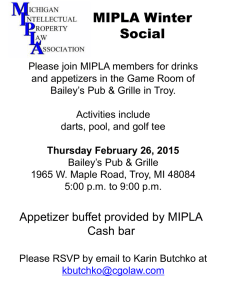

the Sorrell College of Business at Troy University

advertisement

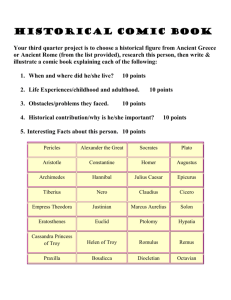

TROY UNIVERSITY ACT3394 Section TDAA Governmental Accounting COURSE SYLLABUS Spring 2014 January 6 – May 6, 2014 PROFESSOR INFORMATION: Name: Amanda N. Paul, MBA, CPA Assistant Professor Office: 124 Bibb Graves Hall Troy, AL 36082 Phone: 334-670-3944 334-670-3136 Secretary – Patsy Brown (BG 155) 334-670-3592 Fax E-mail: anpaul@troy.edu **Please put course title and section in the subject line of any emails sent to the professor. ACT3394 is a business course for future business professionals. As such, all emails should be grammatically correct with proper punctuation and capitalization. Each email should have a salutation and should be “signed” by the student. Texting lingo is NOT acceptable! Emails I receive that do not follow these guidelines will be returned unanswered until corrected. All students should be very familiar with this syllabus and the class schedule as they contain important information to ensure that you are successful in this course. Emails that ask questions on items that are clearly outlined in these documents will be returned to the student with “see syllabus.” Information from these documents is also fair game for quiz and examination questions!! NOTE: For course syllabus posted prior to the beginning of the term, I reserve the right to make minor changes prior to or during the term. I will notify students, via email or Blackboard announcement, when changes are made in the requirements and/or grading of the course. OFFICE HOURS: M & W 8:00 - 11:30 and 1:00 – 2:30 Or by appointment I'm available by email at any time or by phone on weekdays between the hours listed above (Central Time). I respond more quickly to emails than to phone calls. PREREQUISITES: ACT2292 (with a C or better) Page 1 of 10 ACT3394 Amanda Paul COURSE INFORMATION: Class Time: Tu/Th 11:30 – 12:45 p.m. Class Location: 211 Bibb Graves Hall (BG) ENTRANCE COMPETENCIES: The student must possess a basic knowledge of accrual accounting and the capability to perform on a college level. Knowledge of basic mathematics, such as multiplying and dividing fractions and using percentages, and simple algebra, is assumed. STUDENT EXPECTATION STATEMENT: The student is expected to participate in the course via email exchanges (or other communication) with the professor, by reading the assigned readings, submitting assignments, and completing exams in a timely fashion. The student is expected to attend class, participate in class discussions, and completing assignments. You cannot benefit from the class lectures and discussions if you are not present. You must have studied the assigned chapter prior to coming to class, so that you are prepared to contribute to class discussions. If called upon, you are expected to be an active participant in this class. You should be prepared to discuss homework assignments. You should be able to explain the steps involved in completing the assignment. This will help reinforce the learning process and will give you additional practice in effective communication. Students should treat others with respect and conduct themselves with a professional demeanor while in the classroom. Furthermore, talking to one’s neighbor during inappropriate times, speaking out without permission from the professor, leaving the room while class is in session, ringing cell phones, and text messaging also disturb fellow classmates. Every time someone causes a disturbance, the group loses their focus which results in a loss of effectiveness and efficiency for all. Students are expected to check their emails daily and the announcements at least every 48 hours. Students will need to devote a considerable amount of time outside class reading and processing the information in the text. Reading the chapter introduces the topic. Class lectures discuss and explain the topic. Homework, projects and studying reinforce the topic. Several hours outside if class should be devoted to the course each week. Poor preparation for business meetings may create the impression that an individual lacks the necessary attributes to be effective in performing their business related tasks. Your class experience can be enhanced, by demonstrating both a professional demeanor and strong work ethic that indicates a strong desire to learn throughout the whole semester. A professional demeanor is demonstrated through excellent attendance, arriving a few minutes early, opening the textbook to where the last class ended, taking out class notes / any completed homework, raising your hand to regularly participate in the class discussions, and being respectful. A strong work ethic is demonstrated through a sincere attempt to complete all homework assignments prior to class