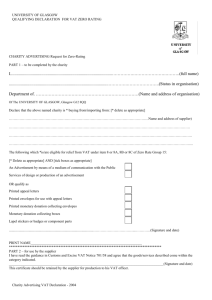

tracey wickes - 1st floor

advertisement