Erich Stolz CEO

advertisement

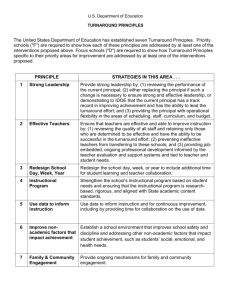

ERICH STOLZ Houston/TX 77077 * (832) 372-5419 * ErichStolz@aol.com www.ErichStolz.com www.LinkedIn.com/in/ErichStolz Corporate Growth and Revitalization Executive – CEO / President / Division Executive Expertise in increasing shareholders’ value by driving earnings growth and revenue, boosting cash flow, establishing sound balance sheets, superior customer service …. and by coaching, inspiring, and motivating others to their highest level of achievement. Sets strategies by working together with owners / boards / customers / employees and implementing a profitable direction with high-performance teams. Profile of Key Strengths Experienced across diverse industrial and commercial market segments (petrochemical, industrial services/products, manufacturing, chemical process equipment, construction, distribution, machining operations, steel fabrication, and engineering). Captures new opportunities, develops new market niches, and broadens market share with existing and new customers. Excels at adapting organizations to changes in market and financial conditions, reversing negative / stalled growth, and drives focused action to exceed goals and outcomes. Leads others through complexity and challenge, motivates and inspires teams to constructive action, and promotes clear understanding of issues and their solutions to establish operations excellence that will accelerate profitability. Develops a culture of sustainable competitive advantage across all business functions that motivate people to perform to their highest potential. Hires the best and retains the right people for the right job. Creates high-performance teams. • Strategy • Maximizing Shareholders’ Value • Growth Champion (Organic Growth, Acquisitions) P & L Management • Establishing Lean, Efficient, and Profitable Entities Relationship Management (Customers / Shareholders / Board of Directors / Owners / Employees / Creditors / Suppliers) People and Team Management (serves as a real business partner with leaders across all functions) MUEHLHAN SURFACE PROTECTION INC. - Houston, TX 6/2007 - Present A $200 million publicly traded specialty contractor for Industrial services. Customer base: (petrochemical, industrial, ship yards, oil/gas platforms, pipelines, refineries, bridges, and governmental agencies). CEO / CHIEF EXECUTIVE OFFICER Responsible for: Managing the $40M U.S. subsidiaries Reversed a $10 M loss to a $8 M profit (EBITDA). 10 5 Profit 2011 0 Loss 2007 -5 -10 2007 2011 Forged growth in emerging wind power markets; capitalized on untapped revenue opportunities in green energy. Reduced management levels from five to two; decreased overhead costs by 52% (people, office space, vehicles, etc.) while accelerating productivity and profitability. Hired and accumulated the best project managers in the industry and built high-performance teams. Together with the Safety Director: Revamped the safety program to ensure compliance and low accident occurrence and to improve the EMR ratings. Safety and accident track record became impeccable. Erich Stolz / Page 2 ErichStolz@aol.com ∙ www.ErichStolz.com ∙ 832.372.5419 www.linkedin.com/in/ErichStolz AMERICAN MANAGEMENT ADVISORS, INC. - Houston, TX 7/1999 – 6/2007 Consulting + Interim C-level firm for U.S. and European companies with focus on growth, restoring profitability, and increasing shareholders value. CEO / Managing Director Responsible for: Managing 10 corporate turnarounds in engineering, manufacturing, distribution, construction, and steel fabrication. Representative Examples: The Bober Group, Europe Corporate Profile: $345 M group of 11 engineering companies. Customer Base: Large construction firms. Turnaround Role: Interim Chairman / CEO; revitalizing 11 engineering entities and positioning the group for a successful sale. Result: Increased the value of the Group by $38 M - the restructured group was sold to Siemens in Europe at a premium price. Acquired a new profitable business unit and closed one unprofitable business unit to strengthen the group portfolio; successfully positioned the company for sale. Boosted EBITDA by $9.5 M. Acclerated Revenue by $55 M. Increased value of the Group by $38 M. Redesigned the bidding process for the entire group of 11 engineering companies; doubled the bid win ratio from 7% to 15%. Value of Corporation The Bober Group Revenue (Million $) 190 160 EBITDA (Million $) Sales Multiplier Value (Million $) Before 290 37.5 4 150 After 345 47.0 4 188 Increased Value of the Corporation by $38 Million 130 100 Value Before Value After Rexroth Corporation - Bethlehem, PA Corporate Profile: $612 M industrial manufacturer of pumps, valves, pneumatics, hydraulics, and fluid/motion control units. Customer Base: Automotive, trucking and heavy equipment suppliers. Turnaround Role: Hired by the Parent’s Board in Germany to create a higher sales value and position the company for sale. Results: • Increased value of the corporation by $48 M. • Boosted cash holdings from $10 M to $60 M in six months; exceeded the goal by 20%. • Reduced the workforce by 5%, adding $12 M to the bottom line. • Sold six real estate facilities on a sale-and-lease-back, and sold excess inventory. • Company was successfully sold to Bosch Automotive Group (Germany). 