and sharing your solutions during in class coverage of such assignments. If you are not able to solve a problem, then you should write down your question that would have helped you to do so. The development of good behavior is a prerequisite to be successful in business. CATALOG DESCRIPTION: Analysis of governmental and not-for-profit accounting issues including the preparation and use of budgets, records, and statements. Accounting majors must complete this course with a grade of C or better. Prerequisite: ACT 2292 (with a grade of C or better). PURPOSE: To introduce the concepts and practices associated with accounting for not-for-profit organizations, municipalities, and governmental agencies. Page 2 of 10 ACT3394 Amanda Paul SPECIFIC CHAPTER LEARNING OBJECTIVES: Each chapter of the textbook begins with specific learning objectives that serve as guideposts for your journey through that chapter. The learning objectives are introduced at the beginning of each chapter and are referenced throughout the chapter. COURSE OBJECTIVES/STUDENT LEARNING OUTCOMES: The objective of this course is to provide students with an understanding of the principles and mechanics of both governmental and not-for-profit accounting. On completion of the course, the student should be able to: 1. Apply the major accounting standards and professional guidance affecting governmental units and not-for-profit entities. 2. Use application software to account for transactions and prepare the financial statements required by GASB for governmental entities. 3. Account for transactions and prepare the financial statements required for not-for-profit organizations. TEXTBOOK(S) AND/OR OTHER MATERIALS NEEDED: 1. Reck, J. L., Lowensohn, S., Wilson, E. R. Accounting for Governmental and Nonprofit Entities (16th) [with City of Smithville/Bingham access code]. Boston, MA: McGraw Hill. (current ISBN 9780077936549) 2. i>clicker 2: ISBN 1429280476 (available in bookstore and will be utilized for several business and accounting courses; if this is your last semester, rent one) Important Note: If you purchase a book without the access code, you must arrange on your own to obtain an access code. Every student will need their own code. NO exceptions!! To purchase a City of Smithville/Bingham access code ($15.00): http://paris.mcgrawhill.com/paris/purchaseproductsview.do?productid=0078110939&goto_url=http%3A%2F%2Fpar is.mcgraw-hill.com%2Fsites%2F0078110939%2Fstudent_view0%2F To register a City of Smithville/Bingham access code and to login: http://highered.mcgraw-hill.com/sites/0078110939/student_view0/index.html Students should have their text, i>clicker2, AND access to City of Smithville/Bingham the first week of class. Not having your book will not be an acceptable excuse for late work. Not having your i>clicker2 will cause you to lose participation points each day. BRING IT TO CLASS EVERYDAY! Other materials: Pencil, paper, calculator. No translating devices or cell phones will be allowed during exams. PowerPoints are provided for printing by the professor for student use. Supplements: City of Smithville/Bingham access code; Other as deemed appropriate *You are required to bring the City of Jacksonville, Florida Financial Statements (Appendix A) to every class meeting. Page 3 of 10 ACT3394 Amanda Paul Internet Access Students must have access to a working computer and access to the internet. Students can use the Troy University computer lab, a public library, etc., to ensure they have access. “Not having a computer” or “computer crashes” are not acceptable excuses for late work. Have a backup plan in place in case you have computer problems. TROY EMAIL: All Students Effective July 1, 2005, all students were required to obtain and use the TROY email address that is automatically assigned to them as TROY students. All official correspondence (including bills, statements, emails from professors and grades, etc.) will be sent ONLY to the troy.edu (@troy.edu) address. COURSE REQUIREMENTS: Upon Enrollment: confirm email address (and be sure to keep your box cleaned out!!); purchase and register City of Smithville/Bingham; purchase/rent and register in BlackBoard i>clicker2 Participation in class discussions Homework assignments City of Bingham project Required examinations STUDENT/FACULTY INTERACTION: Interaction will take place via email, telephone, comments on written assignments, office visits. The student will participate in this course by following the guidelines of this syllabus and any additional information provided by me or Troy University. The student is expected to remain in regular contact with me via email or other communication means, by submitting assignments and taking exams, all in a timely fashion. I respond to e-mails typically the same day or on Mondays to weekend emails. I will communicate