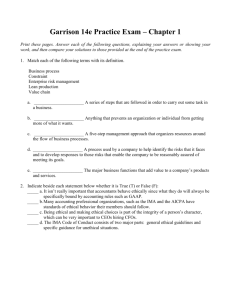

ECSAFA News July - September 2007

advertisement

Secretariat: Street address: Block B, CPA Centre Ruaraka, Thika Road Nairobi Kenya. ECSAFA EXECUTIVE COMMITTEE Postal Address: P. O. Box 4259 – 00100 Nairobi. Tel: 254 20 2021184 Fax: 254 20 2021184 Email: ecsafa@africaonline.co.ke Website: www.ecsafa.org ECSAFA 1. Mr. Morgan Tembo - President (Malawi) 2. Mr. Koos du Toit - Deputy President (Namibia) 3. Ms. Jackie Tong - Member (RSA) 4. Mr. Joseph Wangai - Member (Kenya) 5. Mr. Saleem Kharwa - Member (RSA) Chief Executive Officer/ Secretary - Mr. Vickson Ncube (Zambia) NEWS JULY - SEPTEMBER 2007 Welcome to this issue of ECSAFA News for the period July - September 2007. In our bid to improve the ECSAFA News, we shall continue adding new features and presentation styles. We request members who have suggestions on how we can improve our News to give us their suggestions. To all of you, we earnestly appeal to you to send this electronic News to all your members. We shall, from this Edition onwards be featuring a speech that we believe will inspire you and your members. If any one of you has any speech that you think should be shared with other members, please send it to us for consideration. Featured Speech ACCA Eastern Africa Holds Convention as Allen Blewitt sets the tone for Professional Ethics ACCA, Eastern Africa held its 2nd Convention on 25 – 27 July 2007 at the Speke Resort and Conference Centre in Munyonyo, Uganda. The event brought together about 650 ACCA members and other accountants from 9 countries in the region and the United Kingdom. The theme of the Convention was “Balancing Organizational Success with Ethical Practice”. Delivering his opening speech, ACCA CEO Mr. Allen Blewitt had this to say: The Right Hon. 1st Deputy Prime Minister, Eriya Kategaya, Vice President of the Institute of Certified Public Accountants of Uganda, Narendra Thakkar, distinguished guests, ladies and gentlemen. Firstly, I would like to thank the Deputy President of ICPAU for his excellent speech and very kind words. I am delighted to welcome you all to the opening day of this Convention, and am proud to be addressing such a high level gathering of members from across the region. 1 The issue, which we will be tackling over the next two days, is one, which finance professionals around the world and in every sector are grappling with. It is – in a nutshell – How can we be good at business and still be good? It’s an issue, which faces everyone in this room – and we will be hearing examples of how people have confronted those issues. ACCA believes that confronting the ethical challenge requires not only a moral compass – but moral courage too. This applies to everyone in this room – from government leaders, the CFOs and Finance Directors to those who may be just starting their careers. For those in positions of influence and power, your responsibility is to set the ethical agenda and direction of your organization – to ensure that employees know what you expect from them …and that alongside working for the organization, they also work in the interest of their communities. And for employees you need the courage to hold true to your ethical beliefs in the face of what may seem to be overwhelming edicts from management urging you to do ‘what it takes’ to make profit or bring in business. We all only have to think back to 2001 and the corporate scandals of Enron and WorldCom which shook our profession to see what can happen when the moral compass gets lost and moral courage goes missing- albeit temporarily. The fallout from those events has set the regulatory agenda and created a series of challenges not only for individuals, but also for professional bodies like ACCA, which have a responsibility to support their members. We have taken that responsibility as a ‘given’ for a number of years – but it became an imperative as the reputation of our profession was tainted by the aftermath of the scandals and the public perception of accountants. While some jurisdictions – namely the US - took the view that it might be possible to prevent some unethical behaviour by developing more regulation – ACCA took the view that the solution to the issue would come through a set of principles. We have sought to provide a framework of principles for accountants through their entire career with us. This starts when they study ACCA for the first time - in fact as we meet here ACCA students are getting to grips with our new professional qualification which is examined for the first time in December and which focuses more than ever on ethics and professionalism. That focus was developed following the largest-ever consultation undertaken by an accountancy body – when over 25,000 employers, tuition providers, members and students told us what they wanted to see from a qualification for the 21st century. 