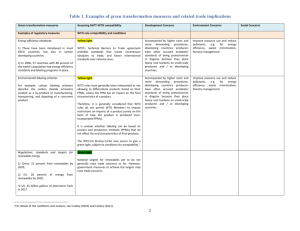

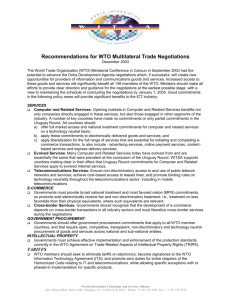

THE WORLD TRADE ORGANIZATION (WTO) A Question

advertisement