as necessary via Blackboard Announcements or e-mail. ATTENDANCE POLICY: Attendance will be taken daily via i>clicker2. Students that miss attendance will be marked late or absent. Students should present documentation for excused absences on the first class day following the absence (i.e. doctor’s excuse, Troy University excuse, etc.). Students are allowed three (3) unexcused absences. For each additional absence, points will be deducted from your total participation points. You have registered for this course at this scheduled time. If you cannot arrive on time or remain for the entire allotted time, you need to drop this course. If you must leave a class early, let me know at the beginning of class. Students who habitually leave early will be asked to drop the course. Students are expected to punctually attend all scheduled classes. People who arrive late disturb everyone else!! Students who arrive late will be not be allowed to make up participation points. Students who are habitually late will be asked to drop the course. For any quizzes, problems, exams, or other activities that are completed in class, you must be present to receive credit. Routine absences from class will have a large, negative impact on your grade. Page 4 of 10 ACT3394 Amanda Paul MAKE-UP WORK POLICY: Missing any part of this schedule may prevent completion of the course. If you foresee difficulty of any type (i.e., an illness, employment change, etc.) which may prevent completion of this course, notify the professor as soon as possible. Failure to do so will result in failure for an assignment and/or failure of the course. See “Attendance” above. If you miss an exam due to an excused absence, I will allow a make-up exam with advance notice to me. If you cannot make it up before the next class meets, you may take a make-up exam during a scheduled time. For any exam not completed, the student will receive a zero (0) grade. If I have not heard from you by the deadline dates for assignments or exams, no make-up work will be allowed (unless extraordinary circumstances existed, such as hospitalization). Requests for extensions must be made in advance and accompanied by appropriate written documentation if the excuse is acceptable to the professor. "Computer problems" are not an acceptable excuse. INCOMPLETE GRADE POLICY: If a student is unable to complete all course grading requirements, the student may be eligible to request the assignment of an incomplete grade. An incomplete grade is not automatically assigned by the instructor, but must be requested by the student and approved by the instructor. The decision to approve or reject a student’s request for an incomplete grade is at the discretion of the instructor using the following criteria: 1) student submits a completed “Petition for an Incomplete Grade” form (https://forms.troy.edu/cgi-bin/adobe/index.cgi?action=incomplete_form) prior to assignment of a course grade (on or before the date of the final assignment or test of the term); 2) student’s progress in the course is deemed satisfactory; 3) student is passing the course when the request is made; and 4) the circumstances that prevented the student’s completion of course requirements are beyond the student’s control and adequate documentation is provided. Refer to TROY Incomplete Grade Policy. An incomplete is not a substitute for an F. If a student has earned an “F” by not submitting all the work or by receiving an overall F average, then the F stands. An incomplete will not be awarded for excessive absences. An incomplete will only be awarded to student presenting a valid case for the inability to complete coursework by the conclusion of the term. It is ultimately the professor’s decision to grant or deny a request for an incomplete grade. METHOD OF INSTRUCTION: To assist you in mastering the course material, I will lecture on each chapter, highlighting and explaining the important concepts, and then together we will work on exercises, problems and financial statement analysis. PowerPoint slides and other materials are posted for your use in Blackboard. The student is responsible for all instructions and assignments given in class, as well as for the supporting textbook content. The student should read the textbook material before the lecture covering that material. This leads to a better understanding of the lecture, as well as the opportunity to ask questions about material(s) in the text that were unclear or that the student did not understand. Homework will be assigned for each chapter. These assignments are made for the sole purpose of allowing the student to determine if they understand the material and to allow for practice of the concepts covered in class. Some of these assignments will be turned in for grading. Students who do not work the homework problems perform very