2 The result is that the minute students begin their journey with ACCA; they’re introduced to ethics, governance and professionalism. They have to tackle issues of professionalism and ethics in eleven (11) of the sixteen (16) papers they will have to tackle, and we have introduced a dedicated paper – Professional Accountant, which aims to ensure that trainees apply relevant knowledge and skills, and exercise professional judgment, when carrying out the role of an accountant. We have also developed a Professional Ethics module, which is designed to give students an interactive way of exploring and practicing their own ethical attitudes. Our students and affiliates are also required to demonstrate their ethical behaviour and sensitivity when completing their practical experience requirements. The aim of these requirements is to ensure that trainees are fully aware of the ethics, values, and standards that apply to the professional accountant, and to make these standards a consistent feature in all aspects of their work. This includes taking personal responsibility for actions, and regularly reflecting on experiences to hopefully have a positive influence on their actions and decision making in the future. Once qualified, ACCA members must show an ongoing commitment to ethics, as our continuing professional development scheme requires members to validate – every year – that they’re behaving ethically. In addition, we have developed a dedicated ethics micro site, which challenges users to identify their own ethical style. But importantly, the site and our tuition stresses one key point - that there is rarely a right or wrong answer to ethical dilemmas. We also stress that at the heart of every ethical dilemma lurks a conflict of interest, which is for each individual to respond to. What we attempt to do is equip our members to make that response confidently and competently by providing a range of support materials - such as online courses, case studies, articles and a range of library resources to enable them to exercise their ethical muscle. We have invested time, effort and resources into helping our members and students develop an ethical approach because we see ethics as impacting directly on ACCA’s reputation and influence around the world. If an ACCA member wishes to remain an ACCA member they have to accept their responsibility to act in the public interest, and not simply to satisfy the needs of individual clients or employers. As people, ACCA professional accountants are already expected to act ethically – in line with the principles of ‘correct’ conduct in the society in which they live and work. The professional ethics which they must accept will ‘raise the bar’ on acceptable levels of behaviour. But what is regarded as ‘acceptable behaviour’ already presents dilemmas –it’s not always obvious where the ‘right’ course of action lies. 3 For example, Rushworth Kidder, President of Institute for Global Ethics, wrote: ‘The really tough choices.. involve right versus right, they are truth versus loyalty, individual versus community, short-term versus long term and justice versus mercy’ The work, which professional accountants undertake as a type of business interpreter between different parts of society, regularly puts them at the heart of often very public ethical dilemmas and issues. And ACCA will also expect senior accountants to act in a way that will set a good example to junior staff. So there are internal as well as external audiences to be mindful of. Surveys of our members around the world have shown that they are worried about how they can build an overall corporate culture based on integrity, all the while dealing with intensifying pressures from increased competition and the need to help grow the business. Interestingly, our research also shows that while many finance professionals struggle with the need to juggle codes of conduct and regulations along with doing business in a tough environment, many said that despite the red tape involved in Sarbanes Oxley - they actually felt it had a positive global effect on business ethics. Some even felt that there should be a more stringent ethical framework!! If there were to be such a framework - rather than a detailed attempt to legislate and regulate ethical behaviour through sub-paragraphs and appendices – ACCA wants any guidance to be principles-based, since that would be best suited to meet the needs of finance professionals in a fast- moving business world. The experiences of Enron and WorldCom in the US and Parmalat in Italy, all heavily regulated business environments, show that legalistic, rules-based codes only encourage some individuals to look for the loopholes to exploit. What worries us at ACCA is that regulation can quickly become over-regulation. We believe that regulation needs to be in proportion to the risk and the consequences of any misconduct. This is because part of the value of having the services of a professional accountant is their ability to exercise judgments based on ethical principles. To impose onerous regulation would limit the ability of professionals to use their judgments and reduce their value to the society in which they work. And regulation, however detailed and prescriptive it may be, can never fully cover the infinite variety and instances of potential conflict upon which professionals may be called to give advice. 