60 50 40 30 Before 20 EBITDA (Million $) Sales Multiplier Corporate Value (Million $) 45.9 4 183.6 After 57.9 4 231.6 Increased Value of the Corporation by $ 48 million 10 0 Cash Before Cash Target Cash After Erich Stolz / Page 3 ErichStolz@aol.com ∙ www.ErichStolz.com ∙ 832.372.5419 www.linkedin.com/in/ErichStolz Alamo Industrial Group $402 Million Diversified Group- San Antonio, TX Corporate Profile: $402 M Diversified Group with focus on the Steel Fabrication Division Customer Base: Steel used in bridges, construction, large structures, municipalities, refineries, general contractors Revitalization Role: Interim COO to turn around the declining steel fabrication unit (Alamo Iron Works). Result: Reversed lender-initiated bankruptcy and restored a sustainable profit platform. Grew revenues of the Steel Fabrication unit 34% from $75 M to $101 M; turned a $2 M loss into a $6 M profit (EBITDA). Redesigned the bidding process; hired professional estimators; significantly improved the timeliness / accuracy of bids. Restructured the steel fabrication operation; achieved 100% error-free production, and established the first “ready to pick-up" of fabricated products for construction contractors. Profit Sales Before After American Industrial Acquisition Corporation - Greenwich, CT Turnaround Role: Interim CEO of a $20 M forging and machining subsidiary. Corporate Profile: $600 M diversified industrial and commercial goods manufacturing group. Result: Rebuilt a $20 M bankrupt forging and machining company and produced a profit in 4 months. Hired a new staff and built a stronger engineering core in a union shop. Reestablished relations with inactive customers (e.g.: General Dynamics nuclear submarines). A.G.I.V. – North Carolina; 3 U.S. subsidiaries of a $2B global European private equity firm 1/1996 – 6/1999 Executive Vice President / Reported to Chairman in Europe. Responsible for: Leading the growth of three U.S.-based manufacturing companies. Increased the combined revenue by $50M – from $156 M to $206 M. Turned a combined $3.6 M loss into a profit of $8.5 M. Met the target goal two years ahead of schedule. Re-established strategic, operational, and P&L health. Analyzed the market conditions and competitiveness to evaluate growth potential; defined the marketing strategy for each business unit, and implemented professional sales teams. Managed individual and team performance; defined specific measurable goals and monitored progress. Maintained the culture, kept the previous business element and practice that worked but tweaked those parts that needed improvements 3 Subsidiary Companies in the U.S.: American Barmag Corp. (Textile and synthetic equipment manufacturer): Refocused the marketing and sales strategy, accelerated sales volume from $121M to $161M, and improved profits by 432% - from $810K to $3.5M. Avenatech Inc. (Hospital equipment + surgical instrument decontamination manufacturer): Drove a sales and marketing strategy which grew sales from $17M to $24M, and turned a $1.9M loss into a $2.4M profit. Carapace Inc. (Disposable medical products manufacturer): Streamlined operations and logistics, increased sales from $18M to $21M, and turned a $2.5M loss into a $2.6M profit. Erich Stolz / Page 4 ErichStolz@aol.com ∙ www.ErichStolz.com ∙ 832.372.5419 www.linkedin.com/in/ErichStolz SCHOTT PROCESS SYSTEMS, INC. - New Jersey; U.S. subsidiary of Schott Group Germany ($2 Billion World-wide) 10/1990 - 8/1995 EBITDA Revenue President / Treasurer / Board Member 1990 1995 Responsible for: Restoring a U.S. subsidiary to profitability. Accelerated the company’s performance rating from a #73 ranking to the #4 performer within the world-wide group of 74 companies. Increased sales six-fold ($12M to $74.5M); expanded the customer base from 15 to >60. Grew profits from $0 to $12M; paid record-breaking dividends for 5 consecutive years. Increased manufacturing productivity by 300%; redesigned the entire manufacturing flow. AEG, DIVISION OF MERCEDES-BENZ (Daimler Group Germany); Power tools and industrial robot manufacturer 10/1980 – 9/1990 Product Manager Responsible for: Total P&L responsibility for the industrial robot and commercial/industrial power tools product lines (production, sales, marketing), and reversing production cost and sales trends. Effectively managed 3500 people. Increased sales from $61M to $289M (375% increase), and established record-breaking dividends for 10 consecutive years. Grew profits from $0 to $22M. Reversed two stagnated product lines; analyzed market conditions and competitiveness to evaluate growth potential, and developed an aggressive marketing strategy and sales team. First to enter the on-site construction, shipyard, appliance, and electronic markets. Designed new products, and established 17 sales/technical service stations across Europe. Optimized operational capacity and output of all production facilities in Germany, Spain, Ireland, and Hungary; redesigned manufacturing operations and streamlined production. 300 200 100 0 EBITDA Revenue Before After Professional Affiliations National Association of Corporate Directors (NACD); corporate board governance resources and education Turnaround Management Association (TMA); an organization of turnaround and corporate renewal leaders Association of Corporate Growth (ACG); a global organization offering M&A resources and information Association of Certified Fraud Examiners (ACFE); premier provider of anti-fraud training and education Education Master of Science Degree - Engineering Management; Drexel University (Philadelphia, PA) Master of Business Administration Degree; Marquette University (Milwaukee, WI) Bachelor of Arts Degree - Accounting & Finance; Elmhurst College (Elmhurst, IL) Professional Certifications Certified Board Director; awarded by National Association of Corporate Directors (Washington, DC) Certified Turnaround Professional (CTP); awarded by Turnaround Management Association (Chicago, IL) Certified Fraud Examiner (CFE); awarded by Association of Certified Fraud Examiners (Austin, TX) International Experience Lived and worked in Europe. Intimately familiar with foreign cultures and business methods. Fluent in German.