Managerial Accounting

advertisement

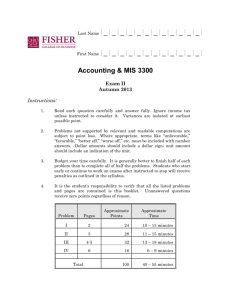

Managerial Accounting Tenth Canadian Edition Connect What You Really Need To Know Chapter 10: Standard Costs and Variances A. A standard is a benchmark or norm for evaluating performance. Manufacturing companies commonly set exacting standards for materials, labour, and overhead for each product. Some service companies, such as auto repair shops and fast food outlets, also set standards. 1. Standards are set for both the quantity and price of inputs. 2. Actual quantities and prices of inputs are compared to the standards. Differences are called variances. Under management by exception, only the significant variances are brought to the attention of management. B. Setting accurate quantity and price standards is a vital step in the control process. 1. Various members of a firm should be involved in setting standards: accountants, purchasing agents, industrial engineers, production supervisors, and line managers. 2. Standards tend to fall into two categories — either ideal or practical. a. Ideal standards are those that can be attained only by working at top efficiency 100% of the time. They allow for no machine breakdowns or lost time. b. Practical standards, by contrast, allow for breakdowns and normal lost time (such as for rest breaks). Practical standards are standards that are “tight, but attainable.” c. Most managers feel that practical standards provide better motivation than ideal standards. The use of ideal standards can easily lead to frustration because they are so difficult to achieve. 3. Direct material standards are set for both the price and quantity of inputs. a. Price standards should reflect the final, delivered cost of materials, net of any cash discounts. This price should include freight, handling, and other costs necessary to get the material into a condition ready to use. b. Quantity standards should reflect the amount of material that is required to make one unit of product, including allowances for unavoidable waste, spoilage, and other normal inefficiencies. 4. Direct labour price and quantity standards are expressed in terms of labour rate and labour hours required to make a unit of product. a. The standard direct labour rate per hour should include wages earned, benefits, employment insurance, and other labour related costs. b. The standard labour hours per unit should include allowances for rest breaks, personal needs of employees, clean-up, and machine down time. 5. As with direct labour, the price and quantity standards for variable overhead are generally expressed in terms of a rate and hours. The rate represents the variable portion of the predetermined overhead rate. The quantity standard is expressed in terms of whatever basis is used to apply variable overhead to products (e.g., direct labour hours). 6. The price and quantity standards for materials, labour, and overhead are summarized on the standard cost card. a. Study the standard cost card in Exhibit 10-2 and trace the figures in it back through the examples on the preceding pages in the text. b. The standard cost per unit represents the budgeted variable production cost for a single unit of product. C. The General Variance Model. A variance is a difference between standard and actual prices or standard and actual quantities. The general model in Exhibit 10-3 shows how variances are computed. Study this model with care. 1. A price variance and a quantity variance can be computed for each of the three variable cost categories—materials, labour, and overhead. 2. Variance analysis is a form of input/output analysis. The inputs are materials, labour, and overhead; the output is the units produced during the period. 3. The standard quantity allowed for the output is the amount of an input that should have been used to complete the output of the period. This is a key concept in the chapter! D. Direct Materials Variances. Exhibit 10-4 illustrates the variance analysis of direct materials. Note that the center column (Actual Quantity of Inputs, at Standard Price) plays a part in the computation of both the price and quantity variances. 1. The materials price variance can be expressed in formula form as: Materials price variance = (AQ AP) – (AQ SP) or Materials price variance = AQ (AP – SP) where: AQ = Actual quantity of the input purchased AP = Actual price of the input purchased SP = Standard price of the input An unfavourable materials price variance has many possible causes, including excessive freight costs, loss of quantity discounts, the wrong grade or type of materials, rush orders, and inaccurate standards. 2. The materials quantity variance can be expressed in formula form as: Materials quantity variance = (AQ SP) – (SQ SP) or Materials quantity variance = SP (AQ – SQ) where: AQ = Actual quantity of the input used SQ = Standard quantity of the input allowed for the actual output SP = Standard price of the input Possible causes of an unfavourable materials quantity variance include untrained workers, faulty machines, low quality materials, and inaccurate standards. 