A Woman's Work

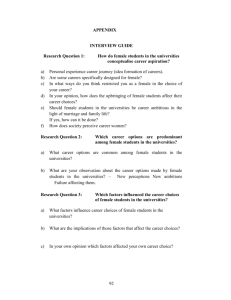

advertisement