poorly on the tests. The homework assignments are directly related to the course goals and objectives, and to the chapter learning objectives. On the homework assignment due dates, you should be prepared to discuss the problems, cases, or any other assigned material. Page 5 of 10 ACT3394 Amanda Paul The labs in Bibb Graves are available for student use and tutors are available. The focus will be on developing analytical and conceptual thinking, not on memorization. Each of you will be an active participant in the learning process, not a passive recipient of information. You will learn by PARTICIPATING! METHOD OF EVALUATION: Exam 1 Exam 2 Comprehensive Final Exam Code of Conduct DB Homework Participation City of Bingham project Total 100 points 100 150 5 55 50 100 560 points ASSIGNMENT OF GRADES: All grades will be posted in the student grade book in Blackboard and will be assigned according to the following scale: A B C D F Postings: FA: 90 – 100% 80 – 89% 70 – 79% 60 – 69% 59% and below Grades will be posted in the Blackboard grade book during the course and final grades will be posted in Trojan WebExpress. “FA” indicates the student failed due to attendance. This grade will be given to any student who disappears from the course for three or more weeks. See the Attendance Policy section of this syllabus for additional information. The last day to drop a course is March 17. After this date, students will not be allowed to drop the course and students will have to take the grade earned in the course. You may drop via Trojan WebExpress or the Records office. A grade will be assigned to you at the end of the course based on your performance on exams and assignments. SUBMITTING ASSIGNMENTS: As per the schedule, homework assignments noted as “Turned In” will be submitted directly to me for grading at the beginning of class. Homework assignments that are noted as “Checked” will be presented to me at the beginning of class as noted per the schedule for completion check. IF YOU WILL NOT BE IN CLASS, YOU SHOULD MAKE ARRANGEMENTS TO SUBMIT YOUR HOMEWORK BEFORE CLASS IN PERSON OR VIA EMAIL. Those late to class will NOT receive credit for that day’s homework. NO EXCEPTIONS. We will review selected homework assignments during class. City of Bingham required printouts will be submitted to me as per the schedule. Note: We will discuss the software in-depth on the first day of class. If you have any problems, please see me. Page 6 of 10 ACT3394 Amanda Paul EXAMINATION SCHEDULE & INSTRUCTIONS: Tentative examination dates are indicated on the assignment schedule. Exam dates are subject to change with advance notice from the professor. The exams may be any combination of multiple choice questions, problems, or subjective short answer questions. The student will need a #2 pencil, an eraser, a green Scantron answer sheet, and a calculator. Credit will be given for Scantron errors when erasures are identified to me immediately upon review of the exam. Cell phones, programmable calculators (those that store text) and translators are not permitted on the exams. Calculators without text storage capability are allowed. For exam purposes, you are responsible for reading all the material in each chapter (unless otherwise stated). I will emphasize the material that I feel is most important or needs additional explanation. The lectures and related PowerPoint presentations are not a substitute for reading the chapters. Mission Relevance: ACT3394’s course learning objectives will be implemented in accordance with the mission of Troy University, the Sorrell College of Business, and School of Accountancy as stated in the Undergraduate Catalog. The professor will strive to offer a high-quality course to assist in the development of successful business leaders. The professor’s highest priorities are the pursuit of teaching excellence, accessibility to students, and a sincere interest in each student’s long-term success. Students are expected to have a strong desire to learn and solid work ethic. School of Accountancy Mission Statement: The mission of the School of Accountancy is to advance the accounting profession by providing quality accounting education to both undergraduate and graduate students. To achieve this, our faculty will: 1) prepare students for career opportunities with increasing professional and managerial responsibility in public accounting as well as government and industry and prepare undergraduate students for admission to graduate programs in accounting and business 2) publish quality intellectual contributions that impact the practice of accounting and accounting education; and 3) provide service to and engage with the academic and professional communities. SCOB Mission Statement: The Sorrell College of Business supports the Troy University mission by preparing our diverse