EDUCATIONAL FOCUS

advertisement

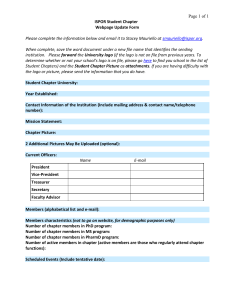

Examples of Lessons Created for the November 8,2010 issue of Canadian Business Magazine INSIDE… Marketing / Branding and Logos, p. 1 Labour Relations / Labour Management Issues, p. 5 Leadership / Management, p. 7 Foreign Investment / Economics, p. 9 1 LESSON PLAN Canadian Business Educational Focus, November 8, 2010 Issue Course Applications: Introduction to Business: Marketing / Branding & Logos Difficulty Level: Level 1-2 Article: “Crowd-sourced chaos at the Gap”, p. 21 Article Summary: In an effort to boost its slowing sales, American retail clothing manufacturer Gap Inc. created a new logo and introduced it online. The new logo, however, was greeted with much criticism on Facebook, Twitter, and various blogs. To counter this backlash, the company announced that it would crowd-source a new logo, but that plan was also met with much disapproval. The company has now decided to revert to the old logo. Some marketing experts are suggesting that this marketing fiasco was a result of the company not really knowing its brand. Outcomes To examine the concepts of brand and branding To consider the role and presentation of a logo To observe a failed marketing initiative and brainstorm counteracting strategies Terminology & Concepts logo: a graphic mark or emblem used by businesses and organizations to aid and promote instant public recognition; logos are either purely graphic (symbols/icons) or are composed of the name of the organization; a logo is a symbol that embodies elements of an organization such as its values, goals, mission, and culture fiasco: a ludicrous or humiliating failure; an effort that went quite wrong crowd-sourcing: the act of taking tasks traditionally performed by an employee, and outsourcing them to a group of people or community, through an “open call” to a large group of people (a crowd) asking for contributions spec work: (short for speculative) any job for which the client expects to see examples or a finished product before agreeing to pay a fee tactical play: a calculated move designed to achieve some specific result submission: surrendering power to another revert: go back to old ways flat revenues: no decline in sales but no growth either brand: a product or service with recognizable and expected characteristics within a target market branding: the application of marketing techniques to a specific product, product line, or brand in order to increase a product’s perceived value to the customer and thereby increase brand franchise and brand equity (the accumulated consumer knowledge/dedication to a brand ); strong branding creates an implied promise that the level of quality people have come to expect from a brand will continue with future purchases of the same product. This may increase sales by making a comparison with competing products more favorable. It may also enable the manufacturer to charge more for the product. 2 consistency: the same throughout in structure or composition incensed: indignant; angered at something unjust or wrong evolution: development; a process in which something passes by degrees to a different stage (especially a more advanced or mature stage) earnest: sincere revolution: a drastic and far-reaching change in ways of thinking and behaving backlash: an adverse reaction to some political or social occurrence gauge: measurement Comprehension 1) Why did Gap change its logo recently? 2) What controversy was incited when the new Gap logo was unveiled on line? How did the company deal with this controversy? 3) According to Ted Matthews, a brand coach at Instinct Brand Equity Coaches, what did Gap do wrong in the way it changed its logo? 4) What is the problem with using crowd-sourcing to come up with a new company logo? 5) Despite the controversy, how may this logo debacle ultimately work to Gap’s benefit? 6) According to brand coach Ted Matthews, how should Gap have managed this uproar over its new logo? Analysis/Assignments 1) Look at the new and the old Gap logo shown in the middle of the article. Why do you think this new logo elicited such strong backlash when it was introduced on the Gap website? What do you think Facebook users, Twitters, and design bloggers have against this logo? 2) According to Ted Matthews, a brand coach at Instinct Brand Equity Coaches, “the No. 1 rule of branding is consistency, and when freshening up is necessary, it should be an evolution not a revolution.” What does he mean? In what ways would you have changed the Gap logo, keeping in mind this rule? 3) Do you agree with the expert quoted in the article who suggests that this whole logo fiasco is a reflection of the Gap management not really knowing the Gap brand? 4) Gap recently announced it is reverting back to its old logo. Is this a good strategy? What would you have the company do to leverage all this public attention created by the logo change to its advantage? 