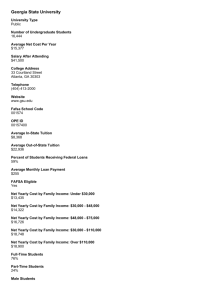

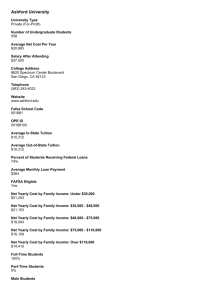

PART I WORKSHEET: GET A JOB

advertisement

PART IV WORKSHEET: It’s your future! 1. Use your research on your future occupation from part I to help you complete the first section of the worksheet. Enter the information from step 2 onto the Budget Worksheet. 2. Now it’s time to figure out how much money you will make monthly and yearly, before taxes. You’ll write all of this into your Budget Worksheet. a. Write the salary you researched in step 2 into the row that says SALARY and the column that says YEARLY. This is your yearly gross pay. b. Divide the salary you researched by 12. Write this number in the row that says SALARY and the column that says MONTHLY. This is your monthly pay. 3. You don’t get to keep all of your money—it is taken out in taxes by the state and federal government to pay for public projects, as well as put into entitlement programs such as Social Security and Medicare. These are called deductions. You’ll write all of this into your Budget Worksheet. a. Take a look at the row that says “Federal tax” and the notes section. Use the table on my website to figure out how much you’ll pay in federal taxes per year. Write that number in the YEARLY column. b. Divide that yearly number by 12 to figure out how much in federal taxes will be taken out of your paycheck per month. Write this number under the MONTHLY column. c. Take a look at the row that says “VA State tax” and the notes section. Multiply your YEARLY SALARY by the percentage in the notes section to figure out how much you’ll pay in State taxes per year. Write that number in the YEARLY column. d. Divide that yearly number by 12 to figure out how much in state taxes will be taken out of your paycheck per month. Write this number under the MONTHLY column. e. Take a look at the row that says “FICA” and the notes section. Multiply your YEARLY SALARY by the percentage in the notes section to figure out how much you’ll pay in State taxes per year. Write that number in the YEARLY column. f. Divide that yearly number by 12 to figure out how much will be taken out of your paycheck per month. Write this number under the MONTHLY column. 4. Now it’s time to figure out your total deductions and your total take-home pay (net pay). a. Add up the numbers from your Federal, State, and FICA for the MONTH. Write this final number in the “Total Deductions” row under MONTHLY. b. Now, subtract your monthly total deduction number from your monthly salary. Write this number in the row “Take Home Pay.” This is how much you will make (net) in a month. c. Do the same steps for the YEARLY column. 5. Now that you have a career and a steady income, it’s time to look at your fixed expenses—things you’ll always have to pay for as an adult. a. This starts with a place to live (no more crashing on the couch for you)! Use the links online to help you find a place. Remember to think about what you might want in the place: a gym, access to shopping, a parking garage, proximity to restaurants or entertainment, etc. b. Once you’ve found a place, record your monthly rent in the Rent row, under the MONTHLY column. Multiply this number by 12 to get your yearly rent, and record it in the YEARLY column. c. If you don’t know how much is paid for your cell phone each month, ask your parent(s). Write this down in your monthly expenses, and multiply it by 12 to get your yearly expense. Remember, if you decide to buy a new phone, or you break this one, you’ll have to take it out of your flexible expense funds later on! d. Other expenses listed are averages for the area for the month/year. Please use these costs. o 6. You’re almost done! Now it’s time to think about all the “extras” you spend money on each month—whether snacks, dinners out with friends or a date, vacations, movies…all of that stuff adds up! a. Food! Ask your parent(s) how much they spend per month on groceries, and divide it by the number of people in the household. This final number is how much you will have to pay for groceries per month. Multiply it by 12 to get your yearly expenses. b. Be realistic about what you’ll spend, and be careful not to spend too much! c. Record your MONTHLY and YEARLY spending in the columns. 7. Finally, you’ll record your monthly and yearly net pay, total fixed expenditures, and total flexible expenditures in the last spreadsheet. 8. After subtracting your fixed and flexible expenditures from your net pay, record this number in the “Remaining Money.” This is how much you have left at the end of the month, and should be saving for the future (if not more!). Some people also choose to “pay themselves first” and make saving a fixed expense each month—this might be the right option for you, too! BUDGET WORKSHEET My chosen career: _____________________________________________ Starting salary: ________________________________________________ Degree(s) and/or training required: ________________________________________________________ ________________________________________________________________________________________ MONTHLY YEARLY (gross pay) Notes SALARY Payroll Deductions (what’s being taken from your paycheck) Federal tax VA State tax FICA (Medicare/Social Security) See tax table 5.75% 7.6% if you are employed by a company; 15.3% if you’re selfemployed TOTAL DEDUCTIONS (what’s being taken—total) TAKE HOME PAY (net pay) MONTHLY Fixed Expenses Rent Utilities (water, electric, gas) Medical care Car payment Student Loan Cell phone YEARLY $125 $250 $250 $90 TOTAL FIXED MONTHLY Flexible (variable) expenses Groceries (at home meals) Dining out/fast food Clothing Entertainment Vacation funds Gas/car maintenance Internet/cable TV TOTAL FLEX YEARLY $100 $50 MONTHLY YEARLY NET PAY -TOTAL FIXED -TOTAL FLEX REMAINING MONEY (SAVINGS) ATTACH ADS(or pictures)/etc. BELOW for cell phone price/monthly pay, groceries, etc. when/where possible.