Personal Finance

advertisement

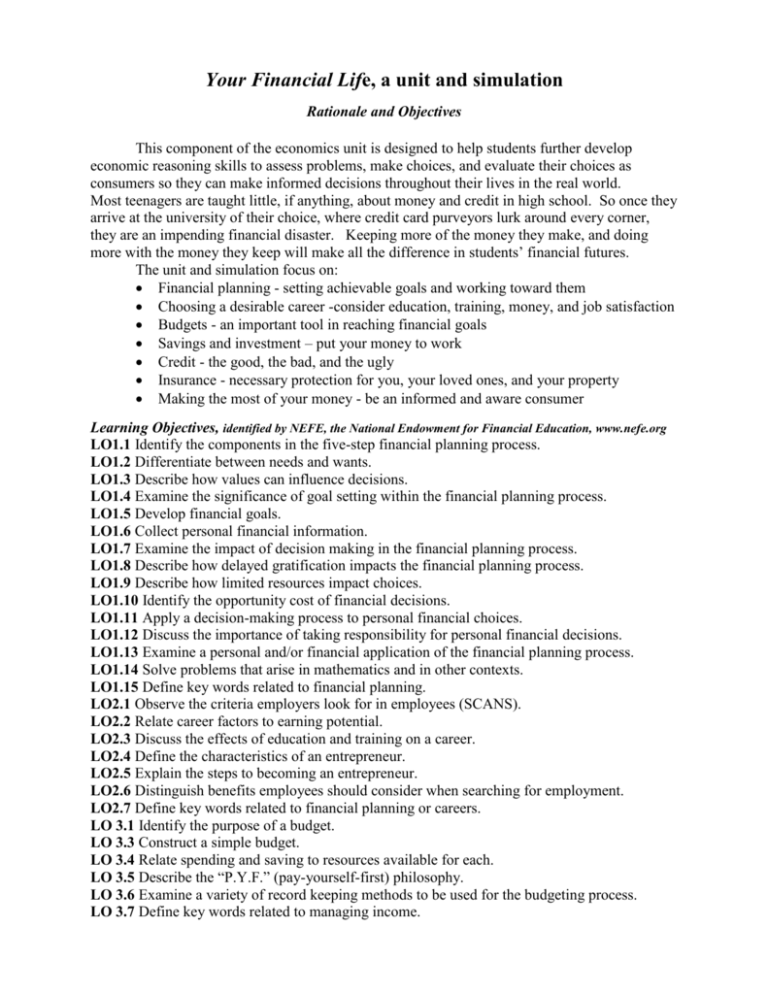

Your Financial Life, a unit and simulation Rationale and Objectives This component of the economics unit is designed to help students further develop economic reasoning skills to assess problems, make choices, and evaluate their choices as consumers so they can make informed decisions throughout their lives in the real world. Most teenagers are taught little, if anything, about money and credit in high school. So once they arrive at the university of their choice, where credit card purveyors lurk around every corner, they are an impending financial disaster. Keeping more of the money they make, and doing more with the money they keep will make all the difference in students’ financial futures. The unit and simulation focus on: Financial planning - setting achievable goals and working toward them Choosing a desirable career -consider education, training, money, and job satisfaction Budgets - an important tool in reaching financial goals Savings and investment – put your money to work Credit - the good, the bad, and the ugly Insurance - necessary protection for you, your loved ones, and your property Making the most of your money - be an informed and aware consumer Learning Objectives, identified by NEFE, the National Endowment for Financial Education, www.nefe.org LO1.1 Identify the components in the five-step financial planning process. LO1.2 Differentiate between needs and wants. LO1.3 Describe how values can influence decisions. LO1.4 Examine the significance of goal setting within the financial planning process. LO1.5 Develop financial goals. LO1.6 Collect personal financial information. LO1.7 Examine the impact of decision making in the financial planning process. LO1.8 Describe how delayed gratification impacts the financial planning process. LO1.9 Describe how limited resources impact choices. LO1.10 Identify the opportunity cost of financial decisions. LO1.11 Apply a decision-making process to personal financial choices. LO1.12 Discuss the importance of taking responsibility for personal financial decisions. LO1.13 Examine a personal and/or financial application of the financial planning process. LO1.14 Solve problems that arise in mathematics and in other contexts. LO1.15 Define key words related to financial planning. LO2.1 Observe the criteria employers look for in employees (SCANS). LO2.2 Relate career factors to earning potential. LO2.3 Discuss the effects of education and training on a career. LO2.4 Define the characteristics of an entrepreneur. LO2.5 Explain the steps to becoming an entrepreneur. LO2.6 Distinguish benefits employees should consider when searching for employment. LO2.7 Define key words related to financial planning or careers. LO 3.1 Identify the purpose of a budget. LO 3.3 Construct a simple budget. LO 3.4 Relate spending and saving to resources available for each. LO 3.5 Describe the “P.Y.F.” (pay-yourself-first) philosophy. LO 3.6 Examine a variety of record keeping methods to be used for the budgeting process. LO 3.7 Define key words related to managing income. LO 4.1 Explain the relationship between saving and investing. LO 4.2 Describe reasons for saving and investing. LO 4.3 Explain the concept of the time value of money. LO 4.4 Describe how time, money, and rate of interest relate to meeting specific financial goals. LO 4.5 Use the Rule of 72. LO 4.6 Explain basic investment principles. LO 4.7 Discuss the impact of investment results when there is a delay in implementing a savings program. LO 4.8 Identify and discuss various savings and investment alternatives. LO 4.9 Define key words related to savings, investing, and time value of money. LO 5.1 Define the purpose of credit. LO 5.2 Explain the importance of using and managing credit wisely. LO 5.3 Define the various costs related to credit. LO 5.4 Identify sources of credit including installment loans, student loans and mortgages. LO 5.5 Use selection criteria for obtaining a credit card. LO 5.6 Discuss the factors to consider when building credit history. LO 5.7 Describe the advantages of using credit. LO 5.8 Discuss ways the use of credit can be abused. LO 5.9 Identify financial consequences of debt. LO 5.10 Describe the steps for correcting debt problems. LO 5.11 Identify impact of bankruptcy on credit. LO 5.12 Define key words related to credit and debt. LO 6.1 Explain the use of insurance as an option for financial protection. LO 6.2 Describe how insurance works. LO 6.3 Identify ways to manage the possibility of financial loss. LO 6.4 Recognize the costs associated with insurance coverages. LO 6.5 Distinguish between the types of auto insurance coverage. LO 6.6 Recognize personal automobile insurance coverage. LO 6.7 Determine factors considered to obtain the cost of automobile insurance. LO 6.8 Relate insurance to your current and future personal needs. LO 6.9 Identify general types of insurance: health, property, life, disability, and liability. LO 6.10 Define the key words relative to financial protection or loss. Objectives from the GATE Scope and Sequence include 3.1.1 make informed choices. 4.1.1 distinguish between fact and opinion. 4.1.2 distinguish relevant from irrelevant information. 4.1.3 determine the accuracy of a statement. 4.1.4 determine the credibility of a source. 4.1.7 identify external and internal bias. 4.1.8 recognize fallacious arguments. 4.1.13 analyze multiple points of view/perspectives. 5.3.2 predict future consequences of present actions. 4.1.10 draw conclusions based on data and inferences about cause/effect relationships. 6.1.1 develop convergent thinking skills such as inductive and deductive reasoning. 7.2.1 incorporate and reflect basic math concepts (e.g., number, time, and money). 7.2.5 incorporate and reflect cause and effect. 7.2.9 incorporate and reflect the supply/demand concept.