3. The materials price variance is usually computed when materials are purchased, whereas the materials quantity variance is usually computed when materials are used in production. Consequently, the price variance is computed based on the amount of material purchased whereas the quantity variance is computed based on the amount of material used in production. See Exhibit 10-5 in the text for an example of direct materials variance analysis when the amount purchased differs from the amount used. E. Direct Labour Variances. Exhibit 10-6 shows the variance analysis of direct labour. Notice that the format is the same as for direct materials, but the terms “rate” and “hours” are used in place of the terms “price” and “quantity”. 1. The price variance for labour is called the labour rate variance. The formula is: Labour rate variance = (AH AR) – (AH SR) or Labour rate variance = AH (AR – SR) where: AH = Actual labour-hours AR = Actual labour rate SR = Standard labour rate Possible causes of an unfavourable labour rate variance include poor assignment of workers to jobs, unplanned overtime, pay increases, and inaccurate standards. 2. The quantity variance for labour is called the labour efficiency variance. The formula is: Labour efficiency variance = (AH SR) – (SH SR) or Labour efficiency variance = SR (AH – SH) where: AH = Actual labour-hours SH = Standard labour-hours allowed for the actual output SR = Standard labour rate Possible causes of an unfavourable labour efficiency variance include poorly trained workers, low quality materials, faulty equipment, poor supervision, insufficient work to keep everyone busy, and inaccurate standards. F. Variable Manufacturing Overhead Variances. Exhibit 10-7 illustrates the variance analysis of variable manufacturing overhead. Note that the format is the same as for direct labour. 1. The price or rate variance for variable manufacturing overhead is called the variable overhead spending variance. The formula for this variance is: Variable overhead spending variance = (AH AR) – (AH SR) or Variable overhead spending variance = AH (AR – SR) where: AH = Actual hours (usually labour-hours) AR = Actual variable manufacturing overhead rate SR = Standard variable manufacturing overhead rate 2. The quantity, or efficiency, variance for variable manufacturing overhead is called the variable overhead efficiency variance. The formula for this variance is: Variable overhead efficiency variance = (AH SR) – (SH SR) or Variable overhead efficiency variance = SR (AH – SH) where: AH = Actual hours (usually labour-hours) SH = Standard hours allowed for the actual output SR = Standard variable manufacturing overhead rate G. Exhibit 10-10 is an extremely important exhibit. It shows that overhead is applied to work in process differently under a standard cost system than it is under a normal cost system. 1. We studied normal cost systems in Chapter 3. In a normal cost system, overhead is applied by multiplying the predetermined overhead rate by the actual hours of activity for a period. 2. In contrast, under a standard cost system overhead is applied to work in process by multiplying the predetermined overhead rate by the standard hours allowed for the output of the period. As discussed earlier in Chapter 10, the standard hours allowed for the output are computed by multiplying the standard hours per unit of output by the actual output of the period. H. The last part of the chapter is concerned with the two fixed manufacturing overhead variances—the budget variance and the volume variance. 1. The fixed overhead budget variance, or simply “budget variance,” is the difference between actual fixed overhead costs and budgeted fixed overhead costs. The formula for the variance is: Budget variance = Actual fixed Flexible budget overhead – fixed overhead cost cost 2. The formula for the fixed overhead volume variance is: Volume = variance Fixed overhead rate Denominator hours – Standard hours allowed I. The “fixed overhead rate” is the fixed portion of the predetermined overhead rate. The volume variance does not measure how well spending was controlled. It is completely determined by the relation between the denominator hours and the standard hours allowed for the actual output. 1. If the denominator hours exceed the standard hours allowed for the output of the period, the volume variance is unfavourable. 2. If the denominator hours are less than the standard hours allowed for the output of the period, the volume variance is favourable. J. In a standard cost system, the amount of overhead applied to products is determined by the standard hours allowed for the actual output. 1. As in Chapter 3, if the actual overhead cost exceeds the amount of overhead cost applied to units of product, then the overhead is underapplied. If the actual overhead cost incurred is less than the amount of overhead cost applied to units, then the overhead is overapplied. 