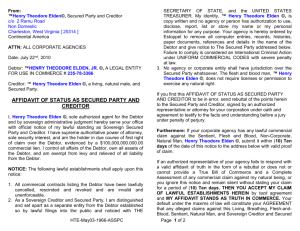

Secured Transactions

advertisement