5) Cite examples of other companies that have changed their logo either recently or in the past, and evaluate the benefits of that change for the company. (A couple examples are KFC and Holiday Inn.) 6) What are the risks of changing a company logo? How may a change in the logo affect a company’s target market? When is it useful to change a logo? 3 7) Design a new logo for the Gap. Keep in mind the following: A logo is a symbol that embodies elements of an organization such as its product/service lines, values, goals, mission, and culture. A logo is used by businesses to aid and promote instant public recognition. Logos are either purely graphic (symbols/icons) or are composed of the name of the organization. Color is considered important to brand recognition. Some colors are associated with certain emotions that the designer/company wants to convey. For instance loud primary colors, such as red, are meant to attract the attention; green is often associated with health or the environment, and more subdued tones can communicate reliability, quality, relaxation, or other traits. Answers to Comprehension Questions 1) Sales at Gap North America, owned by Gap Inc., have declined in the past six months, and are flat compared to last year. The company needed a boost. 2) When Gap introduced a new logo on its website, almost immediately, the design was trashed on Facebook, Twitter and design blogs. But instead of standing by its new look, Gap responded by saying it would soon announce a “crowd-sourcing project” that would look to the public for new design ideas. That, however, further enraged observers, who denounced this crowd-sourcing as glorified spec work done for the company without fees. Finally, Gap announced it would revert to its old logo, and admitted that crowd-sourcing was a wrong idea. 3) Matthews says that the logo chaos came from the management not really understanding its brand. “The No. 1 rule of branding is consistency,” he says, “and when freshening up is necessary, it should be an evolution of the brand, not a revolution.” 4) The problem is that if you ask 100 people, you’ll get 100 different answers. Launching outsourcing is not smart “because you’re going to wind up with a pile of whimsical logos that may not be right for the strategic focus of a clothing company,” says Dave Watson, creative director of design at Taxi Canada. 5) Gap could use the opportunity to get people to re-evaluate what the brand means to them. “The extent of the backlash is a gauge of how strongly people feel, and how important the brand is in the lives of their customers.” 6) Gap should have firmly explained its reason for the change, and moved forward. That confidence would have shown customers that Gap has a clear vision for the future—a strength that would have defined the brand more than a logo ever will. 4 TUTORIALS Canadian Business Educational Focus, November 8, 2010 Issue Canadian Business Educational Focus, November 8, 2010 Course Application: Labour Relations, Labour-Management Issues Difficulty Level: Article: Level 2-3 Article Summary: Ode: Stelco (1910-2010), p. 27 Stelco’s fortunes were made during World War I and II, but a halfcentury of warfare between unions and management finally took their toll on the company. After many worker strikes, successive managements’ inability to turn the company’s dysfunctional labour relations around, and continued financial problems, Canada’s last steelmaker was bought by U.S. Steel in 2007. Now, the American-owned company is being sued by Canada’s government for allegedly breaking promises made when it acquired Stelco, by laying off workers, cutting production during the Great Recession, and more recently, shutting Hamilton’s Hilton Works. Comprehension / Discussion 1) Define/discuss the following terms: merger: corporate strategy of dealing with the buying, selling and combining of different companies that can aid, finance, or help a growing company in a given industry grow rapidly without having to create another business entity strike: a work stoppage caused by the mass refusal of employees to work; a strike usually takes place in response to employee grievances. labour union: an organization of workers that have banded together to achieve common goals such as better working conditions; The trade union, through its leadership, bargains with the employer on behalf of union members and negotiates labour contracts (collective bargaining) with employers. This may include the negotiation of wages, work rules, complaint procedures, rules governing hiring, firing and promotion of workers, benefits, workplace safety and policies, and provision of benefits to members to insure members against unemployment, ill health, old age and funeral expenses. legacy costs: costs incurred by an organization in prior years under different leadership or when the organization’s priorities and resources were different. It primarily refers to obligations to pay health care costs and pensions for current employees and retirees. (Legacy costs are often cited as one of the major problems that diminished the competitiveness of auto manufactueres and older airlines, but organized labour sees this criticism as a way of ending any form of binding contracts between worker and employer.) contract gains: new labour-management contract that contain some or all of workers’ demands creditor protection: legal means by which an individual or company in debt can stay or stall creditors from demanding payments until the company’s operations and finances are restructured pension hole: shortage of money to fund pension programs; not enough money in a pension program to meet retiree obligations bondholders: a bond is a debt security, in which the authorized issuer owes the holders a debt; a bondholder is a registered holder of a financial bond issued by a company holding company: a corporation that holds a majority of the shares outstanding of a subsidiary company. 