student body to become ethical professionals equipped to compete in the global business environment. To achieve this, our faculty, staff, and administration will: 1) provide quality education in global business through our undergraduate and graduate programs, delivered around the world through face-to-face and online environments, to traditional, nontraditional, military, and international students; 2) contribute to the development and application of knowledge focused on applied business, learning, and pedagogical research; 3) provide service to the University, business and professional organizations, and our communities through individual involvement, business outreach, and our centers for research. SCOB Vision Statement: The Sorrell College of Business will be a recognized and respected leader for quality and flexibility in the delivery of business education that prepares graduates to succeed in the global business environment. Page 7 of 10 ACT3394 Amanda Paul Troy University Mission Statement: Troy University is a public institution comprised of a network of campuses throughout Alabama and worldwide. International in scope, Troy University provides a variety of educational programs at the undergraduate and graduate levels for a diverse student body in traditional, nontraditional and emerging electronic formats. Academic programs are supported by a variety of student services which promote the welfare of the individual student. Troy University's dedicated faculty and staff promote discovery and exploration of knowledge and its application to life-long success through effective teaching, service, creative partnerships, scholarship and research. COURSE SCHEDULE: See Excel schedule available for dates and assignments Chapter 1 Chapter 2 Chapter 3 Chapter 4 Chapter 5 Chapter 6 Chapter 7 Chapter 8 Chapter 9 Chapter 11 Chapter 13 Chapter 14 Introduction to Accounting and Financial Reporting for Governmental and Not-for-Profit Entities Principles of Accounting and Financial Reporting for State and Local Governments Governmental Operating Statement Accounts; Budgetary Accounting Accounting for Governmental Operating Activities-Illustrative Transactions and Financial Statements Accounting for General Capital Assets and Capital Projects Accounting for General Long-term Liabilities and Debt Service Accounting for Business-Type Activities of State and Local Governments Accounting for Fiduciary Activities-Agency and Trust Funds Financial Reporting of State and Local Governments Auditing of Governmental and Not-for-Profit Organizations Accounting for Not-for-Profit Organizations Not-for-Profit Organizations – Regulatory, Taxation, and Performance Issues Blackboard Support Center Blackboard Online Support Center for Troy University provides Customer Care Technicians who are available to support you 24 hours a day/7 days a week. If you are experiencing technical difficulties with your coursework or with features in Blackboard that are generating errors, please click the link. http://trojan.troy.edu/etroy/blackboard.html NON-HARASSMENT, HOSTILE WORK/CLASS ENVIRONMENT: Troy University expects students to treat fellow students, their professors, other TROY faculty, and staff as adults and with respect. No form of “hostile environment” or “harassment” will be tolerated by any student or employee. CELL PHONES AND OTHER ELECTRONIC DEVICES: Use of any electronic devise by students in the instructional environment is prohibited unless explicitly approved on a case-by-case basis by the professor of record or by the Office of Disability Services in collaboration with the professor. Refer to the Troy University policy. **Cell phones should be silenced during class. Texting is strictly prohibited during class. If I see you, I will stop class to ask you to stop!! AMERICANS WITH DISABILITY ACT (ADA): Information, including appropriate contact information, can be found at the link for Troy University’s Office of Human Resources at http://trojan.troy.edu/etroy/studentservices/adaptiveneeds.html Page 8 of 10 ACT3394 Amanda Paul Any student whose disabilities fall within ADA guidelines must inform me at the beginning of the term of any specials needs or equipment necessary to accomplish the requirements for this course. Students must also provide written proof of their disability to the professor. HONESTY AND PLAGIARISM: The awarding of a university degree attests that an individual has demonstrated mastery of a significant body of knowledge and skills of substantive value to society. Any type of dishonesty in securing those credentials therefore invites serious sanctions, up to and including suspension and expulsion (see Standard of Conduct in each TROY Catalog). Examples of dishonesty include actual or attempted cheating, plagiarism*, or knowingly furnishing false information to any university