4 This is why we advocate that our profession, governments, regulators, and investors should focus on supporting professional bodies such as ACCA in ensuring that there is a high level of awareness and understanding on the principles that guide behaviour. ACCA supports the idea of a principles-based ethical code, as it would provide a framework for ‘doing the right thing’. It will be tempting for many to develop a code of conduct for their own organizations, but it is important that these codes actually make a difference and can be seen to make a difference. Since we have been looking at how to influence for the good – we also need to look at and tackle what might encourage behaviour that leaves much to be desired. The biggest pressure is on employees to be ‘successful’ - with success invariably being measured in financial terms. That may involve staff working in a culture where they are encouraged to do ‘whatever it takes’ to sell more products, win more customers and beat their competitors. Business leaders – and Human Resources professionals must develop measures of ‘success’, which are not based on financial performance – and instead look at creating rewards structures, which promote ‘ethical’ behaviour. Don’t answer this out loud – but how many business leaders here currently have the means or the desire to reward an employee who may have lost your money by failing to win or retain clients or contracts, but who has acted decently, and ethically throughout? Their refusal to act improperly or to compromise the ethical values of the organization may have a short term cost – but could well have much greater long term reputational and financial gains, by having taken a decision that has steered the organization clear of allegations of dishonesty or complicity in fraudulent behaviour, for example. This is why business leaders have to champion ethics – why they must be seen to apply an ethical code to all elements of their professional and private life. It really needs to be a case of ‘do as we do’, not just ‘do as we say’ when it comes to ethics. The challenge for us is to demonstrate to stakeholders just how successful organizations with a strong –and used - code of ethics are. Companies should consider the business case behind having an ethical approach to work, and maybe, just maybe, board and senior management should promote the idea that companies and employees do the right thing just because it is the right thing to do. And when it comes to doing the right thing, we are delighted and honoured to have with us the Right Honourable Eriya Kategaya, the 1st Deputy Prime Minister of Uganda, whom we know has led from the front in instilling ethical behaviour. We salute his courage and that of the Ugandan Government, which we thank for its support of ACCA and of this event. Thank you, ladies and gentlemen 5 MEMBERSHIP NEWS Institute of Certified Public Accountants of Uganda (ICPAU) Baliddawa is new ICPAU President The Institute of Certified Public Accountants of Uganda has elected Mr. Joseph B. Baliddawa as the new President while the new Vice President is Mr. Narendra A. Thakkar. Ethiopian Professional Association of Accountants and Auditors (EPAAA) Awoke Gebresilassie Heads EPAAA The Ethiopian Professional Association of Accountants and Auditors has elected Mr. Awoke Gebresilassie as Board Chairman while the Vice Board Chairman is Mr. Kokeb Moges. Kokeb is the ECSAFA contact person. Institute of Chartered Accountants of Zimbabwe (ICAZ) ICAZ Elects Tawanda Gumbo as President The Institute of Chartered Accountants of Zimbabwe has elected Mr. Tawanda Gumbo as its President. Mr. Nyasha Zhou is the Senior Vice-President. Swaziland Institute of Accountants (SIA) SIA Appoints New CEO The Swaziland Institute of Accountants has appointed Mr. Barnabas Mhlongo as its Chief Executive Officer. MEMBERS NEWS Institute of Certified Public Accountants of Kenya (ICPAK) Council fostering deeper ties with Kenyan government The ICPAK council, in its bid to developing stronger working relationships with the Government and Parliament, has met key government and parliamentary representatives through a series of meetings held during the period running from June to August 2007. These meetings have involved in-depth discussions on how the Institute can work with various government ministries in promoting accountability and good governance; safeguarding the accountancy profession through ensuring high quality of persons within the profession and appointment of qualified