2.1 What is 'place of supply of services'?

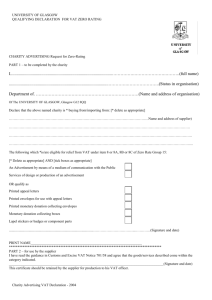

advertisement