2. In a standard cost system, the sum of the overhead variances equals the amount of underapplied or overapplied overhead. Overhead under- or overapplied = Variable overhead spending variance + Variable overhead efficiency variance + Fixed overhead budget variance + Fixed overhead volume variance = Overhead underapplied or overapplied If the sum of the variances is unfavourable, the overhead is underapplied. If the sum of the variances is favourable, the overhead is overapplied. K. Overhead Performance Reporting and Capacity Analysis. The middle portion of the chapter focuses on variable manufacturing overhead. Two types of variable overhead performance reports are illustrated. One type of report shows just a spending variance. The other type of report shows both a spending and an efficiency variance. Both of these variances were discussed earlier in Chapter 10. 1. If the flexible budget allowances in the performance report are based on the actual number of hours worked during the period, then there will be just a spending variance. a. In preparing a performance report under this approach, the cost formulas in the flexible budget are applied to the actual number of hours worked for the period. b. The budget allowances computed in “a” above are then compared to actual costs of the period and a spending variance results. Exhibit 10-14 illustrates this procedure. c. The overhead spending variance combines both price and efficiency variances. An unfavourable variance could occur because the standard is in error, prices paid for overhead items were too high, or too many overhead resources were used. 2. If the flexible budget allowances in the performance report are based on both the actual number of hours worked and the standard hours allowed for the output of the period, both a spending and an efficiency variance are computed. a. Exhibit 10-13 contains a performance report using this approach. Study the column headings in this exhibit carefully. b. The term “variable overhead efficiency variance” is a misnomer. This variance has nothing to do with how efficiently or inefficiently variable overhead resources were used. The inefficiency is really in the base underlying the application of overhead. For example, if direct labour-hours are used as the activity base, an unfavourable variable overhead efficiency variance will occur whenever the actual direct labour-hours exceeds the standard number of direct labour-hours allowed for the actual output. L. Overhead Performance Reporting and Capacity Analysis. The flexible budget can serve as the basis for computing predetermined overhead rates for product costing purposes. The formula is: Predetermined overhead rate = Overhead from the flexible budget for the denominator level of activity Denominator level of activity 1. The denominator level of activity is the level of activity (usually in direct labour-hours or machine-hours) that is assumed when the predetermined overhead rate is computed. The numerator in the rate is the amount of manufacturing overhead from the flexible budget at that level of activity. 2. The predetermined overhead rate can be divided into two parts, one for the variable overhead costs and the other for the fixed overhead costs. a. The fixed component of the predetermined overhead rate depends on the level of the denominator activity that is chosen. The larger the denominator activity, the lower the rate will be. b. The variable component of the predetermined overhead rate does not depend on the level of the denominator activity; it is constant. M. Not all variances are worth investigating. Managers should be interested only in the variances that are significant and out of the norm. Statistical control charts, such as the one in Exhibit 10-15, can be used to identify the variances that are worth investigating. N. There are some potential problems with the use of standard costs. Most of these problems result from improper use of standard costs or from using standard costs in situations in which they are not appropriate. 1. Standard cost variance reports are usually prepared on a monthly basis and may be released to managers too late to be really useful. Some companies are now reporting variances and other key operating data daily or even more frequently. 2. Managers must avoid using variance reports as a way to find someone to blame. Management by exception, by its nature, tends to focus on the negative. Managers should remember to reward subordinates for a job well done. 3. If labour is fixed, the only way to avoid an unfavourable labour efficiency variance may be to keep workers busy all the time producing output—even if there is no demand. This can lead to excess work in process and finished goods inventories. 4. A favourable variance may not be good. For example, Pizza Haven has a standard for the amount of mozzarella cheese in a 9-inch pizza. A favourable variance means that less cheese was used than the standard specifies. The result is a substandard pizza. 5. A standard cost reporting system may lead to an emphasis on meeting standards to the exclusion of other important objectives, such as maintaining and improving quality, on-time delivery, and customer satisfaction. 6. Just meeting standards may not be sufficient; continual improvement may be necessary. Appendix 10A: Further Analysis of Materials Variances A. The direct materials quantity variance can be analyzed further into a materials mix variance and a materials yield variance. This further refinement is, however, possible only if the firm uses different inputs of the same kind that are good substitutes. For example, treated lumber and untreated lumber may be considered as good substitutes for building a deck. These variances are presented in Exhibit 10A-1. Study it carefully. 