accountants as heads of accounting units. The recent growth experienced in the financial sector in Kenya, has made it imperative to ensure that the professionals charged with managing and steering the growth are not only qualified and competent but also members of an Institute that ensures continuous professional development (CPD) and has a code of ethics enforceable on all its members. The implementation of International Public Sector Accounting Standards (IPSAS) in the area of Local government with a view to improving the quality of financial reporting in the local government sector was elaborated on during the visit to Honorable Musikari Kombo, Minister for Local Government. This implementation would also enable the sector to ensure 6 accountability of collected funds and track the utilization of these funds in providing the required services. The need to strengthening the country’s financial management system was touched on during the visit to Honourable Ole Kaparo, the Speaker of the Kenya National Assembly (Kenyan Parliament) through readily availing the expertise found within the ICPAK membership. This would further boost the impact of the yearly submissions made by the institute towards the drafting of the National Budget. The Institute has also been involved in the drafting of The Accountants Act bill, the statute that governs it. This issue and the push for the draft amendments to be tabled in parliament and come into law was revisited in the meeting held with Honourable Amos Kimunya, the Minister for Finance and a former Institute Chairman. It is hoped that fruitful working relationships will be established and that overall, issues of financial management and reporting coupled with good governance will lead to better accountability in the governmental sector. The National Board Of Accountants And Auditors, Tanzania Accountants’ Annual Seminar and Dinner The National Board of Accountants and Auditors (NBAA) will hold the “Accountants’ Annual Seminar and Dinner” from 6th to 7th December 2007 at the White Sands Hotel, Dar es Salaam, Tanzania. The theme of this year’s annual conference is “International Standards – Implementation & Challenges” Papers will be presented from various resource persons and participants will get an opportunity to discuss on the problems and challenges on the implementation of the IFRSs, ISAs and IPSA. The conference will be followed by annual dinner to be held on 7th December 2007. Conference details and booking forms will be available on the NBAA website (www.nbaatz.org) in early October 2007. NBAA would like to invite all interested persons to attend this important annual event. NBAA Revised Syllabus: The National Board of Accountants and Auditors has revised its syllabus, which will become operational effective in the May 2008 examinations. The revised syllabus has taken account of the International Education Standards Board’s requirements, by enriching the contents and including subject areas that had not adequately been covered under the current syllabus. Apart from enriching the contents, two additional subjects have been added in the professional examination scheme namely Business Ethics and Corporate Governance and Contemporary Issues in Accounting In the Accounting Technician examination scheme, one additional subject has been added i.e. Introduction to Information and Communication Technology, which is a vital subject for accounting technician students. 7 The Board will continue to maintain a two-tier examination scheme to cater for the Accounting Technician examinations and the Professional examinations, which leads to the Certified Public Accountant – CPA (T) qualification. The Accounting Technician examination scheme will comprise two levels – Accounting Technician Level I and II with four and five subjects to be examined in each level respectively. The Professional Examination scheme will comprise three stages, where the Foundation stage will comprise two modules of four subjects each; while the Intermediate and Final stages will each comprise two modules of three subjects each. In this scheme a total of 20 subjects will be examined. The syllabi will be launched during the Board’s Graduation and Awards Ceremony to be held on 6th October 2007. The Prime Minister, Hon. Edward N. Lowassa will officiate the ceremony. The Institute of Chartered Accountants in England and Wales (ICAEW) and Institute of Chartered Accountants of Pakistan (ICAP) Announce Training Programme in Pakistan ICAEW has announced a historic memorandum of understanding with the ICAP. The agreement provides global opportunities and strengthens ties between both institutes. The memorandum enables ICAP members to undertake advanced level tuition through a top-up programme which allows them to become members of the ICAEW. In addition, it enables a sharing of experience and the exchange of best practice across a range of disciplines on behalf of