Chapter 6[1] MONITORING AND ENFORCEMENT OF

advertisement

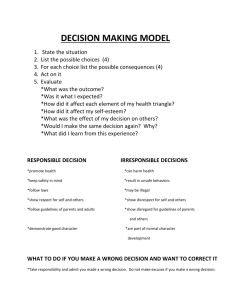

![Chapter 6[1] MONITORING AND ENFORCEMENT OF](http://s3.studylib.net/store/data/008511292_1-6842c077d70f0c501c01cf76788bcced-768x994.png)