1. The mix variance measures the dollar effect of any difference between the actual mix of materials and the budgeted mix of materials. In other words, it measures the effects of change in material mix on the total materials cost. It is calculated as follows for each input: (AQa – Ma) × SPa where: AQa Ma SPa = Actual quantity of input a used = Standard mix of input a actually used = Standard price of input a Note that Ma is calculated by multiplying the total actual quantity of inputs used by the standard mix for input a. 2. The yield variance measures the difference between the total actual quantity of inputs used and the total standard quantity of inputs allowed at the budgeted mix. It is computed as follows for each input: (Ma – SQa) × SPa where: Ma SQa SPa = Standard mix of input a actually used = Standard quantity of input a = Standard price of input a Appendix 10B: General Ledger Entries to Record Variances A. Many companies carry inventories at standard cost and record standard cost variances in the general ledger. This simplifies bookkeeping. B. Favourable variances are recorded as credits, and unfavourable variances are recorded as debits. Exhibit 10B-1 summarizes the cost flows in a standard cost system. 1. The entry to record an unfavourable material price variance upon purchase of materials on account would be: Raw Materials (AQP × SP) XXX Materials Price Variance (U) Accounts Payable (AQP × SP) XXX XXX where AQP is the actual quantity purchased. 2. The entry to record a favourable material quantity variance would be: Work in Process (SQ × SP) Materials Quantity Variance (F) Raw Materials (AQU × SP) XXX XXX XXX where AQU is the actual quantity used. 3. The entry to record an unfavourable labour efficiency variance and a favourable labour rate variance would be: Work in Process (SH × SR) Labour Efficiency Variance (U) Labour Rate Variance (F) Wages Payable (AH × AR) XXX XXX XXX XXX 4. Variable overhead variances generally aren’t recorded in the accounts separately; rather, they are determined as part of the general analysis of overhead. Appendix 10C: Analyze Sales Variances A. The interaction of price and quantity represents important information for businesses to analyze to determine why the strategic goals and specific budgeted targets were not achieved. Managers want to know the effects of market volume changes, market penetration or share changes, sales mix changes, and price changes. B. Exhibit 10C–1 summarizes the relationships among budgeted and actual results. The first level sales variances are the sales price variance and then sales volume variance. C. The sales volume variance can be further analyzed into its second level component parts: the market volume variance and the market share variance. D. An alternative view of sales volume variances can be generated by examining the sales mix variance and the sales quantity variance in terms of their relationship to the budgeted contribution margin. For this approach to be meaningful, management must be in a position to control the mix of products it sells in the market. What To Watch Out For (Hints, Tips and Traps) When considering a materials quantity variance, remember that the standard quantity allowed is based on the actual output. For instance, if 5,000 drapes were produced and each required 2 metres of fabric, the standard quantity allowed would be 10,000 metres. Any other amount of fabric would result in a variance. This logic can also be extended to apply to all the other variances. Recall that the efficiency or inefficiency of the variable overhead efficiency variance is not with the use of the overhead but rather in the use of the base itself. For instance, if the base is labour hours, then the responsibility for the variable overhead efficiency variance is the responsibility of the individual that manages the labour efficiency variance (the base). Some students may question why a fixed overhead cost ever has a budget variance. Recall that fixed means that the cost does not depend on the level of activity; fixed does not mean that the cost will always be the same. For instance, even depreciation costs can differ from the budget due to additions, premature retirements and other unanticipated events. Note that the structure of variance performance reports start at the bottom and build upward, with managers at each level receiving information on their own performance as well as information on the performance of each manager under them in the chain of responsibility. This variance information flows upward from level to level in a pyramid fashion, with the president finally receiving a summary of all activities in the organization. If the manager at a particular level (such as the production superintendent) wants to know the reasons behind a variance, he or she can ask for the detailed performance reports prepared by the various operating departments. Remember that each manager is responsible only for those costs over which he or she has control.