the respective memberships. ICAP currently has 3,800 members across commerce and industry. ICAP recognises that it is necessary to provide advanced accounting skills to its members to meet the international demand for accountants both in Pakistan and internationally. ICAP and ICAEW have a strong working relationship and it was because of this history, ICAP and ICAEW decided to enter into the memorandum of understanding. The ICAEW is committed to working with accounting institutes to share experience and develop best practice. The memorandum of understanding was signed in Pakistan on Thursday 30th August. ICAEW and the Chartered Institute of Public Finance and Accountancy (CIPFA) define future relationship Memorandum of Understanding sets out framework for a strategic partnership The ICAEW and the CIPFA have signed a memorandum of understanding that sets out a framework for a strategic partnership between the two bodies. The strategic partnership between the CIPFA and ICAEW will see the institutes work together on a series of joint initiatives and projects for the benefit of their respective memberships and students and in order to fulfil and deliver their public interest obligations. 8 Both bodies already work closely together on a number of joint initiatives. The ICAEW’s Public Sector Group utilises resources provided by CIPFA including Public Finance magazine as well as access to online technical information. The ICAEW is currently helping CIPFA to develop a new Practice Assurance Scheme and is also supporting a CIPFA-led scenario planning project to examine the pressures and challenges which the public services are likely to face over the next twenty years. Initiatives in the pipeline include joint policy representations on professional and technical matters where there is scope to make common cause. The relationship will be led by a newly created partnership board. The institutes will also exchange observers on their respective councils and boards and be able to nominate representatives to join selected committees. More information is available on the ICAEW website at www.icaew.com Enquiries: Ellen Bisnath, Manager Countries and Markets, International Affairs, ICAEW T: +44 (0) 20 7920 8511 E: ellen.bisnath@icaew.com MEMBERS CONFERENCES The Institute of Chartered Accountants of Zimbabwe (ICAZ) holds it Winter School ICAZ held its Winter School from 19 to 22 July 2007 under the Theme “If the Foundations Be Destroyed – What Next”. The Winter School took a frank and critical look at the economic and political situation in Zimbabwe as it affects the business and professional environment. It also looked at the way forward. The ECSAFA CEO attended the Winter School. He challenged the ICAZ members to take full control of the destiny of ECSAFA by ensuring that adequate funding was available for ECSAFA to implement its Strategy. His attendance was fully funded by ICAZ. Eastern Africa ACCA Convention, 2007 Close to 650 ACCA members and other accountants from Eastern Africa attended the second Eastern Africa ACCA Convention in Kampala, Uganda. This event was presided over by ACCA President, Gill Ball and attended by ACCA’s CEO Allen Blewitt and 3 ACCA Council members. The delegates hailed from 10 countries –Uganda, Kenya, Tanzania, Ethiopia, Sudan, the UK, Rwanda, Eritrea, Malawi and the USA. The first in these series of events was held in Nairobi, Kenya in December 2005. The event which was held under the theme; “Balancing organizational success with ethical practice”, in July 2007 was addressed by a very impressive line-up of influential speakers. These included the Deputy Prime Minister of Uganda, the Rt. Hon. Eriya Kategaya, the Minister of State for Finance, Planning and Economic Development, Professor Semakula Kiwanuka, one of 9 America’s leading experts on governance, ethics and accountability and Inspector General of New Orleans, Professor Robert Cerasoli, among others. ACCA Conventions in Eastern Africa are aimed at o Enabling the sharing of professional knowledge and best practice amongst professional accountants and other finance professionals; o Providing a forum for accountants to discuss and develop solutions to development challenges facing business, the profession and the society at large; o Facilitating gainful business links and interaction between professional accountants and business entities across the region. o Providing a platform for contributing to and influencing policy debates in the profession, in business and in society as a whole. The 2007 Convention dealt with the key question - how can professionals be good at business and still be good? It was clear at the end of the event that every professional not only needs a moral compass – but also moral courage, to be able to weather ethical and moral storms. The event served to bring back ethics into the mainstream of professional dialogue and to highlight the role and responsibility