employee. Students that cheat on ANY exam or assignment in the course will receive a grade of zero. – See School of Accountancy Code of Conduct. You will be asked to acknowledge adherence to the SoA Code of Conduct on each examination and assignment. LIBRARY SUPPORT: The address of the Library Web site is http://trojan.troy.edu/library/ Additionally, the Library can also be accessed by choosing the “Library” link from the University’s home page, www.troy.edu, or through Blackboard. FACULTY EVALUATION: At the end of each term, students will be notified of the requirement to fill out a course evaluation form. These evaluations are completely anonymous and are on-line. Useful Websites: Technical Audit and Accounting Guidance: FASB Codification: The FASB developed the FASB Accounting Standards Codification™ Research System (Codification Research System) to streamline the research process. The Codification Research System has numerous features to assist subscribers with research, and the home page includes a link to an online tutorial that describes how to use the system. The benefit of performing research using the Codification is that users will be able to identify all related content in one location much more easily than researching the thousands of previous standards. The FASB suggests the following steps when conducting research: 1. Browse the topical structure and related tables of contents. Because all related content is organized topically, users should be able to identify most content by topical browsing. Based on direct feedback, more than ninety percent of users responded that they know the topic that they need to research. 2. Subscribers should use the text search feature only for very specific items (for example, guidance about inducements). Text search is based on specific language. Deviations from a selected search expression will lead to certain relevant content being excluded from search results. The Codification Research System does incorporate certain tools to help overcome the issue, but searching will always be constrained. Page 9 of 10 ACT3394 Amanda Paul Link for access: http://aaahq.org/ascLogin.cfm or http://aaahq.org/FASB/Access.cfm Student Access Username - AAA51302 Password - pvhgmGD AICPA: http://www.aicpa.org/ The American Institute of Certified Public Accountants is the national professional organization for all Certified Public Accountants. Its mission is to provide members with the resources, information, and leadership that enable them to provide valuable services in the highest professional manner to benefit the public as well as employers and clients. ASCPA http://www.ascpa.org/Content/home.aspx The Alabama Society of Certified Public Accountants is the state professional organization for Certified Public Accountants. Its mission is to provide members with the resources, information, and leadership that enable them to provide valuable services in the highest professional manner to benefit the public as well as employers and clients. AAA: http://aaahq.org/links/super_links.cfm The American Accounting Association promotes worldwide excellence in accounting education, research and practice. Founded in 1916 as the American Association of University Instructors in Accounting, its present name was adopted in 1936. The Association is a voluntary organization of persons interested in accounting education and research. EDGAR Database: http://www.sec.gov "Search Companies and Filings" allows you to retrieve real-time filings for a specific company and to find key company information — including its name, address, telephone number, state of incorporation, Central Index Key (CIK) number, Standard Industrial Classification (SIC) code, and fiscal year end. Simply type in the name of the company or its CIK number. Note: A CIK is the unique number that the SEC's computer system assigns to individuals and corporations who file disclosure documents with the SEC. All new electronic and paper filers, foreign and domestic, receive a CIK number. You don't need to know a company's CIK, but searching by that number will narrow your search to the exact company you want. PCAOB: www.pcaobus.org The PCAOB is a private sector, nonprofit corporation, created by the Sarbanes-Oxley Act of 2002, to oversee the auditors of companies in order to protect the interests of investors and further the public interest in the preparation of informative, fair and independent audit reports. All of the post-Sarbanes-Oxley technical guidance is available for free at http://www.pcaobus.org/Standards/index.aspx. The Public Company Accounting Oversight Board initially adopted the current ASB Auditing Standards (SAS). Since that time, six standards have been adopted by the PCAOB and subsequently approved by the Securities and Exchange Commission. Page 10 of 10 ACT3394 Amanda Paul