5 Comprehension/Discussion 1) What made The Steel Company of Canada profitable in the past? the First and Second World Wars 2) What caused the 1946 worker strike? How did this strike change the relations between the company’s management and its workers? Demanding higher wages, a 40-hour workweek and recognition of their union, about 2,000 employees lay siege to the Hilton Works mill. This strike put management in a state of war with Hamilton workers. Since the 1946 strike, Stelco workers have walked off the job about once every decade. 3) What problems did Stelco have to deal with in the 1990s? How did Steeltown residents help the company? In the early 1990s, the company ran into problems dealing with the market downturn and competition form east Asia. Steeltown residents launched a share-buying spree to help then-CEO Fred Telmer deal with these problems. 4) What action by then-CEO Fred Telmer enraged Hamilton workers in 1996? In 1996, Telmer enraged Hamilton workers by using pension holiday legislation to stop fully funding retiree obligations. 5) In addition to the market downturn and competition form east Asia, Stelco’s Hamilton Hilton Works was also showing its age. How did these problems come to a head in 2001? What did the management ask the employees at Hamilton Hilton Works to do to help the company? After Stelco lost $178 million in 2001, Telmer’s replacement Jim Alfano pleaded with Hamilton employees to help him deal with the mix of weak market conditions, legacy costs and cheap imports that had driven more than 25 competitors bankrupt. But Stelco had just granted contract gains to Lake Erie employees, so USWA Local 1005, which represents the Hamilton mill, demanded similar wage increases. 6) When Courtney Pratt took over Stelco in 2004, the company filed for creditor protection with $545 million in long-term debt and a $1.3-billion pension hole. What management error did Pratt make while the company was under creditor protection? Chinese demand for steel started to heat up after Stelco obtained creditor protection, and the company started posting record profits while claiming to be insolvent. Bondholders became aggressive—they forced the company to wipe out shareholders and legally separate the newer, better Lake Erie operation from the Hamilton mill and its obligations. Lake Erie workers accepted the restructuring after winning wage increases. Calling the process a fraud, Local 1005 refused to participate. 7) What happened to Stelco after it emerged from creditor protection? Stelco emerged from CCAA in 2006 as a holding company. After continuing to struggle with only 3,500 employees, Canada’s last steelmaker was bought for $1.9 billion in 2007 by US Steel, which allegedly broke promises to Ottawa when it laid off workers and cut production during the Great Recession. While fighting related fines for these broken promises, U.S. Steel recently announced Hamilton’s Hilton Works will be idled indefinitely. 6 Analysis / Assignments 1) What role did the labour union play in Stelco’s eventual takeover by U.S. Steel? What role did the management play in this outcome? 2) An important aspect of Stelco’s management-union conflict was wage increases, but legacy costs were also a hot button issue. Explain what legacy costs are and how these can cause deep financial problems for a company. 3) What does the fact that Stelco returned to profitability immediately after gaining CCAA protection suggest about the steel maker? How would this affect its relationship with its workers? 4) Did the government make the right decision in allowing U.S. Steel to acquire Stelco? Could the sale of Stelco to U.S. Steel been averted? How did this deal work out for Canada? 5) Research the 1946 strike which gave rise to Stelco workers’ union, and prepare a report on this event. What led to this strike? What happened during the strike? What was the outcome of the strike? What is the signficiance of this event for Stelco and Canada’s labour unions? 6) Labour relations refer broadly to any dealings between management and workers about employment conditions. Most commonly, however, labor relations refers to dealings between management and a workforce that is already unionized, or has the potential to become unionized. How would you characterize Stelco’s labour relations? Course Leadership, Management Applications: Level 2-3 Difficulty Level: Article: “Why it pays to be a jerk”, p. 28 Article Summary: Since co-founding the Redwood Shores, Calif.