that accountants have in the fight against unethical practices in society. It helped participants to renew their individual and collective commitments to ethical conduct in the workplace. IFAC MATTERS Proposed Revisions to Regional Organization and Other Grouping Policy Statement Compliance Advisory Panel and the IFAC staff have been reviewing the existing policy statement for Regional Organizations and Regional Groupings. The CAP has approved a proposed revision for consultation purposes. The primary objectives of the revision were to: 1. better align the strategies and activities of IFAC and its regional and other partners 2. update the policy to reflect the changes in the environment since 2000 when the last policy was issued, and 3. clearly articulate the mutual accountabilities between IFAC and its regional and other partners. One of the other changes is the proposal to drop the reference to “regional” with respect to “other groupings”. This is being proposed as it was felt that other groupings have formed and may form in the future around the commonalities – not just regional proximity. In this sense, the CAP and staff agreed that greater flexibility in this respect was appropriate. The policy statement seeks to make a provision for de-recognition to a regional organization that fails to meet its obligation to IFAC. 10 IFAC Declares December 2 – 8 2007 “World Accountancy Week” In the ECSAFA News issued in April 2007 we announced to members that IFAC had declared December 2 – 8 2007 as “World Accountancy Week”. We urged member bodies to organize high-profile national events to mark this week. Has your member body made any progress in this regard???? TECHNICAL MATTERS ECSAFA Standard-Setters Workshop The 5th ECSAFA Standard-setters Workshop will be held in Harare, Zimbabwe on 28 September 2007. The workshop objective will be to provide an opportunity for standard-setters to share recent technical developments, discuss a Report on the Observance of Standards and Codes (ROSC) – accounting and auditing assessment - conducted by the World Bank, finalize the ECSAFA comment letter on International Financial Reporting Standards for Small and Medium Sized Entities (IFRS for SME), and note the progress made in the implementation of public sector accounting standards in the region. We encourage you or a member of your technical committee to participate. If you require a copy of the programme and invitation, submit your request to the ECSAFA Secretariat. Auditing The International Auditing and Assurance Standards Board (IAASB), in its meeting in July 2007, approved exposure drafts of nine proposed International Standards of Auditing (ISAs), including each of its international quality control and auditor reporting standards. These have all been redrafted in accordance with the IAASB's new drafting conventions designed to improve the clarity of its pronouncements. The proposed standards include: International Standard on Quality Control (ISQC) 1 (Redrafted) − Quality Control for Firms that Perform Audits and Reviews of Financial Statements, and Other Assurance and Related Services Engagements, ISA 220 (Redrafted) − Quality Control for an Audit of Financial Statements, ISA 510 (Redrafted) − Initial Audit Engagements - Opening Balances, ISA 530 (Redrafted) − Audit Sampling. ISA 700 (Redrafted) − The Independent Auditor's Report on General Purpose Financial Statements; ISA 705 (Revised and Redrafted) − Modifications to the Opinion in the Independent Auditor's Report; ISA 706 (Revised and Redrafted) − Emphasis of Matter Paragraphs and Other Matter(s) Paragraphs in the Independent Auditor's Report; ISA 800 (Revised and Redrafted) − Special Considerations − Audits of Special Purpose Financial Statements and Specific Elements, Accounts or Items of a Financial Statement; and ISA 805 (Revised and Redrafted) − Engagements to Report on Summary Financial Statements. We encourage members who have adopted ISAs to comment on the proposed standards which are available on the IFAC website. 11 Accounting We continue to encourage members who have adopted International Financial Reporting Standards (IFRS) to refer to the International Accounting Standard Board (IASB) website, particularly the “IASB Update” which is issued monthly, in order to obtain information relating to recent developments (www.iasb.org.uk) In addition, we encourage you to provide comments on the proposed standard on IFRS for SME referred to in the previous Newsletter and also consider participating in field-testing it. Comments are requested by 1 October 2007. To assist with field-testing, IASB has released a field test kit. The standard and the kit are available at IASB website. Public Sector The International Public Sector Accounting Standards Board (IPSASB) develops International Public Sector Accounting Standards (IPSASs). The IPSASs, exposure drafts and the IPSASB’s work programme are available on the IFAC