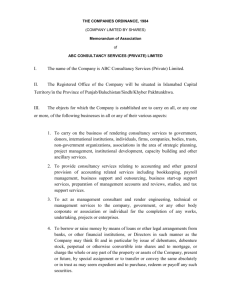

11. entire agreement

advertisement