–based Oracle in 1977, Larry Ellison’s antics have earned him the distinction of Silicon Valley’s consummate meanie. He’s been described as a “modern-day Genghis Khan who has elevated ruthlessness in business to a carefully cultivated art form. His weapons are not the marauding hordes but his company’s possession of a key technology platform, his willingness to exploit it, and his disdain for anyone who gets in his way.” The incredible success that Ellison has enjoyed goes against the current ideas of what good leadership is all about, yet Ellison has managed to built Oracle into one of the most important tech firms on the planet, with annual revenues of $27 billion—about a billion dollars shy of his personal fortune. Comprehension / Discussion 1) The incredible success of Oracle founder and CEO Larry Ellison goes against all accepted literature on the qualities it takes to make a good leader. What are those qualities? In what ways does Ellis differ from this model? Qualities like empathy, mediation skills and humility. By all accounts, he is a bad listener and a big talker, whose brash, take-no-prisoners approach tends to alienate employees and customers alike. 2) What main strategy has Ellison been deploying in his plan to make Oracle into one of the most important tech firms on the planet? 7 Acquisition. Ellison’s willingness to buy out the competition has been essential to sustaining growth. “This is an industry in which basically growth has slowed to a crawl. The only way...you as a company can make progress is by acquisitions.” After acquiring more than 65 tech firms in the past five years, Ellison announced in September that he would be “buying chip companies,” suggesting that Oracle is positioning itself for “another level of world domination.” 3) How did Ellison start Oracle? What was his “vision” from the beginning? Working at Ampex in the mid-1970s—a firm that did contracts for the U.S. government— he got his first taste of database software while working on a project for the CIA with the code name “Oracle.” Around the same time, he read a paper published by IBM, which outlined a way to make it easier to store and retrieve data—a prototype for the first relational database. “I saw the paper, and thought that, on the basis of this research, we could build a commercial system.” “His plan was to start with database software and move into tools and applications years before any code was written on those areas....” 4) What is Ellison’s approach to human resource management? His strength is to hire very good people—the right people for the job, and for being able to work with him. Ellison’s willingness to constantly refresh the talent pool is also seen as a strength. He has a habit of casting off previously trusted executives, oftentimes shortly before their stock options are due to vest. Some say he does this if certain executives start to outshine them. 5) How does Ellis manage Oracle? Leaving the traditional management duties to trusted associates has enabled him to focus on thinking big—a crucial element for success in today’s tech world. “It allows him to be the visionary, the guy who determines what companies he’s going to buy and where he’s going to go,” he says. “He’s the strategic leader.” 6) According to psychoanalyst Michael Maccoby, author of Narcissistic Leaders: The Incredible Pros, The Inevitable Cons, what makes Ellison so successful? “What makes Ellison so successful, even though he’s a narcissist visionary and really not very good at working with people, is that he understands himself, and he understands who he needs to work with.” 7) According to Charles O’Reilly, an expert in organizational leadership at Stanford, what is the potential downside of a leader with a “cocksure attitude” like Ellison’s? It can have dramatic consequences. “When they’re right, everybody loves them,” he says of leaders like Ellison. “But it only takes one major mistake and you can destroy the company.” Analysis/Assignments 1) What kind of leader is the founder and CEO of Oracle, Larry Ellison? Is he a leadership model for present times, in your opinion? 2) According to this article, to what qualities and strategies of Ellison’s does Oracle owe its success? 3) What do the following show about the kind of leader Larry Ellison is and his business strategies? his public attack on Hewlett Packard 8 his confrontation with Bill Gates his takeover of PeopleSoft 4) Author Michael Maccoby wrote a book entitled Narcissistic Leaders: The Incredible Pros, The Inevitable Cons. Maccoby identifies Ellison as a narcissistic leader. What do you think would be Ellison’s “incredible pros” and his “inevitable cons?” 5) Respond to the following quote: “If anything, Ellison is merely the poster boy for what it takes to thrive in an increasingly ruthless environment…And his stunning trajectory offers a valuable lesson: in the cutthroat arena of big business, sometimes it pays to be a jerk.” 6) Read the article “Evolution of leadership” on page 58. How would Larry Ellison respond to the thesis of this article? How would he respond to the ideas of Frederick Winslow Taylor, whose seminal 1911 book, The Principles of Scientific Management, advocated the establishment of management as a formal discipline? Course Foreign Investment, Economics Applications: Level 3 Difficulty Level: Article: “Bay Street protectionism”, p. 12 Article Summary: