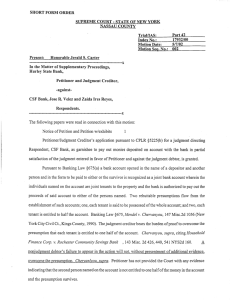

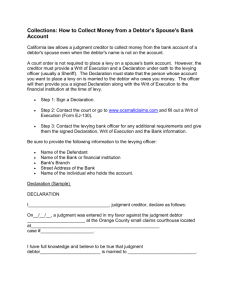

judgments - New Jersey Law Revision Commission

advertisement