website. IPSASB has issued ED 33 Amendments to IPSAS 4 – The Effect of Changes in Foreign Exchange Rates. The ED proposed updates to IPSAS 4 to reflect, as appropriate for the public sector, the latest revisions to the corresponding IFRS. Key proposals in ED 33 reflect amendments made by the IASB to International Accounting Standard 21 – The Effects of Changes in Foreign Exchange Rates. Comments on the ED are requested by 31 December 2007. Ethics The International Ethics Standards Board for Accountants (IESBA) has issued the following exposure drafts: Proposed Revised Section 290 of the Code of Ethics for Professional Accountants, Independence - Audit and Review Engagements, and Proposed Section 291, Independence Other Assurance Engagements The exposure draft (ED) proposes to strengthen three components of the independence requirements contained in the IFAC Code of Ethics for Professional Accountants (Code). The components in provision of internal audit services to an audit client; Independence implications related to the relative size of fees received from one assurance client; and Contingent fees for services provided to assurance clients. Comments on the ED are requested by 15 October 2007. Comments on Proposed Strategic Plan IESBA is seeking comment on an exposure draft of its Strategic and Operational Plan for the period 2008-2009. The plan outlines the initiatives that IESBA will be involved in to serve the public interest by setting high quality ethical standards for professional accountants and by facilitating the convergence of international and national ethical standards, thereby enhancing the quality and consistency of services provided by professional accountants. Professional Accountants in Business (PAIB) Control From a Risk-Based Perspective and the Role of Accountants in Business PAIB has released a new publication Internal Control from a Risk-Based Perspective. The publication features interviews on experiences and views on establishing effective internal 12 control systems. The interviews help to demonstrate the importance of a risk-based approach to internal control in helping an organization manage its overall risk. They also shed light on the nature of risk in organizations, how to establish an internal control system focused on driving performance and supporting the delivery of strategic objectives, and success stories that can help organizations in considering improvements to their approach. The publication is available in IFAC website. Small and Medium Accounting Practices (SMPs) Proposals to Develop Practice Management Guide for Small and Medium Accounting Firms IFAC is requesting proposals for the development of a practice management guide for use by SMPs. The purpose of the guide will be to assist SMPs in managing their practices in an efficient, profitable and professional manner. It is intended that the guide will cover a range of topics, such as strategic planning, management structure, client relationships, managing finances and risk, partnership issues, networking, and succession planning. The specifications for the Request for Proposal: Development of a Practice Management Guide for Use by Small and Medium Practices are available on the IFAC website. MEMBER TECHNICAL DEVELOPMENTS South Africa APB approves issue of Statement of GAAP for Small and Medium-sized Entities The South Africa Accounting Practices Board (APB) has approved for issue of a South African Statement of Generally Accepted Accounting Practice for Small and Medium-sized Entities (SMEs). The statement will apply to ‘limited interest' companies as defined in the Corporate Laws Amendment Act, 2006 (CLAA); an Act that has been promulgated into law, though the effective date has not been announced. It has been issued based on IFRS for SMEs without any change to the original text. The statement has been issued after a process where SAICA requested respondents to comment on the proposal to adopt IFRS for SMEs in South Africa in its exposure draft form as a transitional standard for `limited interest' companies until the Financial Reporting Standards Council, required by CLAA, is established and develops accounting standards for such companies. Most respondents supported the proposed process. The statement is expected to be effective upon issue. Technical Assistance ECSAFA provides a technical query service to member bodies. Member bodies with queries must channel them to the ECSAFA Secretariat, ecsafa@africaonline.co.ke 13 FUTURE MEETINGS ECSAFA EXCOM and Council Meetings The next scheduled ECSAFA meetings are as follows: Dates of Meetings Type of Meeting Host Member Body & Country 2008 – 1st Half EXCOM/Council/AGM ACCA, Mauritius /MIPA 2008 – 2nd Half EXCOM/Council NBAA in Tanzania 2009 – 1st Half EXCOM/Council/AGM LIA in Lesotho 2009 – 2nd Half EXCOM/Council/ECSAFA 8th Congress and 20th Anniversary Celebrations SAICA in South Africa Nairobi, September 2007 14