Australian-based mining giant BHP Billiton has made a $40 billion hostile takeover bid for Canada’s Potash Corporation of Saskatchewan Inc., the world's largest fertiliser producer. Since the bid was announced it has been mired in controversy, largely because the company’s business is one of Canada’s strategic natural resources. The federal government and the government of Saskatchewan are reviewing the offer, and corporate Canada—and Canadians—are considering the implication of this deal for Canada in terms of economic and national risks and benefits. This latest foreign acquisition bid for a Canadian company has many questioning the net benefits to Canada of what they perceive as a growing extent of foreign investment in Canada. Comprehension / Discussion 1) What is the view of the majority of chief executives and business leaders polled by Canadian Business on the takeover of Saskatoon-based Potash Corp. by Australia’s BHP Billiton? A majority of chief executives and business leaders polled think Ottawa should block a Potash Corp. sale, even if shareholders support the acquisition. 2) What is the argument of Dick Haskayne, a Potash Corp. shareholder and board member of many Canadian companies, against the takeover of Saskatoon-based Potash Corp. by Australia’s BHP Billiton? “With major foreign takeovers, there has to be a net benefit to Canada. And with BHP, I see no net benefit. None.” Haskayne doesn’t want control of more resources exported overseas, especially not when he thinks Potash Corp. will eventually be worth more than BHP is offering. 3) What is Dick Haskayne’s view on foreign investment in Canada? Haskayne argues corporate Canada has been dangerously “hollowed out” by takeovers of industrial giants such as Alcan and Falconbridge, not to mention our major steelmakers. 4) What has been the response of the federal government to the BHP takeover bid? 9 Lynn Meahan, press secretary to Minister of Industry Tony Clement, declined to comment until a review of the matter, if needed, is completed under the Investment Canada Act. 5) Although Prime Minister Harper is a supporter of foreign investment, what evidence is there that the government is getting more aggressive with foreign-controlled companies? The Harper government has started being more aggressive with foreign-controlled companies. Ottawa, for example, is currently suing U.S. Steel for cutting jobs and production at the former Stelco plants it bought in 2007, after promising to maintain certain levels of production and employment. 6) According to a Conference Board of Canada study, what is the potential impact of a BHP acquisition of Potash Corp.? What is BHP’s response to this finding? A BHP acquisition of Potash Corp. could cost provincial coffers $2 billion over a decade if the Australian company proceeds with a new $12-billion mine proposal, which would create more than 2,000 jobs but generate capital write-offs. BHP executives point out that the benefits gained from the construction and operation of Saskatchewan’s first new potash mine in four decades could offset the negative implications of deferred tax payments. 7) What did a 2008 Conference Board study on the impact of foreign takeovers of Canadian companies find? What does the University of Calgary’s School of Public Policy say about foreign takeovers in Canada? In 2008, the Conference Board concluded that, on average, foreign takeovers of Canadian companies were more positive than all-Canadian deals because “product and geographic overlap of businesses is less with foreign owners.” The University of Calgary’s School of Public Policy recently pointed out that Canadian corporations actually do more taking over than getting swallowed. Analysis / Assignments 1) What could be some of the potential effects of Potash Corp. acquisition by Australian-based BHP on the province of Saskatchewan? 2) Why would fund manager Stephen Jarislowsky warn that Canada’s politicians will contribute to the “suicide of the country” if a takeover of Potash Corp. is allowed to take place? 3) What are the views of free market supporters on Canada’s government suing U.S. Steel for cutting jobs and production at the former Stelco plants it bought in 2007, after promising to maintain certain levels of production and employment? What is the view of the economic protectionists on this issue? 4) “I don’t think Canadian companies should be taken over by companies that can’t themselves be taken over,” says Ian Telfer, chairman of Vancouver-based Goldcorp. “Whether Canada should designate some companies as takeover-proof is another question.” What is your response to this statement? 5) What are some of the major concerns about foreign investment in Canada? What are the benefits of foreign investment for Canada? What is the position of the Harper government on foreign investment in Canada? 6) Research to find out the circumstances surrounding the takeover of Inco by Brazil's Companhia Vale do Rio Doce, and the takeover of Stelco by U.S. Steel. What have been the outcomes of these foreign takovers for Canada? (You may want to read “The Ode” on page 27 of this week’s issue of Canadian Business for information about Stelco.) 10