Types of financial instruments Cash instruments Derivatives instruments Foreign Exchange instruments c. How to calculate financial instruments d. Interest rate risk 4. An Introduction to Financial Regulation a. Federal Reserve b. Interest rates c. Depository institution regulation d. Deposit insurance (FDIC) e. Monetary policy 14 Possible textbooks and reading materials: Financial Institution Management: A Risk Management Approach, Irwin/McGraw-Hill, 5th Edition, 2005 Bank Management & Financial Services, McGraw-Hill/Irwin, 7th Edition, 2006 Possible instructors: Benjamin Teal, Bank of America 15 Attachment #6 Course Outline for ITCS/ITIS 2301 Financial Services Computing Environment 1. Architectures a. Service Oriented Architectures (SOA) b. Web Services c. Grid 2. Transaction Processing a. High volume, on-line and batch applications b. Impact of mixed environment: legacy and new applications, distributed and mainframe platforms. c. Key issues that technology must address include high speed, high reliability, traceability (log auditing, non-repudiation), and auditability. 3. Security, compliance, and regulatory concerns a. Increased emphasis for financial institutions b. Use of technology to provide better control and management in areas like discoverability, data retention, and “Big Brother” 4. Strategies for High Availability and Recoverability a. Active-Active b. Hot Cold c. Virtualization d. Others 5. Customer and business partner channels a. Call centers b. Branch offices c. Internet d. Telephone e. ATM/kiosks f. Email g. Print and output technologies 6. Impact of off-shoring and outsourcing a. Remote development 7. Quality management a. CMM 8. Field trips and hands-on experiences a. Call centers b. Trading floors c. Data centers Possible textbooks and reading materials: Possible instructors: Ken Russell, Kinetic Strategy Partners; Allan Shub, Wachovia 16 Attachment #7 Course Outline for ITCS/ITIS 3301 Introduction to the Regulatory Environment for Financial Services Firms 1. History of the Financial Services IT regulatory environment 2. Focus areas for regulation a. Investments/securities i. Legislation: Investment Advisors Act, Investment Company Act, Security Exchange Act ii. Case study – insider trading b. Banking i. Office of the Comptroller of the Currency, FDIC, Federal Reserve, Office of Thrift Supervision ii. Case study – the Savings & Loan crisis in the 1980s c. Financial reporting integrity i. Case Study – Accounting fraud at WorldCom ii. Case Study – Enron d. Privacy i. Gramm-Leach Bliley ii. HIPAA iii. State Laws (California, etc.) e. Consumer protection i. FCC TCPA and State DNC (Do-Not-Call) laws ii. Identity theft iii. Federal and state breach notification laws (banking) iv. Payment Card Industry (PCI) v. Email (CANSPAM) (ID of sender, Ability to opt out, COPPA (protection of children online)) f. Federal and state record retention requirements g. Anti-terrorist and national security i. USA Patriot Act ii. Anti-money laundering 3. Key risks a. Managed services & outsourcing b. Contractual issues c. Disaster recovery d. Business continuity planning 4. Governance a. Case Study - Sarbanes-Oxley (SOX) b. Case Study – IT Governance Possible textbooks and reading materials: Possible instructors: Ken Russell, Kinetic Strategy Partners; Allan Shub, Wachovia 17 Attachment #8 Course Outline for ITCS/ITIS 4640 and 4641, Financial Services Informatics Industry Foundations Capstone I and II These two courses will consist of individual or group projects in the teaching, theory, or application of Financial Services Informatics under the direction of a faculty member. The courses will provide cumulative experiences to students working in realistic projects in a team environment. Key topics will be the challenges facing information technology within the Financial Services Industry. Some examples may include outsourcing and off-shoring, platform consolidation, out-dated infrastructure, new product introduction, expanding services, and poor infrastructure in developing countries. Students will initiate and complete their data collection and analysis, formulating conclusions and/or strategies. They will develop a written report of their research findings, following the prescribed format, and develop a presentation format of their choice, designed to enable others to understand the project, the outcomes, recommendations and conclusions, and their learning experiences. Possible textbooks and reading materials: Will be dependent on topic selected. Possible instructors: Any tenure track faculty member in the College may serve as advisor for a capstone course. 18